Security Services Market Size 2025-2029

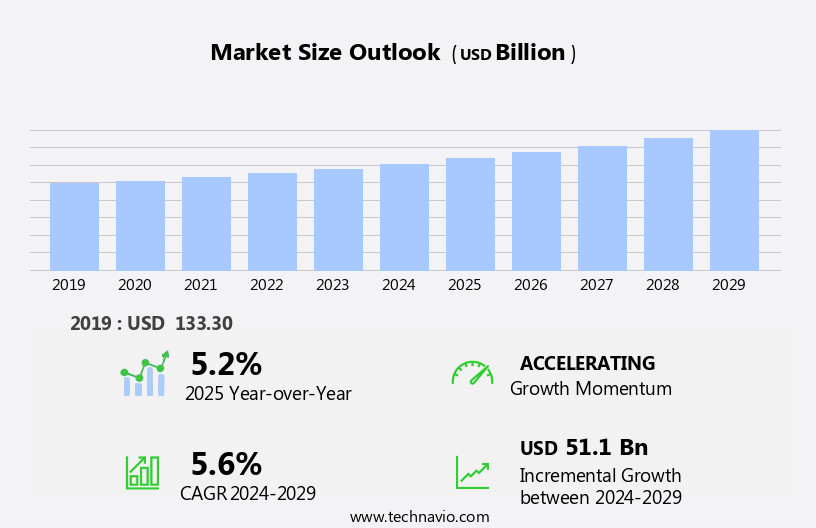

The security services market size is forecast to increase by USD 51.1 billion at a CAGR of 5.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the escalating number of data breaches and cyber-attacks worldwide. A key trend shaping the market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies to enhance security capabilities and improve threat detection. However, the high initial cost of implementing these advanced security solutions poses a challenge for smaller organizations. The market is also driven by the adoption of Big Data, Artificial Intelligence, Machine Learning, and IoT integration, which generate vast amounts of data that require protection.

- Regulatory hurdles also impact adoption, as stringent compliance requirements add complexity to security service implementation. To capitalize on market opportunities, companies must focus on offering cost-effective, customizable solutions that cater to various organizational sizes and regulatory environments. Effective navigation of these challenges requires a strategic approach, including partnerships with technology providers and a strong understanding of evolving regulatory requirements.

What will be the Size of the Security Services Market during the forecast period?

- In the dynamic market, organizations prioritize robust Security Information Management (SIM) solutions to monitor and analyze complex data patterns. Data Breach Notification (DBN) regulations mandate swift response to security incidents, driving the need for advanced Security Incident Management (SIM) and Automation (SOA) tools. Behavior Analytics (BA) and Threat Hunting enable Security Analysts and Cybersecurity Professionals to proactively detect and mitigate threats. Security Certifications, such as CISSP and CISM, ensure a competent workforce. Zero Trust models strengthen the Security Posture by verifying every user and device request. Patch Management and Data Leakage Prevention are essential components of Vulnerability Management. Cybersecurity Insurance, Data Governance, and Privileged Access Management are critical elements of a comprehensive security strategy. The market is also influenced by the need for proactive cybersecurity measures, such as Behavioral Analytics, Malware Detection Solutions, and Multi-factor Authentication, to mitigate human errors and misconfigured devices.

- Security Training, Security Awareness Programs, Ethical Hacking, and Security Logging are ongoing investments to maintain a strong Cybersecurity Framework. Incident Response Planning and Business Impact Analysis are crucial for minimizing damage in the event of a breach. NIST Cybersecurity Framework provides a standardized approach for managing risk. Security Engineers and Security Training are vital for maintaining a strong Security Posture.

How is this Security Services Industry segmented?

