Off-Road Vehicle Seats Market Size 2025-2029

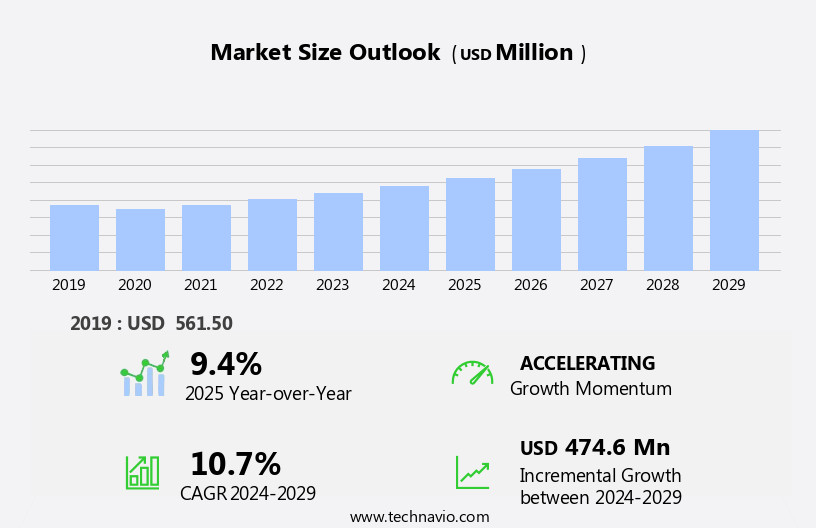

The off-road vehicle seats market size is forecast to increase by USD 474.6 million at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth driven by advancements in seat materials, which offer enhanced durability, comfort, and safety features. These innovations cater to the unique demands of off-road applications, where seats must withstand extreme conditions and provide superior support for passengers. Additionally, the emergence of additive manufacturing technology in automotive seats is revolutionizing production processes, enabling customization and cost savings. However, the market faces challenges due to the rising prices of raw materials, particularly foam and leather, which increase production costs.

- To capitalize on this market, companies must focus on developing cost-effective solutions using alternative materials or innovative manufacturing methods. Strategic partnerships and collaborations with material suppliers and technology providers can also help companies stay competitive and meet the evolving demands of the off-road vehicle market.

What will be the Size of the Off-Road Vehicle Seats Market during the forecast period?

- The market exhibits growth, driven by consumer buying trends and evolving preferences for comfort and safety. Economic scenarios, such as disposable income levels and interest rates, influence purchasing decisions. Political scenarios, including regulations and tariffs, impact production costs and market access. Social scenarios, including demographic shifts and lifestyle trends, shape demand for advanced features like electrically adjustable, heated, and powered seats. External factors, including technological advancements and safety regulations, continue to reshape the market landscape.

- Leading players invest in research and development to introduce luxury features and meet evolving consumer needs. The market size is expected to expand, driven by these trends and the increasing popularity of off-road vehicles.

How is this Off-Road Vehicle Seats Industry segmented?

The off-road vehicle seats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Side-by-sides

- ATVs

- Off-road motorcycles

- Type

- Electric seat actuation system (ESAS)

- Manual seat actuation system (MSAS)

- Product Type

- Bucket seats

- Bench seats

- Suspension seats

- Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

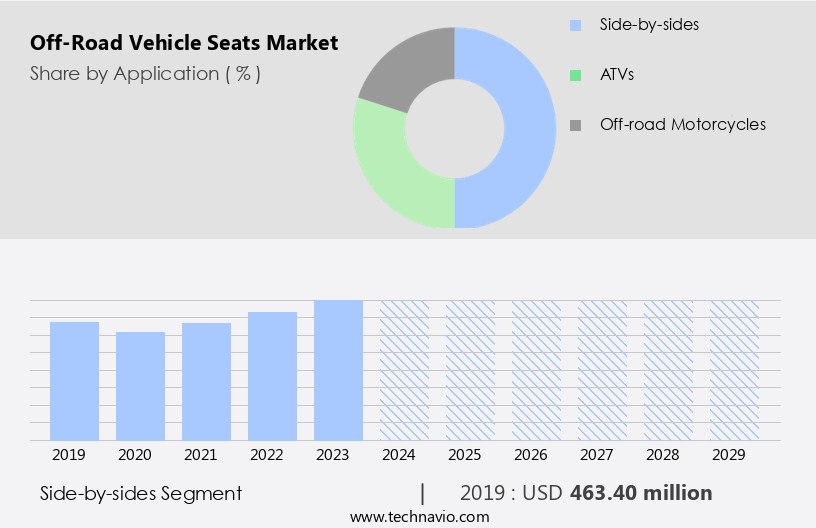

The side-by-sides segment is estimated to witness significant growth during the forecast period.

