Release Liners Market Size 2024-2028

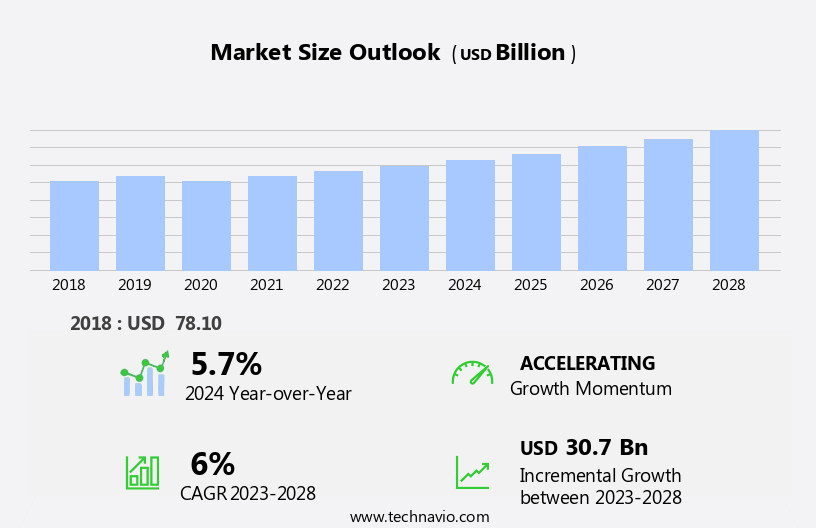

The release liners market size is forecast to increase by USD 30.7 billion, at a CAGR of 6% between 2023 and 2028.

- The market is witnessing significant growth, driven by advancements in labeling technology. The integration of smart labels, RFID tags, and other digital technologies is revolutionizing the industry, enabling enhanced product tracking, traceability, and consumer engagement. Additionally, the increasing preference for sustainable and eco-friendly solutions is fueling the popularity of biodegradable and compostable release liners. However, the availability of substitutes, such as direct-printed labels and uncoated papers, poses a challenge to market growth.

- Companies must innovate and differentiate their offerings to cater to the evolving demands of consumers and businesses, while also addressing the sustainability concerns. To capitalize on the opportunities and navigate the challenges effectively, market participants must focus on developing technologically advanced, eco-friendly, and cost-effective solutions.

What will be the Size of the Release Liners Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Flexible packaging, a key application sector, witnesses ongoing advancements in automation and FDA compliance, leading to increased demand for release liners. Industrial packaging also experiences growth, with a focus on cost optimization, inventory control, and custom designs. Food contact compliance remains a critical consideration, with regulatory bodies enforcing stringent standards. The shift towards sustainable packaging solutions, such as biodegradable materials and renewable resources, is gaining momentum. Automated packaging and FDA compliance are essential for e-commerce fulfillment, further fueling market growth. Flexographic printing, a popular printing technology, offers advantages in terms of cost efficiency and peel resistance.

Oxygen permeability and barrier films are crucial for product preservation, while waste reduction and recyclable materials are integral to the circular economy. Lamination techniques, printing technologies, and coating processes contribute to the enhancement of surface treatment and seal strength. Adhesive properties, tamper evident features, and antimicrobial properties are essential for consumer packaging, ensuring product safety and shelf life extension. Industry regulations and compliance certification are vital for pharmaceutical-grade and medical-grade materials. Logistics optimization and distribution networks are essential for efficient product packaging and delivery. The market's continuous dynamism reflects the ongoing unfolding of market activities and evolving patterns.

How is this Release Liners Industry segmented?