The security services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- SaaS security services

- Managed security services

- Security consulting services

- Threat intelligence security services

- Application

- BFSI

- Healthcare

- IT and telecom

- Others

- Deployment

- Services

- Software

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

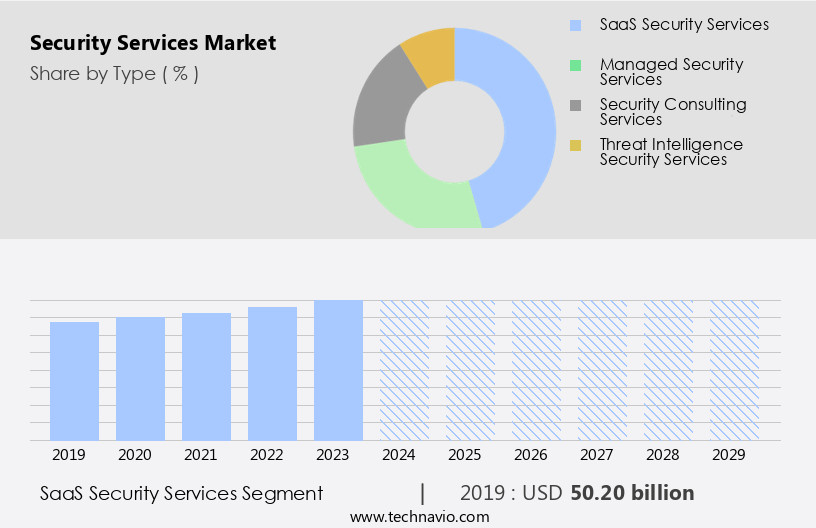

The SaaS security services segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing adoption of advanced technologies and the shifting focus towards cloud-based solutions. Software as a Service (SaaS) offers enterprises cost optimization benefits, high automation, and scalability, making it a preferred choice for businesses. The surge in SaaS applications usage among enterprises is driving the demand for SaaS security services. These services help secure operations and confidential data from other companies, enabling a rapid return on investment (ROI). Enterprises are investing heavily in SaaS solutions to free up organizational resources and focus on their core services. The declining cost of services is another key trend contributing to the growth in the demand for SaaS security services. The cybersecurity landscape is continually evolving, necessitating proactive measures like Data Loss Prevention, encryption, intrusion management, vulnerability scanning, and continuous monitoring.

Physical security and perimeter security continue to be essential components of comprehensive security strategies. Malware detection and vulnerability assessments are crucial for safeguarding digital assets. Compliance frameworks and risk management practices ensure adherence to regulatory requirements and minimize potential risks. Application security, access control, risk mitigation, and managed security services are integral to securing the IT infrastructure. Disaster recovery, security testing, threat intelligence, and business continuity plans are essential for ensuring business resilience. Critical infrastructure, financial institutions, and other high-risk industries are increasingly investing in advanced security solutions, such as artificial intelligence, machine learning, and data analytics, to mitigate threats and improve security posture.

The market is evolving rapidly, with a focus on advanced technologies, cost optimization, and comprehensive security solutions. Enterprises are investing in a range of security services to protect their digital and physical assets and ensure business continuity. The market is expected to continue growing, driven by the increasing adoption of cloud-based solutions, the need for regulatory compliance, and the ever-evolving threat landscape.

The SaaS security services segment was valued at USD 50.20 billion in 2019 and showed a gradual increase during the forecast period. Security consulting, penetration testing, security audits, and patrol services are essential for maintaining a robust security framework. Data loss prevention, identity management, PCI DSS, and security operations centers are critical components of a comprehensive security strategy. Insider threats, incident response, endpoint security, video surveillance, mobile security, cloud security, alarm systems, social engineering, data breaches, network security, antivirus software, intrusion prevention systems, and access control systems are all integral to a holistic security approach. Emergency response and security awareness training are essential for ensuring a proactive security posture. Threat assessment and threat intelligence are crucial for staying informed about potential risks and vulnerabilities.

