Retirement Communities Market Size 2025-2029

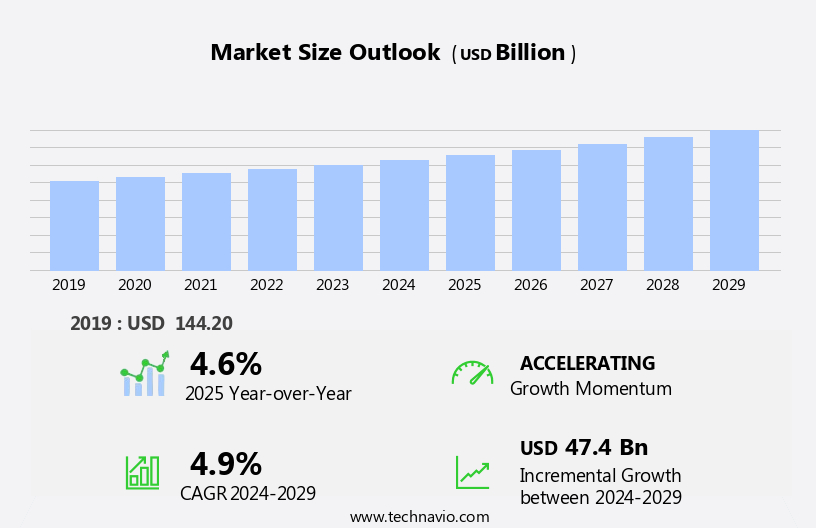

The retirement communities market size is forecast to increase by USD 47.4 billion at a CAGR of 4.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising life expectancy and the resulting demand for specialized living arrangements for the aging population. This demographic shift presents favorable business opportunities for real estate developers, particularly those who can offer innovative and high-quality solutions tailored to the unique needs of seniors. Regulatory compliance is paramount, with licensure requirements and accreditation standards ensuring quality healthcare services, such as geriatric care, skilled nursing, rehabilitation, and hospice care. However, the market also faces challenges, including the need to provide proper healthcare solutions and addressing the diverse requirements of an aging population with varying health conditions and income levels.

- Effectively navigating these challenges and capitalizing on the opportunities requires a deep understanding of the evolving needs and preferences of the senior demographic, as well as the ability to offer flexible and comprehensive solutions that address their physical, emotional, and social needs. Companies that can successfully meet these demands will be well-positioned to thrive in this dynamic market. Outright purchases, leases or rentals, and hybrid models are all viable options for seniors, depending on their financial situation and lifestyle preferences. Senior living marketing strategies are focussing on addressing the demands and touch points of prospects.

What will be the Size of the Retirement Communities Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses a range of senior housing options, including life care communities, assisted living facilities, and active adult communities. Security measures, emergency response systems, and memory care units cater to the unique needs of the aging population, particularly those with Alzheimer's disease. Capital expenditures for housing options, staffing ratios, and caregiver training programs are essential for maintaining resident satisfaction. Financial planning services, estate planning, and long-term care insurance are crucial for managing the financial aspects of retirement living.

- Housing options span from independent living facilities to age-restricted communities, catering to various needs and preferences. Attractive financing options, availability of land, and various models, including outright purchases, leases or rentals, hybrid models, and senior living facilities, cater to diverse lifestyle preferences and budgets. Wellness centers, community resources, and transportation services contribute to the overall quality of life. Optometry, pharmaceutical, and palliative care programs further enhance the comprehensive range of services offered. Turnover rates in retirement communities remain a significant consideration, with ongoing staff training and Medicare and Medicaid coverage playing crucial roles in addressing workforce challenges. Fire safety systems and certification programs ensure the safety and security of residents.

How is this Retirement Communities Industry segmented?

