Tactical Footwear Market Size 2024-2028

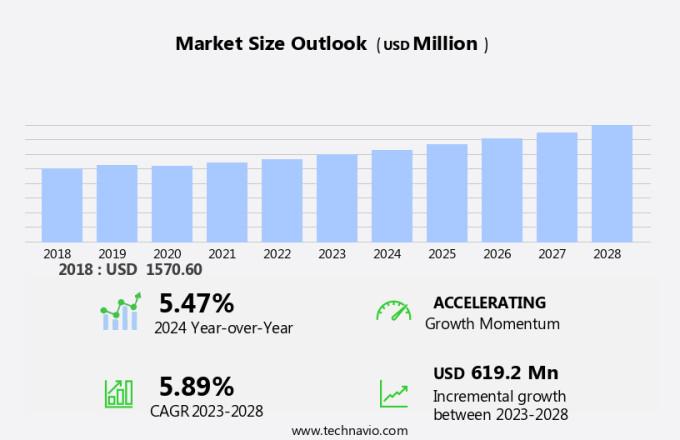

The tactical footwear market size is forecast to increase by USD 619.2 million at a CAGR of 5.89% between 2023 and 2028. The market is experiencing significant growth due to several driving factors. One key trend is the increasing popularity of extreme sports and outdoor activities, leading to heightened demand for tactical boots in both the armed forces and civilian sectors. Additionally, stricter regulations regarding the production of leather and the use of hazardous chemicals are pushing manufacturers to prioritize foot protection and gait comfort in their designs. Ankle determination and climate change resilience are also crucial considerations for this market. Men's footwear, particularly tactical boots, continue to be in demand due to their versatility and durability. Social media marketing plays a significant role in promoting these products to a wider audience. Procurement of raw materials, such as leather, must adhere to stringent government regulations to ensure quality and sustainability. Overall, the market is expected to continue its expansion in the coming years as consumers seek footwear that offers superior foot protection and performance.

What will be the Size of the Market During the Forecast Period?

The market caters to the demands of various sectors, including law enforcement, military, and outdoor enthusiasts. This market focuses on providing specialized footwear that offers protection, comfort, and durability for individuals who require footwear for challenging terrains and harsh weather conditions. Protection is a primary concern in tactical footwear. These footwear types incorporate features such as reinforced toe caps, waterproofing, and non-slip soles to ensure foot safety. The use of durable materials like nylon, full-grain leather, split leather, nubuck, suede, and synthetic leather enhances the footwear's ability to withstand rugged terrain and slippery surfaces.

Furthermore, comfort is another essential factor in tactical footwear. Cushioned footbeds and ankle determination offer support and comfort to the wearer, enabling them to perform their tasks efficiently. Tactical boots, armed forces boots, and extreme sports boots are some popular types of footwear that cater to these requirements. The market offers a wide range of footwear options for men. These footwear types are designed to protect the feet from various hazards, including impact, water, and extreme temperatures. Gait protection is another crucial feature that ensures the footwear provides adequate support and stability, allowing the wearer to move freely and effectively.

Moreover, the durability of tactical footwear is a significant factor that sets it apart from regular footwear. High-quality materials and advanced manufacturing techniques ensure that these footwear types can withstand the rigors of daily use. Although tactical footwear tends to have a higher price point than regular footwear, the investment is worth it for the added protection and durability. In conclusion, the market caters to the unique needs of various sectors by offering footwear that provides protection, comfort, and durability. The use of high-quality materials, advanced manufacturing techniques, and innovative features ensures that tactical footwear is a worthwhile investment for those who require footwear for challenging conditions.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Men

