Organic Food And Beverages Market Size 2025-2029

The organic food and beverages market size is valued to increase USD 476.9 billion, at a CAGR of 18.6% from 2024 to 2029. The rising number of new product launches will drive the organic food and beverages market.

Major Market Trends & Insights

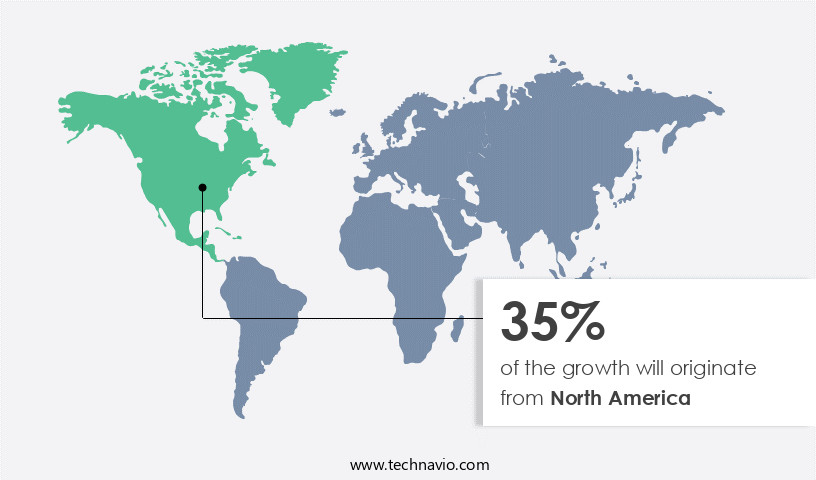

- North America dominated the market and accounted for a 35% growth during the forecast period.

- By Product Type - Organic fruits and vegetables segment was valued at USD 57.80 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 261.67 billion

- Market Future Opportunities: USD 476.90 billion

- CAGR : 18.6%

- North America: Largest market in 2023

Market Summary

- The market represents a significant and continually evolving sector within the global food industry. This market encompasses a range of core technologies and applications, including organic farming practices and certification processes, as well as various product categories such as organic fruits, vegetables, dairy, and beverages. A key driver for the market's growth is the rising number of new product launches, fueled by increasing consumer awareness about the health benefits associated with organic food and beverages. However, challenges persist, including the high cost of organic products, which can limit their accessibility to some consumers. Regions like Europe and North America are major contributors to the market, with Europe holding a substantial market share due to stringent regulations and consumer preference.

- According to recent reports, the organic food market is projected to reach a 10.9% adoption rate by 2025. The market continues to unfold with new trends and developments, offering opportunities for businesses and investors alike.

What will be the Size of the Organic Food And Beverages Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Organic Food And Beverages Market Segmented and what are the key trends of market segmentation?

The organic food and beverages industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Organic fruits and vegetables

- Organic dairy products

- Organic prepared foods

- Organic meat

- Others

- Distribution Channel

- Offline

- Online

- Process

- Processed

- Unprocessed

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The organic fruits and vegetables segment is estimated to witness significant growth during the forecast period.

Organic food and beverages have gained significant traction in both developed and developing markets, with North America and Europe leading the way in consumption. The organic fruits and vegetables segment is particularly popular in these regions. According to recent studies, the consumption of organic produce is projected to expand further during the forecast period. The increasing awareness of artificial preservatives and additives in food is fueling this growth. Organic food offers numerous advantages over conventional produce. For instance, the nutritional composition of organic fruits and vegetables is richer, providing a 20%-40% higher antioxidant intake compared to non-organic produce.

Moreover, organic farming practices prioritize water conservation techniques, natural food preservation, and packaging sustainability. In the realm of livestock management, organic farming practices focus on animal welfare standards and organic certification standards. Food processing technologies, precision agriculture techniques, and sustainable agriculture methods are also employed to ensure food safety regulations and supply chain traceability. Pest management strategies such as integrated pest management and organic certification standards are essential components of organic farming practices. Furthermore, innovative farming techniques like aquaponics production, vertical farming systems, and agricultural biodiversity are being adopted to optimize crop yield and enhance nutritional value.

The Organic fruits and vegetables segment was valued at USD 57.80 billion in 2019 and showed a gradual increase during the forecast period.

Sustainable packaging materials, renewable energy sources, and waste reduction methods are integral to the organic food industry. Improving food security, consumer preference research, and microbial food fermentation are other key trends shaping the market. The organic food market is expected to grow substantially during the forecast period, with a significant increase in demand for organic fruits and vegetables. According to estimates, the market for organic fruits and vegetables is projected to expand by 15%, while the market for organic dairy and meat is expected to grow by 18%. These growth figures reflect the increasing consumer preference for healthier, more sustainable food options.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Organic Food And Beverages Market Demand is Rising in North America Request Free Sample

In 2024, the US and Canada accounted for significant market share in the organic food and beverages sector in North America. The demand for health-conscious alternatives to synthetic and processed food products has surged, with consumers in these countries increasingly aware of the long-term health risks associated with such items. Diabetes, obesity, and gluten sensitivity are among the health concerns driving this shift. As a result, the market has witnessed notable growth, with consumers favoring natural and chemical-free alternatives. According to recent studies, over 50% of US consumers prefer organic food, and the Canadian market for organic food is projected to reach USD 6.2 billion by 2027.