Regional Analysis

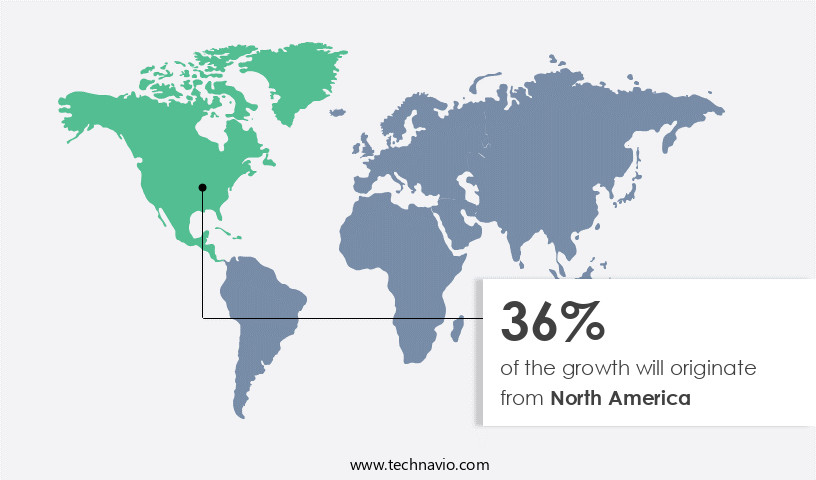

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing need for robust IT and business infrastructure, stringent IT security compliance regulations, and the high adoption of security solutions. The proliferation of cyberattacks targeting enterprises to obtain sensitive data poses a significant threat to economies, further fueling the demand for advanced security services. These solutions include physical security, perimeter security, malware detection, vulnerability assessments, compliance frameworks, risk management, application security, access control, risk mitigation, managed security services, intrusion detection, disaster recovery, security testing, threat intelligence, and security consulting. Moreover, the adoption of business continuity, penetration testing, security audits, patrol services, data loss prevention, security analytics, identity management, PCI DSS, security operations center, insider threats, security assessments, incident response, endpoint security, video surveillance, mobile security, cloud security, alarm systems, social engineering, data breaches, network security, antivirus software, intrusion prevention systems, and access control systems is on the rise, particularly in the services and industrial sectors.

The preference for cloud security solutions is a notable trend, as they enhance the delivery systems' quality in these industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Security Services market drivers leading to the rise in the adoption of Industry?

- The escalating issue of data thefts on a global scale is the primary factor fueling market growth. The market is experiencing significant growth due to the increasing number of cyber threats and data breaches. According to recent research, cyber thefts by hackers and cybercriminals have risen alarmingly, leading to an elevated demand for security testing, threat intelligence, and information security solutions. In 2024, two notable data breaches occurred, impacting millions of individuals. MediSecure, an Australian electronic prescription provider, suffered a large-scale ransomware attack, compromising the sensitive medical and personal information of approximately 12.9 million Australians. Meanwhile, U.S.

- Health insurance giant Kaiser disclosed a data breach after inadvertently sharing the private health information of 13 million people. These incidents underscore the importance of threat assessment, security consulting, business continuity planning, penetration testing, security audits, patrol services, data loss prevention, security analytics, and identity theft protection. Organizations are investing in these services to safeguard their critical assets, mitigate risks, and maintain regulatory compliance.

What are the Security Services market trends shaping the Industry?

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) is becoming a significant trend in the market. These advanced technologies are essential for enhancing security systems' efficiency, accuracy, and adaptability. The market is undergoing significant transformation with the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced solutions are increasingly being utilized to enhance threat detection, automate incident response, and analyze large datasets in real-time to identify potential security breaches. This shift towards proactive security measures is driving innovation and operational efficiency in the industry. Leading companies are embracing AI and ML to provide comprehensive security services for critical infrastructure and data security. For instance, Atos offers AI-driven cybersecurity solutions for Qatar's smart city initiative, TASMU. Their platform leverages intelligent analytics and AI capabilities to secure critical infrastructure and applications, enabling preventative measures against potential threats.

- Moreover, security awareness training, identity management, emergency response, and PCI DSS compliance are essential components of modern security services. Security operations centers play a crucial role in monitoring and responding to security incidents, while insider threats continue to pose significant risks. Companies must prioritize security awareness training to mitigate these risks and ensure their workforce is equipped to identify and respond to potential threats. The integration of AI and ML into security services is revolutionizing the industry, enabling proactive threat detection and response. Companies that prioritize these advanced technologies and invest in comprehensive security solutions will be best positioned to protect their critical infrastructure and data from evolving threats. Managed security services, including threat detection, intrusion management, and vulnerability scanning, are becoming increasingly popular.

How does Security Services market faces challenges face during its growth?