- Women

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- UK

- Middle East and Africa

- South America

- APAC

By Distribution Channel Insights

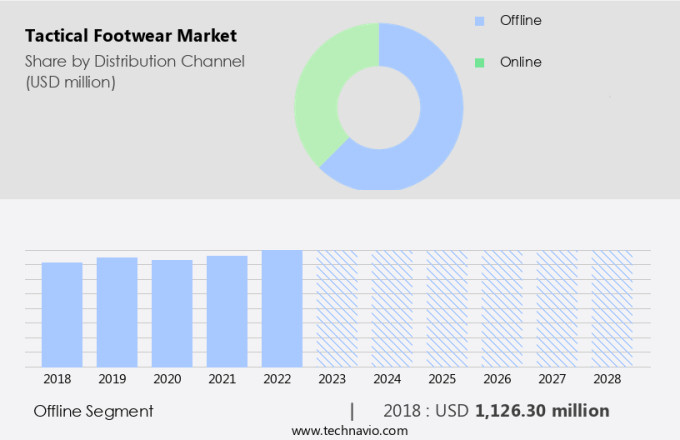

The offline segment is estimated to witness significant growth during the forecast period. The offline distribution channel holds a significant share in The market, with specialty stores, department stores, hypermarkets, and warehouse clubs being the primary outlets. These channels invest heavily in physical retail stores to expand their market presence. In-store product trials, branding through signages, and promotional discounts are effective marketing strategies employed by tactical footwear manufacturers. Full-grain leather, split leather, Nubuck, suede, and synthetic leather are popular raw materials used in the production of tactical footwear.

Furthermore, the durability of these materials is a key factor driving the high price point of tactical footwear. Split leather, for instance, is a cost-effective alternative to full-grain leather, making it a preferred choice for many manufacturers. Specialty stores catering to tactical footwear offer a wide range of options, including those made from specialty leathers such as Nubuck and suede. The high price of these footwear types is justified by their superior durability and unique aesthetic appeal. Synthetic leather, on the other hand, offers a more affordable alternative while maintaining the essential features of tactical footwear. The market is characterized by intense competition, with major players investing in research and development to offer innovative products.

Moreover, Norris Tactical Sneakers, for example, has gained popularity for its unique design and functionality. However, raw material prices continue to pose a challenge for manufacturers, impacting the final price of the footwear. In conclusion, the market is a growing industry, with a strong focus on durability and functionality. Offline distribution channels, particularly specialty stores, remain the dominant sales channels, offering customers a wide range of options. Manufacturers continue to invest in research and development to offer innovative products while managing the impact of raw material prices on the final product cost.

Get a glance at the market share of various segments Request Free Sample

The offline segment accounted for USD 1.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The demand for specialized footwear, such as tactical footwear, is on the rise in Asia Pacific (APAC), driven by several factors. Increasing disposable income and the growing preference for premium footwear are key factors fueling the market's expansion. Moreover, the health-conscious population in APAC is driving the demand for tactical footwear in various adventure sports activities, including extreme sports, hunting, mountaineering, and rocky terrain sports. In addition to sports, tactical footwear is also extensively used by law enforcement and military personnel for protection in harsh weather conditions, rugged terrain, and slippery surfaces. Major contributors to the market in APAC are China, India, and Japan, with a significant presence of established manufacturers like Under Armour, Inc. This market is expected to witness substantial growth due to the increasing popularity of tactical footwear and the need for durability and comfort in various industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising prominence of hiking and trail running as outdoor recreational activities is the key driver of the market. In today's health-conscious world, individuals are increasingly engaging in outdoor activities such as hiking and trail running. These pursuits, popular in countries like the United States, Canada, and China, provide excellent cardiovascular workouts. They help reduce the risk of heart disease, enhance bone density, and improve blood sugar and blood pressure levels. Furthermore, hiking and trail running foster core muscle strength and overall body balance. The expansion of hiking and trail running facilities and the encouragement of these activities by government initiatives contribute to their growing popularity. When it comes to footwear for these activities, consumers prioritize comfort, durability, and functionality.

Furthermore, nylon material is a common choice due to its lightweight and breathable properties. Waterproofing is another essential feature, ensuring feet stay dry during wet conditions. Reinforced toe caps protect against rough terrain, while non-slip soles prevent accidents on uneven surfaces. Cushioned footbeds provide comfort and support, enhancing the overall tactical advantage of the footwear. Moreover, eco-friendly materials are gaining popularity as consumers become more environmentally conscious. These materials offer the same benefits as traditional materials but with a reduced carbon footprint. The versatility of tactical footwear makes it suitable for various outdoor activities, making it a worthwhile investment for the health-conscious and adventure-seeking population.

Market Trends

The use of social media marketing is the upcoming trend in the market. Tactical footwear, which includes armed forces boots and extreme sports footwear, is a significant segment of the footwear industry. The production of tactical boots often involves the use of high-quality materials, such as leather, to ensure foot protection and ankle determination. However, the manufacturing process may involve the use of hazardous chemicals, which raises concerns about climate change. Social media has become an essential tool for promoting tactical footwear. Companies leverage platforms such as Facebook, Twitter, Instagram, and YouTube to engage consumers and boost sales. The increasing internet penetration and growth of e-commerce have expanded the market for various footwear options, including tactical boots.

