Rhenium Market Size 2024-2028

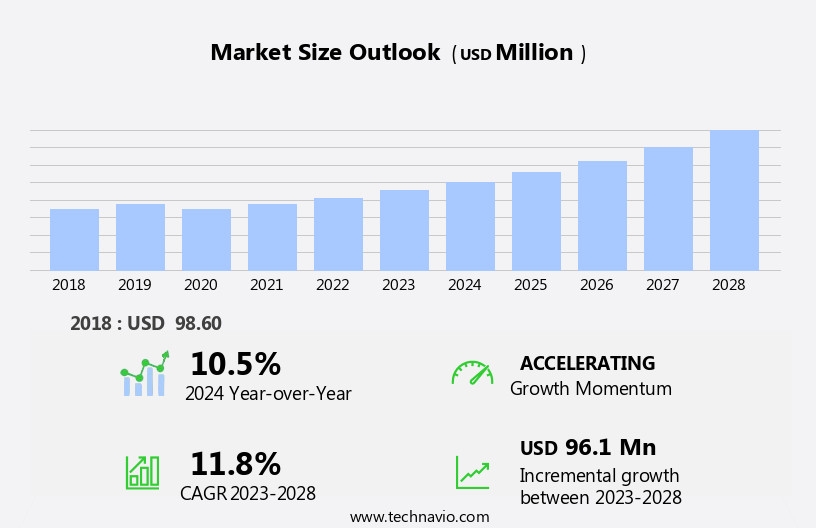

The rhenium market size is forecast to increase by USD 96.1 million at a CAGR of 11.8% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for aerospace engines due to the rising trend of air travel. Rhenium's unique properties, such as high melting point, excellent thermal and electrical conductivity, and resistance to corrosion, make it an essential component in the manufacturing of jet engine parts. Additionally, the healthcare industry is witnessing a in the use of rhenium-188, a radioisotope used in diagnostic and therapeutic applications, further fueling market expansion. However, market growth is not without challenges. The price volatility of rhenium, which is primarily sourced from Chile and Russia, poses a significant risk for market participants.

- Producers and consumers must navigate this price instability to ensure a steady supply and maintain profitability. Companies seeking to capitalize on market opportunities should focus on developing alternative sources of rhenium or finding ways to reduce their reliance on it. Meanwhile, those looking to navigate challenges effectively should consider investing in research and development to find substitutes or alternative applications for rhenium, thereby mitigating the impact of price fluctuations.

What will be the Size of the Rhenium Market during the forecast period?

- The market encompasses the global trade of this rare, silver-gray metal with the chemical symbol Re and transition metal properties. Known for its stable chemical properties, high melting point, and creep resistance, rhenium is a valuable element in various industries. In heavy-duty vehicles, it enhances fuel efficiency and engine performance. In the power industry, rhenium is used as a catalyst in hydrogenation processes. Rhenium's unique characteristics make it essential in aerospace applications, particularly in jet engines and high-temperature alloys. Its high density, resistance to poisons, and high-temperature applications in superalloys are crucial for missile propulsion and aircraft production.

- Porphyry copper deposits are a significant source of rhenium. Other rare elements, such as molybdenite, may also contain rhenium. The heavy metal is used in biomedical applications due to its lustrous nature and ability to withstand cold working properties. Rhenium's role in heavy-duty vehicles, aerospace, and the power industry underscores its importance in various sectors. Its high melting point and resistance to corrosion make it a sought-after alloying element for various industries, further fueling market growth.

How is this Rhenium Industry segmented?

