Agricultural Machinery Market Size 2025-2029

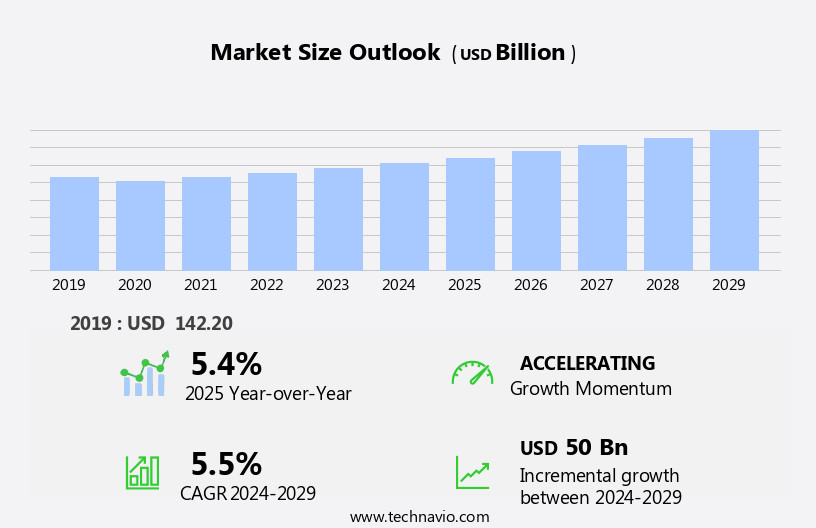

The agricultural machinery market size is forecast to increase by USD 50 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by various factors. Notably, government subsidies aimed at promoting the agricultural sector have fueled the demand for advanced machinery. Farmers are increasingly investing in modern agricultural equipment to enhance productivity and efficiency. Another key trend is the rising popularity of small tractors, which cater to the needs of small and medium-sized farms. This segment is witnessing robust growth due to its affordability and versatility. However, the market also faces several challenges. One major obstacle is the high initial investment required for purchasing agricultural machinery. This can limit the adoption of advanced technology among small-scale farmers.

- Additionally, the lack of skilled labor and maintenance facilities in rural areas can hinder the effective use and longevity of these machines. Companies seeking to capitalize on market opportunities must address these challenges by offering flexible financing options, training programs for farmers, and establishing robust after-sales support networks. By doing so, they can effectively navigate the complexities of the market and secure a competitive edge.

What will be the Size of the Agricultural Machinery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting market dynamics. Soil sensors and precision farming techniques are revolutionizing crop management, providing real-time data for optimized irrigation and nutrient application. Baling presses and grain storage solutions are adapting to meet emission standards, ensuring sustainable agricultural practices. Attachment compatibility and service networks are becoming increasingly important for seamless integration of various machinery components. Variable rate technology and material sourcing are streamlining farming operations, while irrigation systems and precision farming methods are enhancing crop yields. Manufacturing processes are leveraging machine learning and AI to improve efficiency and reduce operating costs.

The market's unfolding patterns are also influencing financing options and farm management software, enabling farmers to make data-driven decisions. Fuel efficiency and engine power are key considerations for machinery selection, as is data security and maintenance cost. Agricultural drones and GPS guidance are transforming remote sensing and field monitoring, while safety features and hydraulic systems are ensuring operator comfort and machine reliability. The ongoing evolution of agricultural machinery is shaping the industry, with continuous innovation in power transmission, dealer support, and parts distribution.

How is this Agricultural Machinery Industry segmented?

