Polyvinyl Butyral Market Size 2024-2028

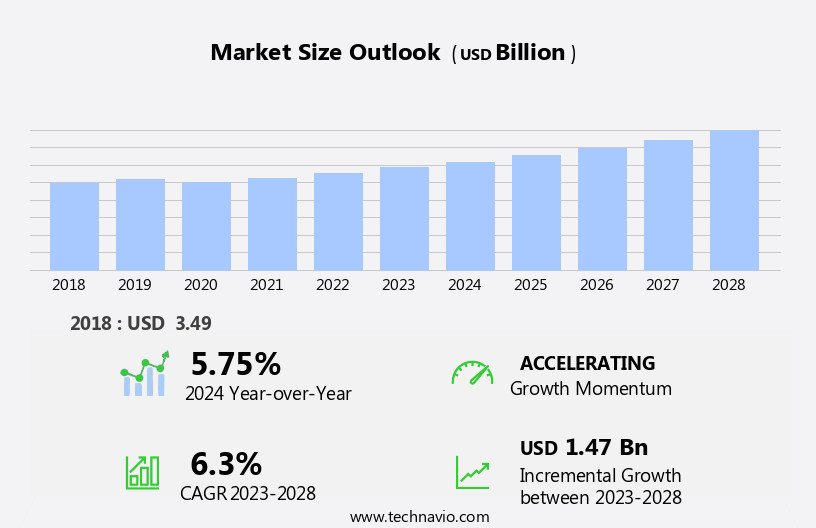

The polyvinyl butyral market size is forecast to increase by USD 1.47 billion at a CAGR of 6.3% between 2023 and 2028.

- The Polyvinyl Butyral (PVB) market is experiencing significant growth, driven primarily by the increasing demand for PVB films in various industries. One of the most notable sectors fueling this growth is the photovoltaic industry, where PVB is extensively used in laminated solar modules due to its excellent optical and mechanical properties. However, market expansion is not without challenges. The market's dynamics are heavily influenced by the fluctuation in crude oil prices, which impacts the production cost of PVB as it is derived from acetyls, a byproduct of crude oil refining. This price volatility poses a significant challenge for market participants, necessitating strategic planning and operational agility.

- To capitalize on the growth opportunities and navigate these challenges effectively, companies in the PVB market must focus on optimizing their supply chain, exploring alternative raw materials, and diversifying their customer base. By staying informed of market trends and adapting to the evolving business landscape, organizations can position themselves for long-term success in this dynamic market.

What will be the Size of the Polyvinyl Butyral Market during the forecast period?

- The photovoltaic industry's growth is driving significant demand for PVB resins, particularly in applications such as thin films and laminated glass. Airports are increasingly utilizing PVB-based adhesives in solar panels for energy generation and infrastructure development. Construction spending on buildings and infrastructure projects, including construction services, is also contributing to the market's expansion. Processing innovations in PVB resins are leading to advancements in various industries, such as paints and coatings and the paper industry. Industrialization in sectors like railways and automobile production is further fueling the need for PVB resins in adhesives and other applications. The infrastructure bill's passage is expected to accelerate the adoption of PVB resins in construction and infrastructure projects.

- Thin films and PVB-based adhesives are gaining popularity in the photovoltaic industry due to their superior properties, such as high strength, flexibility, and durability. The market for PVB resins is expected to continue its growth trajectory, driven by these trends and the increasing demand for renewable energy solutions. PVB resins are also finding applications in various end-use industries, including construction, transportation, and packaging, due to their versatility and performance benefits. The photovoltaic industry's continued growth and the increasing adoption of renewable energy sources are key factors driving the market's expansion. In summary, the photovoltaic industry's growth and the increasing demand for renewable energy solutions are fueling the market for PVB resins.

- Applications in thin films, laminated glass, and various end-use industries, such as construction, transportation, and packaging, are driving the market's expansion. Processing innovations and the versatility of PVB resins are also contributing to their growing popularity.

How is this Polyvinyl Butyral Industry segmented?

The polyvinyl butyral industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Films and sheets

- Paints and coatings

- Others

- End-user

- Automotive

- Building and construction

- Electrical and electronics and others

- Geography

- North America

- US

- Europe

- Germany

- Middle East and Africa

- APAC

- China

- India

- Japan

- South America

- Rest of World (ROW)

