Ploughing And Cultivating Machinery Market Size 2025-2029

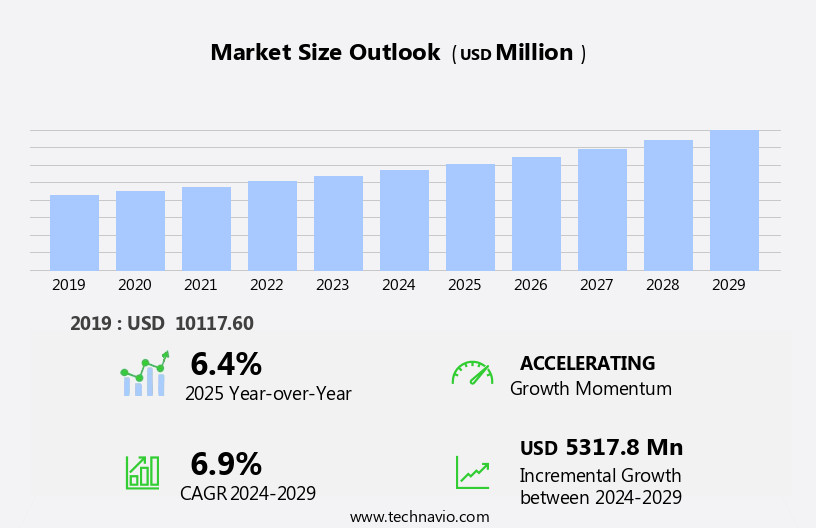

The ploughing and cultivating machinery market size is forecast to increase by USD 5.32 billion at a CAGR of 6.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing government support for agricultural practices worldwide. This trend is particularly prominent in developing countries, where agricultural modernization is a priority. Another key driver is the increasing number of product launches, as manufacturers introduce innovative agricultural machinery solutions to address the high cost of ploughing and cultivating equipment. These new offerings aim to increase efficiency, reduce labor costs, and improve productivity. However, the high cost of agricultural machinery remains a significant challenge for many farmers, particularly small-scale producers. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on offering affordable financing options, leasing schemes, and rental services. Additionally, advancements in agricultural machinery technology, such as precision farming tools, are enhancing productivity and sustainability, further boosting market potential.

- Additionally, partnerships with governments and agricultural organizations can help expand market reach and provide access to valuable resources and expertise. Agricultural drones, precision spraying, and harvesting equipment are further enhancing farm automation and digital agriculture. Overall, the market presents significant opportunities for growth, particularly in emerging economies, as the demand for mechanized farming solutions continues to increase. Companies that can offer innovative, cost-effective solutions and strong partnerships will be best positioned to succeed in this dynamic market.

What will be the Size of the Ploughing And Cultivating Machinery Market during the forecast period?

- The market encompasses a range of tractor implements and tillage tools essential for farm equipment operations. This market is characterized by continuous innovation, driven by the need for agricultural productivity, operational efficiency, and environmental sustainability. Trends include the adoption of agricultural robotics for yield monitoring, variable rate application, precision seeding, and soil health management. Fertilizer management, pest control, and crop rotation practices are also key areas of focus. No-till farming and reduced tillage techniques are gaining popularity, necessitating the integration of sensor networks, remote sensing, automated steering, machine vision, field mapping, soil sampling, and crop modeling into farm management software.

- Sustainable farming practices, including regenerative agriculture and climate-smart agriculture, are shaping the market's direction, with a focus on food security, labor cost reduction, resource optimization, and environmental sustainability. Overall, the market is a dynamic and evolving landscape, driven by the intersection of agricultural innovation and technological advancements.

How is this Ploughing And Cultivating Machinery Industry segmented?

The ploughing and cultivating machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- P and C parts