- The high initial cost of security services poses a significant challenge to the industry's growth trajectory. This expense, a common concern for businesses and organizations, can hinder the expansion and progression of the security services sector. The market faces a notable challenge with the high initial investment required for various security solutions. Small and medium-sized enterprises, as well as cost-conscious consumers, often find it difficult to afford the upfront costs associated with security systems. Basic home security packages from companies offer essential features starting from around USD 199 to USD 599, but advanced systems with smart home integration, multiple surveillance cameras, and professional installation can cost upwards of USD 3,000. Commercial-grade systems, which are more complex and sophisticated, carry even higher price tags. Security assessments, incident response, endpoint security, video surveillance, mobile security, cloud security, alarm systems, social engineering, data breaches, network security, antivirus software, and intrusion prevention systems are crucial components of comprehensive security solutions.

- Despite their importance, the high initial investment can deter potential customers. However, the long-term benefits, including enhanced protection against cyber threats and physical security risks, often outweigh the upfront costs. It is essential for businesses and individuals to carefully consider their security needs and budget when selecting a security solution. Code audits, cyber intelligence, and smartphone and tablet security are also critical components of a comprehensive cybersecurity strategy.

Exclusive Customer Landscape

The security services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the security services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, security services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company specializes in advanced security services, including cyber fusion centers for safeguarding operational technology and industrial control systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- ARCON

- Barracuda Networks Inc.

- Broadcom Inc.

- BT Group Plc

- Cisco Systems Inc.

- Dell Technologies Inc.

- Deloitte Touche Tohmatsu Ltd.

- Fortinet Inc.

- Gen Digital Inc.

- Ilantus Inc.

- International Business Machines Corp.

- Kyndryl Inc.

- McAfee LLC

- Open Text Corp.

- Palo Alto Networks Inc.

- Proofpoint

- Zscaler Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Security Services Market

- In February 2024, Palo Alto Networks, a leading cybersecurity company, announced the launch of its new Security Operations as a Service (SOaaS) offering, which provides customers with 24/7 threat detection and response services (Palo Alto Networks Press Release, 2024). This new service is designed to help organizations address the growing cybersecurity skills gap and the increasing volume of security threats.

- In March 2025, Amazon Web Services (AWS) and ADT, a leading security services provider, announced a strategic partnership to offer integrated security solutions that combine AWS's cloud technology with ADT's physical security services (AWS News, 2025). This collaboration aims to provide customers with a comprehensive security solution that covers both physical and digital security needs.

- In July 2024, Honeywell announced the acquisition of Elster, a leading provider of gas and water metering technologies, for approximately USD5.1 billion (Honeywell Press Release, 2024). This acquisition is expected to expand Honeywell's presence in the utility infrastructure market and strengthen its position in the security services sector, particularly in the areas of smart grid and energy management.

Research Analyst Overview

The market continues to evolve, with dynamic market activities shaping the industry's landscape. Physical security remains a crucial aspect, encompassing perimeter security and access control. Malware detection and vulnerability assessments are integral components of information security, ensuring compliance with various frameworks and effective risk management. Application security, threat intelligence, and security consulting are essential for mitigating risks and enhancing business continuity. Managed security services, including intrusion detection, disaster recovery, and security testing, offer proactive solutions. Penetration testing and security audits provide valuable insights, while threat assessment and security analytics help identify potential vulnerabilities. Patrol services and data loss prevention are crucial for critical infrastructure protection. With the rise of remote work, cloud-based services have become essential for business functions like Customer Relationship Management (CRM), payroll, and enterprise communication, ensuring secure access to data from anywhere.

Artificial intelligence and machine learning are increasingly integrated into security solutions, offering advanced threat detection and response capabilities. Security awareness training, emergency response, identity management, and PCI DSS compliance are vital components of a comprehensive security strategy. Insider threats and data breaches pose significant risks, necessitating robust security assessments and incident response plans. Endpoint security, mobile security, cloud security, alarm systems, social engineering, and network security are essential services, seamlessly integrated into the evolving security landscape. Cloud security concerns, including cloud implementation, software-defined perimeters, and cloud-based security solutions, are becoming increasingly important. Ongoing threat intelligence and risk mitigation strategies ensure businesses remain protected in an ever-changing security environment.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Security Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 51.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, UK, China, Germany, India, France, Japan, Canada, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Security Services Market Research and Growth Report?

- CAGR of the Security Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the security services market growth of industry companies

We can help! Our analysts can customize this security services market research report to meet your requirements.