This trend underscores the evolving consumer preferences and the continuous growth potential of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production and distribution of organic food and beverages, employing methods that prioritize sustainability and adhere to strict organic farming standards. Comparing organic food production methods to conventional ones, organic farming significantly enhances soil health, reducing the need for synthetic fertilizers and pesticides. This approach contributes to the nutritional value assessment of organic produce, which is often perceived as superior by consumers. Sustainable beverage packaging solutions are another critical aspect of the market. The impact of organic farming on biodiversity is a significant concern, and effective pest control strategies, such as integrated pest management systems, are essential.

Comparing organic and conventional food processing methods, the former focuses on minimizing food waste during distribution through techniques like temperature control and modified atmospheric packaging. The organic farming industry's effect on greenhouse gas emissions is substantial, with organic farming practices contributing less to global warming than conventional farming. Organic certification plays a crucial role in consumer trust, ensuring transparency and traceability throughout the supply chain. Evaluating organic livestock farming practices, these systems prioritize animal welfare and natural living conditions. Techniques for extending the shelf life of organic products are essential, as are sustainable food production systems design and optimization of resource utilization in organic farming.

Methods improving food security through organic farming are gaining increasing attention, as is the assessment of renewable energy use in food production. Adoption rates of organic farming practices in developing regions are significantly lower than in developed countries. For instance, less than 5% of agricultural land in Africa is organically farmed, compared to over 30% in Europe. This disparity presents an opportunity for growth and innovation in the market.

The growing awareness of health and environmental concerns has significantly fueled the expansion of the organic food and beverages market. Consumers are increasingly prioritizing clean-label products, free from synthetic pesticides and genetically modified organisms, which has led to a surge in demand across various regions. The organic food and beverages market is also being driven by supportive government policies, increased availability through mainstream retail channels, and evolving consumer preferences toward sustainable agriculture and eco-friendly packaging. As competition intensifies, brands operating in the organic food and beverages market are focusing on innovation, supply chain transparency, and certifications to build trust and differentiate themselves in a crowded landscape.

What are the key market drivers leading to the rise in the adoption of Organic Food And Beverages Industry?

- The increasing number of new product launches serves as the primary catalyst for market growth.

- The market experiences consistent expansion due to the increasing number of new product launches. Companies introducing successful organic products witness enhanced revenue and expanded market shares. For example, Homegrown Produce unveiled a new line of organic products with extended shelf life in January 2025. These innovative offerings, featuring fresh produce preserved using advanced technologies, cater to the growing demand for convenient and affordable clean eating options.

- The initial rollout took place in major retail chains nationwide, with full national availability anticipated by April 2025. The market's continuous evolution reflects the ongoing efforts to meet consumer preferences and address the increasing awareness of health and wellness.

What are the market trends shaping the Organic Food And Beverages Industry?

- Consumer awareness regarding the health benefits of organic food and beverages is increasingly prevalent in current market trends. Organic food and beverages are gaining popularity due to growing consumer consciousness about their potential health advantages.

- The market is experiencing significant growth driven by increasing consumer awareness about the health benefits associated with these products. This trend is expected to persist as urban populations continue to prioritize their health and wellness. The market's expansion is further fueled by the growing availability of organic options in mainstream retail channels, including supermarkets and online platforms. According to recent studies, the organic food and beverages sector is witnessing a noticeable shift in consumer preferences towards healthier alternatives.

- For instance, the organic fruits and vegetables segment is projected to dominate the market due to its numerous health benefits. Furthermore, the organic dairy and meat segments are also gaining traction as consumers become more conscious of their dietary choices. These trends are expected to shape the market's trajectory during the forecast period.

What challenges does the Organic Food And Beverages Industry face during its growth?

- The escalating costs of organic food and beverage products pose a significant challenge to the industry's growth trajectory.

- Organic food and beverages represent a growing market segment, with consumer preference for healthier, more sustainable options driving demand. According to recent studies, the organic food market is projected to expand at a steady pace, outpacing the growth of the overall food industry. This trend is due in part to the time-consuming and resource-intensive production processes required for organic farming. With no use of chemicals, pesticides, artificial fertilizers, or growth hormones, the cost of producing organic food is significantly higher than conventional alternatives.

- This high cost can limit accessibility for some consumers, particularly those in economically challenging circumstances. However, the organic food market's continuous expansion reflects a larger cultural shift towards healthier, more ethically-sourced food options. Despite challenges, this evolving market shows no signs of slowing down.

Exclusive Customer Landscape

The organic food and beverages market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic food and beverages market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Organic Food And Beverages Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic food and beverages market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amys Kitchen Inc. - This company specializes in producing organic food and beverage products, including an organic black bean and cheese burrito.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amys Kitchen Inc.

- Archer Daniels Midland Co.

- Ardent Mills LLC

- Aurora Organic Dairy

- Bunge Ltd.

- Cargill Inc.

- Danone SA

- Drakes Organic Spirits Inc.