Off-road vehicle seats refer to the seating systems used in side-by-side vehicles, known for their popularity due to their short travel suspension, high-power motors, and ability to carry multiple passengers and cargo. These vehicles' lightweight design, high suspension, and short wheelbase ensure proper handling and stability on various terrains. Applications ranging from cargo transportation, agriculture, and ranching to recreational activities contribute to their widespread adoption. Side-by-side vehicles are equipped with deep-treaded pneumatic tires, bench or bucket seats for two or more occupants, a steering wheel, and foot pedals for acceleration and braking. Seats in these vehicles offer advanced features such as heated, ventilated, memory, and powered seats, enhancing comfort and convenience.

Safety regulations mandate side curtain airbags and other safety features, while technological advancements include automated driving and autonomous vehicles. Seat materials include polyester fabrics, laminate composites, and cutting-edge trim, ensuring durability and comfort. Cushioning systems and ergonomic designs cater to personalized and customizable preferences. Seat frames, seat suspension, and seat materials adhere to durability standards, ensuring long-lasting performance. Market research firms like , , and predict growth in the market due to cost reductions, increasing demand for luxury features, and the expanding SUV market. Key trends include the integration of advanced safety features, such as integrated lumbar support, and the use of synthetic leather and nonwoven polyesters.

In , off-road vehicle seats cater to the unique requirements of side-by-side vehicles, offering advanced features, safety regulations, and ergonomic designs to meet the needs of various applications and user preferences.

Get a glance at the market report of share of various segments Request Free Sample

The Side-by-sides segment was valued at USD 463.40 million in 2019 and showed a gradual increase during the forecast period.

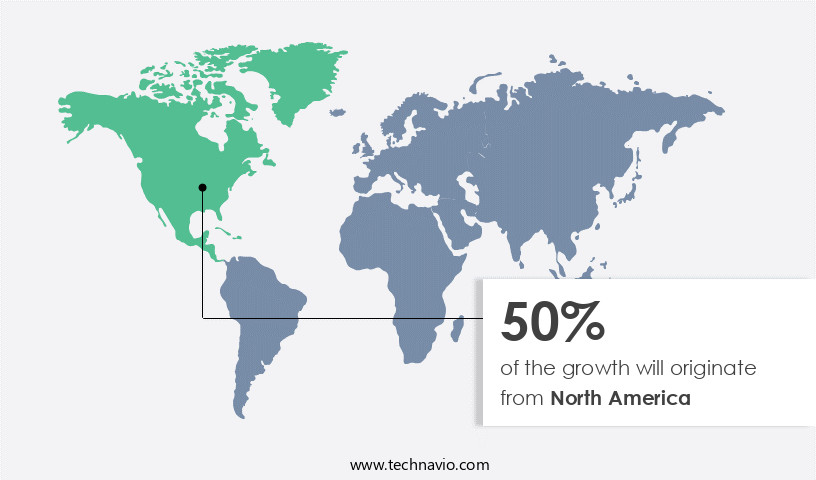

Regional Analysis

North America is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for off-road vehicle seats is driven primarily by the significant demand for off-road vehicles in the US and Canada. Major contributors to this demand include the sales of all-terrain vehicles (ATVs), side-by-side vehicles, dirt bikes, and adventure motorcycles in these countries. Furthermore, the region's hosting of numerous motorcycling and off-road rallying events significantly benefits the market. Off-road motorcycles are particularly popular in the US, with original equipment manufacturers (OEMs) such as Yamaha Motor Co. Ltd., Kawasaki Motors Corp., Honda Motor Co. Ltd., and KTM AG offering a wide range of models under the dirt, adventure, off-road, and dual-sport categories.

Advanced features, such as electric vehicles, luxury features like powered seats, heated seats, ventilated seats, memory seats, and automated driving, are increasingly becoming standard in off-road vehicles, enhancing the overall consumer experience. Safety regulations and safety features, including seat suspension, ergonomic design, seat materials, cushioning systems, and durability standards, are essential considerations for OEMs in the development of off-road vehicle seats. Technological advancements, such as seat concepts, multizone climate, trim materials like polyester fabrics and laminate composites, cutting-edge trim, and comfortable positions, are also key factors influencing the market. The SUV market's growth and the ability to navigate various terrains further contribute to the demand for off-road vehicle seats.

Cost reductions through the use of synthetic leather, personalized and customizable seat designs, side curtain airbags, and safety features like traffic accidents prevention systems are also essential market trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Off-Road Vehicle Seats Industry?

Advances in off-road vehicle seat materials is the key driver of the market.

- Off-road vehicle seats have gained significant attention due to the increasing demand for off-road vehicles. This market dynamics has intensified competition among manufacturers, leading them to innovate and develop advanced seat offerings. Traditional off-road vehicle seats are typically made of vinyl materials or a combination of suede and vinyl. However, recent advancements include full suede seats, which provide enhanced comfort and stability as aftermarket fitments.