Furthermore, consumers can now easily access a wide range of footwear and make informed decisions based on their specific needs. Increased consumer awareness and demand for foot protection have fueled the growth of the market. The market is expected to continue growing due to the rising popularity of extreme sports and the need for gait protection in various industries. Companies are investing in research and development to create innovative footwear solutions that cater to the unique requirements of different customer segments. In conclusion, the market is a dynamic and growing industry driven by consumer demand, technological advancements, and marketing efforts. Companies are using social media and e-commerce platforms to reach consumers and promote their products, while also focusing on sustainability and innovation to meet evolving customer needs.

Market Challenge

Stringent government regulations for procurement of raw materials such as leather is a key challenge affecting the market growth. Tactical footwear, including boots and shoes, is a significant market segment within the larger footwear industry. A substantial portion of these footwear products is manufactured using leather, which is highly valued for its durability and premium appeal. However, the leather industry, particularly in certain regions, is subject to rigorous government regulations. For example, the European leather industry, specifically in Germany, is subject to stringent rules set by various government entities and associations.

Furthermore, these regulations cover the production of leather, waste disposal, chemical usage, environmental protection, and recycling. Consequently, the implementation of these regulations adds to the operational costs of manufacturers, amounting to approximately 5% of their total expenses. Online sales of tactical footwear, such as military boots, cold weather boots, jungle boots, and desert boots, continue to grow in the e-commerce sector. Online stores are increasingly becoming a preferred platform for consumers to purchase these footwear types due to their convenience and accessibility.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ASICS Corp - The company offers tactical footwear under the brand ASICSTIGER.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASICS Corp.

- Belleville Boot Co.

- Compass Group Diversified Holdings LLC

- Danner

- GALAXY UNIVERSAL LLC

- Galls LLC

- Garmont International Srl

- Liberty Shoes Ltd.

- Maelstrom Footwear

- Magnum Boots

- Nike Inc.

- Olive Planet Pvt Ltd.

- PUMA SE

- Rocky Brands Inc.

- Rodo Ltd.

- Tecnica Group SpA

- The Original Footwear Co

- Under Armour Inc.

- Warson Group Inc.

- Wolverine World Wide Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Tactical footwear is a specialized category of footwear designed for individuals who require protection and comfort in challenging environments. This market caters to various sectors including law enforcement, military personnel, and outdoor enthusiasts. The footwear is engineered to provide superior protection against harsh weather, rugged terrain, and slippery surfaces. Key features of tactical footwear include durable materials such as nylon, waterproofing, reinforced toe caps, non-slip soles, and cushioned footbeds. These footwear offer a tactical advantage in tough conditions, ensuring flexibility and breathability. Military footwear, military boots, and tactical boots are popular choices for those in extreme sports, hazardous environments, and the armed forces.

Furthermore, cold weather boots, jungle boots, desert boots, and online sales through e-commerce platforms have gained popularity due to their versatility and accessibility. Manufacturers use eco-friendly materials such as full-grain leather, split leather, nubuck, suede, and synthetic leather to produce durable footwear. However, the high price of raw materials and the environmental impact of leather production and hazardous chemicals used in manufacturing have become concerns. Cushioning technologies like Ortholite footbeds and slip-resistant outsoles have improved the comfort and performance of tactical footwear. Brands are known for their tactical sneakers and shoes with Vibram outsoles, providing excellent traction and durability. The footwear exports decline has affected the market, but the demand for tactical footwear remains strong due to its essential role in various industries and extreme sports such as hunting, mountaineering, and hiking.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.89% |

|

Market Growth 2024-2028 |

USD 619.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.47 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

US, China, India, Russia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ASICS Corp., Belleville Boot Co., Compass Group Diversified Holdings LLC, Danner, GALAXY UNIVERSAL LLC, Galls LLC, Garmont International Srl, Liberty Shoes Ltd., Maelstrom Footwear, Magnum Boots, Nike Inc., Olive Planet Pvt Ltd., PUMA SE, Rocky Brands Inc., Rodo Ltd., Tecnica Group SpA, The Original Footwear Co, Under Armour Inc., Warson Group Inc., and Wolverine World Wide Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch