Meal Vouchers And Employee Benefit Solutions Market Size 2025-2029

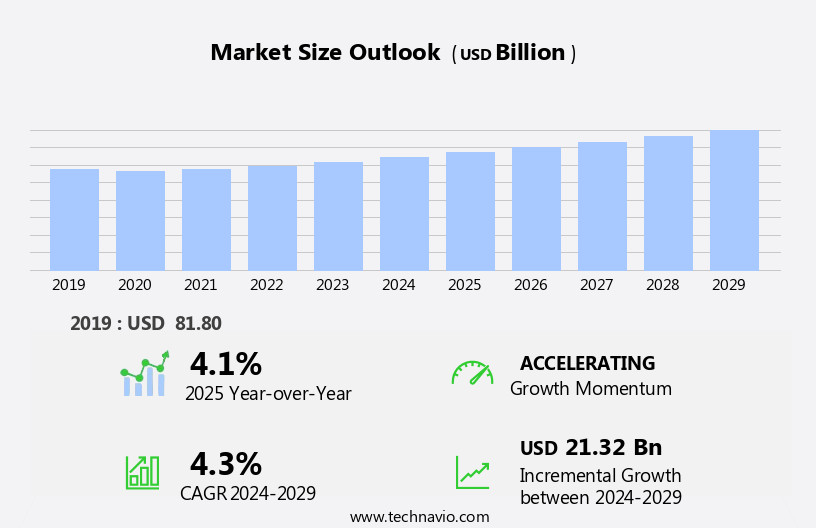

The meal vouchers and employee benefit solutions market size is forecast to increase by USD 21.32 billion at a CAGR of 4.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the tax benefits associated with meal vouchers and the shift toward digital solutions. Employers are increasingly recognizing the cost savings and employee morale boost that come with offering meal vouchers and other benefits as part of compensation packages. In fact, according to various industry reports, the global meal voucher market is projected to reach a substantial value by 2025, growing at a steady pace. However, this market is not without its challenges. Data privacy and security are paramount concerns in the digital age, and companies must ensure that sensitive employee information is protected.

- Additionally, the implementation of digital meal voucher and benefit solutions requires significant investment in technology and infrastructure. Despite these challenges, the opportunities for growth are substantial. Companies that can effectively navigate these issues and offer innovative, user-friendly solutions will be well-positioned to capitalize on the market's expanding demand. Employers seeking to attract and retain top talent, while also controlling costs, will continue to turn to meal vouchers and employee benefit solutions as a key component of their compensation strategies.

What will be the Size of the Meal Vouchers And Employee Benefit Solutions Market during the forecast period?

- The market encompasses a range of offerings designed to enhance financial and health well-being for employees. Meal vouchers, meal coupons, travel vouchers, and gift coupons serve as essential components of employee compensation packages, fostering workplace productivity and team engagement. Beyond meal solutions, this market includes offerings for health and wellness, retirement plans, flexible work arrangements, and financial benefits. Businesses, enterprises, government agencies, educational institutions, and various organizations recognize the importance of employee satisfaction, productivity, retention, morale, and positive work culture. As workforce demographics evolve, so too do the demands for comprehensive employee benefit solutions. These offerings contribute to competitive advantages, supportive government policies, and tax incentives, all while promoting corporate social responsibility.

- The market continues to expand, with a growing emphasis on health and wellness initiatives. As businesses strive to attract and retain top talent, the demand for innovative and inclusive employee benefit packages remains high. The market's overall size and direction reflect this ongoing trend, with continued growth expected in the coming years.

How is this Meal Vouchers And Employee Benefit Solutions Industry segmented?