The release liners industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Paper

- Film

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

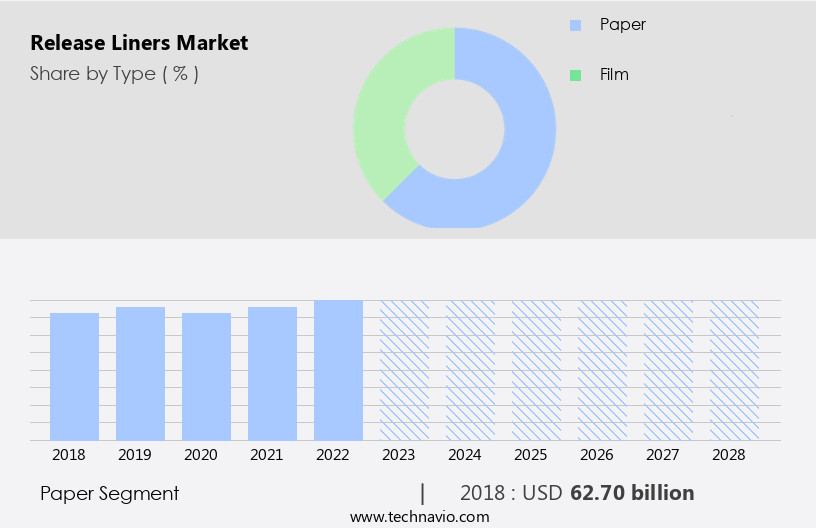

The paper segment is estimated to witness significant growth during the forecast period.

In the dynamic the market of 2023, paper emerged as the leading substrate segment due to its inherent characteristics, including rigidity and strength. These properties make paper an ideal choice for various applications. Sustainability is a significant factor distinguishing paper from films. The paper used in release liners is primarily sourced from renewable resources, such as cellulosic wood fibers, extracted from softwood and hardwood trees. The natural degradability of these fibers reduces the environmental impact, making paper-based release liners increasingly popular. In contrast, films are predominantly derived from non-renewable resources like petroleum and crude oil feedstock, contributing to their low natural degradability.

The release liners industry also focuses on other trends, such as ink compatibility, e-commerce fulfillment, and automation. E-commerce growth has led to an increased demand for customized and automated packaging solutions. Ink compatibility is crucial for ensuring the adhesion of inks to various substrates, while biodegradable materials and labeling requirements cater to evolving consumer preferences. Packaging machinery, peel resistance, lamination techniques, and oxygen permeability are essential aspects of release liners. Waste reduction and testing standards are vital for maintaining product preservation and ensuring compliance with industry regulations. Circular economy initiatives, medical-grade materials, and food contact compliance are also gaining traction in the market.

Cost optimization, inventory control, and custom designs are essential for businesses seeking to remain competitive. Consumer packaging, logistics optimization, and distribution networks are critical components of the supply chain management process. Recyclable materials, printing technologies, and sustainability initiatives are driving the market towards more eco-friendly solutions. Barrier films, carbon footprint reduction, and seal strength are important considerations for product packaging. Compliance certification, adhesive properties, and sustainable packaging are essential for maintaining consumer trust and meeting regulatory requirements. Coating processes, surface treatment, and antimicrobial properties are crucial for ensuring product preservation and shelf life extension. In summary, the market is driven by various factors, including paper's sustainability, automation, and e-commerce fulfillment.

The industry is continuously evolving, with a focus on ink compatibility, biodegradable materials, and regulatory compliance. The integration of renewable resources, recyclable materials, and sustainable practices is shaping the future of the market.

The Paper segment was valued at USD 62.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

