Safety Shoes Market Size 2025-2029

The safety shoes market size is forecast to increase by USD 2.21 billion, at a CAGR of 6.5% between 2024 and 2029.

- The market exhibits significant growth potential driven by the increasing awareness and stringent regulations regarding workplace safety. The market is fueled by the rising demand for ergonomically designed safety footwear shoes that cater to various industries, including construction, manufacturing, and oil & gas. However, the improper selection of safety shoes based on the nature of work and environmental conditions can pose challenges to both employees and organizations. Key trends shaping the market include the integration of advanced technologies such as waterproof materials, thermal insulation, and anti-slip soles to enhance the functionality and comfort of safety shoes.

- Additionally, the growing preference for customized safety shoes based on individual foot size and shape is expected to further fuel market growth. Companies seeking to capitalize on these opportunities should focus on innovation, quality, and customer satisfaction to differentiate themselves in a competitive landscape. Effective supply chain management and strategic partnerships can also help companies navigate challenges such as increasing raw material costs and fluctuating market demand.

What will be the Size of the Safety Shoes Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report Request Free Sample

The market encompasses a broad range of footwear designed to protect workers from various hazards in diverse industries. This market caters to the needs of construction sites, oil and gas operations, manufacturing sectors, and numerous other applications. The demand for safety shoes is driven by the inherent risks associated with these industries and the importance of ensuring worker safety and regulatory compliance. Industrial footwear, often referred to as safety shoes or protective footwear, is a crucial component of occupational safety gear. These shoes are engineered to provide enhanced protection against impact, compression, electrical hazards, extreme temperatures, slips, and other workplace hazards.

The market for safety shoes is diverse and expansive, with offerings ranging from steel toe boots and composite toe boots to fire-resistant shoes and heat-resistant shoes. Quality assurance plays a significant role in the market. Brands strive to maintain high standards and ensure their products meet the necessary safety certifications. Brand recognition is essential, as workers and employers seek reliable and trustworthy safety footwear suppliers. Online retailers have emerged as a popular distribution channel, providing convenience and accessibility for customers. The construction industry is a significant consumer of safety shoes, with workers requiring footwear that can withstand the rigors of the job.

Workers in extreme weather conditions, such as cold temperatures or hot environments, require insulated work boots and heat-resistant shoes, respectively. The oil and gas sector, mining, and manufacturing sector also contribute significantly to the market's growth. Worker safety is the primary concern in the market. Death cases due to workplace injuries can be prevented by using appropriate safety footwear. Slip-resistant shoes, puncture-resistant boots, and impact-resistant boots are essential for various industries. Comfortable work shoes are also crucial, as workers often spend long hours on their feet. Product innovation is a key driver of growth in the market. Manufacturers continually introduce new technologies and materials to improve the functionality and durability of their products.

How is this Safety Shoes Industry segmented?

The safety shoes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Construction

- Chemical

- Manufacturing

- Mining

- Others

- Product Types

- Steel Toe Shoes

- Composite Toe Shoes

- Soft Toe Shoes

- Metatarsal Guard Shoes

- Material Type

- Leather

- Synthetic

- Rubber

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

. By Distribution Channel Insights

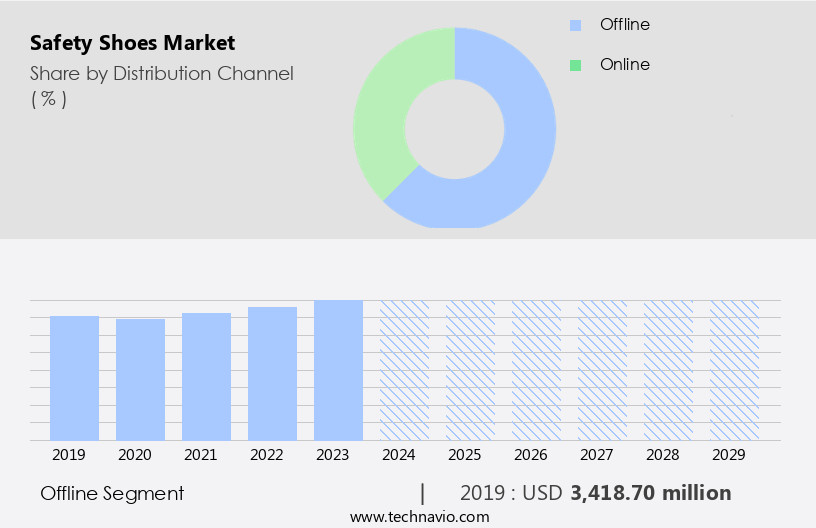

The offline segment is estimated to witness significant growth during the forecast period.