The meal vouchers and employee benefit solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Meal vouchers

- Employee benefits

- Product

- Non-cash voucher

- Cash voucher

- Enterprise Size

- Large

- Medium

- Large

- Medium

- Industry

- Manufacturing

- Healthcare

- IT and Telecom

- BFSI

- Retail

- Transportation and Logistics

- Others

- Manufacturing

- Healthcare

- IT and Telecom

- BFSI

- Retail

- Transportation and Logistics

- Others

- Deployment

- Physical

- Digital

- Geography

- Europe

- France

- Germany

- Italy

- Spain

- UK

- South America

- Brazil

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Middle East and Africa

- UAE

- Europe

By Type Insights

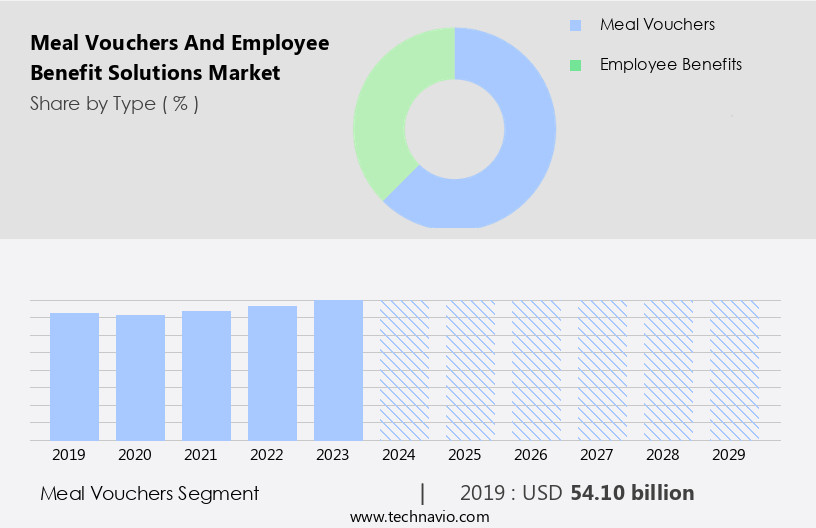

The meal vouchers segment is estimated to witness significant growth during the forecast period.

The meal vouchers segment remains a substantial component of the market in 2024. This market growth is attributed to tax incentives offered under various tax regimes, such as in India, where meal vouchers worth USD0.585 or less per meal are exempt from tax. Meal vouchers serve as an essential element of employee compensation structures, with tax benefits determined by the respective country's laws. In India, these vouchers are regulated by the Reserve Bank of India (RBI) under the Prepaid Payments Instruments Act. companies like Sodexo and Edenred distribute and administer these vouchers, charging a commission from employers for their services.

Meal vouchers contribute to employee financial well-being and workplace productivity by addressing team engagement and work-life balance. Additionally, they impact consumption patterns and production patterns, as employees can make informed choices regarding their meals based on their dietary preferences and partner restaurants or food delivery services. Employee benefits solutions encompass meal vouchers, health and wellness programs, retirement plans, flexible work arrangements, financial benefits, and more. These solutions foster positive work cultures, boost morale, and serve as competitive advantages for businesses, enterprises, government agencies, educational institutions, and multinational companies (MNCs). Market dynamics include geopolitical influences, natural disasters, climate change, economic impact, trade policies, social concerns, demographic changes, supplier power, and buyer power.

Digital technologies, such as mobile applications, online platforms, and integrated benefit platforms, are transforming the delivery and management of these solutions. Advanced analytics and reporting capabilities enable businesses to monitor employee engagement, productivity, and retention rates. Financial wellness programs offer budgeting tools, healthcare coverage, paid time off, and insurance options to support employee well-being. Social media campaigns, content marketing, and tax incentives further enhance the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Meal vouchers segment was valued at USD 54.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

