Engineered Wood Products Market Size 2025-2029

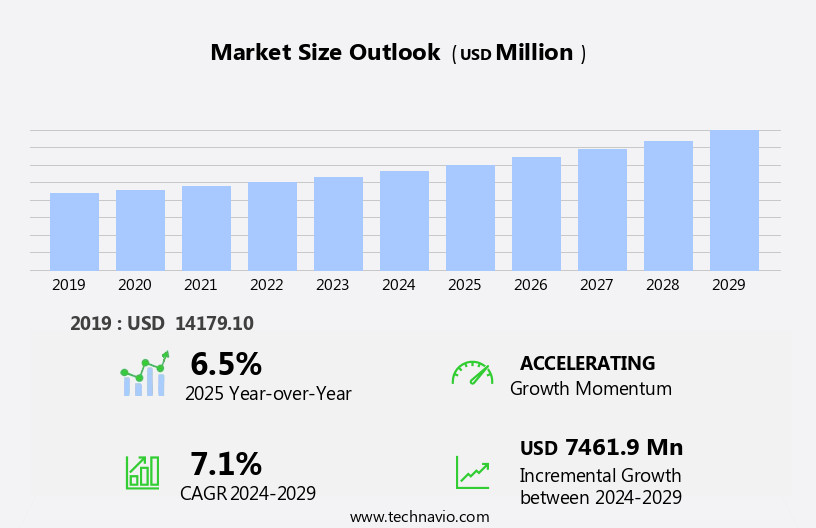

The engineered wood products market size is forecast to increase by USD 7.46 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for residential and commercial construction. This trend is fueled by the numerous benefits of engineered wood products, including their durability, cost-effectiveness, and sustainability. However, rising wages in manufacturing hubs pose a challenge for market participants, increasing production costs and potentially impacting profitability. Additionally, the market is subject to high volatility in raw material prices, particularly for softwood lumber and wood pulp, which can significantly impact the pricing and competitiveness of engineered wood products.

- Companies in this market must navigate these challenges by implementing efficient production processes, exploring alternative raw material sources, and fostering strong supplier relationships to mitigate price fluctuations. To capitalize on opportunities, market players should focus on innovation, expanding their product offerings, and exploring new markets and applications for engineered wood products.

What will be the Size of the Engineered Wood Products Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in material science and technology. This sector encompasses a range of applications, from non-structural to structural, and includes medium-density fiberboard (MDF) and high-density fiberboard (HDF), wood-plastic composites (WPC), cross-laminated timber (CLT), and various other engineered wood solutions. Suppliers in this industry face continuous market dynamics, influenced by consumer demand, building codes, testing procedures, and industry standards. Sustainable forestry practices and forest certification play a crucial role in raw material sourcing, while edge treatment, pressing machines, and drying kilns ensure product quality. Environmental impact is a significant concern, with a focus on reducing carbon footprint and minimizing waste management.

Surface finishes, formaldehyde emissions, and moisture content are essential factors in product design and consumer appeal. In the retail sector, WPC and CLT have gained popularity for their versatility in exterior cladding and furniture manufacturing. Product lifecycle management is essential for maintaining competitiveness and meeting evolving market trends. Material science innovations continue to impact the sector, with advancements in strength properties, dimensional stability, and fire retardants. Quality control measures, such as testing procedures and surface treatments, are crucial to maintaining product integrity and meeting customer expectations. The market is an ever-changing landscape, requiring suppliers to stay informed of the latest industry developments and consumer preferences.

Adaptability and innovation are key to success in this dynamic sector.

How is this Engineered Wood Products Industry segmented?

The engineered wood products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Structural wood I-beams

- Glued laminated timber (Glulam)

- LVL

- Others

- Application

- Construction

- Furniture

- Others

- End-user

- Residential

- Non-residential

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

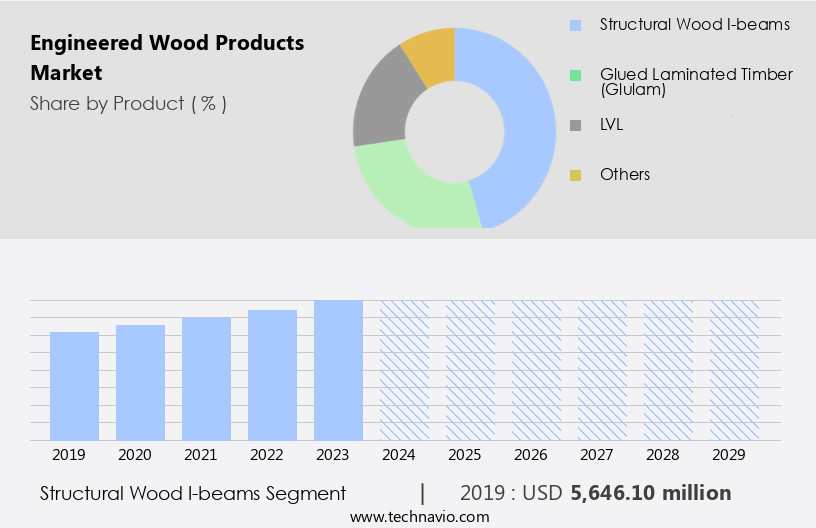

The structural wood i-beams segment is estimated to witness significant growth during the forecast period.

