Radiation Oncology Market Size 2024-2028

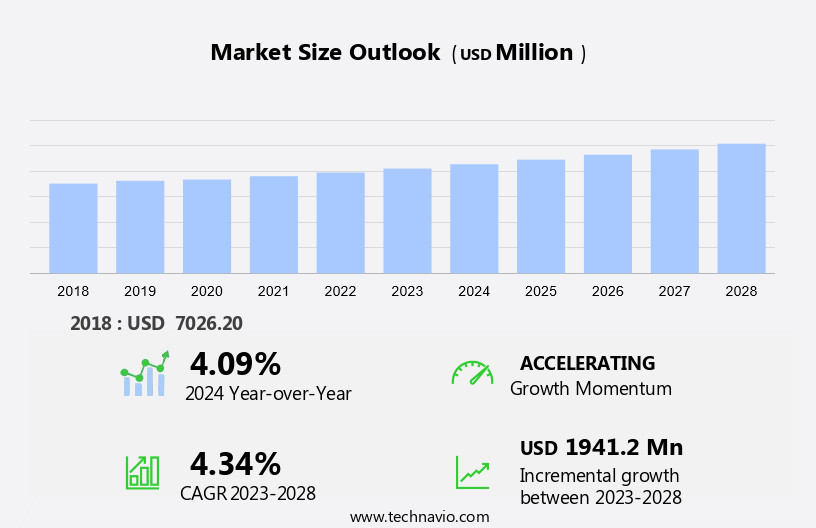

The radiation oncology market size is forecast to increase by USD 1.94 billion at a CAGR of4.34% between 2023 and 2028.

- In the market, the primary drivers include the increasing incidence of cancer and the rise in healthcare expenditure. As cancer continues to be a significant health concern, the demand for advanced radiation therapy techniques, such as seeds and stereotactic therapy, is increasing. These treatments offer therapeutic benefits by targeting abnormal cells with precision, reducing the impact on healthy cells. Technological developments, including advanced treatment planning software, tumor tracking systems, artificial intelligence, and machine learning, enable more effective and personalized treatment plans. However, challenges persist, including the lack of access to radiotherapy in certain regions and the high cost of these advanced treatments. Despite these challenges, the market is expected to grow, driven by the potential for improved patient outcomes and the ongoing technological advancements In the field.

What will be the Size of the Radiation Oncology Market During the Forecast Period?

- The market is a significant segment of the healthcare industry, focusing on the delivery of radiation therapy to treat various types of cancer. This form of oncology treatment, also known as radiotherapy, utilizes high-energy radiation to destroy tumor cells. Radiation oncology plays a crucial role in cancer treatment, with breast cancer, metastatic melanoma, and neuroendocrine cancers being some of the common indications. The increasing prevalence of cancer and the growing demand for advanced therapeutic benefits have driven the market's growth. Regulatory scrutiny remains a critical factor In the market.

- Stringent regulations ensure the safety and efficacy of radiotherapy devices and treatment planning software. These regulations also apply to advanced technologies like proton therapy, which offers improved therapeutic benefits for certain types of cancer. Imaging data plays a pivotal role in radiation oncology. Accurate and timely access to imaging data is essential for effective treatment planning and delivery. Cancer treatment centers and oncology research institutes are investing in advanced imaging technologies to enhance their capabilities. Technological developments in radiation oncology are continually evolving. Companies are focusing on improving the precision, efficiency, and patient experience of radiotherapy. Radiotherapy devices, such as those manufactured by Elekta and Gamma Knife, are being enhanced with innovative features.

How is this Radiation Oncology Industry segmented and which is the largest segment?

The radiation oncology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- EBRT

- Brachytherapy

- Application

- Breast cancer

- Lung cancer

- Penile cancer

- Prostate cancer

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Type Insights

- The EBRT segment is estimated to witness significant growth during the forecast period.