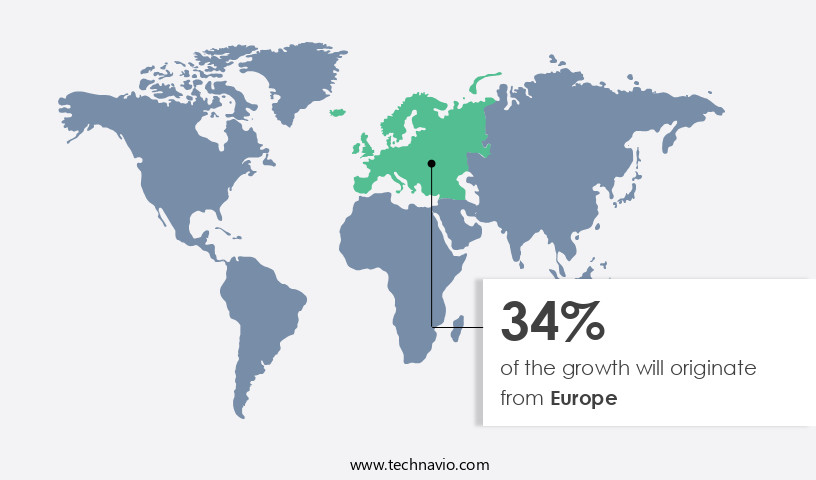

Europe is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing growth in the region, driven by shifting consumption patterns and the increasing preference for digital payment methods. Tax incentives associated with meal vouchers serve as a significant market driver. Some countries are implementing new regulations, such as Italy, which increased the electronic meal voucher limit from â¬7 to â¬11.30 per day from January 1, 2024. These changes impact the usage of meal vouchers, contributing to market expansion. Additionally, workforce demographics, health and wellness concerns, and financial benefits are influencing businesses, enterprises, government agencies, educational institutions, and multinational companies (MNCs) to prioritize employee satisfaction, productivity, retention, morale, and positive work culture.

Employee engagement, work-life balance, and corporate social responsibility are essential components of this market, with digital technologies, such as mobile applications, online platforms, and integrated benefit platforms, playing a crucial role. Financial wellness solutions, including budgeting tools, healthcare coverage, paid time off, and insurance options, are also gaining traction. Social media campaigns, content marketing, and tax incentives further enhance the market's appeal. Market dynamics include geopolitical influences, natural disasters, climate change, economic impact, trade policies, and demographic changes, as well as supplier and buyer power. Employee wellness, dietary preferences, partner restaurants, food delivery services, and digital meal vouchers are essential considerations for businesses seeking to optimize their employee benefit solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Meal Vouchers And Employee Benefit Solutions Industry?

- Tax benefits of meal vouchers is the key driver of the market.

- Meal vouchers and employee benefit solutions have gained significance in the global business landscape, offering tax advantages to companies, organizations, and employers. In several countries, providing meal vouchers, food coupons, or prepaid meal cards as part of an employee's salary structure exempts the employer from tax liability. For instance, the Workers' Food Program (PAT) was introduced in Brazil in 1976, enabling companies to pay for their employees' food provisions in exchange for tax relief. Similarly, in India, the number of meal vouchers an employee uses is not considered part of their taxable salary. The Income Tax Department of the Indian government grants tax benefits for free food and beverages offered to employees.

- These benefits not only help employers reduce their tax burden but also enhance employee morale and productivity. Employers can explore meal voucher and employee benefit solutions as a strategic tool to optimize their tax liabilities while providing valuable perks to their workforce.

What are the market trends shaping the Meal Vouchers And Employee Benefit Solutions Industry?

- Shift toward digital meal vouchers and employee benefit solutions is the upcoming market trend.

- The market is witnessing significant growth due to the increasing internet penetration rate in developing economies and the widespread adoption of mobile internet and smartphones. This digital transformation is driving a shift towards digital wallets and payment methods, with numerous retailers and companies now accepting payments through these modes. The European Commission, for instance, is investing in ultra-fast networks to enhance internet infrastructure, aiming to provide high-speed internet coverage to all its citizens by 2025 and gigabit connectivity by 2030.

- This initiative, along with the growing trend of automation and digitization among companies like Sodexo Group and Edenred, is enabling personalized services for clients and employees. The market is expected to continue growing as more organizations embrace digital solutions for their meal voucher and employee benefit programs.

What challenges does the Meal Vouchers And Employee Benefit Solutions Industry face during its growth?

- Data privacy and security issues is a key challenge affecting the industry growth.

- In today's digital business landscape, meal voucher and employee benefit solutions have become essential tools for organizations to attract and retain talent. These solutions offer numerous advantages, such as streamlined administration, increased efficiency, and improved employee morale. However, with the growing adoption of technology comes the risk of data breaches. companies providing meal voucher and employee benefit services often collect and store personal information of employees and business partners. While many companies employ commercially available security technologies to protect this data, any vulnerability in their servers or mobile apps could lead to privacy concerns and potential reputational damage.