The agricultural machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Tractors

- Harvesting machinery

- Haying machinery

- Planting and fertilizing machinery

- Plowing and cultivating machinery

- Application

- Land development and seedbed preparation

- Sowing and planting

- Harvesting and threshing

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

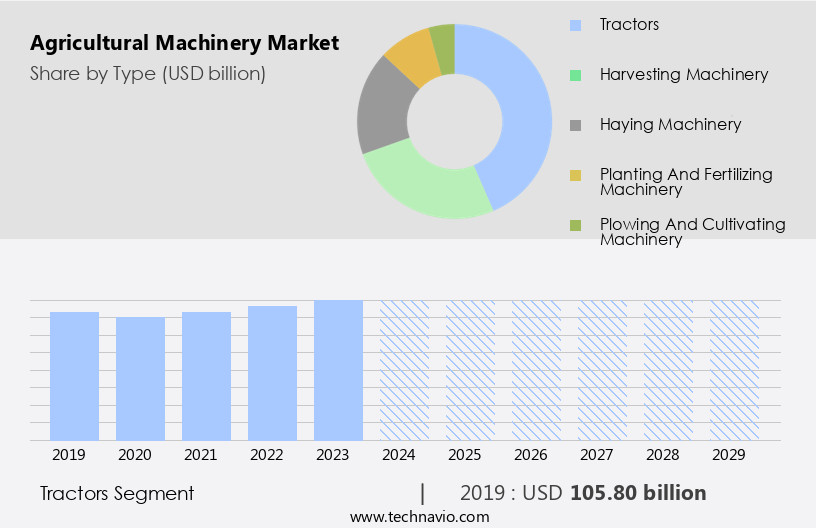

The tractors segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of equipment essential for modern farming operations. Forage harvesters, seed drills, and grain dryers are among the key machinery types. Smart farming practices, such as precision seeding, yield monitoring, and variable rate technology, are increasingly adopted to optimize crop production. Aftermarket parts and dealer support ensure the longevity of machinery, while remote sensing and connected agriculture enable real-time monitoring and data analytics. Power transmission systems, engine technology, and fuel efficiency are critical factors influencing machinery performance and operating costs. Financing options and farm management software facilitate equipment acquisition and streamline operations. Emission standards and safety features are crucial considerations for manufacturers.

Soil sensors, irrigation systems, and material sourcing are integral to optimizing farm productivity. Manufacturing processes, parts distribution, and service networks ensure efficient machinery production and maintenance. Machine learning and AI in agriculture enhance productivity and reduce labor requirements. Fuel efficiency, operating cost, and grain storage are essential concerns for farmers. Hydraulic systems, attachment compatibility, and maintenance cost are vital for machinery reliability. Agricultural drones, gps guidance, and data security are emerging trends in the market. Used equipment and financing options cater to farmers with limited budgets. Farmers also seek financing for new machinery purchases. The market for agricultural machinery is diverse and dynamic, with ongoing advancements in technology and evolving farmer needs shaping its trajectory.

The Tractors segment was valued at USD 105.80 billion in 2019 and showed a gradual increase during the forecast period.

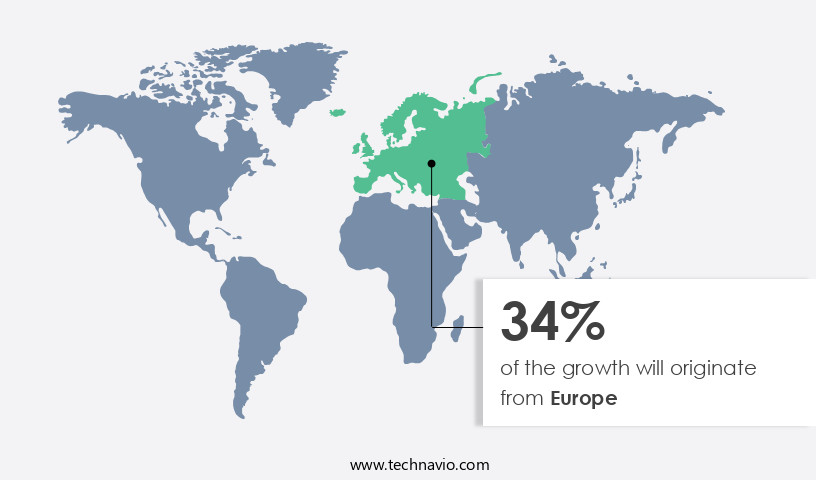

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences significant growth, driven by the increasing population and subsequent food demand, particularly in the Asia Pacific (APAC) region. India and China are key contributors to this market in APAC, with the region's agricultural machinery sector expanding at an impressive rate. Factors fueling this growth include government initiatives, such as agriculture subsidies and credit availability, which encourage farmers to invest in advanced machinery. In India, a large portion of the agricultural workforce remains under-mechanized, presenting a substantial opportunity for market expansion. Precision farming, smart farming, and connected agriculture are emerging trends, with farmers adopting technology for yield monitoring, precision seeding, and variable rate application.

