Navigation Lighting Market Size 2024-2028

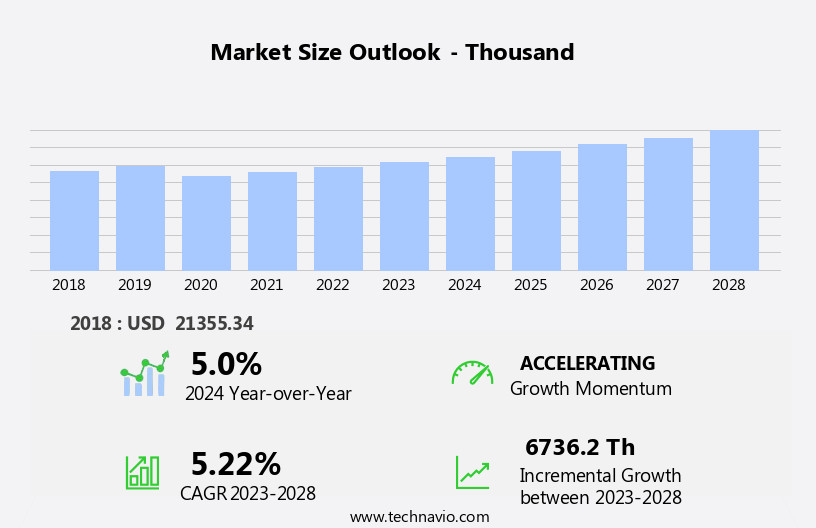

The navigation lighting market size is forecast to increase by USD 6736.2 thousand at a CAGR of 5.22% between 2023 and 2028.

What will be the Size of the Navigation Lighting Market During the Forecast Period?

How is this Navigation Lighting Industry segmented and which is the largest segment?

The navigation lighting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Marine industry

- Aerospace industry

- Type

- High light intensity

- Medium light intensity

- Low light intensity

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

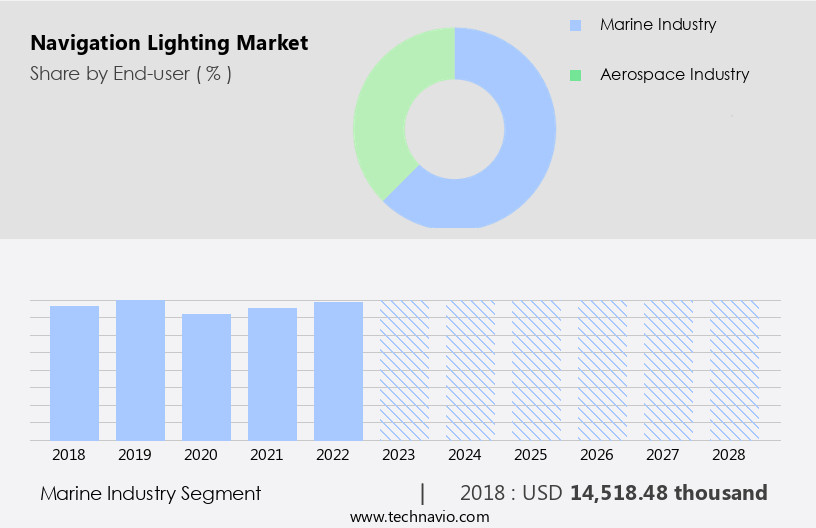

- The marine industry segment is estimated to witness significant growth during the forecast period.

Navigation lighting plays a crucial role in ensuring safety and efficiency In the maritime industry. This market segment focuses on the installation of navigational lights on various watercraft, including ships and boats, as well as marine structures. These lights serve as visual aids, enabling vessels to navigate through waterways, ports, and channels. They are typically positioned at the bow, stern, and sides of the vessel for identification and communication with nearby watercraft. Navigation lights are essential for preventing collisions and accidents, particularly during nighttime or low visibility conditions. In the aerospace industry, similar lighting systems are used on aircraft for takeoff and landing, as well as for air traffic control.

Navigation lights are available in various intensities - low, medium, and high - to cater to different operational requirements. Technologies such as incandescent filaments, light-emitting diodes (LED), halogens, flashes, and strobes are used In the production of these lights. Key players in this market include aircraft manufacturing and shipping industries, airline companies, aerospace transportation, marine tourism, and harbormasters, among others.

Get a glance at the Navigation Lighting Industry report of share of various segments Request Free Sample

The Marine industry segment was valued at USD 14518.48 thousand in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

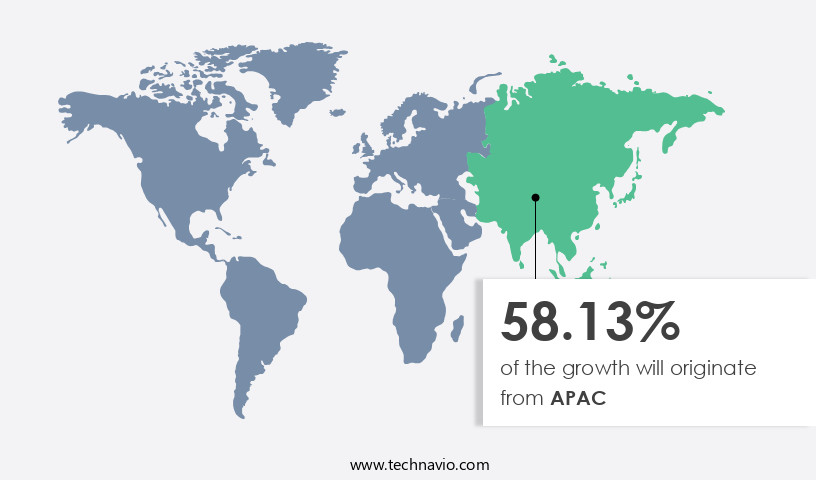

- APAC is estimated to contribute 58.13% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is experiencing significant growth In the market due to the expanding aerospace industry and increased air passenger traffic. In 2022, APAC accounted for over 44% of the global GDP and witnessed a surge in air travel, particularly in emerging economies like India and China, driven by increased spending from the middle-income population. The number of air passengers is projected to continue increasing due to the untapped populations In the region. Navigation lighting is essential for aircraft, watercraft, and spacecraft for safe nighttime operation. The market encompasses various lighting technologies, including incandescent filaments, light-emitting diodes (LED), and halogens.

These lighting systems provide low, medium, and high light intensity for visual signaling on vessels, boats, land-based structures, and offshore structures. The market caters to various industries, including aircraft manufacturing, shipping vessels, and aerospace transportation, as well as airline companies and cruise ship tourism. Key players In the market include manufacturers of illuminating devices, control panels, flashers, marine lights, running lights, and lenses. The market is expected to continue growing due to the increasing demand for safe navigation In the maritime and aerospace industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Navigation Lighting Industry?

Introduction of energy-efficient lighting technologies is the key driver of the market.

What are the market trends shaping the Navigation Lighting Industry?

Declining manufacturing cost of LEDs is the upcoming market trend.

What challenges does the Navigation Lighting Industry face during its growth?

Delays in aircraft delivery is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The navigation lighting market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the navigation lighting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, navigation lighting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aveo Engineering Group s.r.o - The market encompasses a range of products designed to enhance aviation safety during low-visibility conditions. These include offerings such as the Cessna 177 Cardinal, Crystal Conforma, and Wingtip with Ultra Galactica lights. These lighting systems provide essential visual cues for pilots, enabling them to identify other aircraft, obstacles, and runway approaches. By adhering to international standards for aviation lighting, manufacturers ensure that these products contribute to a safer and more efficient flying experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aveo Engineering Group s.r.o

- Beghelli S.p.A.

- Brunswick Corp.

- Canepa and Campi Srl

- Carmanah Technologies Corp.

- Clarience Technologies

- DAEYANG ELECTRIC Co. Ltd.

- Den Haan Rotterdam

- FAMOR S.A.

- Glamox Group

- Lopolight Aps

- ORGA BV

- Osculati Srl

- Oxley Group

- Perko Inc.

- Phoenix Products LLC

- R Stahl AG

- Raytheon Technologies Corp.

- SPX Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Navigation lighting plays a crucial role in ensuring safe and efficient operation in various industries, including marine, aerospace, and land-based structures. The use of illuminating devices for visual signaling during nighttime vehicle operation and in low light conditions is essential for the safety of passengers, crew members, and other users of waterways and airspace. In the marine sector, navigation lights are utilized on various types of vessels and boats, from small recreational craft to large cargo ships and cruise liners. These lights serve multiple functions, including identifying the type and size of the vessel, indicating its direction, and warning of potential hazards.

Marine navigation lights typically consist of red, green, and white lights, which are displayed in specific arrangements to comply with international regulations. Similarly, In the aerospace industry, aircraft navigation lights are used to ensure safe takeoff, landing, and flight operations. These lights are essential for air traffic control and for providing visual cues to pilots during nighttime and low-visibility conditions. Aircraft navigation lights are typically installed on the wings, tail, and leading edges of the wings, and they may consist of flashing or steady lights, depending on their function. The use of navigation lighting is not limited to marine and aerospace applications.

In land-based structures, such as seaports and airports, navigation lights are used to guide vessels and aircraft during their approach and departure. These lights are also used to mark runways, taxiways, and other critical infrastructure. The market for navigation lighting is driven by several factors, including increasing air passenger traffic, cruise ship tourism, and the growing demand for safety and efficiency in transportation. The development of advanced lighting technologies, such as light-emitting diodes (LED) and high intensity discharge (HID), has led to the production of more energy-efficient and durable navigation lights. The marine industry has seen significant growth In the adoption of LED technology for navigation lighting.

LED lights offer several advantages over traditional incandescent filaments and halogens, including longer lifespan, lower power consumption, and improved durability. LED technology also allows for greater flexibility In the design of navigation lights, enabling the creation of more compact and versatile lighting solutions. Similarly, In the aerospace industry, the adoption of advanced lighting technologies is driving the development of more efficient and effective navigation systems. For example, xenon navigation lights offer improved brightness and durability compared to traditional halogen navigation lights. These lights are also more energy-efficient, reducing the overall weight and fuel consumption of aircraft. In conclusion, the market is a dynamic and growing industry, driven by the need for safety, efficiency, and innovation in transportation.

The adoption of advanced lighting technologies, such as LED and HID, is transforming the market, offering new opportunities for manufacturers and users alike. Whether In the marine, aerospace, or land-based sectors, navigation lighting remains an essential component of safe and efficient transportation systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.22% |

|

Market growth 2024-2028 |

USD 6736.2 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.0 |

|

Key countries |

US, China, Japan, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Navigation Lighting Market Research and Growth Report?

- CAGR of the Navigation Lighting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the navigation lighting market growth of industry companies

We can help! Our analysts can customize this navigation lighting market research report to meet your requirements.