- In this era of digitization, data has become a crucial asset, and its protection is paramount. For instance, Edenred offers various payment options, including Apple Pay, Google Pay, SAMSUNG Pay, and its proprietary solutions, to its beneficiaries for making payments online. Businesses must carefully evaluate the security measures implemented by their meal voucher and employee benefit solution providers to mitigate the risk of data breaches and safeguard their reputation.

Exclusive Customer Landscape

The meal vouchers and employee benefit solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the meal vouchers and employee benefit solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, meal vouchers and employee benefit solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alelo - The company provides meal vouchers and extensive employee benefit solutions, including transportation benefits and more, under the Alelo Benefit program. This comprehensive offering enhances workforce well-being and productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alelo

- Alera Group Inc.

- Axis Bank Ltd.

- Certify Inc.

- Circula GmbH

- CIRFOOD s.c.

- Edenred SE

- Electrum Fintech Solutions Pvt. Ltd.

- Empyrean Benefits Solutions Inc.

- Hrmony GmbH

- ICICI Bank Ltd.

- Monizze NV SA

- PIB Group Ltd.

- Set Corporate Services Inc.

- Sodexo SA

- SPENDIT AG

- SWILE

- The Up Group Ltd.

- UniCredit SpA

- VA Tech Ventures Pvt. Ltd.

- VR BenefÃcios

- Zaggle Prepaid Ocean Services Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Meal vouchers and employee benefit solutions have emerged as essential components of modern human resource management. These offerings contribute significantly to the financial well-being and overall wellness of employees, fostering productivity, team engagement, and positive work culture. Meal vouchers, which include meal coupons, travel vouchers, and gift coupons, serve as a valuable tool for businesses to support their employees' daily needs and enhance their work-life balance. The demand for meal vouchers and employee benefit solutions is driven by various factors. Production and consumption patterns continue to evolve, necessitating flexible and adaptable benefits. Workforce demographics are changing, with an increasing focus on health and wellness, retirement plans, and financial benefits.

Furthermore, businesses are recognizing the importance of employee satisfaction, productivity, and retention in a competitive market. Professional services and enterprises, including government agencies, educational institutions, and multinational companies (MNCs), are increasingly adopting integrated benefit platforms to manage their employee benefit programs. These platforms offer advanced analytics and reporting capabilities, enabling organizations to gain insights into their workforce demographics and consumption patterns. Geopolitical influences, natural disasters, climate change, economic impact, and trade policies have created a complex business environment. Employers are responding by offering employee benefits that address social concerns and support their workforce during challenging times.

For instance, meal vouchers can help employees manage their food expenses during economic downturns or natural disasters. Digital technologies, such as mobile applications and online platforms, have transformed the way meal vouchers and employee benefits are delivered and managed. Digital meal vouchers offer convenience and flexibility, allowing employees to use them at partner restaurants, food delivery services, and other eligible merchants. The market for meal vouchers and employee benefit solutions is dynamic and competitive. Buyer power and supplier power influence the pricing and offerings in this market. Businesses must navigate these dynamics to secure the best deals and offer competitive advantages to their employees.

Marketing activities, such as social media campaigns and content marketing, play a crucial role in promoting employee benefits and enhancing brand visibility. Tax incentives and government policies also impact the adoption and implementation of meal vouchers and employee benefit solutions. In , meal vouchers and employee benefit solutions are essential components of modern human resource management. They contribute to the financial well-being and overall wellness of employees, fostering productivity, team engagement, and positive work culture. The market for these offerings is dynamic and influenced by various factors, including production and consumption patterns, workforce demographics, and geopolitical influences.

Employers must navigate these dynamics to offer competitive benefits and create a supportive work environment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 21.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Meal Vouchers And Employee Benefit Solutions Market Research and Growth Report?

- CAGR of the Meal Vouchers And Employee Benefit Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, South America, APAC, North America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the meal vouchers and employee benefit solutions market growth of industry companies

We can help! Our analysts can customize this meal vouchers and employee benefit solutions market research report to meet your requirements.