Aftermarket parts, power transmission, and dealer support are essential components of the market, ensuring machinery remains operational and efficient. Engine technology, fuel efficiency, and operating cost are critical considerations for farmers, leading to increased demand for grain dryers, seed drills, and baling presses. The market also prioritizes emission standards, attachment compatibility, and service networks. Additionally, advancements in machine learning, AI in agriculture, data security, maintenance cost, and safety features are shaping the industry. Agricultural drones, data analytics, used equipment, GPS guidance, and hydraulic systems are further enhancing agricultural productivity. The market's evolution encompasses manufacturing processes, parts distribution, engine power, and financing options, all aimed at improving farm management software and optimizing supply chain logistics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative sector that caters to the ever-evolving needs of modern farming. This market encompasses a diverse range of equipment, from tractors and harvesters to irrigation systems and livestock equipment. Farmers rely on advanced technology and robust machinery to optimize yields, enhance productivity, and minimize labor requirements. Key players in this market include combines, plows, seed drills, sprayers, and tillage equipment. These machines are engineered for precision, efficiency, and durability, incorporating features such as GPS guidance, variable rate application, and autonomous steering. The market is further driven by trends like precision farming, automation, and the increasing demand for sustainable and eco-friendly agricultural practices. With ongoing research and development, the market continues to evolve, offering farmers cutting-edge solutions to meet the challenges of modern agriculture.

What are the key market drivers leading to the rise in the adoption of Agricultural Machinery Industry?

- Government subsidies play a crucial role in driving the agricultural sector's market growth. These subsidies provide essential financial support, enabling farmers to invest in modern farming techniques and technologies, thereby increasing productivity and competitiveness in the industry.

- The market is driven by various factors that prioritize productivity, efficiency, and technological advancements in farming. One significant trend is the integration of smart farming practices, including remote sensing, connected agriculture, AI in agriculture, and machine learning, which optimize crop yields and reduce resource consumption. These technologies enhance operator comfort and improve power transmission systems, ensuring harmonious and immersive farming experiences. Moreover, the aftermarket for parts and dealer support plays a crucial role in the market. Farmers require reliable and efficient machinery to maintain their productivity, and timely access to replacement parts and expert support is essential. The market's growth is further emphasized by the increasing emphasis on precision farming and sustainable agriculture practices.

- Investments in agricultural machinery have become increasingly important for farmers, with various governments offering subsidies to support the agricultural sector and ensure food security. For instance, in 2023, the Indian government provided an 80% subsidy on machinery and equipment to help farmers maintain stubble. Other initiatives, such as the Rashtriya Krishi Vikas Yojana (RKVY), the National Food Security Mission (NFSM), the Sub-Mission on Agricultural Mechanization (SMAM), and NABARD loans, aim to provide farmers with the necessary resources to invest in modern agricultural machinery.

What are the market trends shaping the Agricultural Machinery Industry?

- The rising preference for small tractors signifies a notable market trend in the agricultural industry. This trend is driven by the increased demand for compact and efficient machinery for farming operations.

- The market is witnessing notable growth, particularly in the segment of small precision seeding equipment and yield monitoring systems. These technologies enable farmers to optimize their operations, improve crop yields, and reduce operating costs. Financing options and farm management software are also gaining traction, facilitating easier access to capital and better management of resources. Seed drills, equipped with advanced engine technology, ensure fuel efficiency and contribute to overall cost savings. Grain dryers, essential for preserving harvested crops, are another significant investment for farmers.