The retirement communities industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Assisted living facilities

- Continuing care retirement communities

- Rest homes

- Application

- Elderly people

- Disabled people

- Gender

- Female

- Male

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

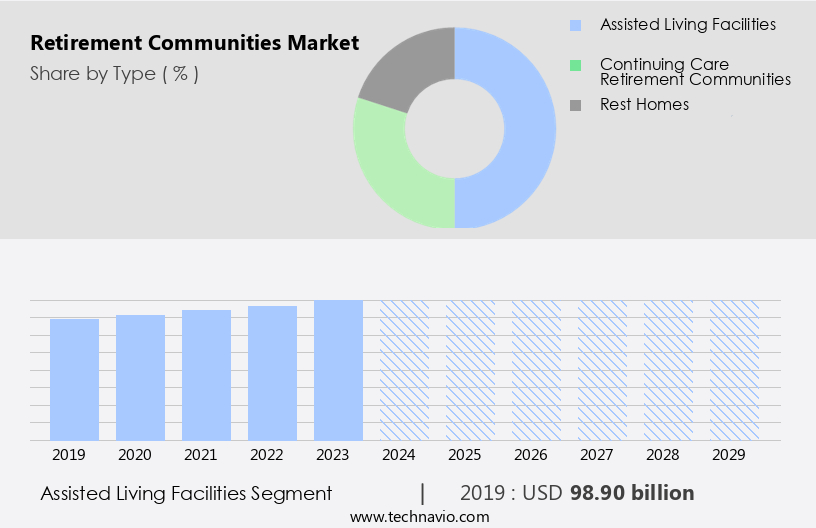

The assisted living facilities segment is estimated to witness significant growth during the forecast period. Assisted living communities within the retirement market cater to seniors who necessitate aid with activities of daily living but do not warrant continuous medical supervision. These facilities provide essential services such as meal preparation, housekeeping, medication management, and personal care assistance to uphold residents' autonomy and enhance their living experience. Assisted living residences are meticulously designed to emulate a homelike atmosphere, featuring private or semi-private living quarters and communal spaces for social interaction and recreational activities. Many establishments offer additional amenities, including fitness centers, libraries, beauty salons, and transportation services, to encourage residents' physical and mental well-being. Wellness programs, mental health services, and caregiver training are also integral components of these communities, ensuring a holistic approach to senior care.

Dining services tailored to dietary requirements and medical conditions further contribute to residents' satisfaction and comfort. The aging population, particularly the baby boomer generation, is driving the demand for such facilities, with a growing emphasis on aging in place and access to comprehensive healthcare services. Financial planning and estate planning are crucial aspects of retirement living, and assisted living communities often provide resources and assistance in these areas. Resident safety, regulatory compliance, infection control, and emergency response systems are stringent priorities in these communities, ensuring a secure living environment. Skilled nursing, hospice care, long-term care facilities, and residential care facilities are alternative housing options for seniors with more complex care needs.

The Assisted living facilities segment was valued at USD 98.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