- The continuous pursuit of superior riding experiences drives manufacturers to explore new materials and technologies, ensuring the off-road vehicle seat market remains dynamic.

What are the market trends shaping the Off-Road Vehicle Seats Industry?

Growing emergence of additive manufacturing for automotive seats is the upcoming market trend.

- Additive manufacturing, a technology that converts three-dimensional digital designs into physical components by depositing materials, is gaining significant traction across various industries. Notably, the automotive sector, where precision manufacturing is crucial, is embracing this technology. In the automotive industry, additive manufacturing is being adopted by both manufacturers and components suppliers, including those producing seats and related components. This technology allows for the creation of complex designs using a range of materials in filament, liquid resin, and fine powder forms.

- Metals, composites, and plastics are among the materials used to manufacture 3D printable objects. The automotive seats industry's acceptance of additive manufacturing is growing, as it offers advantages such as reduced production time, lower material waste, and increased design flexibility.

What challenges does the Off-Road Vehicle Seats Industry face during its growth?

Rise in raw material prices of off-road vehicle seats is a key challenge affecting the industry growth.

- Off-road vehicle seats differ in design from those of street-legal vehicles, yet the raw materials used for their manufacture are consistent within the automotive industry. Primarily, off-road seats are constructed from open-cell or closed-cell polymers, such as polyurethane or polyethylene. These polymers are chosen based on their density and firmness for molding into the seat pan. As key raw materials for automotive seats, including off-road vehicle seats, any price fluctuations significantly impact manufacturing costs.

Exclusive Customer Landscape

The off-road vehicle seats market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the off-road vehicle seats market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, off-road vehicle seats market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acerbis Italia Spa - The company specializes in providing off-road motorbike seats, catering to popular brands like Honda, KTM, and Husqvarna, among others. Our offerings ensure enhanced comfort and durability for an optimal riding experience. By focusing on these essential elements, we aim to improve overall performance and safety for off-road enthusiasts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acerbis Italia Spa

- Autofit Pvt. Ltd.

- Beard Seats

- Bestop Inc.

- Corbeau USA LLC

- Great Day Inc.

- Holley Performance Products

- Jettrim LLC

- MasterCraft Safety

- MOMO Srl

- NRG Innovations

- PRP Seats

- Rugged Ridge

- Seat Concepts

- Sparco USA

- Suburban Auto Seat Co. Inc.

- Wes Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of commodities and services designed to enhance the driving experience for consumers in various terrains. External factors, such as safety regulations and consumer preferences, play a significant role in shaping the market dynamics. Winning imperatives for off-road vehicle seat manufacturers include the integration of advanced features, such as electric power, heating, ventilation, and memory functions. These cutting-edge technologies cater to the evolving needs of consumers, who seek comfort and convenience in their off-road adventures. Safety regulations continue to be a crucial consideration in the development of off-road vehicle seats.

Seats with advanced safety features, such as side curtain airbags and integrated lumbar support, help protect passengers during traffic accidents. Additionally, the integration of automated driving and autonomous vehicle technologies is expected to further enhance safety and comfort. The off-road seats market is witnessing technological advancements, with a focus on ergonomic design and durability. Seat suspension systems, cushioning systems, and seat frames are being engineered to provide optimal comfort and support for passengers. Seat materials, such as nonwoven polyesters and laminate composites, offer durability and resistance to wear and tear. Trim materials, including polyester fabrics and synthetic leather, are increasingly being used to enhance the aesthetic appeal of off-road vehicle seats.

These materials offer a range of benefits, including ease of cleaning and resistance to UV damage. The SUV market represents a significant growth opportunity for off-road vehicle seat manufacturers. With the increasing popularity of SUVs, there is a growing demand for seats that can handle various terrains and provide a comfortable and personalized driving experience. Cost reductions are also a key focus area for off-road vehicle seat manufacturers. Innovations in manufacturing processes and the use of cost-effective materials, such as nonwoven polyesters, are helping to reduce production costs while maintaining quality and durability standards. In , the market is driven by a range of external factors, including safety regulations, consumer preferences, and technological advancements.

Manufacturers are responding to these trends by developing seats with advanced features, ergonomic designs, and durable materials to meet the evolving needs of consumers in the off-road market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market growth 2025-2029 |

USD 474.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, Canada, Germany, China, UK, Mexico, Italy, France, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Off-Road Vehicle Seats Market Research and Growth Report?

- CAGR of the Off-Road Vehicle Seats industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the off-road vehicle seats market growth of industry companies

We can help! Our analysts can customize this off-road vehicle seats market research report to meet your requirements.