Engineered wood products, including medium-density fiberboard (MDF) and high-density fiberboard (HDF), have gained significant traction in the construction materials industry due to their strength properties, dimensional stability, and cost-effectiveness. Price fluctuations in the market are influenced by various factors, including raw material sourcing, manufacturing processes, and consumer demand. Reclaimed wood, a sustainable alternative, is increasingly being used to reduce waste and minimize the environmental impact. Building codes and testing procedures ensure safety and compliance, while drying kilns and pressing machines optimize moisture content and product quality. Forest certification and edge treatment enhance durability and surface finish. Formaldehyde emissions are closely monitored to meet industry standards.

Surface treatments and finishing techniques cater to diverse consumer preferences. Wood adhesives and fire retardants contribute to the product's strength and safety. Product design, supply chain management, and material science continue to evolve, with innovations in wood-plastic composites (WPC), cross-laminated timber (CLT), and non-structural and structural applications. The market's focus on sustainability, quality control, and carbon footprint reduction is shaping its future trends.

The Structural wood I-beams segment was valued at USD 5.65 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

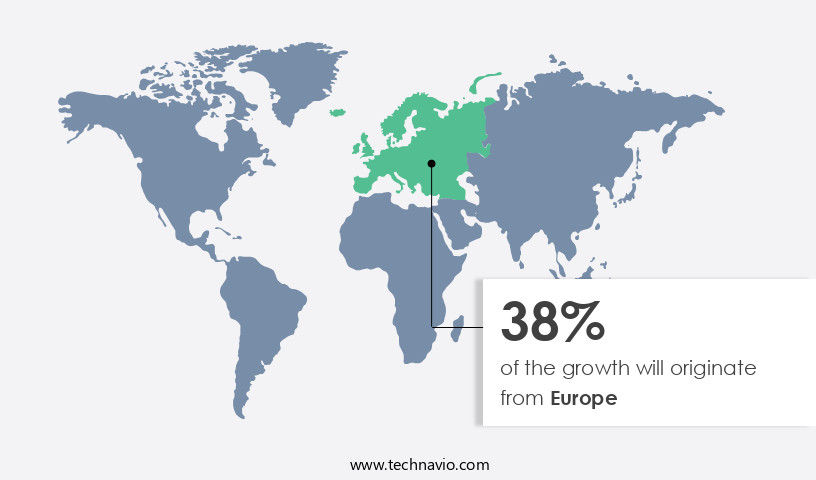

Europe is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Europe has experienced significant growth since 2005, driven by increasing consumer demand for sustainable construction materials and home decor. Glulam, a popular engineered wood product, is expected to double in consumption between 2024 and 2029. Major producers of glulam are located in Germany, Austria, and Finland, with a substantial portion of Finnish production exported to Japan. Italy was a significant importer in the 2000s. The European market is characterized by high disposable incomes, a growing population, and steady economic growth, leading to increased demand for consumer goods and furniture manufacturing. Sustainable forestry practices and industry standards ensure the production of high-quality engineered wood products.

Drying kilns and testing procedures are implemented to maintain moisture content and strength properties. Forest certification and edge treatment are essential for dimensional stability and fire retardancy. Pressing machines and wood adhesives are used in the manufacturing process, while surface treatments and finishing techniques enhance the aesthetic appeal. Supply chain management and material science play crucial roles in ensuring product lifecycle and carbon footprint reduction. Additionally, engineered wood products are used in both non-structural and structural applications, including exterior cladding and cross-laminated timber. The market's evolution reflects the industry's commitment to innovation, quality, and sustainability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Engineered wood products have gained significant traction in the construction industry due to their durability, affordability, and eco-friendly attributes. These innovative building solutions are manufactured using advanced technologies, integrating natural wood with adhesives, veneers, and other materials. Engineered wood floors, for instance, offer superior strength and stability compared to solid wood, while engineered wood panels provide excellent insulation and are resistant to moisture. The market encompasses a wide range of applications, from flooring and wall panels to roofing and structural components. These products cater to various sectors, including residential, commercial, and industrial, making them versatile solutions for architects, builders, and homeowners. Engineered wood products are engineered for sustainability, using renewable resources and reducing waste. They also offer design flexibility, with various textures, colors, and finishes available. Manufacturers employ rigorous quality control measures to ensure consistency and adherence to industry standards. The market is driven by factors such as increasing demand for sustainable building materials, growing urbanization, and advancements in manufacturing technologies. The market is also influenced by regulatory initiatives promoting energy efficiency and environmental sustainability. Engineered wood products offer numerous benefits, including cost-effectiveness, ease of installation, and low maintenance requirements. They are also highly customizable, allowing for unique design applications and meeting specific project needs. In summary, the market represents a dynamic and growing sector in the construction industry, offering innovative, sustainable, and cost-effective solutions for various applications and sectors.

