Radiation Therapy Equipment Market Size 2024-2028

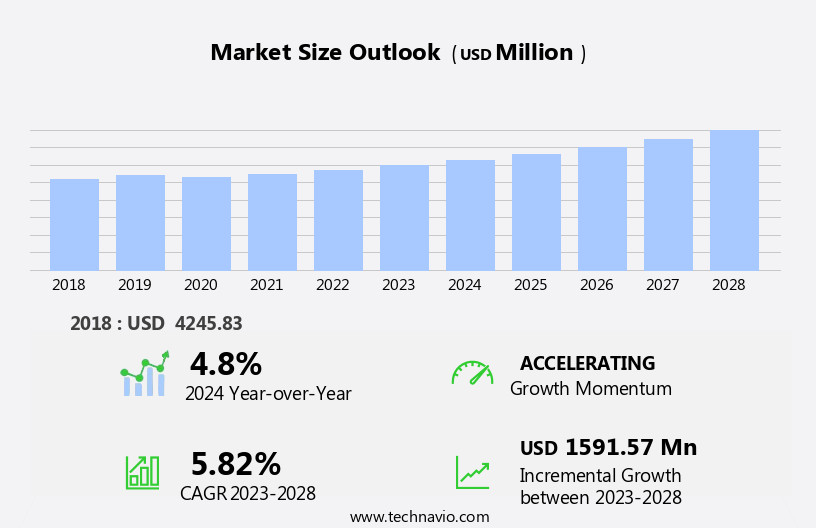

The radiation therapy equipment market size is forecast to increase by USD 1.59 billion at a CAGR of 5.82% between 2023 and 2028.

- The Radiation Oncology Market, encompassing Radiotherapy Devices and Radiation Detection and Monitoring Equipment, exhibits significant growth due to the increasing incidence of cancer, particularly colorectal cancer. This trend is further fueled by advancements in customer support services provided by market companies, ensuring optimal patient care. However, the high cost of radiation therapy equipment remains a challenge for market expansion, particularly in underserved regions. Market participants must innovate to offer cost-effective solutions without compromising quality to cater to a broader customer base. The Radiation Detection and Monitoring Equipment Market plays a crucial role in ensuring patient safety and treatment efficacy, making it an essential segment withIn the Radiation Oncology Market.

What will be the Size of the Radiation Therapy Equipment Market During the Forecast Period?

- The market encompasses a diverse range of technologies and devices used in cancer treatment, including proton therapy, treatment planning systems, and various imaging modalities. The market is driven by the increasing incidence of cancer and the availability of advanced radiotherapy devices that offer improved accuracy and precision in tumor targeting. Radiotherapists and oncologists utilize imaging data for dose calculation and delivery techniques such as intensity-modulated radiotherapy (IMRT), stereotactic radiotherapy (Stereotactic), and the Radixact system. Technology trends include telemedicine, which enhances access to healthcare, and the integration of imaging techniques for better tumor visualization. Cancer types like breast cancer, skin cancer (including basal cell carcinoma, melanoma, and squamous cell carcinoma), and lip cancer continue to fuel market growth.

- Market dynamics are influenced by ongoing research studies and the continuous development of advanced radiotherapy devices and treatment methods. company analysis indicates a competitive landscape with numerous players offering innovative solutions to meet the evolving needs of the healthcare industry.

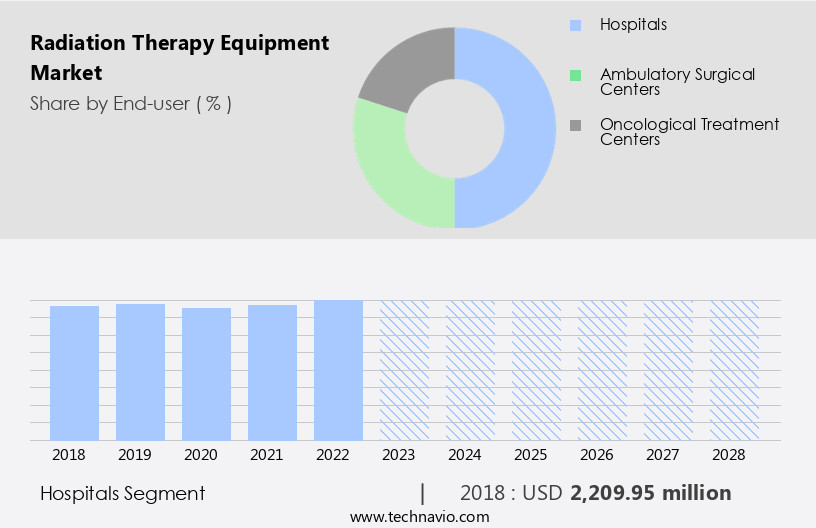

How is this Radiation Therapy Equipment Industry segmented and which is the largest segment?