The rhenium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Superalloys

- Catalysts

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- APAC

- China

- South America

- Middle East and Africa

- North America

By Application Insights

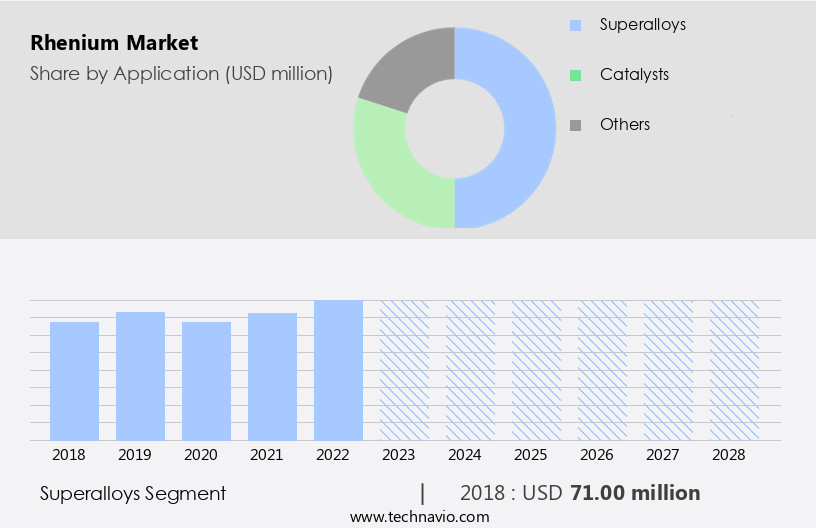

The superalloys segment is estimated to witness significant growth during the forecast period.

The market holds significant importance in various industries, particularly in the manufacturing of superalloys. Superalloys, which contain rhenium, exhibit unique properties such as high melting points, superior mechanical stability, and rigidity. These properties make rhenium an essential component in the production of nickel-based, molybdenum-based, tungsten-based, and copper-based superalloys. The energy sector, specifically the aerospace industry, is the largest consumer of rhenium due to its extensive use in jet engines and gas turbine engine blades. Rhenium's high melting point, low coefficient of friction, and high density make it an ideal alloying element for these applications. In the automotive sector, rhenium is used in automobile tail purification systems to reduce carbon monoxide emissions, contributing to improved fuel efficiency and reduced environmental impact.

Rhenium's application extends to the electrical engineering and chemical industries, where it is used as a catalyst in hydrogenation processes and petrochemical refining. Its resistance to poisons and stable chemical properties make it a valuable component in various catalysts. Furthermore, rhenium is used in the power industry for its heat resistance and in the production of space systems due to its high density and lustrous metal properties. The mining of rhenium is often associated with harmful health effects and geopolitical instability due to the mining activities of this heavy metal. However, advancements in recycling technologies have led to the recycling of rhenium from spent catalysts, aerospace manufacturers' scrap, and other industrial waste streams.

This not only reduces the environmental impact but also provides a sustainable solution to the increasing demand for rhenium. In summary, rhenium's unique combination of properties makes it an indispensable element in various industries, including aerospace, automotive, electrical engineering, and chemical. Its high demand in high-performance applications and limited availability make it a valuable commodity. The ongoing research and development in extraction technologies and recycling methods aim to mitigate the challenges associated with rhenium production and ensure a steady supply to meet the growing demand.

Get a glance at the market report of share of various segments Request Free Sample

The Superalloys segment was valued at USD 71.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