- Hometown Food Co.

- Kellogg Co.

- Nestle SA

- ORGANIC India Pvt. Ltd.

- Organic Valley

- PepsiCo Inc.

- Pillsbury

- PS Organic

- The Coca Cola Co.

- The Hain Celestial Group Inc.

- The Hershey Co.

- United Natural Foods Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Organic Food And Beverages Market

- In January 2024, Danone, a leading global food company, announced the acquisition of New Zealand's organic infant formula producer, Bellamy's Australia, for approximately USD 1.5 billion. This strategic move aimed to strengthen Danone's presence in the organic baby food market (Danone Press Release, 2024).

- In March 2024, Starbucks Corporation, the world's largest coffeehouse chain, launched its new line of organic hot and cold beverages in collaboration with Stumptown Coffee Roasters. The partnership aimed to cater to the growing demand for organic and sustainably sourced food and beverages (Starbucks Press Release, 2024).

- In May 2024, Coca-Cola's organic beverage brand, Honest Tea, entered the Indian market through a partnership with ITC Limited, India's largest consumer goods company. This strategic move expanded Honest Teas' reach into a new geography, targeting the growing demand for organic beverages in India (ITC Press Release, 2024).

- In April 2025, General Mills, a leading food company, announced the completion of its acquisition of organic cereal brand, Annie's Inc., for approximately USD 820 million. This acquisition aimed to expand General Mills' organic food offerings and strengthen its presence in the growing organic food market (General Mills Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Organic Food And Beverages Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.6% |

|

Market growth 2025-2029 |

USD 476.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Organic food and beverages have gained significant traction in the marketplace, driven by consumers' increasing focus on reducing their carbon footprint and prioritizing sustainability. This trend is evident in various aspects of the industry, from organic ingredient sourcing to water conservation techniques and natural food preservation. Organic livestock management and food processing technologies are also undergoing transformations, adopting precision agriculture techniques to minimize resource usage and enhance nutritional value. Food safety regulations and supply chain traceability have become essential components of the organic food sector, ensuring transparency and accountability. In the realm of organic farming practices, there is a growing emphasis on pest management strategies that rely on integrated pest management and nutritional composition analysis.

- Organic certification standards continue to evolve, with a focus on animal welfare and sustainable agriculture methods. Aquaponics production and vertical farming systems are gaining popularity due to their water conservation capabilities and crop yield optimization. Sustainable packaging materials, renewable energy sources, and waste reduction methods are also becoming increasingly important in the industry. Consumer preference research indicates that organic food and beverages are not just a passing trend. The market is dynamic, with ongoing innovations in areas such as microbial food fermentation, hydroponic cultivation, and food quality control. Soil health indicators and sustainable agriculture methods are essential for long-term success in this sector.

- The market is a vibrant and evolving landscape, with a strong focus on sustainability, transparency, and consumer preferences. From reducing carbon footprint to improving food security, the industry continues to adapt and innovate, offering a wealth of opportunities for businesses and consumers alike.

What are the Key Data Covered in this Organic Food And Beverages Market Research and Growth Report?

-

What is the expected growth of the Organic Food And Beverages Market between 2025 and 2029?

-

USD 476.9 billion, at a CAGR of 18.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Product Type (Organic fruits and vegetables, Organic dairy products, Organic prepared foods, Organic meat, and Others), Distribution Channel (Offline and Online), Geography (North America, Europe, APAC, Middle East and Africa, and South America), and Process (Processed and Unprocessed)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising number of new product launches, High cost of organic food and beverages products

-

-

Who are the major players in the Organic Food And Beverages Market?

-

Key Companies Amys Kitchen Inc., Archer Daniels Midland Co., Ardent Mills LLC, Aurora Organic Dairy, Bunge Ltd., Cargill Inc., Danone SA, Drakes Organic Spirits Inc., Hometown Food Co., Kellogg Co., Nestle SA, ORGANIC India Pvt. Ltd., Organic Valley, PepsiCo Inc., Pillsbury, PS Organic, The Coca Cola Co., The Hain Celestial Group Inc., The Hershey Co., and United Natural Foods Inc.

-

Market Research Insights

- The market continues to demonstrate significant growth, with global sales reaching an estimated USD 170 billion in 2021. This figure represents a 10% increase from the previous year, highlighting the increasing consumer preference for healthier and more sustainable food options. In contrast, the conventional food market is projected to grow at a slower pace, with a CAGR of 2% over the same period. Consumer behavior research indicates that health benefits assessment plays a crucial role in driving demand for organic products. Organic farming practices, such as soil amendment techniques, crop rotation, and natural pesticides, contribute to the production of healthier and more nutritious food.

- Furthermore, life cycle assessment and carbon sequestration help reduce the environmental impact of food production. Organic livestock feed and eco-friendly packaging are other key factors contributing to the market's growth. Consumers are increasingly conscious of the environmental impact of their choices and are willing to pay a premium for products that align with their values. As the market continues to evolve, distribution networks, retail strategies, and supply chain transparency will become increasingly important to meet the growing demand for organic food and beverages.

We can help! Our analysts can customize this organic food and beverages market research report to meet your requirements.