What are the key market drivers leading to the rise in the adoption of Engineered Wood Products Industry?

- The significant growth in both residential and commercial construction sectors serves as the primary catalyst for market expansion.

- The engineered wood product market is experiencing notable growth due to the expansion of the global real estate sector and escalating construction activities worldwide. Developed economies, including the US, are allocating substantial investments towards infrastructure development. For instance, the proposed US President 2024 budget includes a significant USD1.2 trillion allocation under the Bipartisan Infrastructure Law for modernizing transportation, energy systems, and climate-resilient infrastructure. In emerging economies like India, the potential 100% FDI for townships and settlement projects is anticipated to boost the demand for wood products during the forecast period. Engineered wood products, such as medium-density fiberboard (MDF), benefit from this market trend due to their versatility and cost-effectiveness.

- These products are widely used in various applications, including furniture, interior decor, and construction. Consumer demand for eco-friendly and sustainable building materials is also driving the market growth, with an increasing preference for forest certification and edge treatment. Manufacturers invest in advanced pressing machines and surface treatments to ensure optimal moisture content and formaldehyde emissions. Raw material sourcing is another crucial aspect, with companies focusing on sustainable and renewable raw material sourcing to meet the growing demand and maintain regulatory compliance.

What are the market trends shaping the Engineered Wood Products Industry?

- The trend in manufacturing industries is shifting towards rising wages. In hubs where manufacturing takes place, wage growth is expected to continue.

- The market is experiencing significant growth due to the increasing demand for these products in various applications, such as exterior cladding and furniture manufacturing. High-density fiberboard (HDF) is a popular engineered wood product due to its strength properties and dimensional stability. Finishing techniques have advanced, allowing for more harmonious and immersive product designs. However, rising wages in manufacturing hubs worldwide, particularly in China and India, pose a challenge for global companies. This trend, driven by urbanization and industrialization in emerging economies, weakens the labor cost advantage enjoyed by these hubs. The use of wood adhesives and fire retardants in engineered wood products enhances their durability and safety, respectively.

- As interior design trends shift towards sustainability and eco-friendly materials, engineered wood products are gaining popularity. Product design innovation continues to be a key driver in the market, with companies focusing on creating new and unique applications for these versatile materials.

What challenges does the Engineered Wood Products Industry face during its growth?

- The volatile nature of raw material prices poses a significant challenge to the industry's growth trajectory.

- Engineered wood products, including wood-plastic composites (WPC) and cross-laminated timber (CLT), have gained significant traction in various industries due to their durability and environmental benefits. In the supply chain management of these products, raw material costs pose a considerable challenge. The price of wood, a primary component, has experienced a notable increase, impacting the production costs of engineered wood products. Additionally, the costs of other raw materials, such as chipboard, timber, foam, polish chemical materials, color paints, and hardware, have risen. The price volatility of wood particleboard is further influenced by fluctuating input and transportation costs and the reduction in production capacities among furniture manufacturers.

- Consequently, the narrowing gap between production cost increments and companies' ability to raise product prices in the market has negatively affected their profit margins. As market dynamics continue to evolve, understanding the product lifecycle, material science, and quality control is crucial for companies to mitigate these challenges and maintain competitiveness.