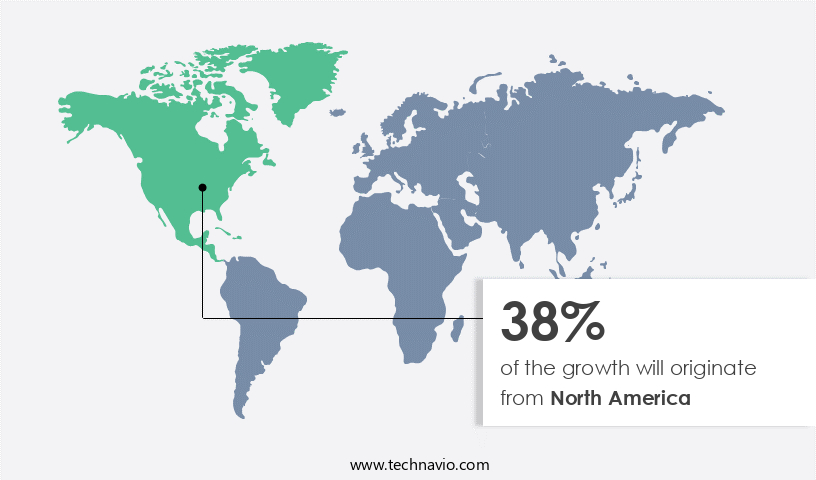

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing significant growth, fueled by an aging population and increasing demand for senior housing options. With the Baby Boomer generation entering retirement age, the United States, in particular, will require an expansion of retirement communities and related services to accommodate this demographic shift. The geriatric population in the US is projected to expand at a substantial rate, with over 60 million Americans aged 65 and above in 2024. This trend is driving the development of various types of retirement communities, including age-restricted, independent living, assisted living, and memory care facilities. Wellness programs, dining services, and community engagement initiatives are becoming increasingly important to meet the diverse needs of this population.

Medical care, mental health services, caregiver training, and healthcare costs are significant considerations in the industry. Geriatric care, skilled nursing, estate planning, and long-term care insurance are also crucial elements of the market. Operating costs, regulatory compliance, infection control, and emergency response systems are essential aspects of ensuring resident safety and satisfaction. The market encompasses a range of housing options, from retirement villages and retirement homes to in-home care and residential care facilities. Community resources, such as transportation services, dental care, and pharmaceutical services, are integral to the overall offering. Fitness centers, therapy services, and social activities contribute to the overall well-being of residents. Staffing ratios, accreditation standards, and accessibility features are essential elements of quality care. The market is evolving to meet the changing needs of the aging population, with a focus on aging in place and personalized care.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Retirement Communities market drivers leading to the rise in the adoption of Industry?

- The increasing life expectancy serves as the primary catalyst for market growth. The market experiences significant growth due to various factors, with an aging population being a primary driver. As people live longer, the demand for communities catering to their unique needs increases. Retirement communities are age-restricted residential areas designed for older adults, typically those aged 55 and above. These communities provide essential services and amenities to ensure residents maintain their independence and quality of life. Services encompass healthcare, including memory care for individuals with dementia or Alzheimer's, medical care, mental health services, and caregiver training.

- Wellness programs, dining services, and social activities are also common offerings. Financial planning resources help residents manage healthcare costs, which can be a significant concern for older adults. Geriatric care and healthcare services are integral components of these communities, ensuring residents receive comprehensive care as they age.

What are the Retirement Communities market trends shaping the Industry?

- The real estate market presents favorable business opportunities for developers, thereby acting as an emerging trend offering potential for significant growth. This trend is driven by various factors, including increasing demand for urban living spaces, government incentives, and technological advancements in construction and property management. Retirement communities have gained significant attention from buyers seeking peaceful living environments post-retirement. Preference is given to properties situated in suburban areas, offering a pollution-free environment and open spaces. This trend is observed globally, including in developing economies, presenting substantial opportunities for real estate developers. The market caters to various care levels, including independent living, residential care facilities, convalescent homes, and skilled nursing facilities. Services offered range from community engagement programs, fitness centers, therapy services, dental care, and hospice care. Accreditation standards and staffing ratios are crucial factors influencing resident satisfaction. Long-term care facilities and turnover rates are essential indicators of market health.

- Developers must prioritize these aspects to ensure the success of their projects. The market's growth is driven by an aging population, increasing life expectancy, and the desire for active aging. As the demand for retirement communities continues to rise, developers can capitalize on this trend by offering high-quality, customized living solutions.

How does Retirement Communities market face challenges during its growth?

- Providing effective healthcare solutions is a crucial challenge that significantly impacts the industry's growth trajectory. The market faces a significant challenge in addressing the healthcare needs of its residents, given the increasing population of older adults. To meet this demand, retirement communities can collaborate with healthcare providers, offering on-site medical professionals and services. Additionally, providing access to specialists such as geriatricians, neurologists, and cardiologists is crucial for addressing the unique healthcare requirements of older adults. Community amenities can also include transportation services, home health services, skilled nursing services, emergency response systems, rehabilitation services, palliative care, assisted living services, and community resources.