- North America

By Application Insights

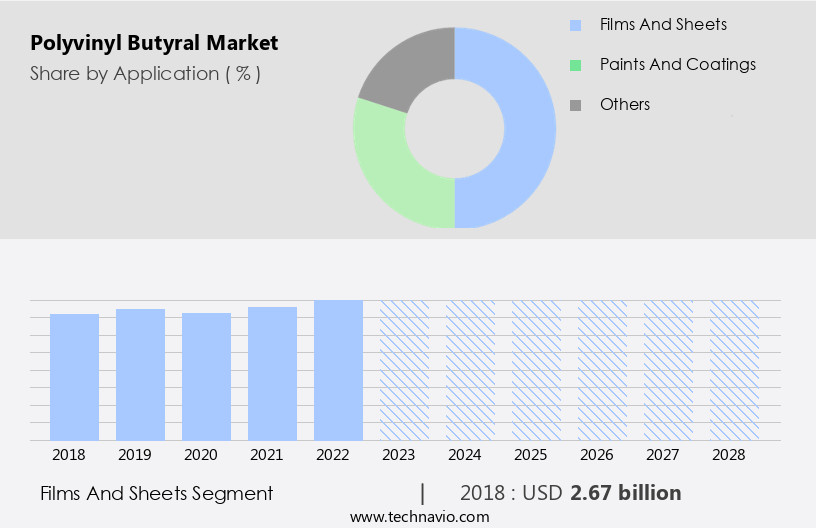

The films and sheets segment is estimated to witness significant growth during the forecast period.

The global market for polyvinyl butyral (PVB) films and sheets is experiencing significant expansion due to their superior qualities in various industries. PVB films are extensively used in packaging applications, protecting graphics and ensuring adhesion for diverse products, including food, beverages, pharmaceuticals, and electronics. Additionally, they are employed in manufacturing bags, labels, and shrink wrap. In the medical sector, PVB films are utilized for producing surgical gloves, IV bags, and blood bags. Moreover, they find extensive usage in building materials, such as roofing, siding, and windows. The automotive and construction industries' expansion is a primary driver for the global PVB market's growth.

In the automotive segment, PVB films are utilized for laminated safety glass, offering noise reduction and safety benefits. In infrastructure development, PVB films are used in construction services for bonding materials and encapsulation in solar photovoltaic modules. Furthermore, they are essential components in aesthetic bonding solutions for laminated glass in buildings and railways. The clean energy sector's increasing investment in solar cells and thin films also contributes to the market's growth. PVB films are used as encapsulation materials, ensuring the longevity and efficiency of these renewable energy solutions. The paper industry and electrical & electronics industry also use PVB films for various applications, including insulation and protective coatings.

Emerging economies' infrastructure spending and the photovoltaic industry's advancements further fuel the market's expansion. Safety concerns in various industries and processing innovations also create opportunities for PVB films' utilization in UV protection and paints & coatings.

Get a glance at the market report of share of various segments Request Free Sample

The Films and sheets segment was valued at USD 2.67 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The polyvinyl butyral (PVB) market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. The expansion of the automobile and construction sectors in APAC is driving the demand for PVB-based adhesives and resins. In the automobile industry, PVB resins are utilized for manufacturing weather-resistant windshields and are integral to metallic paints. The construction sector's increasing requirement for laminated films and sheets further boosts the market's growth. The electronics industry's proliferation of metallic parts in devices and the automobile industry's shift towards lightweight materials also contribute to the market's expansion.

Additionally, PVB resins are employed in various applications, such as solar photovoltaic modules, noise reduction, and safety, further expanding the market's reach in the APAC region. The growth of emerging economies, infrastructure spending, and the increasing demand for aesthetic bonding solutions, laminated glass, and encapsulation materials in various industries also create lucrative opportunities for market participants.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Polyvinyl Butyral Industry?

- Increasing demand for polyvinyl butyral films is the key driver of the market.

- Polyvinyl butyral is a vital material in various industries, predominantly used as an interlayer for glass lamination in the automotive, architectural, and construction sectors. This interlayer plays a crucial role in bonding two panels of glass under high heat and pressure, resulting in a single glass unit with optical transparency. The polyvinyl butyral film's tough, strong, and ductile polymer ensures the prevention of cracks. In the architectural sector, this material is extensively utilized for manufacturing safety-glass laminates due to its exceptional properties.

- Furthermore, it finds application in the packaging industry as a printing ink. Polyvinyl butyral's versatility and durability make it an indispensable component in numerous applications.

What are the market trends shaping the Polyvinyl Butyral Industry?

- Growing demand from PV industry is the upcoming market trend.

- The solar photovolvoltaic (PV) industry has witnessed significant growth, with increased installation capacity leading to a decrease in greenhouse gas emissions and the release of harmful pollutants. Solar panels, used for both residential and industrial applications, convert sunlight into electricity through the PV effect. This phenomenon involves the conversion of light energy into electricity using semiconductors. Polyvinyl butyral (PVB), a thermoplastic polyester resin, plays a crucial role in the solar PV industry as an encapsulation material for solar cells and graphene batteries.

- Its exceptional thermal properties, including thermal and ionic conductivity, make it an ideal choice for this application. According to recent research, renewable energy sources accounted for approximately 45% of global electricity generation in 2023, leaving a substantial room for growth in the adoption of solar PV technology. With the ongoing global shift towards sustainable energy sources, the demand for PVB is expected to continue its upward trend.

What challenges does the Polyvinyl Butyral Industry face during its growth?

- Fluctuation in crude oil prices is a key challenge affecting the industry growth.

- Polyvinyl butyral is a resin derived from the reaction of polyvinyl alcohol and butyraldehyde, both petroleum-based raw materials. The price instability of crude oil over the past five years has significantly impacted the cost of these raw materials, constraining the manufacturing capacity of companies. This volatility translates into increased supplier bargaining power, eroding the profitability of manufacturers. Consequently, companies may raise the price of polyvinyl butyral due to the unpredictability of raw material costs.

- As a result, The market growth may be significantly hindered by the uncertainties surrounding the pricing of its essential raw materials throughout the forecast period.

Exclusive Customer Landscape

The polyvinyl butyral market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyvinyl butyral market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyvinyl butyral market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arpadis Benelux NV - Polyvinyl butyral resins serve as essential raw materials in the production of laminated safety glass sheets for various industries, including automotive and architecture. These resins offer superior strength and flexibility, enhancing the glass's safety and durability. The versatile applications of laminated safety glass extend beyond automobiles and buildings, making polyvinyl butyral resins an indispensable component in numerous sectors. By utilizing advanced manufacturing processes, our company delivers high-quality resins that meet stringent industry standards, ensuring optimal performance and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arpadis Benelux NV

- Central Drug House P Ltd.

- Chang Chun Group

- DUBI Chem Marine International

- Eastman Chemical Co.

- Everlam NV

- HENAN JINHE INDUSTRY CO. LTD.

- KURARAY Co. Ltd.

- Shark Solutions ApS

- Sinoever International Co. Ltd

- SIVA CHEMICAL IND

- Swastik Interchem Pvt Ltd.

- TER Chemicals GmbH and Co. KG

- TRIDEV RESINS PVT. LTD.

- WMC Glass

- M S Jainish Industries

- MHM Holding GmbH

- Synpol Products Pvt. Ltd.

- Uniform Synthetics

- Vizag Chemical International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyvinyl Butyral (PVB) adhesives have gained significant traction in various industries due to their unique properties and versatility. These adhesives, derived from PVB resins, have been instrumental in addressing the evolving needs of numerous sectors, including clean energy, automobile production, and construction. In the clean energy sector, PVB-based adhesives have been extensively used in the manufacturing of solar photovoltaic modules. These adhesives play a crucial role in bonding the solar cells to the synthetic substrates, ensuring optimal performance and durability. The thin films of PVB provide essential functions such as encapsulation material, UV protection, and light transfer, enhancing the overall efficiency of the solar modules.

The automotive segment has also embraced the use of PVB adhesives, particularly in the production of laminated glass. These adhesives offer superior safety features by holding the glass layers together during collisions, reducing the risk of shattering and minimizing potential injuries. Furthermore, PVB adhesives are utilized in the aesthetic bonding solutions for various automotive applications, contributing to the overall enhancement of vehicle design and functionality. The construction industry has witnessed a surge in the adoption of PVB adhesives due to their ability to provide robust bonding materials for various applications. In infrastructure development, PVB adhesives are used extensively in the construction of airports, railways, and other large-scale projects, ensuring the structural integrity of the buildings and reducing the risk of noise pollution.

The manufacturing sectors, including the paper industry and electrical & electronics industry, have also benefited from the use of PVB adhesives. In the paper industry, PVB adhesives are employed for bonding purposes, while in the electrical & electronics industry, they are used for insulation and encapsulation of sensitive components. Processing innovations in the PVB industry have led to the development of advanced adhesive formulations, catering to the diverse requirements of various industries. These innovations include the integration of UV protection and improved bonding strength, enhancing the overall performance and durability of the adhesives. The emergence of emerging economies has led to an increased demand for PVB adhesives due to their wide applicability and cost-effectiveness.

These economies are investing heavily in infrastructure development, clean energy, and automotive manufacturing, creating significant opportunities for the growth of the PVB market. The role of PVB adhesives extends beyond their traditional applications, as they are increasingly being used in various industries to address specific challenges. For instance, in the FMCG industry, PVB adhesives are used for labeling applications, ensuring the longevity and durability of product labels. In conclusion, the market is witnessing robust growth due to the diverse applications and unique properties of PVB adhesives. From clean energy and automotive to construction and manufacturing sectors, PVB adhesives are providing innovative solutions, enhancing performance, and contributing to the overall growth and development of various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2024-2028 |

USD 1.47 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.75 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyvinyl Butyral Market Research and Growth Report?

- CAGR of the Polyvinyl Butyral industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyvinyl butyral market growth of industry companies

We can help! Our analysts can customize this polyvinyl butyral market research report to meet your requirements.