- With the increasing focus on reducing operating expenses and enhancing productivity, the demand for fuel-efficient machinery is on the rise. The supply chain for agricultural machinery is becoming more streamlined, offering farmers a wider range of options and competitive pricing. Despite the initial investment, these advanced technologies offer long-term benefits, making them attractive investments for farmers.

What challenges does the Agricultural Machinery Industry face during its growth?

- The rental availability of agricultural tractors poses a significant challenge to the growth of the agricultural industry. This issue hinders the industry's expansion and productivity, as farmers may struggle to access the necessary equipment for their operations.

- The market encompasses a diverse range of equipment, including soil sensors, baling presses, and irrigation systems, among others. Market growth is driven by the adoption of precision farming techniques, variable rate technology, and emission standards. Attachment compatibility and service networks are key considerations for farmers when purchasing machinery. Material sourcing and grain storage are also significant factors. However, the rise of agricultural equipment rental services poses challenges to the market. Small-scale farmers, who use machinery for limited periods, often rent instead of buying high-cost machinery. The Indian Ministry of Agriculture and Farmers Welfare, for instance, developed a farm equipment rental app to offer affordable alternatives to costlier farm machines.

- This trend may impact the market's growth trajectory. Precision farming, which involves using technology to optimize crop yields and reduce waste, is a significant market trend. Baling presses, irrigation systems, and soil sensors are essential components of precision farming. Emission standards are also becoming increasingly important, as governments worldwide implement regulations to reduce agricultural machinery's environmental impact. In conclusion, the market is dynamic, influenced by various factors, including precision farming, emission standards, and the rise of equipment rental services. Understanding these trends is crucial for businesses operating in this sector.