Offline distribution channels for occupational safety gear, specifically industrial footwear, include retail stores and safety equipment suppliers. Retailers, such as Red Wing Shoe Stores, offer a diverse range of safety shoes, allowing customers to try on various styles for proper fit and comfort. Safety equipment and supply stores, like Grainger, cater to industries requiring safety gear with extensive inventories. Online retailers also play a significant role in the market, offering convenience and a wide selection. The market for safety shoes is driven by the need for worker safety in various industries, including construction, oil & gas, manufacturing, and emergency services.

Extreme weather conditions, injuries, and regulatory compliance are key factors fueling market growth. Product innovation, such as heat-resistant, waterproof, and impact-resistant shoes, enhances employee wellness and productivity. Brand recognition and quality assurance are essential factors for customers when purchasing safety shoes. The application spectrum includes steel toe boots, logger boots, fire-resistant shoes, chef boots, and mining safety boots, among others. Heavy-duty footwear, including tactical footwear and composite toe boots, is also in demand. Insulated work boots, chemical-resistant boots, and slip-resistant shoes cater to specific industry needs. Market growth is further driven by the increasing awareness of workplace safety and the expanding application spectrum.

Workers in industries like agriculture, fishery, and healthcare also require safety footwear for their unique hazards. Online retailers and distribution channels, such as Amazon and Walmart, have gained popularity due to their convenience and extensive selection. However, offline distribution channels continue to play a crucial role in catering to the diverse needs of various industries and ensuring proper fit and comfort for workers.

The Offline segment was valued at USD 3.42 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Occupational Safety Gear market, specifically Industrial Footwear, experiences significant growth due to the increasing prioritization of Worker Safety in various industries. Key drivers include the construction sector, where Steel Toe Boots and other protective footwear are essential for preventing injuries and fatalities. Quality Assurance and Brand Recognition play crucial roles in the market, with Safety Equipment Suppliers catering to the demand for Comfortable Work Shoes and Product Innovation. Extreme weather conditions, such as those encountered in Oil & gas and Agriculture, necessitate Heat-Resistant Shoes, Insulated Work Boots, and Waterproof Work Boots. Injuries and fatalities in industries like Manufacturing, Mining, and Emergency Services call for Slip-resistant Shoes, Fire-Resistant Shoes, and Impact-resistant Boots.

Online Retailers have emerged as a popular distribution channel, providing convenience and accessibility to a wide range of Safety footwear. Application spectrum includes Construction sites, Warehouses, Restaurants, and even Police and Military forces. Regulatory Compliance and Employee Wellness are essential considerations, driving the demand for Puncture-Resistant Boots, Chemical-resistant Boots, and Composite Toe Boots. The market growth is fueled by the increasing urbanization and industrialization in the Asia Pacific region, which has led to the expansion of industries like Construction, Manufacturing, and Automotive. Countries like China, India, Japan, and Australia are at the forefront of this growth, with their improving economic conditions and substantial investments in various industries.

The urban population in east APAC accounted for 61% of the global population in 2024, and the increase in urban settlements in these countries has led to a significant increase in demand for Safety footwear. Public and private sector enterprises in these countries are expected to invest heavily in construction and manufacturing projects, owing to the availability of inexpensive labor.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Safety Shoes Industry?

- Safety shoes are essential protective gear for workers in various industries to ensure their foot safety against hazards. Regulatory bodies, such as OSHA, enforce stringent guidelines to compel organizations to adopt safety practices, including the use of safety shoes. ANSI sets performance standards for manufacturers, requiring safety shoes to be impact and compression-resistant, offering protection against falling objects and heavy rolling objects. Metatarsal safety shoes provide additional protection to the foot area between the toes and ankle.

- Adherence to these guidelines is crucial to avoid penalties. Manufacturers must meet these criteria to cater to the safety needs of diverse industries.

What are the market trends shaping the Safety Shoes Industry?

- Safety shoes are essential personal protective equipment, designed with ergonomic features to ensure the wearer's safety, health, and hygiene. The ergonomic design of these shoes is crucial, as they significantly impact body weight distribution and movement. Failure to meet ergonomic standards can result in various health issues, including discomfort and fit problems. The design and construction of safety shoes significantly affect the body, influencing joint angles in the legs and upper body posture. Manufacturers have a responsibility to prioritize ergonomics in their protective footwear to ensure optimal safety and comfort. The importance of ergonomics in safety shoes cannot be overstated, given their significant impact on the wearer's overall well-being.

- In conclusion, ergonomics plays a vital role in the design and construction of safety shoes. Ensuring ergonomic properties in these footwear is essential for the safety, health, and comfort of the wearer. Manufacturers must prioritize ergonomics to meet the necessary safety standards and provide the best possible protection for their customers.