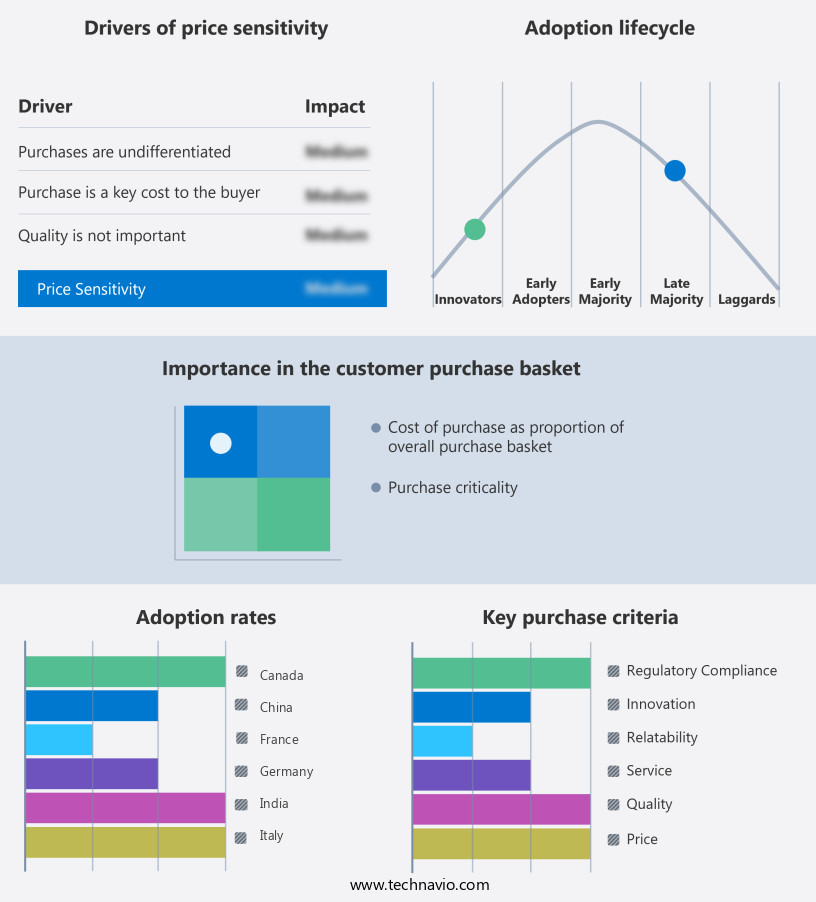

Exclusive Customer Landscape

The engineered wood products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the engineered wood products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, engineered wood products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Boise Cascade Co - The company specializes in the production and distribution of engineered wood products, including Versa Lam LVL.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Boise Cascade Co

- Celulosa Arauco y Constitucion SA

- Georgia Pacific LLC

- Greenply Industries Ltd.

- Huber Engineered Woods LLC

- J M Huber Corp.

- Kahrs

- Lampert Lumber

- Louisiana Pacific Corp.

- Lowes Co. Inc.

- M.Y. Timber Co. Ltd

- Raute Corp.

- RH Group

- Rockshield Engineered Wood Products ULC

- Roseburg Forest Products Co.

- Universal Forest Products Inc.

- UPM Kymmene Corp.

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Engineered Wood Products Market

- In January 2024, Arauco, a leading global forest products company, announced the launch of its new line of engineered I-joists, named "Arauco I-Joists," at the International Builders' Show in Las Vegas. These joists offer improved strength and dimensional stability, making them an attractive alternative to traditional sawn lumber (Source: Arauco Press Release).

- In March 2024, Weyerhaeuser and LP Building Solutions joined forces to create a strategic partnership, aiming to expand their market reach and product offerings in the engineered wood products sector. This collaboration allowed Weyerhaeuser to leverage LP's extensive distribution network and engineering expertise (Source: Weyerhaeuser Press Release).

- In May 2024, Norbord, a leading manufacturer of engineered wood products, completed the acquisition of the OSB and plywood assets of West Fraser Timber Co. Ltd. This acquisition significantly increased Norbord's production capacity and market share in North America (Source: Norbord Press Release).

- In January 2025, the European Commission approved the use of third-generation engineered wood products, such as cross-laminated timber (CLT), in high-rise buildings up to 18 stories. This approval marked a significant milestone in the adoption of engineered wood products in the European construction industry (Source: European Commission Press Release).

Research Analyst Overview

- Engineered wood products have gained significant traction in the construction industry due to their superior performance and sustainability attributes. These innovative building solutions offer various benefits, including rot resistance, pattern options, and insect resistance. Wood treatment methods, such as chemical and thermal modification, enhance the durability and chemical resistance of engineered wood, making it suitable for both indoor and outdoor applications. Industry regulations and emission standards continue to shape the market, with a focus on health and safety and sustainability initiatives. Energy efficiency is another key trend, as engineered wood products are increasingly being used for insulation and thermal modification to reduce energy consumption.

- Specialty products, including core panels and bespoke designs, cater to specific market needs, while mass production and precision manufacturing ensure consistent quality and cost-effectiveness. Acoustic properties, water resistance, and abrasion resistance are other important performance standards that engineered wood products must meet. Waste reduction is a significant trend, with engineered wood products offering a more sustainable alternative to traditional wood construction. UV resistance, color options, and texture choices add to the design aesthetics, making engineered wood an attractive choice for architects and builders. Overall, the market is dynamic and innovative, driven by a focus on performance, sustainability, and design flexibility.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Engineered Wood Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 7461.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Germany, China, UK, France, Japan, Italy, Canada, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Engineered Wood Products Market Research and Growth Report?

- CAGR of the Engineered Wood Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the engineered wood products market growth of industry companies

We can help! Our analysts can customize this engineered wood products market research report to meet your requirements.