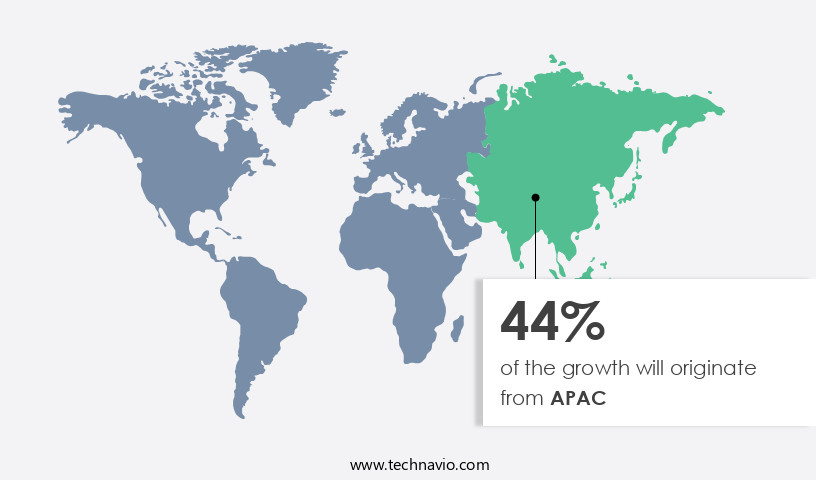

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, APAC holds the largest share of consumption and is projected to experience the fastest growth through 2023. This growth can be attributed to the expanding packaging sector and the increasing demand from infrastructure and construction industries in the region. Release liners are extensively used in various sectors including retail, consumer durables, automotive, food and beverages, and construction in APAC. China and India are significant contributors to the market's growth in this area. Macroeconomic developments and the emergence of robust economies like China and India are fueling the expansion of the e-commerce industry, further driving the demand for release liners.

In addition, the region's focus on waste reduction, sustainability initiatives, and regulatory compliance is shaping the market trends. The market encompasses various technologies such as flexographic printing, gravure printing, digital printing, and coating processes. Peel resistance, lamination techniques, oxygen permeability, and seal strength are crucial factors influencing the market dynamics. Medical-grade materials, food contact compliance, and FDA compliance are essential considerations in the industry. Automated packaging, inventory control, and custom designs are also gaining popularity. The market is subject to industry regulations and product lifecycle management. Circular economy, renewable resources, and carbon footprint reduction are key sustainability initiatives. Product preservation, tamper evident features, and anti-static properties are essential for various applications.

The market's future lies in cost optimization, logistics optimization, and the integration of advanced printing technologies and material compositions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Release Liners Industry?

- Technology innovations significantly drive the labeling market's growth. Advancements in this field continue to shape industry trends and consumer experiences.

- The market is experiencing significant growth due to the technological advances in labeling solutions. These innovations expand the functionality of labels, transforming them from mere carriers of product information into interactive portals. Labels now offer features such as downloadable product details, ingredient information, coupons, and promotional offers. Moreover, RFID technology enables efficient inventory management and streamlined supply chain operations. The integration of these advanced technologies in release liners is propelling the market forward, offering numerous benefits to businesses.

- RFID technology, in particular, is revolutionizing the industry by enabling real-time tracking of items and enhancing overall supply chain efficiency. These advancements are poised to redefine the packaging landscape and create new opportunities for businesses in various sectors.

What are the market trends shaping the Release Liners Industry?

- The increasing preference for eco-friendly packaging solutions is driving the market trend towards biodegradable and compostable release liners. These sustainable alternatives to traditional plastic liners offer significant environmental benefits, making them a popular choice for businesses seeking to reduce their carbon footprint.

- The market is experiencing significant growth due to the increasing demand for sustainable packaging solutions. Traditional release liners, typically made from plastic materials, pose environmental concerns as they take years to decompose in landfills. In response to rising consumer awareness and the push for eco-friendly practices, industries are transitioning to biodegradable and compostable release liners. These alternatives, derived from renewable resources like paper or bio-based polymers, decompose naturally without harming the environment. The packaging, food, and medical industries, which focus on reducing single-use plastics and enhancing product sustainability, are particularly driving this trend. Biodegradable and compostable release liners offer several advantages, including waste reduction, improved peel resistance, and enhanced oxygen permeability.

- They are also compatible with various converting equipment and packaging machinery, ensuring seamless integration into existing production processes. Moreover, they meet labeling requirements and are suitable for lamination techniques, making them versatile options for various applications. The circular economy, which emphasizes the reuse and recycling of materials, further bolsters the demand for biodegradable and compostable release liners. In the medical industry, where product preservation is crucial, these materials are often used in medical-grade applications to ensure the highest level of safety and efficacy. As the market continues to evolve, testing standards and certifications will play a vital role in ensuring the quality and reliability of these eco-friendly alternatives.

What challenges does the Release Liners Industry face during its growth?

- The availability of substitutes poses a significant challenge to the industry's growth trajectory. In today's competitive market, businesses must continually innovate and differentiate themselves to maintain market share and stay ahead of their competitors. The ease with which consumers can switch to alternative products or services can significantly impact a company's revenue and profitability. Therefore, it is crucial for industry players to closely monitor market trends, invest in research and development, and build strong brand loyalty to mitigate the threat of substitutes and ensure sustainable growth.

