Powder Injection Molding Market Size 2024-2028

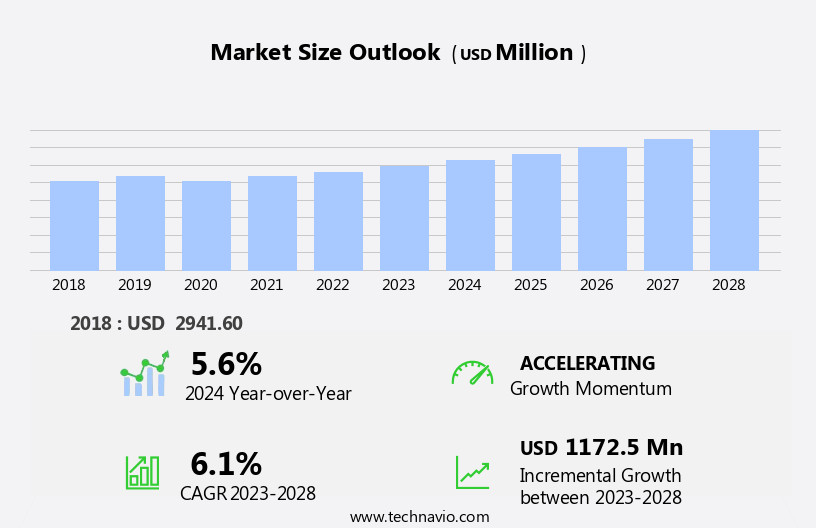

The powder injection molding market size is forecast to increase by USD 1.17 billion at a CAGR of 6.1% between 2023 and 2028.

- The market is witnessing significant growth due to technological innovations in injection molding robots and the increased adoption of collaborative robots (cobots) In the manufacturing process. These advancements enhance productivity and efficiency In the PIM industry. However, the high cost of tooling remains a major challenge for market growth. To address this issue, manufacturers are exploring cost-effective solutions such as 3D printing of molds and using alternative materials. Cost-effectiveness, precision medicine, and minimizing side effects are key market drivers, with ongoing innovation in vision correction technologies and instruments continuing to shape the industry landscape. The market is expected to witness steady growth In the coming years, driven by these trends and the increasing demand for lightweight and high-performance components in various industries. Companies are investing in research and development to improve the process and expand its applications, offering significant opportunities for market participants.

What will be the Size of the Powder Injection Molding Market During the Forecast Period?

- The market in the field of ophthalmology has experienced significant growth due to the increasing demand for advanced eye care solutions. Aberration correction, including presbyopia and astigmatism, is a primary focus In the industry, addressing lower-order errors and higher-order errors that impact eye health. Ophthalmologists and optometrists utilize advanced technologies such as corneal topography and surgical planning to provide precise refractive error correction, including LASIK surgery, intraocular lenses, and cataract surgery. Patient safety is paramount, with ongoing clinical trials and advancements in eye drops, eye exams, and telemedicine in ophthalmology enhancing access to care for myopic and hyperopic patients.

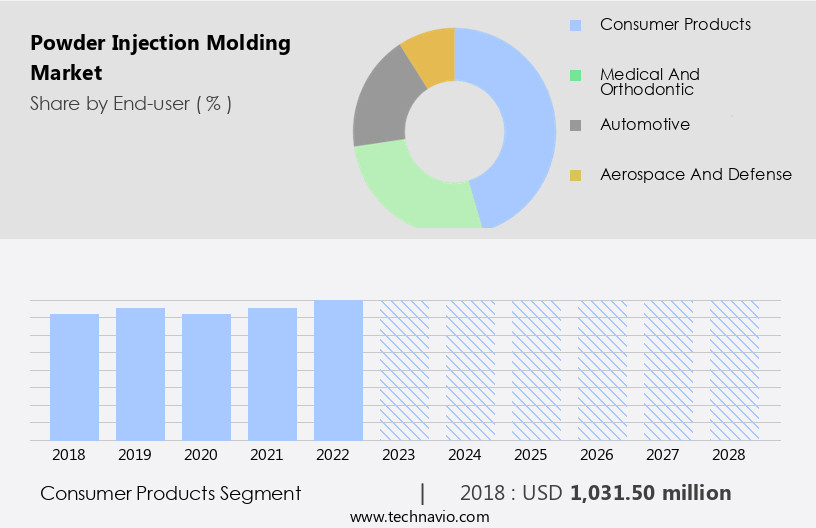

How is this Powder Injection Molding Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Consumer products

- Medical and orthodontic

- Automotive

- Aerospace and defense

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The consumer products segment is estimated to witness significant growth during the forecast period. The market experiences significant growth due to its application In the electronics sector. This industry requires intricate components in substantial quantities, driving the demand for PIM technology. The miniaturization of electronic devices is a prevailing trend, necessitating smaller, high-performing, and cost-effective parts. PIM excels in this area, as it is the most efficient technique for producing small and precise parts. Few alternatives can compete with PIM's ability to manufacture large volumes of components with tight tolerances. Key sectors withIn the electronics industry include eye care and healthcare facilities, where PIM is utilized for producing advanced eye care devices such as wavefront aberrometers, LASIK machines, and photorefractive keratectomy systems.

- PIM's precision and ability to address higher-order vision issues, including spherical and cylindrical aberrations, make it a valuable tool for ophthalmologists and clinicians. Additionally, PIM's potential in addressing age-related visual abnormalities, such as presbyopia and myopia, further expands its market reach. Despite economic conditions, the aging population's increasing need for personalized vision correction continues to fuel the market's growth.

Get a glance at the Powder Injection Molding Industry report of share of various segments Request Free Sample

The consumer products segment was valued at USD 1.03 billion in 2018 and showed a gradual increase during the forecast period.

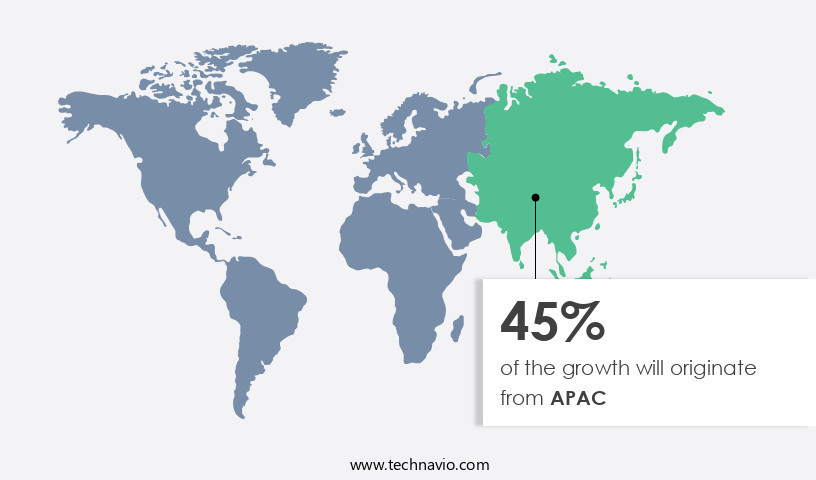

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region is expected to lead the global Powder Injection Molding (PIM) market due to increasing demand for metal injection molding in countries like China and growing interest in advanced molding systems in emerging markets such as Vietnam, Thailand, and India. companies are exploring expansion opportunities In these countries by establishing new manufacturing facilities. APAC is the largest contributor to the global PIM market and is projected to maintain its dominance during the forecast period. The region's manufacturing sector is witnessing a rise in robot installations for various processes, presenting an opportunity for PIM technology adoption. Advanced PIM systems enable the production of complex parts with high precision, making them suitable for various industries, including eye care.

Moreover, in the eye care sector, PIM is used to manufacture components for eye lasers, wavefront aberrometers, and other advanced eye care equipment. The aging population and the increasing prevalence of eye disorders such as astigmatism, myopia, and hyperopia are driving the demand for personalized vision correction solutions. However, challenges such as limited testing facilities, inadequate testing equipment, and untrained personnel require planning and investment in supporting infrastructure. The integration of AI, machine learning, cloud computing, IoT, and digital transformation In the PIM value chain can optimize processes and improve efficiency. The economic conditions and aging population are expected to influence the market's growth, with a focus on higher-order vision issues, such as halos, comets, and higher-order errors, which naturally occur with age.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Powder Injection Molding Industry?

- Technological innovations in injection molding robots is the key driver of the market. The market is experiencing significant growth due to the increasing demand for advanced eye care solutions, particularly In the areas of LASIK and photorefractive keratectomy (PRK). Enterprise adoption of AI, cloud computing, and big data is driving innovation In the sector, enabling personalized vision correction for various eye disorders such as astigmatism, myopia, hyperopia, and higher-order aberrations. Ophthalmologists and clinicians are leveraging wavefront aberrometers and IoT technology to diagnose and treat visual abnormalities more accurately and efficiently. PIM companies are focusing on value chain optimization by providing precision machinery and supporting infrastructure.

- Machine learning algorithms and ray-tracing formulas are being integrated into eye laser systems to provide higher-order vision correction, addressing issues such as halos, comets, and pupil diameter. Despite the economic conditions and limited testing equipment In the planning phases, the aging population's increasing need for eye care solutions presents significant opportunities for growth. Specialty clinics and hospitals are investing in advanced eye care technology to cater to the growing demand for personalized vision correction. However, untrained personnel and inadequate medical check-ups pose challenges to the industry's growth. The market is expected to continue its upward trajectory as companies focus on addressing these challenges and delivering innovative solutions to meet the evolving needs of the healthcare industry.

What are the market trends shaping the Powder Injection Molding Industry?