- Planters transplanters and seeders

- Weeders and hoes

- Cultivation machines

- Ploughs

- Technology

- Manual

- Semi automatic

- Automatic

- End-User

- Small-Scale Farmers

- Large-Scale Farmers

- Agricultural Contractors

- Power Source

- Manual

- Electric

- Diesel

- Distribution Channel

- Online

- Offline

- Direct Sales

- Application

- Soil Loosening

- Clod Size Reduction

- Clod Sorting

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

By Type Insights

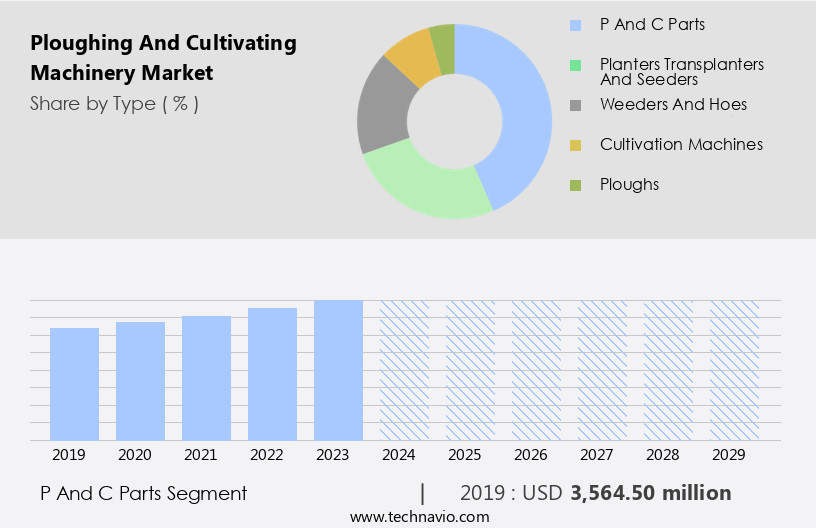

The P and C parts segment is estimated to witness significant growth during the forecast period. The market has experienced consistent growth due to various factors. Government initiatives offering financial incentives for farmers to invest in agricultural equipment have been a significant driving force. Furthermore, the rise of contract farming has expanded market opportunities. Key market growth drivers include the increasing agricultural mechanization and farmers' income growth. Favorable climate conditions for food production, coupled with accessible government loans for all income levels, are also expected to support market expansion. Technologically advanced agricultural technologies, such as autonomous tractors and drones, which facilitate cost-effective food production to meet increasing demand, offer promising growth prospects for the P and C parts segment during the forecast period.

The adoption of precision agriculture, GPS guidance systems, data analytics, and smart technologies in farming operations enhances field efficiency, crop yields, and resource utilization. Additionally, sustainable agriculture practices, including conservation tillage and soil erosion prevention, contribute to market growth. Equipment maintenance solutions and agricultural mechanization have become essential to address labor shortages and improve farming productivity. The integration of artificial intelligence, machine learning, predictive analytics, and real-time monitoring in farming solutions further enhances efficiency and sustainability.

Get a glance at the market report of share of various segments Request Free Sample

The P and C parts segment was valued at USD 3.56 billion in 2019 and showed a gradual increase during the forecast period.

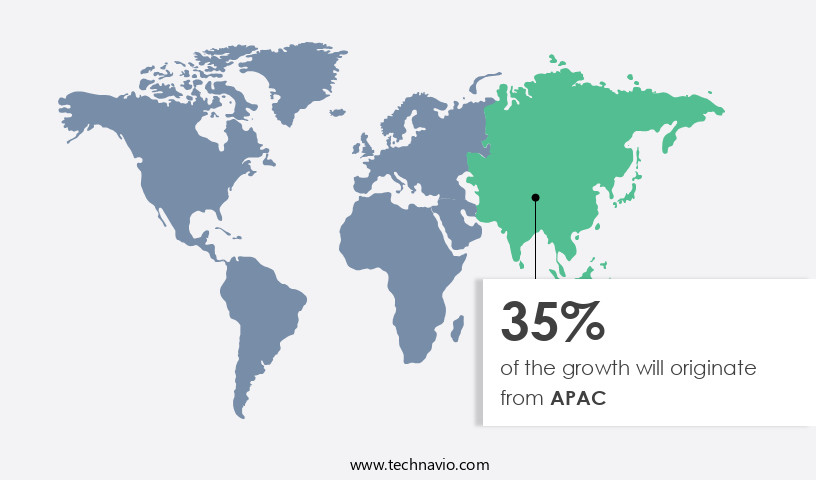

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the APAC region is experiencing significant growth, primarily driven by major markets such as China, India, Japan, and Australia. Government initiatives promoting sustainable agricultural practices are a significant factor fueling this expansion. In India, the government and international organizations are working together to improve soil health, water management, irrigation, seed varieties, pest management, credit financing, and farm mechanization. Furthermore, various governments in the region offer subsidies for purchasing agricultural equipment, including ploughing and cultivating machinery. Notable initiatives include India's Sub-Mission on Agriculture Mechanization (SMAM) and Indonesia's Agriculture Work Plan Document. Precision agriculture, GPS guidance systems, data analytics, autonomous machinery, and semi-autonomous machinery are increasingly adopted to enhance farming efficiency and productivity.

Soil preparation, crop yield, and resource efficiency are key benefits of these advanced technologies. Plough design, cultivator types, seedbed creation, soil aeration, weed control, nutrient mixing, and precision farming are essential aspects of ploughing and cultivating machinery. Equipment durability, soil structure, and farm productivity are crucial factors in the selection and implementation of these solutions. Key technologies include GPS-enabled equipment, soil sampling, soil moisture sensors, and equipment maintenance systems. The labor crisis and the need for skilled labor are driving the adoption of farm mechanization. The market is expected to grow due to increasing food consumption and food storage output, government benefits, and the availability of high-powered cultivators, self-cultivators, two-wheel tractors, and four-wheel tractors.

Clod size reduction, clod sorting, plant roots, soil drainage, friable soil, air and nutrients, moisture and nutrients, and smart farming are essential components of efficient farming. Ploughing systems, cultivator blades, land cultivation, and soil turnover are fundamental farming solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ploughing And Cultivating Machinery Industry?