What challenges does the Safety Shoes Industry face during its growth?

- Safety shoes are an essential component in various industries, ensuring workers' protection against specific occupational hazards. OSHA defines the types and usage of safety shoes based on the industrial requirements. For instance, steel-toe shoes are mandatory for construction workers due to the risk of heavy objects falling on their feet. Heat-resistant shoes are essential in industries with extreme temperatures. The selection of appropriate safety shoes is crucial to maintain workplace safety and productivity. Market dynamics indicate a growing demand for safety shoes due to increasing industrialization and stringent safety regulations. Additionally, advancements in technology have led to the production of safety shoes with enhanced features, such as waterproofing, electrical resistance, and improved comfort.

- The market for safety shoes is expected to grow significantly due to these factors. It is essential for organizations to understand the different types of safety shoes and select the appropriate ones to ensure worker safety and regulatory compliance.

Exclusive Customer Landscape

The safety shoes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the safety shoes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, safety shoes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anbu Safety Industrial Co. Ltd. - The company specializes in providing a diverse range of safety footwear options, including 3-button boots, B Sport, and Bora Derby styles. These shoes prioritize safety and comfort, ensuring optimal protection for various workplace environments. With a commitment to innovation and quality, the company continually expands its product offerings to meet the evolving needs of its global clientele.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anbu Safety Industrial Co. Ltd.

- Bata Brands Sarl

- Boskalis

- Carhartt Inc.

- Caterpillar Inc.

- Dunlop Protective Footwear

- Footwear Industries Pty Ltd.

- Gabri Sas co of MOLO SANTE and C.

- Honeywell International Inc.

- KARAM Group

- Liberty Shoes Ltd.

- Pezzol Industries Srl

- RAHMAN GROUP

- Red Wing Brands of America Inc.

- SAFETYKING INDUSTRIAL FOOTWEAR M SDN BHD

- UVEX WINTER HOLDING GmbH and Co. KG

- VF Corp.

- W. L. Gore and Associates Inc.

- Wolverine World Wide Inc.

- Zain Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Safety Shoes Market

- In May, 2023, Protective Industrial Products (PIP), a U.S.-based manufacturer of Personal Protective Equipment (PPE), acquired ISM Heinrich Krämer GmbH & Co. KG. While financial details were not disclosed, this acquisition aims to enhance PIP's global safety solutions offerings and strategically expand its market reach.

- In March, 2025, India's Ministry of Commerce and Industry published the Footwear made from Leather and other Materials (Quality Control) Order, 2024. This order mandates that certain types of footwear, including leather safety boots and shoes, must conform to specific Indian standards and bear the Bureau of Indian Standards (BIS) Mark, effective August 1, 2024, with a transitional period until July 31, 2026, for existing non-compliant stock.

- Throughout 2024 and continuing into 2025, there has been a significant trend towards the integration of smart technologies into safety shoes. This includes embedded sensors to monitor worker fatigue, temperature, pressure, and even hazardous gas exposure, as well as mobile connectivity for real-time tracking and alerts, enhancing proactive safety measures in industrial settings.

- In February, 2025, uvex safety announced that its new uvex 1 x-cite product family of safety shoes was honored with the German Design Award 2025. This recognition underscores the industry's focus on merging advanced protective features with modern, ergonomic, and aesthetically appealing designs, addressing the growing demand for comfortable and stylish safety footwear.

Research Analyst Overview

- The market in the United States continues to experience significant activity, driven by the growing demand for occupational safety gear in various industries. This market encompasses a wide range of footwear types, including tactical footwear, fire-resistant shoes, comfortable work shoes, heavy duty footwear, chemical-resistant boots, steel toe boots, heat-resistant shoes, protective footwear, impact-resistant boots, industrial footwear, logger boots, insulated work boots, safety equipment suppliers, and more. Key growth factors include the increasing focus on employee wellness and regulatory compliance, the expanding distribution channels such as online retailers, and the continuous innovation in safety standards and product offerings.

- Market trends include the rising popularity of slip-resistant shoes, emergency services footwear, and brand recognition in the form of logoed workwear. The manufacturing sector, mining, military, and construction industries are major contributors to the market's size and direction. Quality assurance and safety standards remain top priorities for both manufacturers and end-users, ensuring the continued demand for safety footwear in various applications. Overall, the market is expected to grow steadily, driven by the need for worker safety and the evolving requirements of various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Safety Shoes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 2209.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Japan, Germany, India, Canada, UK, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Safety Shoes Market Research and Growth Report?

- CAGR of the Safety Shoes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the safety shoes market growth of industry companies

We can help! Our analysts can customize this safety shoes market research report to meet your requirements.