- Compliance with regulatory standards and infection control measures are essential to ensure the well-being and safety of residents. By prioritizing healthcare services and resources, retirement communities can create living environment that caters to the specific needs of their aging population.

Exclusive Customer Landscape

The retirement communities market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the retirement communities market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, retirement communities market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Affinity Living Communities - This company specializes in the development and management of retirement communities, providing senior residents with a vibrant and engaging living experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Affinity Living Communities

- AlerisLife Inc.

- American Retirement Homes Inc.

- British United Provident Association Ltd.

- Brookdale Senior Living Inc.

- Enlivant Master Mgmt CO LLC

- Erickson Senior Living Management LLC

- Front Porch

- Genesis Healthcare Inc.

- HC One Ltd.

- Honor Technology Inc.

- Interim HealthCare Inc.

- Korian

- Life Care Companies LLC

- Senior Lifestyle

- Sienna Senior Living Inc.

- Sonida Senior Living Inc.

- Sunrise Senior Living LLC

- Village Concepts

- Wickshire Senior Living

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Retirement Communities Market

- In March 2024, Brookfield Living, a leading retirement living provider, announced the launch of its new active adult community, "Brookfield Blossom," in Florida. This community, designed for seniors seeking an active lifestyle, includes amenities such as a fitness center, swimming pool, and social spaces (Brookfield Living Press Release, 2024).

- In July 2024, Silvercare, a prominent retirement community operator, entered into a strategic partnership with a major healthcare provider, Meridian Health. This collaboration aims to integrate healthcare services into Silvercare's retirement communities, enhancing the overall living experience for seniors (Meridian Health Press Release, 2024).

- In January 2025, Kisco Senior Living, a retirement community developer, closed a USD150 million funding round led by Blackstone Real Estate. The funds will be used to expand Kisco's portfolio and improve existing communities (Business Wire, 2025).

- In May 2025, the U.S. Government passed the "Senior Living Infrastructure Act," which includes provisions for increased funding for the development and improvement of retirement communities, particularly those focused on affordable housing options for low-income seniors (White House Press Release, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market dynamics shaping various sectors. Aging in place solutions, transportation services, and community amenities are increasingly integrated to cater to the unique needs of the aging population. Home health services, skilled nursing services, and emergency response systems ensure the provision of necessary medical care, while regulatory compliance and infection control measures prioritize resident safety. Rehabilitation services, community resources, and housing options offer residents opportunities for engagement and independence. Assisted living services, palliative care, and life care communities provide comprehensive care for those with specific health conditions. Parkinson's care, mental health services, and caregiver training are essential components of holistic care.

The retirement communities market is evolving to meet growing demand for specialized care. Senior living communities offer comprehensive geriatric care services, including nursing homes, hospice care services, and specialized dementia care units, Alzheimer's care units, and Parkinson's care units. Essential resident services, such as podiatry services and optometry services enhance well-being, while in-home care services and personal care services provide flexibility. Facilities prioritize resident safety measures and rigorous infection control practices to maintain quality care. Financial planning, including estate planning services and Medicare coverage, helps residents manage costs. Resident satisfaction surveys inform improvements, while occupancy rates reflect market trends.

Wellness programs, dining services, and fitness centers contribute to residents' overall well-being. Financial planning, estate planning, and long-term care insurance help manage the financial aspects of retirement living. Operating costs, staffing ratios, accreditation standards, and resident satisfaction are critical factors influencing the success of retirement communities. Dental care, pharmaceutical services, and therapeutic offerings enhance the quality of life for seniors. Fire safety, accessibility features, and security measures ensure a safe living environment. Social activities, turnover rates, and hospice care round out the comprehensive range of services offered in this ever-evolving market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Retirement Communities Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2025-2029 |

USD 47.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, Germany, Canada, China, UK, France, Italy, Mexico, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Retirement Communities Market Research and Growth Report?

- CAGR of the Retirement Communities industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the retirement communities market growth of industry companies

We can help! Our analysts can customize this retirement communities market research report to meet your requirements.