- Growing government support for agricultural practices globally is the key driver of the market. Global agricultural organizations and governments are advocating for productivity enhancements through initiatives that support farming businesses. In the European Union (EU), young farmers under the age of 40, upon application, are eligible for funding to establish farming operations. This financial assistance is granted for up to five years following the commencement of farming activities. Young farmers also receive priority for direct payment entitlements from national or regional reserves.

- These incentives motivate EU farmers to invest in ploughing and cultivating machinery, thereby increasing productivity. Similarly, the Canadian Agricultural Loans Act (CALA) Program, administered by the Government of Canada, offers financial assistance to farmers, enabling them to invest in essential machinery and technology for their farming businesses.

What are the market trends shaping the Ploughing And Cultivating Machinery Industry?

- An increasing number of product launches is the upcoming market trend. The market is witnessing growth due to companies' strategic initiatives to expand their product offerings. New product launches enable market participants to boost sales and secure a larger market share. To cater to a wider customer base, companies are introducing machinery variants with advanced features and patented innovations. For instance, in 2023, Mahindra and Mahindra Ltd. Introduced the Mahindra OJA series, a lineup of lightweight 4WD tractors.

- This innovative range consists of seven models, from 20HP to 40HP, and incorporates advanced technology for heightened productivity and efficiency. These developments underscore the competitive landscape in the market.

What challenges does the Ploughing and Cultivating Machinery Industry face during its growth?

- The high cost of ploughing and cultivating machinery is a key challenge affecting the industry's growth. Ploughing and cultivating machinery play a crucial role in agricultural production, particularly during the sowing season. However, the significant investment required for this equipment, which is only useful during specific periods, poses challenges for small and medium-scale farmers with limited financial resources. Air seeders, a type of ploughing and cultivating machinery, are suitable for large, consolidated agricultural lands, further limiting their applicability. The high cost and seasonal utility of ploughing and cultivating machinery make it less prioritized compared to other agricultural equipment with year-round functionality.

- Farmers in rural areas of developing countries, in particular, face budget constraints when acquiring new agricultural equipment. Despite its importance, the limited functionality of ploughing and cultivating machinery can make it a less essential investment for farmers.

Exclusive Customer Landscape

The ploughing and cultivating machinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ploughing and cultivating machinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ploughing and cultivating machinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGCO Corp. - The company offers ploughing and cultivating machinery that provides farmers with the highest level of productivity in large acreage enterprises.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Alamo Group Inc.

- BEDNAR FMT sro

- Bucher Industries AG

- CLAAS KGaA mBH

- CNH Industrial NV

- Deere and Co.

- Dewulf

- Great Plains Manufacturing Inc.

- Gregoire Besson SAS

- HORSCH Maschinen GmbH

- Kubota Corp.

- Landoll Co. LLC

- LEMKEN GmbH and Co. KG

- Mahindra and Mahindra Ltd.

- Mfg. Co. Inc.

- Opico

- Sonalika International Tractors Ltd.

- Titan Machinery Inc.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of advanced technologies designed to optimize field operations and enhance agricultural productivity. This sector is characterized by continuous innovation, driven by the need for resource efficiency, conservation tillage, and sustainable agriculture. Precision agriculture, fueled by GPS guidance systems and data analytics, plays a significant role in this market. Smart technologies, including autonomous and semi-autonomous machinery, enable farmers to make informed decisions based on real-time monitoring and predictive analytics. These advancements contribute to improved crop yields, soil health, and overall farming efficiency. Soil preparation is a critical aspect of the market. Primary tillage methods, such as moldboard plows, disk plows, and chisel plows, are used for soil loosening, clod size reduction, and clod sorting.

These processes are essential for creating a suitable seedbed and ensuring optimal conditions for plant growth. Cultivating weeds and uprooting unwanted vegetation is another essential function of ploughing and cultivating machinery. This process contributes to better nutrient availability, improved soil permeability, and reduced soil erosion. Advanced plough designs and cultivator types cater to various soil types and farming conditions, ensuring effective weed control and soil aeration. Equipment maintenance is a crucial factor in the market. High-powered cultivators, self-cultivators, two-wheel tractors, and four-wheel tractors all require support systems for efficient and reliable operation. This includes regular servicing, timely replacement of worn parts, and the implementation of preventative maintenance strategies.

The market is driven by the need for agricultural mechanization and the labor crisis in the agricultural sector. With increasing food consumption and food storage output, there is a growing demand for machinery that can help farmers meet these demands while adhering to sustainable practices. Government benefits and incentives for the adoption of advanced farming solutions further boost market growth. The market is a dynamic and innovative sector that plays a vital role in modern agriculture. With a focus on precision farming, sustainable practices, and equipment durability, this market is poised for continued growth and development. Farmers and agricultural professionals rely on advanced ploughing and cultivating machinery to optimize field operations, enhance crop yields, and promote sustainable agriculture.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 5.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, China, Germany, Japan, India, UK, South Korea, Italy, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ploughing And Cultivating Machinery Market Research and Growth Report?

- CAGR of the Ploughing And Cultivating Machinery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ploughing and cultivating machinery market growth and forecasting

We can help! Our analysts can customize this ploughing and cultivating machinery market research report to meet your requirements.