The radiation therapy equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Ambulatory surgical centers

- Oncological treatment centers

- Product

- External beam radiation therapy device

- Internal beam radiation therapy device

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals segment is estimated to witness significant growth during the forecast period. Radiotherapy, a sophisticated treatment modality for various medical conditions, primarily cancer, necessitates advanced equipment and infrastructure. Hospitals, with their extensive resources, serve as the primary consumers of radiotherapy technology. Equipped with dedicated oncology departments or cancer centers, these healthcare facilities invest in radiotherapy devices for delivering precise radiation doses to cancerous tumors, minimizing damage to healthy tissues. Adoption of these devices offers numerous advantages, including enhanced precision, reduced side effects, improved patient outcomes, and increased treatment efficiency. Radiotherapy technology drives the delivery of complex procedures with heightened accuracy and safety. Proton therapy, treatment planning, imaging data, and cancer treatment are integral components of radiotherapy.

Technological advancements have led to the emergence of HDR brachytherapy, systemic radiotherapy, and various delivery techniques such as intensity-modulated radiotherapy and stereotactic radiotherapy. Imaging techniques, dose calculation, and delivery techniques play crucial roles in ensuring effective radiotherapy treatment. The prevalence of cancer and increasing access to healthcare in emerging economies fuel the demand for radiotherapy devices. company analysis, market facets, and upcoming trends shape the radiotherapy equipment market landscape.

Get a glance at the market report of various segments Request Free Sample

The Hospitals segment was valued at USD 2.21 billion in 2018 and showed a gradual increase during the forecast period.

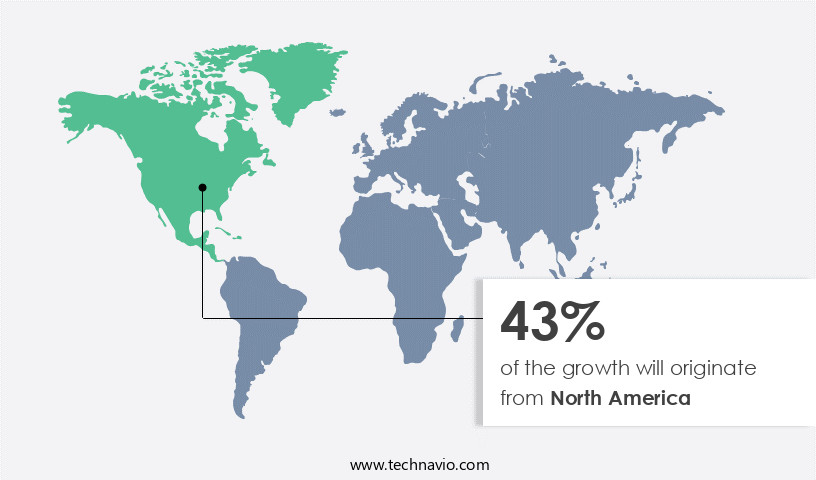

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is projected to expand at a steady pace, driven by the availability of advanced radiotherapy devices, increasing cancer patient population, and technological advancements in precision treatment methods. In 2023, the US and Canada accounted for the largest market share due to the presence of leading companies, such as Elekta, and the high per-capita healthcare expenditure. The market is witnessing a surge in product launches, including the FDA clearance of Elekta's Harmony radiation therapy system in June 2021 and the launch of its Harmony linear accelerator in September 2020. Furthermore, the region offers extensive training programs for radiotherapists and oncologists, ensuring optimal utilization of radiotherapy treatment technology.

Key trends include the adoption of image-guided radiotherapy, intensity-modulated radiotherapy, stereotactic radiotherapy, and HDR brachytherapy. The market landscape is fragmented, with key companies including company A, company B, and company C. The increasing incidence of cancer, particularly breast cancer, skin cancer, and tumors, is fueling market growth. Upcoming trends include telemedicine, complex separation techniques, and emerging economies' growing awareness about cancer.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Radiation Therapy Equipment Industry?

- Rising occurrence of colorectal cancer is the key driver of the market.Radiation therapy plays a crucial role in cancer treatment, with advanced radiotherapy devices such as linear accelerators, particle therapy systems, and HDR brachytherapy afterloaders being utilized for precision treatment. Treatment planning involves the use of imaging data to create a customized plan for each cancer patient, ensuring accurate dose calculation and delivery techniques, including intensity-modulated radiotherapy and stereotactic radiotherapy. The availability of advanced technology-driven radiotherapy devices, telemedicine, and research studies contribute to improved oncologic care. The prevalence of cancer, particularly colorectal cancer, which is the third most commonly occurring cancer in men and the second most commonly occurring cancer in women, necessitates continuous advancements in radiotherapy technology.

Factors contributing to the rising incidence of colorectal cancer include an increasing obese population, unhealthy diet, lack of physical activity, and medical conditions such as diabetes. In 2020, the CDC reported 126,240 new colorectal cancer cases and 51,869 related deaths. The market facets of radiation therapy are continually evolving, with upcoming trends including complex separation techniques, increasing awareness about cancer, and the emergence of emerging economies. The reliable data available from various sources indicates a growing need for advanced radiotherapy devices and technology to cater to the increasing number of cancer patients. Key companies In the market focus on providing innovative solutions to meet the demands of oncologists and radiotherapists for effective cancer treatment.

Cancer patients undergo various radiotherapy treatments, including external beam therapy, internal beam therapy (such as HDR brachytherapy), and imaging techniques like CT, MRI, and ultrasound for accurate diagnosis and treatment planning. The multileaf collimator is a crucial component of linear accelerators, enabling precise dose delivery and shaping. The market for radiation therapy equipment is expected to grow significantly due to the increasing incidence of cancer and the need for advanced technology to provide effective treatment while minimizing the risk of radiation.

What are the market trends shaping the Radiation Therapy Equipment market?

- Improvement in customer support services by vendors of radiation therapy equipment is the upcoming market trend.The market is driven by the advancements in technology, leading to precision treatments for cancer patients. Proton therapy, HDR brachytherapy, and particle therapy are some of the technology-driven radiotherapy treatments gaining popularity. Treatment planning relies on imaging data to ensure accurate dose calculation and delivery techniques, such as intensity-modulated radiotherapy and stereotactic radiotherapy. Radiotherapists and oncologists collaborate to provide optimal oncologic care, utilizing telemedicine for remote consultations. The availability of advanced radiotherapy devices, including linear accelerators and multileaf collimators, enhances the effectiveness of radiation therapy. Early detection and access to healthcare are crucial for cancer patients, making the prevalence of cancer a significant market facet.

The incidence of cancer, particularly breast cancer, skin cancer, and tumors, necessitates ongoing research studies to improve treatment methods and reduce the risk of radiation. companies, such as Elekta, provide comprehensive services, including support, installation, repair, and maintenance, to ensure optimal performance of radiation therapy systems. These services contribute to the recurring revenue of the companies and enable them to expand their installed base and fulfill orders on time. Upcoming trends include the integration of artificial intelligence and machine learning for improved dose calculation and delivery. The company landscape is competitive, with key companies focusing on innovation to cater to the evolving needs of the market.

Reliable data is essential for making informed decisions In the market.

What challenges does the Radiation Therapy Equipment Industry face during its growth?

- High cost of radiation therapy equipment is a key challenge affecting the industry growth.The market is experiencing continuous growth, driven by the increasing prevalence of cancer and the availability of advanced radiotherapy devices. Technological advancements in treatment planning, imaging data, and precision treatment methods, such as proton therapy, HDR brachytherapy, and stereotactic radiotherapy, are key factors fueling market expansion. However, the high cost of radiation therapy equipment, including linear accelerators, particle therapy systems, and stereotactic afterloaders, poses a challenge, particularly in emerging economies. The cost of these devices varies depending on their features, with conventional external beam radiation therapy equipment costing between USD300,000 and USD1,300,000. The integration of technology-driven solutions like intensity-modulated radiotherapy (IMRT), image-guided radiotherapy (IGRT), and multileaf collimators (MLC) further increases the cost.