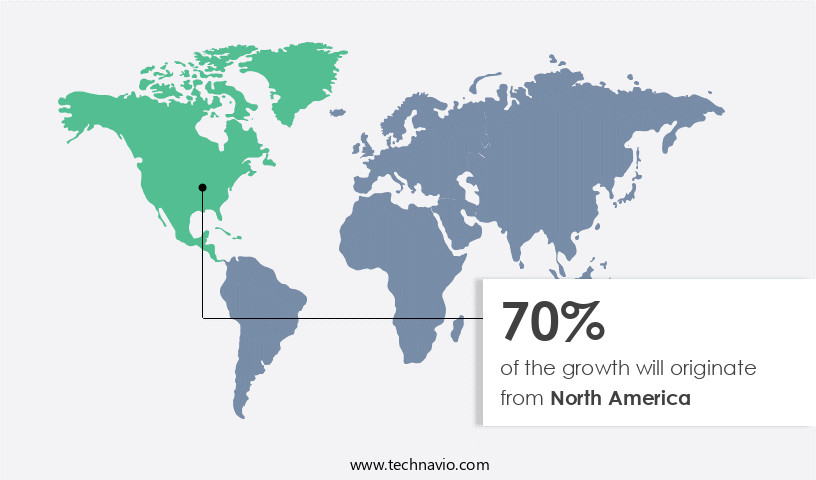

North America is estimated to contribute 70% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is primarily driven by its extensive usage in the aerospace and defense industry, particularly in the manufacture of jet engines and turbine components. North America dominates the market due to the presence of major players in this sector, including Airbus, Boeing, Bombardier, Cessna Aircraft Company, and Lockheed Martin, based in the United States. Rhenium's unique properties, such as high melting point, resistance to poisons, and creep resistance, make it an essential alloying element for superalloys. The energy sector is another significant consumer of rhenium, primarily due to its application in catalysts for hydroprocessing and petrochemical refining. In the power industry, rhenium is used for its heat resistance and stability in generating electricity.

The automobile industry also utilizes rhenium for automobile tail purification and cold working properties. The mining and extraction of rhenium, primarily from porphyry copper deposits, can pose harmful health effects, including respiratory tract irritation and skin irritation. Geopolitical stability in mining regions can also impact the availability and cost of rhenium. Recycling technologies have emerged as a potential solution to mitigate the environmental impact and reduce the dependency on primary rhenium sources. Recycling Rhenium from spent catalysts and aerospace components is an area of active research. Rhenium's applications extend beyond the aforementioned industries, including electrical engineering, chemical element usage, and biomedical applications.

In the aerospace industry, rhenium is used in rocket technology and missile propulsion. In the automotive sector, it is used in heavy-duty vehicles and aircraft production. In the electronics industry, rhenium's high density and stable chemical properties make it an attractive material for various applications. The defense budget, fuel efficiency, and high octane gasoline are other factors influencing the demand for rhenium. The market for rhenium is expected to continue its growth trajectory due to the increasing adoption of rhenium in various industries and the development of new rhenium alloys with enhanced properties.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rhenium Industry?

- Rising demand for aerospace engines is the key driver of the market.

- Rhenium is a valuable element extensively utilized in the aviation industry, primarily for enhancing the efficiency of jet engines. The aviation sector presently represents the largest consumer of rhenium due to its unique properties, including a high melting point, hardness, and scratch resistance. These characteristics make rhenium indispensable in jet engine components such as turbines and heat shields, enabling them to withstand extreme temperatures and high chemical resistance. Beyond aviation, rhenium also finds application in various other industries, such as electronics, chemical processing, and glass manufacturing. Its demand is driven by its ability to improve the performance and durability of various products.

- The market is expected to grow due to the increasing demand for fuel-efficient technologies and the expanding aviation industry. Despite the US being the major producer of rhenium, Poland and China also contribute significantly to the global supply. As a , I can help you gain a better of the market dynamics and trends shaping the rhenium industry.

What are the market trends shaping the Rhenium Industry?

- Growing use of rhenium-188 in healthcare industry is the upcoming market trend.

- Rhenium-188, a high-energy emitting radioisotope, is derived from a tungsten-188 generator. This isotope plays a significant role in various therapeutic applications within the realm of nuclear medicine, radionuclide therapy, oncology, interventional radiology, and cardiology. The medical industry utilizes rhenium-188 for the preparation of radiopharmaceuticals and the treatment and diagnosis of diseases, including bone metastasis, rheumatoid arthritis, and primary cancers. Moreover, rhenium-188 is employed in the production of phosphonates, antibodies, peptides, and lipiodol.

- The high-energy B-emission of rhenium-188 is effective in eradicating tumors. Despite its potential, the application of rhenium-188 for medical purposes is still in its infancy in numerous countries.

What challenges does the Rhenium Industry face during its growth?

- Fluctuations in price of rhenium is a key challenge affecting the industry growth.

