Oilfield Crown Block Market Size 2026-2030

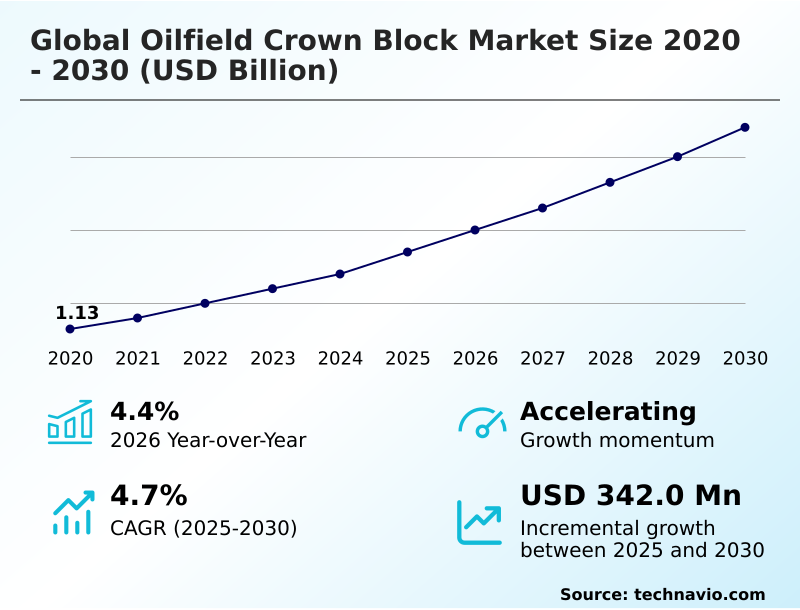

The oilfield crown block market size is valued to increase by USD 342 million, at a CAGR of 4.7% from 2025 to 2030. Resurgence of deepwater and ultra-deepwater exploration projects will drive the oilfield crown block market.

Major Market Trends & Insights

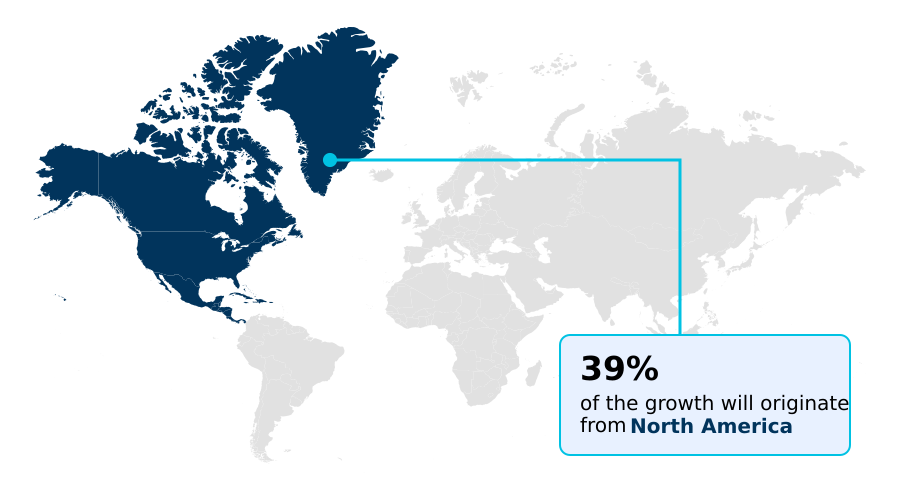

- North America dominated the market and accounted for a 39.3% growth during the forecast period.

- By Application - Onshore segment was valued at USD 1.15 billion in 2024

- By Capacity - Mid-range segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 545.2 million

- Market Future Opportunities: USD 342 million

- CAGR from 2025 to 2030 : 4.7%

Market Summary

- The Oilfield Crown Block market is defined by its role in providing the essential stationary pulley system for drilling rig hoisting operations. The sector is advancing beyond simple mechanical functions toward integrated, intelligent systems. A key driver is the industry's push into ultra-deepwater exploration, where the derrick load capacity must support immense drilling string weight.

- This necessitates equipment with a high hook load rating and advanced bearing technology. Concurrently, a major trend is the integration of sensors for predictive maintenance, allowing operators to monitor structural integrity and mitigate drilling line wear. This shift is critical as capital expenditure budgets remain under pressure from fluctuating commodity prices.

- For instance, a drilling contractor might retrofit an aging rig with a modern, sensor-equipped crown block assembly. This upgrade not only extends the asset's lifecycle but also improves its safety profile and operational efficiency, enabling it to compete for contracts that require API 8C certification and high-performance capabilities, thereby maximizing return on investment in a competitive landscape.

What will be the Size of the Oilfield Crown Block Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Oilfield Crown Block Market Segmented?

The oilfield crown block industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Application

- Onshore

- Offshore

- Capacity

- Mid-range

- Heavy duty

- Light duty

- End-user

- Production drilling

- Exploration drilling

- Geography

- North America

- US

- Canada

- Mexico

- Middle East and Africa

- Saudi Arabia

- UAE

- Turkey

- APAC

- China

- Indonesia

- India

- Europe

- UK

- The Netherlands

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Rest of World (ROW)

- North America

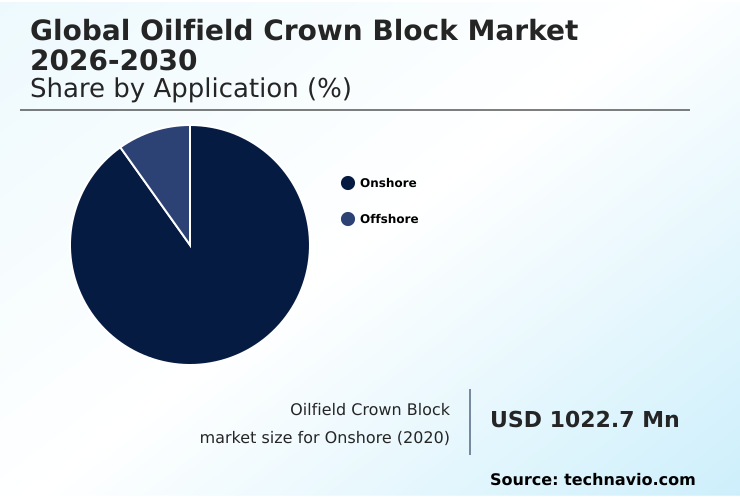

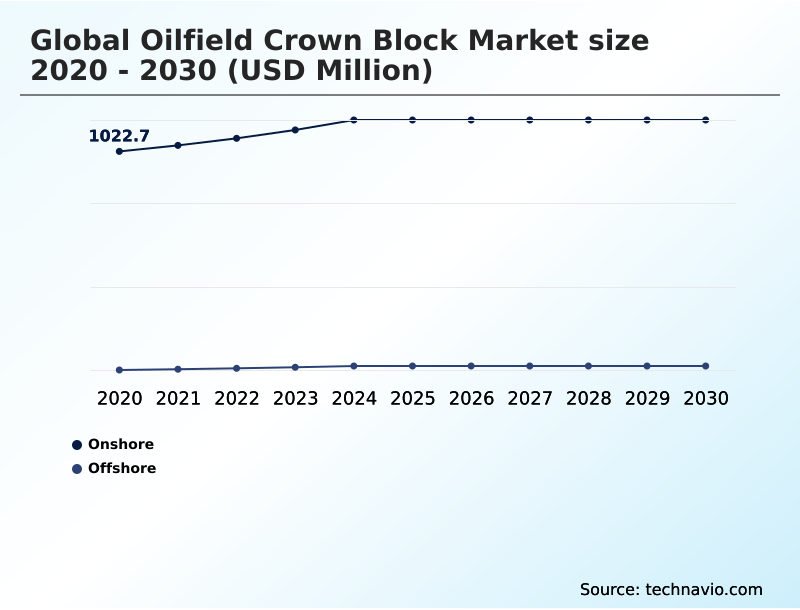

By Application Insights

The onshore segment is estimated to witness significant growth during the forecast period.