Despite these challenges, the market is expected to grow due to the increasing awareness about cancer and the need for improved oncologic care. Telemedicine and research studies are also contributing to the market's growth, particularly In the treatment of breast cancer and various types of tumors, including skin cancer (basal cell carcinoma, melanoma, and squamous cell carcinoma). company analysis and reliable data are crucial for understanding the market dynamics and the competitive landscape.

Exclusive Customer Landscape

The radiation therapy equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the radiation therapy equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, radiation therapy equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Accuray Inc. - The company specializes in advanced radiation therapy solutions, featuring the CyberKnife system. This technology enables precise treatment for a range of complex and intricate conditions, catering to both straightforward and challenging cases. The CyberKnife system's unique capabilities offer enhanced accuracy and efficacy in radiation therapy applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accuray Inc.

- Bionix LLC

- Canon Inc.

- Carl Zeiss AG

- Eckert and Ziegler AG

- Elekta AB

- Hitachi Ltd.

- Hologic Inc.

- iCAD Inc.

- IntraOp Medical Corp.

- Ion Beam Applications SA

- IsoRay Inc.

- Mevion Medical Systems Inc.

- Optivus Proton Therapy Inc.

- P CURE

- Panacea Medical Technologies Pvt. Ltd.

- Provision Healthcare

- Siemens Healthineers AG

- Sotera Health Co.

- Sumitomo Heavy Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Radiation therapy, a crucial component of oncologic care, continues to evolve with advancements in technology and imaging techniques. The radiotherapy devices market is driven by the growing prevalence of cancer and the increasing availability of advanced radiotherapy equipment. The integration of technology in radiation therapy has led to precision treatment methods, including proton therapy, HDR brachytherapy, and particle therapy. Radiotherapists and oncologists utilize imaging data for effective treatment planning and dose calculation. Conformal radiotherapy, intensity-modulated radiotherapy, and stereotactic radiotherapy are some of the delivery techniques that ensure accurate dose delivery to the tumor while minimizing exposure to healthy cells.

External beam and internal beam therapies are the two primary modalities used in radiation therapy. Linear accelerators are commonly used in external beam therapy, while afterloaders are essential in internal beam therapy. The market dynamics of radiotherapy equipment are influenced by several factors, including the risk of radiation, per-capita healthcare expenditure, and access to healthcare. Telemedicine and research studies are emerging trends In the radiotherapy market, enabling remote consultation and improving patient care. The prevalence of cancer varies across different types, with breast cancer, skin cancer, and tumors being the most common. The radiotherapy market landscape is competitive, with key companies focusing on innovation and product development.

Multileaf collimators and imaging techniques are essential components of modern radiotherapy systems. Dose calculation and delivery techniques are critical aspects of radiotherapy treatment planning and execution. Upcoming trends In the radiotherapy market include the use of complex separation techniques and emerging technologies in emerging economies. Awareness about cancer and its early detection is increasing, leading to a higher demand for radiotherapy equipment. The company landscape is diverse, with several players offering solutions tailored to specific market facets. The radiotherapy market is expected to grow significantly In the coming years due to the increasing incidence of cancer and the availability of reliable data and advanced technologies.

The market's key companies are investing in research and development to offer innovative solutions and improve patient outcomes. The market's future growth is promising, with several opportunities for collaboration and partnerships among companies. The radiotherapy equipment market is a dynamic and evolving industry driven by technological advancements, increasing cancer prevalence, and the growing demand for precision treatment methods. The market's competitive landscape is shaped by several factors, including the risk of radiation, access to healthcare, and the focus on innovation and product development. The future of radiotherapy equipment is promising, with several opportunities for growth and collaboration among companies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.82% |

|

Market growth 2024-2028 |

USD 1591.57 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.8 |

|

Key countries |

US, Canada, UK, Germany, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Radiation Therapy Equipment Market Research and Growth Report?

- CAGR of the Radiation Therapy Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the radiation therapy equipment market growth of industry companies

We can help! Our analysts can customize this radiation therapy equipment market research report to meet your requirements.