Onshore Wind Power Systems Market Size 2024-2028

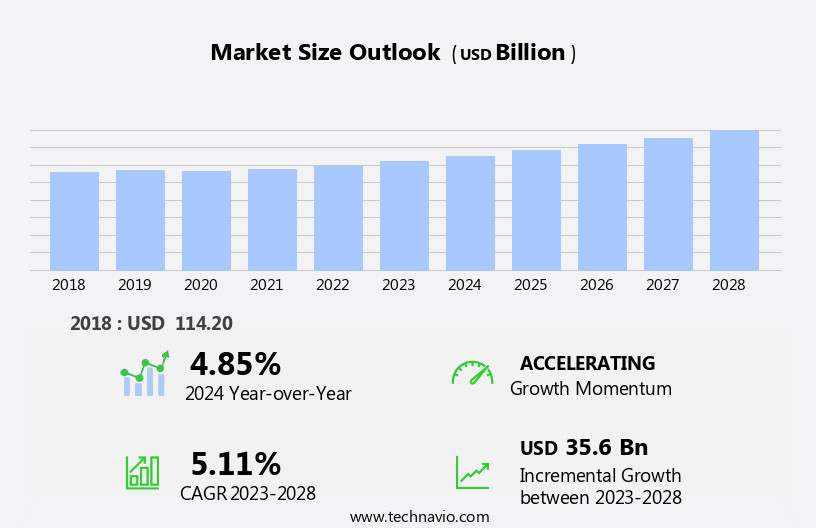

The onshore wind power systems market size is forecast to increase by USD 35.6 billion at a CAGR of 5.11% between 2023 and 2028.

What will be the Size of the Onshore Wind Power Systems Market During the Forecast Period?

How is this Onshore Wind Power Systems Industry segmented and which is the largest segment?

The onshore wind power systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Wind turbine

- T and D

- Others

- End-user

- Electric power

- Renewable energy

- Oil and gas

- Aviation

- Others

- Geography

- APAC

- China

- North America

- US

- Europe

- Germany

- France

- South America

- Brazil

- Middle East and Africa

- APAC

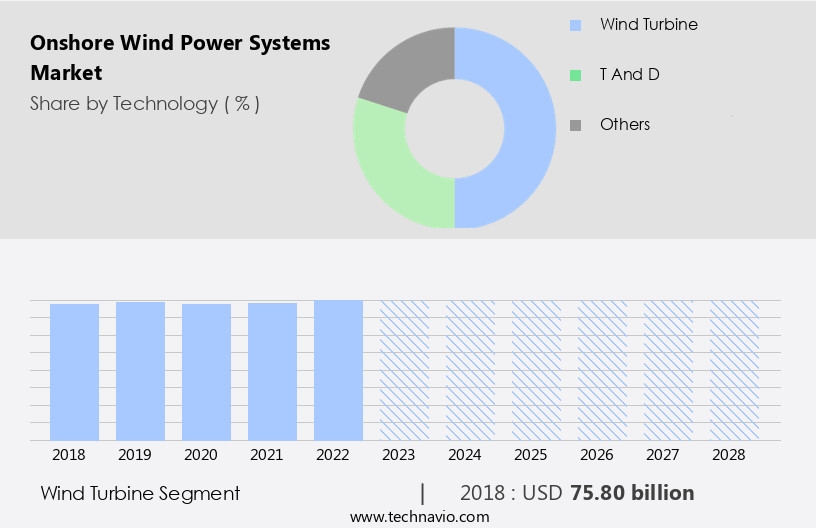

By Technology Insights

- The wind turbine segment is estimated to witness significant growth during the forecast period.

Wind power systems, specifically onshore wind turbines, are a vital component of the renewable energy sector. These systems utilize wind energy to generate electricity, harnessing the power of the wind through the use of turbines. The primary components of a wind turbine include the mast, nacelle, rotor blades, gearbox, and generator. The mast, ranging in length based on the turbine's power, supports the rotor and nacelle. The rotor, typically consisting of three blades, spins due to the air pressure difference, generating kinetic energy. The rotor is connected to the generator, either directly or via a gearbox, increasing the rotational speed.

Wind energy is a clean, sustainable alternative to traditional oil and gas sources, and is increasingly being integrated into the electric power grid. Advancements in technology, such as digitalization, remote monitoring, and peak power management, are enhancing the efficiency and reliability of wind energy systems. Additionally, community-owned wind farms and hybrid power systems are gaining popularity, expanding the market's reach. The wind power market is witnessing new product launches, contractual agreements, and competitive insights, driven by the increasing demand for electricity generation and the need for grid connectivity. Wind energy is a promising solution for meeting peak power demand, especially during high, medium, and low wind speed conditions.

Wind capacity continues to grow, with on-grid and off-grid applications, and the integration of power storage, demand response, frequency response, and system stability solutions.