The onshore segment is primarily driven by the operational demands of land-based rigs, particularly in high-volume unconventional shale plays. In these environments, the focus is on mobility and efficiency, influencing drilling equipment design.

The evolution toward modular crown block designs, which facilitate faster rig-up time, is a key response to these needs. For instance, such designs can reduce rig mobilization time by up to 15%, a critical metric for operators in cost-sensitive regions.

These onshore drilling operations require a robust hoisting system capable of withstanding the vibrational stresses of frequent relocations between wellheads.

The emphasis is on standardized, durable hardware that supports drilling process automation and minimizes non-productive time, ensuring consistent performance across large-scale development programs.

The Onshore segment was valued at USD 1.15 billion in 2024 and showed a gradual increase during the forecast period.

Regional Analysis

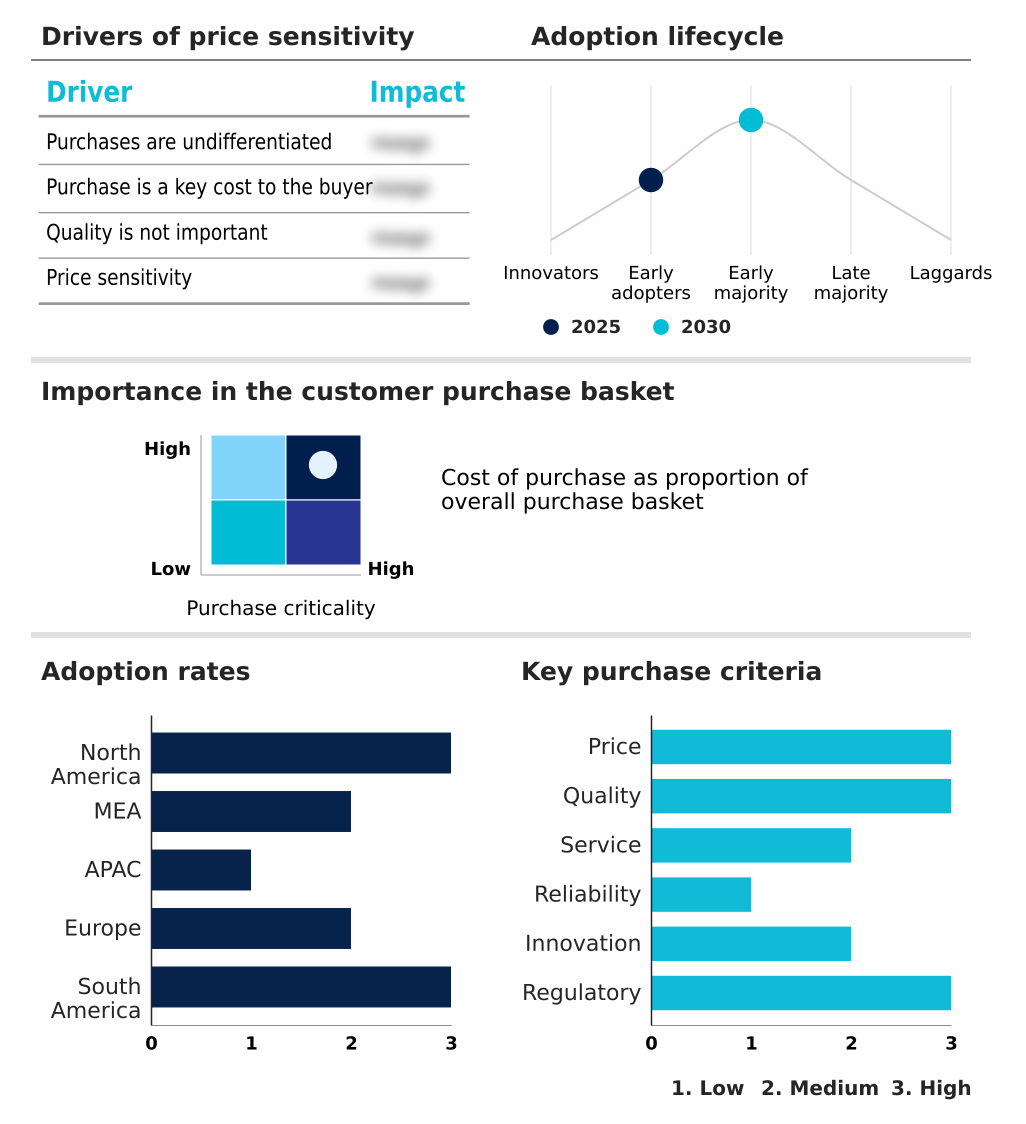

North America is estimated to contribute 39.3% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Oilfield Crown Block Market Demand is Rising in North America Request Free Sample

The geographic landscape is characterized by mature regions focusing on efficiency and emerging frontiers driving demand for high-capacity equipment.

North America accounts for approximately 39% of the market opportunity, with a strong focus on rig fleet modernization for unconventional shale plays.

The adoption of automated rigs in this region has contributed to a 10% reduction in drilling time per well.