- Increased use of cobots in the injection molding process is the upcoming market trend. The Powder Injection Molding (PIM) market is experiencing significant growth due to innovation and digital transformation in enterprise strategies. Big data and AI are driving precision and personalized vision correction in advanced eye care, particularly In the treatment of eye disorders such as astigmatism, myopia, hyperopia, and higher-order aberrations. Cloud computing and IoT technologies enable real-time data analysis and support for specialized clinics and hospitals. PIM's supporting infrastructure is essential for the manufacturing process, as it allows for the optimization of value chain processes. Machine learning algorithms and ray-tracing formulas are used to improve the accuracy of eye laser systems, ensuring higher-order vision issues are addressed.

- Ophthalmologists and clinicians benefit from wavefront aberrometers, which measure the eye's light refraction to provide personalized correction plans. However, economic conditions and limited testing equipment can pose challenges In the planning stages of refractive surgery. Untrained personnel and medical check-ups are also crucial considerations In the use of advanced eye care technologies. Aging populations and the increasing prevalence of eye diseases, such as halos and comets, necessitate the need for more sophisticated eye surgery and corneal surface treatments. PIM's role In the eye care industry is vital, as it allows for the production of high-quality, customized eye structures for various vision correction procedures.

What challenges does the Powder Injection Molding Industry face during its growth?

- High tooling cost is a key challenge affecting the industry's growth. The Powder Injection Molding (PIM) market In the enterprise sector is experiencing significant growth due to innovation and digital transformation In the healthcare industry. Big data and AI are driving strategy in SMEs, enabling personalized vision correction for eye care, including LASIK and wavefront-guided correction for astigmatism, myopia, hyperopia, and higher-order aberrations. In the planning phase, limited testing and inadequate testing equipment pose challenges, necessitating precision and supporting infrastructure. PIM tools are capital-intensive, with a high initial cost despite a comparatively low production cost.

- The manufacturing time ranges from 5 to 12 weeks, from the design to the finishing stages. Cloud computing and IoT are essential for value chain optimization, enabling real-time monitoring and analysis of eye structures, ophthalmologists' medical check-ups, and eye diseases. Machine learning algorithms enhance the accuracy of ray-tracing formulas used in eye laser systems, addressing higher-order vision issues such as halos, comets, and vision errors. In the advanced eye care industry, precision and accuracy are crucial. Ophthalmology clinics and hospitals rely on wavefront aberrometer machines to measure the eye's refractive error, pupil diameter, and spherical and higher-order aberrations. These measurements are vital for planning and executing eye surgery, including LASIK and photorefractive keratectomy, ensuring the best possible outcomes for patients.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMT Pte. Ltd.

- ARBURG GmbH Co KG

- ARC Group Worldwide Inc.

- ASH Industries

- ATW Companies

- Chung Nam Group of Companies

- CMG Technologies Ltd.

- Epson Atmix Corp.

- Form Technologies

- GKN Sinter Metals Engineering GmbH

- Indo US MIM Tec Pvt. Ltd.

- Koch Industries Inc.

- Metal Powder Products Inc.

- Plastic Product Co. Inc.

- PSM Industries Inc.

- RHP Technology GmbH

- Sintex AS

- The Dynamic Group

- The Federal Group USA

- Vibrom spol. s r.o.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant enterprise growth due to the increasing demand for innovative solutions in various industries. With the advent of big data and cloud computing, SMEs are leveraging these technologies to enhance their strategic planning and improve precision In their manufacturing processes. The integration of artificial intelligence and machine learning algorithms is revolutionizing the industry, enabling businesses to optimize their value chains and produce high-quality products. In the realm of advanced eye care, the application of powder injection molding is gaining traction. The technology's ability to create complex eye structures with high precision is a significant advantage In the field of ophthalmology.

Moreover, the use of wavefront aberrometer and photorefractive keratectomy in personalized vision correction is driving the demand for advanced manufacturing techniques. Clinicians and healthcare services are increasingly relying on wavefront-guided correction to address visual abnormalities such as astigmatism, myopia, hyperopia, and higher-order aberrations. The aging population and the prevalence of eye diseases are further fueling the growth of the market. Despite the promising opportunities, the market faces challenges In the planning phase. The limited testing capabilities and inadequate testing equipment pose significant barriers to entry. Moreover, the need for specialized knowledge and expertise In the use of wavefront aberrometers and eye laser systems necessitates a high level of personnel training.

Furthermore, the economic conditions and the aging population are also influencing the market dynamics. The increasing prevalence of age-related eye diseases and the need for affordable and accessible eye care solutions are driving the demand for advanced manufacturing technologies. The use of ray-tracing formulas and higher-order vision issues, such as halos and comets, are becoming increasingly important considerations In the design and manufacturing of eye laser systems. The optimization of the value chain, from the anterior corneal surface to the retina, is crucial for the success of powder injection molding In the eye care industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2024-2028 |

USD 1.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

US, China, Japan, Germany, UK, India, South Korea, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Powder Injection Molding Market Research and Growth Report?

- CAGR of the Powder Injection Molding industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the powder injection molding market growth of industry companies

We can help! Our analysts can customize this powder injection molding market research report to meet your requirements.