Get a glance at the Onshore Wind Power Systems Industry report of share of various segments Request Free Sample

The Wind turbine segment was valued at USD 75.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

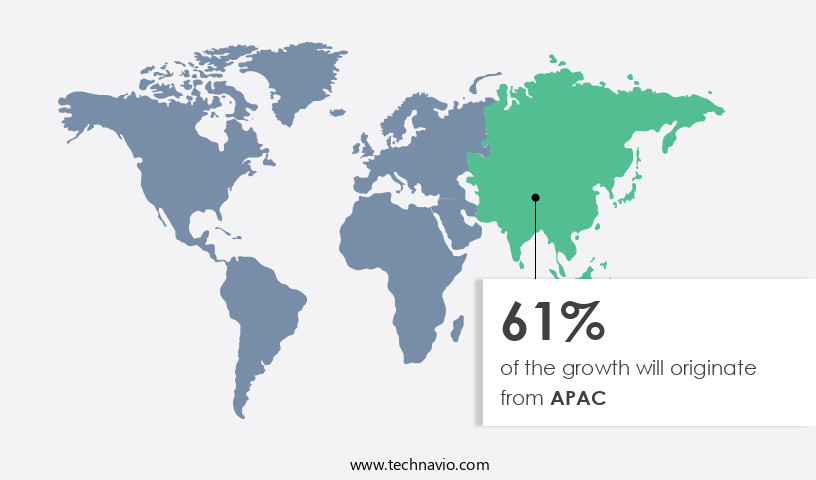

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the increasing energy demands driven by population growth and rising living standards. Renewable energy, particularly wind energy, is gaining prominence In the region as countries strive to reduce their reliance on traditional energy sources and decrease greenhouse gas emissions. New installations of onshore wind power systems are being implemented to meet these energy requirements. In China and India, for instance, there is a pressing need to address pollution issues, leading to a heightened focus on renewable energy. Wind energy is becoming a preferred choice for electricity generation in APAC, with wind turbines being installed across various wind speeds, from high to low.

The market is characterized by advancements in wind turbine technology, grid connectivity, power capacity, and peak power demand management. Companies such as Envision Energy, Vestas Wind System, Enercon GmbH, Mitsubishi Power Systems, Repower, and Peak Power Management are at the forefront of these developments. Digitalization is also playing a crucial role, with remote monitoring and demand response systems enhancing system stability and reliability. Power storage solutions, including battery charging through wind power, are further expanding the market's potential.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Onshore Wind Power Systems Industry?

Rising height and capacity of wind towers is the key driver of the market.

What are the market trends shaping the Onshore Wind Power Systems Industry?

Digitalization and remote monitoring is the upcoming market trend.

What challenges does the Onshore Wind Power Systems Industry face during its growth?

Issues related to land availability and proper sites to set up wind farms is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The onshore wind power systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the onshore wind power systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, onshore wind power systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AB SKF - Onshore wind power systems are a vital component of the renewable energy sector. One notable offering in this domain is SKF WindCon, designed specifically for onshore wind turbines. This system ensures optimal performance and reliability through advanced bearing technology and condition monitoring capabilities. SKF WindCon's features include improved efficiency, extended maintenance intervals, and enhanced safety. By investing in such innovative wind power solutions, organizations can contribute to a sustainable energy future while maximizing their operational efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- AEROVIDE GmbH

- Belden Inc.

- Bora Energy

- CS WIND Corp.

- Doosan Corp.

- Emergya Wind Technologies BV

- ENERCON GmbH

- Envision Energy USA Ltd.

- Fujikura Co. Ltd.

- General Electric Co.

- K2 Management

- Nexans SA

- Nordex SE

- ReGen Powertech Pvt. Ltd.

- Siemens AG

- Suzlon Energy Ltd.

- TERNA S.p.A.

- Vestas Wind Systems AS

- Xinjiang Goldwind Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Onshore wind power systems have emerged as a significant contributor to the global electricity generation landscape, offering a reliable and renewable source of energy. The technology behind onshore wind power systems continues to evolve, with advancements in digitalization, remote monitoring, and peak power management playing a crucial role in enhancing system efficiency and performance. The onshore wind power market is driven by various factors, including the increasing demand for clean energy sources and the need to reduce reliance on traditional oil and gas-based power generation. The integration of wind power into the electric grid has become a priority for many countries, leading to significant investments in on-grid and off-grid wind power projects.

One of the key trends In the onshore wind power market is the adoption of digital technologies. Remote monitoring systems enable operators to optimize wind turbine performance and prevent downtime, while peak power management and power storage solutions help to balance the grid and ensure system stability. Demand response and frequency response technologies also play a critical role in maintaining grid connectivity and managing power capacity during periods of high wind speed or peak power demand. The onshore wind power market is diverse, with a range of wind turbine technologies and components available to meet different wind conditions and power generation requirements.

From high wind speed turbines to medium and low wind speed systems, there is a solution for every application. On-grid and off-grid systems are also gaining popularity, particularly in remote or community-owned projects. Hybrid power systems, which combine wind power with other renewable energy sources such as solar or hydro, are another emerging trend In the onshore wind power market. These systems offer increased reliability and efficiency, making them an attractive option for energy-intensive industries and remote communities. The onshore wind power market is expected to continue growing, driven by increasing demand for clean energy and technological advancements.

Installed capacity is projected to increase significantly In the coming years, with new product launches and contractual agreements contributing to market growth. Despite the numerous benefits of onshore wind power, there are challenges that must be addressed. These include the intermittency of wind power and the need for reliable data to ensure system efficiency and performance. Comprehensive data and reliable data sources are essential for optimizing wind turbine performance and maintaining grid connectivity. In conclusion, the onshore wind power market is a dynamic and evolving industry, driven by the need for clean energy sources and technological advancements. Digitalization, remote monitoring, and peak power management are key trends shaping the market, while hybrid power systems offer increased reliability and efficiency.

The market is expected to continue growing, with significant investments in new technologies and renewable energy projects.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.11% |

|

Market growth 2024-2028 |

USD 35.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.85 |

|

Key countries |

China, US, Germany, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Onshore Wind Power Systems Market Research and Growth Report?

- CAGR of the Onshore Wind Power Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the onshore wind power systems market growth of industry companies

We can help! Our analysts can customize this onshore wind power systems market research report to meet your requirements.