In contrast, the APAC and the Middle East and Africa regions, each representing about 22% of the opportunity, are driven by large-scale capacity expansion projects. The demand in these areas is for robust equipment capable of sustained heavy duty drilling.

Turnkey drilling solutions are gaining traction, especially in remote locations where logistical efficiency and operational reliability provided by a complete crown block assembly are paramount for project success and asset integrity management.

Market Dynamics

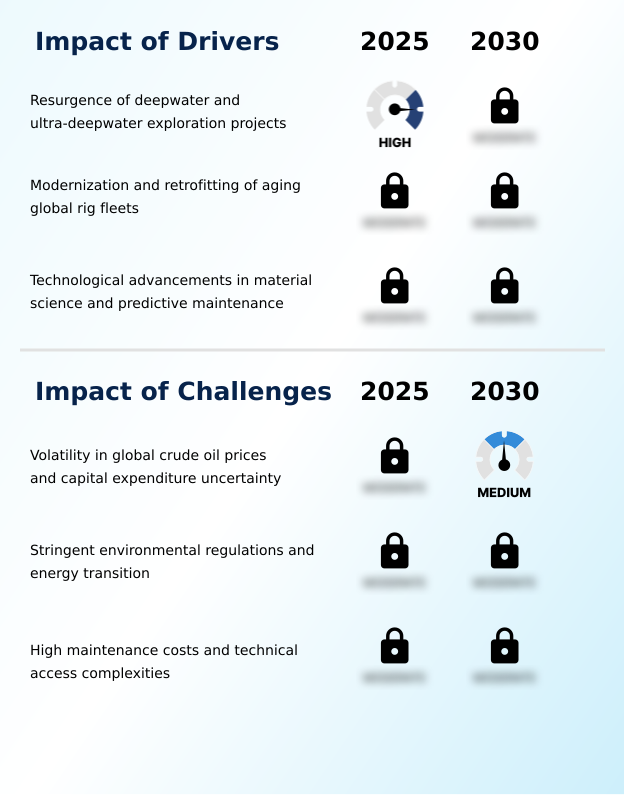

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Understanding the technical nuances of hoisting equipment is critical for operational success in the oil and gas sector. The distinction between the crown block vs traveling block function defines the core mechanics of the drilling rig hoisting system, where one is stationary and the other moves vertically.

- Adherence to a specific crown block API specification is non-negotiable for ensuring safety and interoperability. Design considerations diverge significantly based on application, with onshore vs offshore crown block design priorities shifting from mobility to corrosion resistance.

- For deepwater projects, the heavy duty crown block capacity is a primary concern, while land rig operators focus on a lightweight crown block for land rigs to optimize transport logistics. Proactive management of equipment health is essential; implementing predictive maintenance for crown blocks can significantly reduce the high crown block sheave replacement cost and prevent catastrophic failures.

- Understanding the causes of crown block failure, often related to lubrication or bearing issues, informs better maintenance strategies. Modernization efforts often involve integrating sensors in crown blocks and upgrading crown block lubrication systems.