Radiation oncology, a specialized medical field focusing on the use of radiation to treat various types of cancer, encompasses external beam radiation therapy (EBRT). EBRT utilizes high-energy beams, typically generated by a Linear Accelerator (LINAC, the most common technology), to target and destroy cancer cells. These beams can be delivered as X-rays, electrons, or other particles, such as protons. EBRT plays a crucial role in treating numerous cancer types, including breast cancer, colorectal cancer (CRC), cervical cancer, esophageal cancer, head and neck cancer, lung cancer, prostate cancer, and brain tumors. Advanced radiotherapy systems, such as CyberKnife, Gamma Knife, and TomoTherapy, are also part of the EBRT market.

Furthermore, proton therapy, which uses cyclotrons and synchrotrons, is another subset of EBRT. Among these technologies, LINAC holds the largest market share In the market. By providing precise and effective cancer treatment, these advanced technologies contribute significantly to cancer treatment centers across the US and North America, ensuring improved patient outcomes and quality of life.

Get a glance at the Radiation Oncology Industry report of share of various segments Request Free Sample

The EBRT segment was valued at USD 6.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In North America, the market holds a significant position In the global landscape. The US is a key contributor to the market's revenue in this region, making it the largest market for radiation therapy worldwide. The region boasts the largest installed base of radiotherapy equipment due to factors such as a growing number of cancer cases, the presence of numerous multinational companies, an increasing number of radiotherapy procedures, a large pool of radiotherapists, advanced healthcare infrastructure, and the adoption of advanced radiation therapy devices. The prevalence of cancer in North America is on the rise, with conditions such as lung cancer, metastatic melanoma, and neuroendocrine cancers being common.

Furthermore, the high per-capita healthcare spending In the US is another significant factor fueling the growth of the market. In terms of oncology treatment, pain reduction is a critical aspect, and the use of oncology devices, including particle therapy systems, plays a vital role.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Radiation Oncology Industry?

The increasing incidence of cancer is the key driver of the market.

- The market is experiencing significant growth due to the increasing incidence and prevalence of cancers such as prostate, breast, lung, colorectal, and stomach. In response to this trend, there is a rising demand for advanced medical procedures to cure cancer or alleviate the associated pain. Radiation therapy, which includes proton therapy, radiotherapy, and the use of radioisotopes and radiopharmaceuticals, is becoming an increasingly popular treatment approach. This demand is driven by the need for effective cancer treatment and the availability of advanced radiation therapy devices and equipment. However, regulatory scrutiny remains a key challenge for market growth. Despite this, the increasing healthcare spending In the US and other developed countries is expected to fuel market expansion.

- The market encompasses a range of technologies and services, including radiotherapy equipment, radiotherapy devices, and radiopharmaceuticals. As a professional virtual assistant, I am committed to providing accurate and informative responses in a formal and professional tone. The above information is based on current market trends and research, and I am happy to provide further details or clarification upon request. (Word count: 97)

What are the market trends shaping the Radiation Oncology Industry?

The rise in healthcare expenditure is the upcoming market trend.

- In the global healthcare landscape, the expansion of various chronic conditions, including cancer, and the growing disposable income of populations are driving up healthcare expenditures in both developed and developing nations.

- For instance, as per OECD data from 2019, healthcare spending as a percentage of GDP among OECD countries is projected to rise from 8.8% in 2018 to 10.2% by 2030. The proliferation of hospitals and clinics worldwide is a testament to this trend. This increased spending has resulted in enhancements to healthcare infrastructure and the adoption of advanced medical technology, such as X-ray machines, in healthcare facilities.

What challenges does the Radiation Oncology Industry face during its growth?

Lack of access to radiotherapy is a key challenge affecting the industry growth.

