Oriented Strand Board Market Size 2024-2028

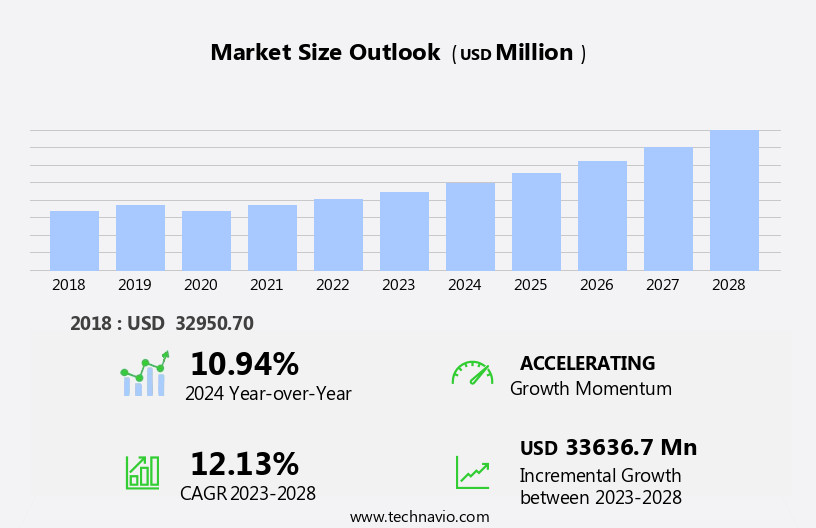

The oriented strand board market size is forecast to increase by USD 33.64 billion at a CAGR of 12.13% between 2023 and 2028.

What will be the Size of the Oriented Strand Board Market During the Forecast Period?

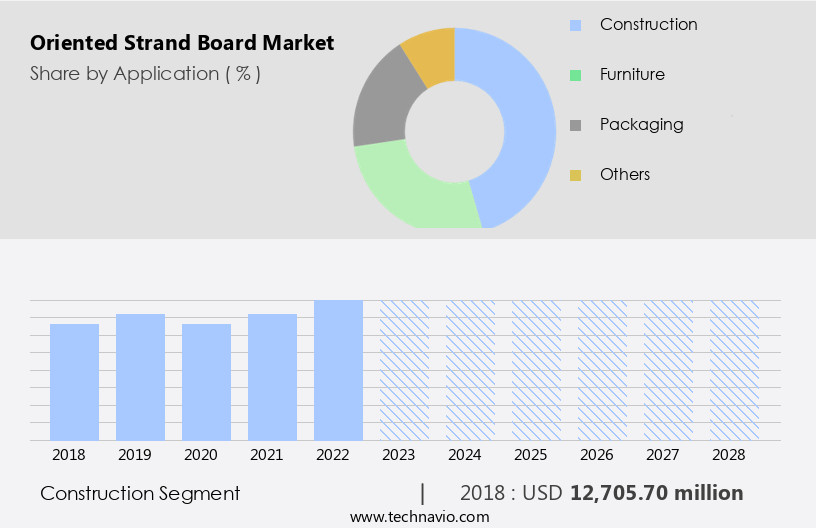

How is this Oriented Strand Board Industry segmented and which is the largest segment?

The oriented strand board industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Construction

- Furniture

- Packaging

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

- The construction segment is estimated to witness significant growth during the forecast period.

Oriented Strand Boards (OSB) serve as a cost-effective and versatile alternative to traditional construction materials, including lumber, plywood, concrete, and steel. Manufactured using wood strands and adhesive, OSBs offer moisture resistance, sustainability, and eco-friendliness, making them suitable for various applications in home improvement projects. These include roofing, wall sheathing, furniture, wood panelling, flooring, shelving, and framing. OSBs are known for their strength, durability, and versatility, which is attributed to advancements in manufacturing technologies, such as terahertz technology. The rising popularity of OSBs in applications like single-layer flooring, subflooring, and wall, roof, and panel sheathing is expected to fuel market growth.

For budget-conscious homeowners, OSBs offer a cost-effective solution compared to plywood, while also providing excellent installation properties. OSBs can be easily cut using a saw and can be painted or stained for aesthetic appeal. Additionally, they offer soundproofing properties, making them an ideal choice for homes and buildings in damp environments or extreme temperatures. Despite their benefits, it is essential to prepare OSBs properly before installation, including treating them with wax and resin to enhance their moisture resistance and durability. OSBs are also an eco-friendly choice, as they can be made from small-diameter trees and recycled wood chips, reducing the environmental impact of construction projects.

Get a glance at the Oriented Strand Board Industry report of share of various segments Request Free Sample

The Construction segment was valued at USD 12.71 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American oriented strand board (OSB) market is projected to expand due to the rising demand from the building and construction sector. The preference for OSBs over alternatives like plywood is increasing, as OSBs offer improved environmental sustainability. Green building materials are gaining popularity in North America, and OSBs are a preferred choice due to their eco-friendliness. For instance, the US Green Building Council promotes the use of sustainable materials in construction. OSBs are suitable for various applications, including roofing, wall sheathing, furniture, wood panelling, flooring, shelving, and more. They offer moisture resistance, versatility, and ease of installation. OSBs are also budget-friendly and can be used in damp environments.

Despite their advantages, it is essential to consider their potential environmental impact, especially regarding formaldehyde emissions and recycling. Proper preparation, including sawing and painting or staining, is necessary to maintaIn their aesthetics and durability. OSBs are engineered wood products made from wood strands and adhesive. They offer fire resistance and can withstand extreme temperatures, making them suitable for framing and sheathing applications. Budget-conscious homeowners and builders value OSBs for their cost-effectiveness and versatility.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Oriented Strand Board Industry?

Increasing residential and commercial construction activities is the key driver of the market.

What are the market trends shaping the Oriented Strand Board Industry?

Growing adoption in Europe is the upcoming market trend.

What challenges does the Oriented Strand Board Industry face during its growth?

Uncertainties in construction projects is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The oriented strand board market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oriented strand board market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oriented strand board market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Coillte Cuideachta Ghniomhaiochta Ainmnithe - Oriented strand boards are manufactured by the company using fresh conifer wood, diverse glue systems, and paraffin wax, available in multiple technical classes. These boards are produced through a modern process, ensuring high-quality and consistency. The use of conifer wood, a renewable resource, contributes to the sustainability of the manufacturing process. The various glue systems employed provide strength and durability to the boards, while paraffin wax coating enhances their resistance to moisture and improves their overall performance. The company's commitment to innovation and quality is reflected in its production of oriented strand boards that cater to diverse applications and industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Coillte Cuideachta Ghniomhaiochta Ainmnithe

- Dieffenbacher GmbH

- DOK Kalevala LLC

- Fritz Egger GmbH and Co. OG

- J M Huber Corp.

- Koch Industries Inc.

- Kronospan Ltd.

- Louisiana Pacific Corp.

- Luli Group Co. Ltd.

- Produits Forestiers Arbec Inc.

- RoyOMartin

- Sonae SGPS SA

- SWISS KRONO Tec AG

- Tolko Industries Ltd.

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The oriented strand board (OSB) market encompasses a robust and dynamic industry, characterized by the production and application of engineered wood panels. These panels, crafted from wood strands bonded together with adhesives, offer various benefits that cater to diverse construction needs. OSB has emerged as a popular alternative to traditional building materials, such as plywood and particleboard, due to its versatility and cost-effectiveness. Its applications span from roofing and wall sheathing to DIY projects like furniture, wood panelling, and flooring. Manufactured using small-diameter trees and recycled wood chips, OSB is an eco-friendly and sustainable choice for budget-conscious homeowners and builders.

Its moisture resistance and durability make it an ideal solution for damp environments and extreme temperatures. OSB's sustainability is further enhanced by its production process, which minimizes waste and reduces the environmental impact. The use of formaldehyde-free adhesives and recycled materials in its manufacturing contributes to its eco-friendly reputation. The versatility of OSB extends beyond its environmental benefits. Its soundproofing properties make it an excellent choice for noise transmission reduction in homes and buildings. Additionally, its compatibility with various finishing options, such as painting, staining, and veneers, allows for customization in terms of aesthetics. OSB's fire resistance is another significant advantage, ensuring safety in various applications.

Its resistance to extreme temperatures makes it suitable for use in various climates and regions. The installation process of OSB is relatively straightforward, requiring minimal preparation. Its compatibility with a wide range of tools, including saws, simplifies the construction process. Despite its numerous advantages, it is essential to note that proper knowledge and preparation are crucial when working with OSB. Proper handling and installation techniques are necessary to ensure optimal performance and longevity. In conclusion, the market represents a dynamic and evolving industry, driven by the production and application of a versatile, cost-effective, and eco-friendly engineered wood panel.

Its benefits, including moisture resistance, durability, sustainability, and versatility, make it an attractive choice for various construction applications. Proper handling, preparation, and installation are essential to maximize its potential and ensure optimal performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.13% |

|

Market growth 2024-2028 |

USD 33636.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.94 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oriented Strand Board Market Research and Growth Report?

- CAGR of the Oriented Strand Board industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oriented strand board market growth of industry companies

We can help! Our analysts can customize this oriented strand board market research report to meet your requirements.