- Release liners, essential components in manufacturing processes to protect adhesive surfaces, encounter competition from alternative materials and solutions. Substitutes, such as non-adhesive materials like silicone-coated papers or films, offer cost benefits or enhanced performance in specific applications, particularly in cost-sensitive industries. These alternatives serve as release liners in various applications, including labels, tapes, and medical adhesives. Moreover, technological advancements, including electronic and smart packaging, pose a threat to traditional release liners. Innovative films or substrates embedded with functionalities in these emerging packaging solutions could potentially diminish the demand for conventional release liners. Industry regulations, such as food contact compliance and FDA regulations, necessitate the use of specific materials with precise material composition for release liners.

- As a result, product lifecycle management and inventory control have become crucial aspects for market players to optimize costs and maintain regulatory compliance. Custom designs and logistics optimization are also essential factors influencing the market dynamics. Roll stock materials, the primary raw material for release liners, continue to be a significant focus area for manufacturers to ensure consistent quality and cost optimization.

Exclusive Customer Landscape

The release liners market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the release liners market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, release liners market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing a diverse selection of release liners, including the 3M Secondary Release Liners 7526L, 4988, 4994, and Silicone Release Liner 4986. These liners offer optimal performance for various applications, showcasing the company's commitment to innovation and quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Ahlstrom Munksjo Oyj

- Compagnie de Saint-Gobain SA

- delfortgroup AG

- DuPont Teijin Films

- Felix Schoeller Holding GmbH and Co KG

- FUJIKO Co. Ltd.

- Glatfelter Corp.

- Inteplast Group

- Laufenberg GmbH

- LINTEC Corp.

- Loparex International BV

- Mativ Holdings Inc.

- Mitsui and Co. Ltd.

- Mondi Plc

- Nan Ya Plastic Corp.

- Polyplex Corp. Ltd

- Siliconature Spa

- UPM Kymmene Corp.

- Xinfeng Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Release Liners Market

- In January 2024, Avery Dennison Corporation, a leading global materials science company, announced the launch of its new line of pressure-sensitive release liners for the labeling industry, featuring enhanced sustainability attributes. This innovation was a response to growing market demand for eco-friendly solutions (Avery Dennison Corporation Press Release, 2024).

- In March 2024, 3M and Henkel Adhesives entered into a strategic partnership to expand their collaboration in the market. The partnership aimed to leverage their collective expertise and resources to develop advanced adhesive technologies and expand their market reach (3M Press Release, 2024).

- In April 2025, H.B. Fuller Company, a leading global specialty adhesives provider, completed the acquisition of Tubacex's release liner business. This acquisition strengthened H.B. Fuller's position in the European the market and expanded its product offerings (H.B. Fuller Company Press Release, 2025).

- In May 2025, Dow Inc. Announced the commercialization of its new line of bio-based release liners. These liners were produced using renewable feedstocks and offered improved sustainability attributes, aligning with the increasing demand for eco-friendly solutions in the market (Dow Inc. Press Release, 2025).

Research Analyst Overview

- The market encompasses various aspects of adhesive technology, including packaging design, adhesion science, and polymer chemistry. Environmental impact and corporate sustainability are increasingly influencing market dynamics, with brands prioritizing social responsibility and product stewardship. Risk management and supply chain resilience are crucial considerations, as are performance testing and quality assurance. Digital transformation and big data analytics are driving innovation, with artificial intelligence and predictive modeling playing key roles in optimizing production capacity and improving product development. Licensing agreements and intellectual property are essential components of the market, shaping competitive advantage.

- Consumer behavior continues to evolve, with waste management and recycling programs gaining importance. Raw material procurement and global sourcing strategies are also critical factors, as is the integration of graphic design and retail strategy. Material science and process optimization are ongoing areas of research and development.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Release Liners Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2024-2028 |

USD 30.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.7 |

|

Key countries |

US, China, Germany, Japan, UK, Canada, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Release Liners Market Research and Growth Report?

- CAGR of the Release Liners industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the release liners market growth of industry companies

We can help! Our analysts can customize this release liners market research report to meet your requirements.