- Radiation oncology is a crucial component of cancer treatment, involving the use of seeds, stereotactic therapy, surgeries, and systemic radiotherapy to target abnormal cells. However, the global radiotherapy market faces challenges due to limited access to this essential therapy. Factors such as insufficient investments, low healthcare expenditure, and a shortage of trained staff and facilities hinder the adoption of radiation equipment. According to reports, over 90% of cancer patients in low-income countries lack access to radiotherapy services. The situation is particularly dire in Africa, where countries like Senegal, Ghana, South Africa, and Ethiopia have a severe shortage of radiotherapy equipment.

- The global standard recommends one radiation megavoltage machine for every 150,000 people in a region. Yet, many countries lack even this basic infrastructure. Technological developments in radiation oncology, such as advanced treatment planning software and tumor tracking systems, offer significant therapeutic benefits. However, their implementation requires substantial investment and skilled personnel. To address this challenge, it is essential to prioritize investments in radiation oncology and train more professionals in this field. By doing so, we can ensure that more patients, particularly those in low-income countries, receive the radiotherapy they need to fight cancer effectively.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the radiation oncology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accuray Inc.

- Becton Dickinson and Co.

- Canon Inc.

- Carl Zeiss AG

- Elekta AB

- Hitachi Ltd.

- iCAD Inc.

- Ion Beam Applications SA

- IsoRay Inc.

- Mallinckrodt Plc

- Mevion Medical Systems Inc.

- Nordion Canada Inc.

- Optivus Proton Therapy Inc.

- Panacea Medical Technologies Pvt. Ltd.

- RefleXion Medical Inc.

- Sensus Healthcare Inc.

- Sumitomo Heavy Industries Ltd.

- Theragenics Corp.

- Varian Medical Systems Inc.

- ViewRay Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Radiation oncology is a specialized field of cancer treatment that utilizes advanced technologies to deliver precise doses of radiation to abnormal cells. The market for radiation oncology is driven by several factors, including the rising number of cancer cases, the aging population, and economic development in emerging nations. Cancer patients, particularly those with advanced cancers such as brain, breast, cervical, colorectal, and liver cancer, are turning to radiation oncology for curative treatment. Technological developments in radiation oncology include the use of 3D conformal radiotherapy, also known as 3D-conformity therapy or 3D-CRT, which allows for more precise targeting of tumors. Other advanced techniques include Intensity-Modulated Radiation Therapy (IMRT), Image-Guided Radiation Therapy (IGRT), and Stereotactic Therapy.

Moreover, radiation oncology devices include linear accelerators, afterloaders, and brachytherapy seeds, which are used to deliver radiation. These devices are used in conjunction with imaging data and treatment planning software to ensure accurate and effective delivery of radiation. Healthcare providers, including cancer treatment centers and physicians, are increasingly adopting radiation oncology as a viable treatment option due to its therapeutic benefits, including pain reduction and the ability to target tumor cells with minimal damage to healthy tissue. However, regulatory scrutiny and rising healthcare spending are challenges facing the market. Emerging nations are expected to see significant growth In the market due to increasing healthcare expenditure and the availability of advanced oncology devices and technology.

Furthermore, technological advancements, such as Particle Therapy Systems and MR-Linac, are also driving growth In the market. Radiotherapy equipment and radiotherapy devices are essential components of radiation oncology, and their adoption rate is expected to increase as cancer cases continue to rise. Radioisotopes and radiopharmaceuticals are also used in radiation oncology for systemic radiotherapy and brachytherapy. Obesity is a growing challenge in radiation oncology, as it can impact the accuracy of radiation delivery. Cancer treatment centers are investing in advanced imaging technologies, such as 4D imaging and 4D radiotherapy, to address this challenge. Neuroendocrine cancers, metastatic melanoma, and head & neck cancers are also being treated with radiation oncology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.34% |

|

Market Growth 2024-2028 |

USD 1.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.09 |

|

Key countries |

US, UK, Canada, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Radiation Oncology industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and the Rest of the World (ROW)

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the radiation oncology market growth of industry companies

We can help! Our analysts can customize this radiation oncology market research report to meet your requirements.