- The benefits of modular crown block design are particularly evident in reducing rig-up times, and designs are evolving to manage the impact of top drive on crown block alignment. As rigs become more advanced, the crown block design for automated rigs is becoming standard.

- These factors collectively influence drilling rig hoisting system efficiency and overall project economics, with preventative strategies reducing failure risks by over 50% compared to reactive approaches, directly impacting operational planning.

What are the key market drivers leading to the rise in the adoption of Oilfield Crown Block Industry?

- A key market driver is the resurgence of exploration projects in deepwater and ultra-deepwater environments, which necessitates high-capacity and technologically advanced drilling equipment.

- Market growth is fueled by the industry's push into more demanding operational frontiers, which require significant upgrades to the drilling rig mast and hoisting systems.

- The resurgence of ultra-deepwater exploration necessitates crown blocks with a hook load rating capable of handling loads exceeding two million pounds, driving innovation in heavy duty drilling equipment.

- Simultaneously, the imperative for rig fleet modernization provides a consistent demand stream, as retrofitting an existing asset with a modern crown block assembly can extend its service life by over a decade.

- Advancements in material science are a critical enabler, yielding a superior strength-to-weight ratio that can reduce mast weight by 15% without compromising derrick load capacity.

- This is particularly vital for improving drilling rig stability and facilitating turnkey drilling solutions in remote areas.

What are the market trends shaping the Oilfield Crown Block Industry?

- The integration of the Industrial Internet of Things (IIoT) and predictive maintenance strategies is an emerging market trend. This development enhances operational efficiency and extends equipment lifecycles.

- Key market trends are redefining the functionality of the stationary pulley system, shifting it from a passive component to an active contributor to operational intelligence. The integration of IIoT sensors enables predictive maintenance, a strategy proven to reduce unscheduled downtime by up to 30% by preemptively addressing sheave bearing and groove wear.

- Concurrently, advancements in material science are leading to the use of high-tensile steel and corrosion resistant alloys. This allows for drilling equipment design that is both stronger and lighter, with some modular crown block designs cutting rig-up time by 15% for mobile land rigs.

- This focus on high-capacity hoisting and drilling process automation is critical for improving efficiency during harsh environment operations, ensuring equipment longevity and reducing non-productive time.

What challenges does the Oilfield Crown Block Industry face during its growth?

- Volatility in global crude oil prices, coupled with uncertainty in capital expenditure, presents a key challenge to the industry's stable growth.

- The market faces significant headwinds from external economic pressures and internal operational complexities. The volatility of capital expenditure budgets, tied to fluctuating oil prices, can result in a lag of six to nine months before equipment orders recover after a downturn.

- Operationally, the high cost of maintenance is a primary concern; non-productive time due to equipment failure on an offshore rig can exceed several hundred thousand dollars per day, underscoring the need for reliable motion compensation system components.

- This challenge is compounded by a growing skills gap, with the industry facing a projected shortage of technicians as retirement rates outpace new entries by nearly a 2-to-1 ratio. This scarcity impacts the ability to perform complex maintenance and ensure the structural integrity of hoisting systems, demanding designs that simplify service and enhance equipment lifecycle extension.

Exclusive Technavio Analysis on Customer Landscape

The oilfield crown block market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oilfield crown block market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Oilfield Crown Block Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, oilfield crown block market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABCO Middle East FZE - Offers API-certified crown blocks engineered for diverse drilling load capacities and custom rig configurations, ensuring operational integrity and compliance with industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABCO Middle East FZE

- Alco Group.

- American Block

- Andy Petroleum Machinery Co. Ltd.

- Bharat Heavy Electricals Ltd.

- Bomco Brasil

- HMH

- Kingwell Oilfield

- Lee C. Moore

- Sinotai Petroleum Equipment Co. Ltd.

- SOOPL

- The Kito Crosby

- Tianjin Elegant Technology Co. Ltd.

- Turbo Tim

- Uralmash OGE Holding LLC

- Zhonghang Machinery Group Co.

- Zhongman Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oilfield crown block market

- In March 2025, TotalEnergies announced the sanctioning of a new exploration phase in the Orange Basin offshore Namibia, committing significant capital to procure ultra-deepwater rigs with heavy-duty hoisting systems.

- In February 2025, Nabors Industries Ltd. successfully deployed a newly engineered rig in the Permian Basin featuring a crown block assembly made from a novel high-tensile micro-alloy steel, reducing mast weight while maintaining high load capacity.

- In March 2025, HMH announced the deployment of a new crown block system for ultra-deepwater drillships in the Gulf of Mexico, featuring advanced sheave technology to minimize drilling line wear.

- In February 2025, American Block delivered custom-designed crown block assemblies to a major operator in the Permian Basin to upgrade legacy rigs for handling longer lateral drilling sections.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oilfield Crown Block Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 281 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 4.7% |

| Market growth 2026-2030 | USD 342.0 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 4.4% |

| Key countries | US, Canada, Mexico, Saudi Arabia, UAE, Turkey, South Africa, Israel, China, Indonesia, India, Australia, Japan, South Korea, UK, The Netherlands, Spain, Germany, France, Italy, Brazil, Argentina and Colombia |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The Oilfield Crown Block market is evolving from a sector defined by heavy mechanical hardware to one driven by intelligent, data-generating assets. The core of this transition lies in the integration of sensor technology for predictive maintenance and real-time load distribution analysis within the crown block assembly.

- This capability allows operators to monitor the health of the hoisting system, preventing costly failures and reducing wireline wear. A key boardroom-level consideration is the strategic choice between investing in new automated rigs or retrofitting existing fleets with modern components that feature advanced bearing technology and top drive integration.

- Upgrading hoisting systems, for example, can enhance a rig’s operational envelope, allowing it to bid on contracts for wells that are 20% deeper than its previous capacity. This shift toward intelligent hardware, which requires API 8C certification and often incorporates corrosion resistant alloys for harsh environments, is critical for maintaining a competitive edge.

- The focus is now on equipment lifecycle extension and optimizing performance through data-driven insights, ensuring the stationary pulley system becomes a dynamic contributor to drilling efficiency.

What are the Key Data Covered in this Oilfield Crown Block Market Research and Growth Report?

-

What is the expected growth of the Oilfield Crown Block Market between 2026 and 2030?

-

USD 342 million, at a CAGR of 4.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Onshore, and Offshore), Capacity (Mid-range, Heavy duty, and Light duty), End-user (Production drilling, and Exploration drilling) and Geography (North America, Middle East and Africa, APAC, Europe, South America)

-

-

Which regions are analyzed in the report?

-

North America, Middle East and Africa, APAC, Europe and South America

-

-

What are the key growth drivers and market challenges?

-

Resurgence of deepwater and ultra-deepwater exploration projects, Volatility in global crude oil prices and capital expenditure uncertainty

-

-

Who are the major players in the Oilfield Crown Block Market?

-

ABCO Middle East FZE, Alco Group., American Block, Andy Petroleum Machinery Co. Ltd., Bharat Heavy Electricals Ltd., Bomco Brasil, HMH, Kingwell Oilfield, Lee C. Moore, Sinotai Petroleum Equipment Co. Ltd., SOOPL, The Kito Crosby, Tianjin Elegant Technology Co. Ltd., Turbo Tim, Uralmash OGE Holding LLC, Zhonghang Machinery Group Co. and Zhongman Group

-

Market Research Insights

- The market is shaped by a dynamic interplay between technological innovation and operational imperatives. The drive for drilling parameter optimization has led to the adoption of advanced systems, where modern designs can improve rig stability and extend wireline service life by over 15%.

- Furthermore, the implementation of remote condition monitoring through integrated sensors has been shown to reduce unplanned equipment downtime by up to 25%, directly impacting operational cost reduction. This focus on efficiency is crucial as operators navigate volatile capital expenditure budgets.

- The push toward drilling process automation requires hoisting systems that offer precise control, contributing to safer and more efficient well construction, particularly in harsh environment operations and complex unconventional shale plays.

We can help! Our analysts can customize this oilfield crown block market research report to meet your requirements.