- The market is experiencing price fluctuations due to the imbalance between demand and supply. The increasing demand for rhenium is driven by its extensive use in the aviation, automotive, and chemical industries. However, the unavailability of resources and the time-consuming extraction process create a supply gap, leading to price instability. Between March 2020 and April 2021, the price of rhenium decreased by 23%, from USD1,630 to USD1,256 per kilograms. This decline was attributed to decreased demand from key industries, continued low prices, and the COVID-19 pandemic, which forced several rhenium recyclers and primary production facilities to halt their activities and focus on more profitable metals.

- Despite these challenges, the demand for rhenium is expected to continue growing due to its essential role in various industries.

Exclusive Customer Landscape

The rhenium market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rhenium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rhenium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Elements - The company specializes in supplying high-performance rhenium compounds, including Rhenium Boride, Rhenium Bromide, Rhenium Carbide, Rhenium IV Chloride, and Rhenium Heptafluoride, catering to diverse industrial applications. These rhenium compounds exhibit exceptional strength, resistance to corrosion, and high melting points, making them indispensable in various industries such as aerospace, automotive, and electronics. Our offerings undergo rigorous quality control processes to ensure the highest standards and consistency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Elements

- ESPI Metals

- Freeport McMoRan Inc.

- H. Cross Co.

- Heraeus Holding GmbH

- Hoganas AB

- KGHM Polska Miedz SA

- Leading Edge Metals and Alloys Inc.

- MOLYMET S.A.

- Joint Stock Co. Navoi Mining and Metallurgical Co.

- Nova Resources B.V.

- Ossila Ltd.

- Remet UK Ltd.

- Rhenium Alloys Inc.

- Ultramet

- Umicore SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Rhenium, a transition metal with a silver-gray appearance, is gaining significant attention in various industries due to its unique properties. This heavy metal, known for its high melting point, resistance to poisons, and excellent creep resistance, is increasingly being utilized in the energy sector and beyond. The energy sector's growing demand for rhenium is driven by its role as a crucial component in catalysts used in the petrochemical refining process. Its ability to enhance fuel efficiency and reduce carbon contamination makes it an essential element in the production of high octane gasoline. Moreover, rhenium's high heat resistance and stability make it an ideal choice for power industry applications.

However, the mining and extraction of rhenium pose certain challenges. Rhenium is primarily found in porphyry copper deposits, where it occurs in trace amounts. Mining activities associated with extracting copper can lead to harmful health effects, including respiratory tract irritation and skin irritation. Geopolitical stability in mining regions can also impact the availability and cost of rhenium. Despite these challenges, the demand for rhenium continues to grow, particularly in the aerospace industry. Rhenium's high melting point and resistance to creep make it an ideal alloying element in superalloys used in jet engines and military engines. Its use in aerospace manufacturing also extends to rocket technology, where it plays a critical role in rocket engines and space systems.

Recycling technologies have emerged as a potential solution to address the challenges of rhenium mining and ensure a sustainable supply of this valuable metal. Recycling rhenium from spent catalysts and end-of-life aerospace components can significantly reduce the need for primary rhenium mining. Rhenium's unique properties also make it an essential component in various other industries. In electrical engineering, it is used for its high density and stable chemical properties. In the automobile industry, rhenium is used in catalytic converters for automobile tail purification. In the defense industry, it is used in military aircraft and missile propulsion.

In the electronics industry, rhenium is used for its excellent conductivity and resistance to high temperatures. In the medical field, rhenium is being explored for its potential use in cancer treatment and as a coating material. In , rhenium's unique properties and wide range of applications make it a valuable commodity in various industries. Its mining and extraction pose challenges, but the development of recycling technologies offers a sustainable solution. The demand for rhenium is expected to continue growing, driven by its use in the energy sector, aerospace industry, and other high-tech applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.8% |

|

Market growth 2024-2028 |

USD 96.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.5 |

|

Key countries |

US, Russia, China, Canada, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rhenium Market Research and Growth Report?

- CAGR of the Rhenium industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rhenium market growth of industry companies

We can help! Our analysts can customize this rhenium market research report to meet your requirements.