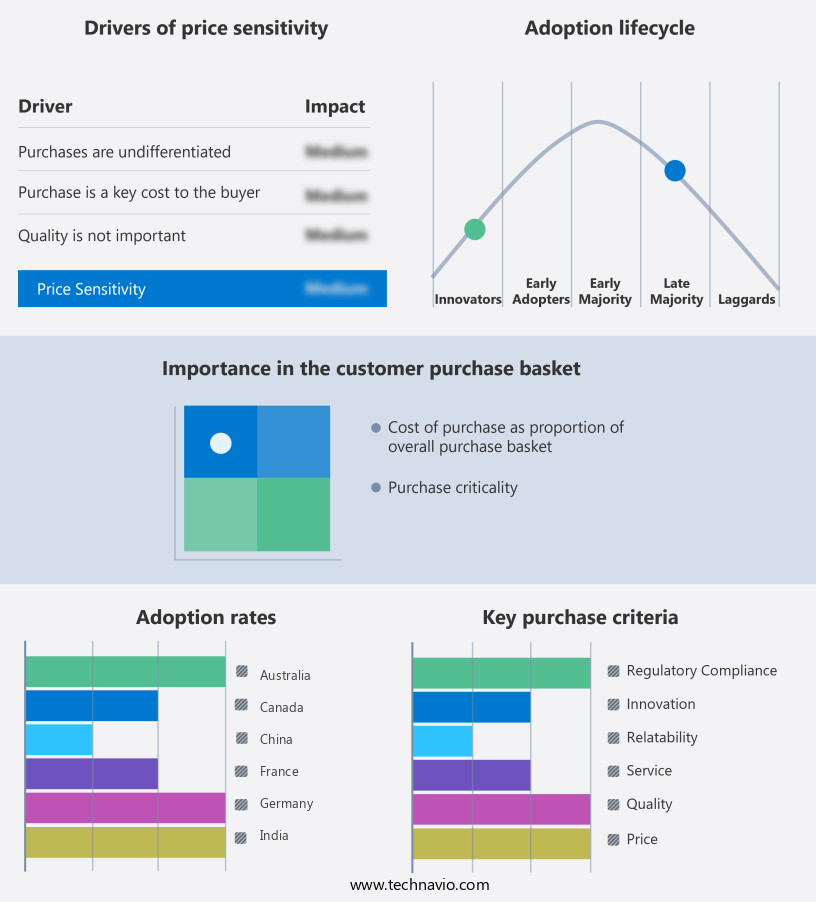

Exclusive Customer Landscape

The agricultural machinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural machinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural machinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGCO Corp. - This company specializes in providing a comprehensive range of agriculture machinery solutions. Our offerings encompass tractors, combine harvesters, hay and forage equipment, spreaders, and sprayers, among others. By investing in advanced technology and engineering, we ensure our machinery delivers optimal performance and efficiency for farmers worldwide. Our commitment to innovation and sustainability sets us apart, as we continuously strive to minimize environmental impact and enhance agricultural productivity. With a focus on customer satisfaction, we provide exceptional after-sales support and service, ensuring our clients can rely on us for all their agriculture machinery needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Agrale SA

- Bucher Industries AG

- CHANGFA GROUP

- Changzhou Dongfeng Agricultural Machinery Group Co. Ltd.

- CLAAS KGaA mBH

- CNH Industrial NV

- Daedong Corp.

- Deere and Co.

- Escorts Ltd.

- HORSCH Maschinen GmbH

- ISEKI and Co. Ltd.

- J C Bamford Excavators Ltd.

- Kubota Corp.

- Mahindra and Mahindra Ltd.

- SDF SpA

- Sonalika International Tractors Ltd.

- Tractors and Farm Equipment Ltd.

- Weichei Lovol Heavy Industry Co. Ltd.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Agricultural Machinery Market

- In January 2024, John Deere, a leading agricultural machinery manufacturer, introduced its new autonomous tractor series, the 8R Autonomous, at the CES tech conference (John Deere press release). This development marks a significant technological advancement in the market, as the self-driving tractors are designed to increase efficiency and productivity on farms.

- In March 2024, AGCO Corporation and CNH Industrial, two major agricultural machinery players, announced a strategic partnership to jointly develop and produce electric and autonomous farming equipment (CNH Industrial press release). This collaboration aims to accelerate the transition to more sustainable farming practices and reduce the environmental impact of agricultural machinery.

- In May 2024, Case IH, a global agricultural equipment manufacturer, completed the acquisition of Precision Planting, a leading provider of precision farming technologies (Case IH press release). This strategic move strengthens Case IH's position in the precision farming market and allows the company to offer more comprehensive solutions to its customers.

- In February 2025, the European Union approved the new Common Agricultural Policy (CAP) reform, which includes a significant investment in the modernization of agricultural machinery and technology (European Commission press release). This policy change is expected to boost the demand for advanced agricultural machinery in Europe and contribute to the growth of the market.

Research Analyst Overview

- The market is witnessing significant advancements driven by the integration of technology in farming practices. Pest control and disease resistance are key areas of focus, with the adoption of gene editing and agricultural biotechnology becoming increasingly prevalent. Drought and salinity tolerance are crucial factors in sustainable agriculture, particularly in regions prone to climate change. Precision livestock farming and animal health are gaining traction, with livestock management software and sensors facilitating efficient farming operations. Organic farming practices continue to grow in popularity, emphasizing the importance of soil health and crop improvement. Crop insurance, renewable energy, and fertilizer application are essential components of modern agriculture, ensuring food security and reducing carbon footprint.

- Agricultural waste management and food processing are vital aspects of the global food supply chain, ensuring minimal waste and maximizing crop yield. Dairy, poultry, and other livestock farming sectors are adapting to these trends, with a focus on water management, harvest optimization, and food safety. Farm subsidies and environmental impact remain critical considerations, with the industry continually striving for innovation while minimizing its footprint.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Agricultural Machinery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 50 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, India, Germany, UK, Japan, Canada, South Korea, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Agricultural Machinery Market Research and Growth Report?

- CAGR of the Agricultural Machinery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the agricultural machinery market growth of industry companies

We can help! Our analysts can customize this agricultural machinery market research report to meet your requirements.