Satellite Internet Market Size 2025-2029

The satellite internet market size is forecast to increase by USD 7.61 billion at a CAGR of 19.7% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing number of Internet of Things (IoT) devices and the ongoing deployment of 5G networks. The proliferation of IoT devices is expanding the scope of connectivity beyond traditional terrestrial networks, creating a demand for satellite internet solutions in remote and hard-to-reach areas. Furthermore, the integration of satellite internet with 5G networks is enabling seamless connectivity and enhancing the overall performance of these systems. However, the market is not without challenges. Weather conditions, particularly heavy rain and snow, can significantly impact satellite signal quality and disrupt service.

- To mitigate this issue, companies are investing in advanced technologies such as adaptive modulation and error correction to improve satellite internet reliability in adverse weather conditions. These investments, along with ongoing technological advancements, present opportunities for companies to capitalize on the growing demand for satellite internet and navigate the challenges effectively. Companies seeking to capitalize on these opportunities should focus on developing and reliable satellite internet solutions, while also addressing the impact of weather conditions on their services.

What will be the Size of the Satellite Internet Market during the forecast period?

- The market encompasses the provision of high-speed connection networks through geostationary satellites, addressing the global connectivity needs of various industries and communities. This market continues to expand, driven by the digital divide and the growing demand for reliable communication capabilities in remote and underserved areas. With increasing bandwidth capabilities, satellite internet is becoming a viable alternative for businesses and individuals in regions with infrastructure challenges. The market is witnessing significant activity, with satellite operators investing in network management systems and international coordination to enhance service delivery.

- The satellite communication industry is also responding to the evolving needs of sectors such as education, healthcare, economic development, and social inclusion. Despite these advancements, challenges persist, including the impact of natural disasters on satellite infrastructure and the ongoing efforts to improve affordability and accessibility. Overall, the market is poised for continued growth, offering valuable solutions for enhancing global communication and connectivity.

How is this Satellite Internet Industry segmented?

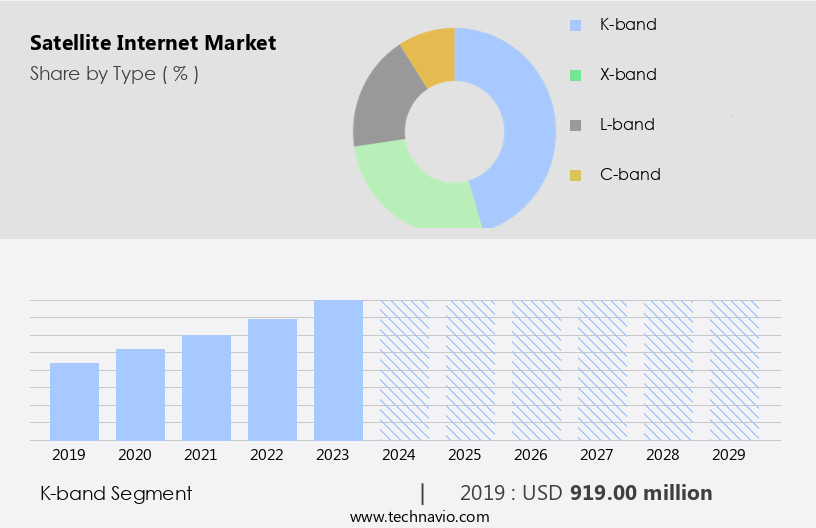

The satellite internet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- K-band

- X-band

- L-band

- C-band

- End-user

- Commercial

- Non-commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

The k-band segment is estimated to witness significant growth during the forecast period.

The K-band segment leads The market due to its extensive usage in defense, broadcasting, and security applications. The adoption of K-band monolithic microwave integrated circuit (MMIC) technology, which facilitates the production of low-noise amplifiers and K-band power amplifiers at a large scale, with cost efficiency and high durability, is fueling market growth. K-band frequency is primarily utilized for wireless broadband access in remote locations, including local-multipoint distribution systems (LMDS), fixed satellites, and digital point-to-point radio services. This technology addresses the connectivity needs of underserved regions and contributes to bridging the digital divide. The advancements in satellite technology, such as high-capacity satellite constellations and bandwidth capabilities, further boost the market's expansion.

Satellite infrastructure plays a crucial role in disaster management, emergency response scenarios, and the delivery of digital services like healthcare and education in remote areas. Ensuring seamless connectivity, high-speed network connectivity, and coverage range are essential factors driving the demand for satellite internet. Additionally, satellite telecommunications providers are continually enhancing their network management systems, international coordination, and service offerings to cater to the evolving needs of businesses and communities.

Get a glance at the market report of share of various segments Request Free Sample

The K-band segment was valued at USD 919.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is projected to experience growth due to the increasing adoption of satellite communication for connection networks in remote and rural areas, particularly in the public sector. The telecommunications industry in North America is anticipated to expand, driven by advancements in technology. The US is addressing infrastructure challenges in land-based broadband services by exploring satellite alternatives. For instance, Amazon.Com, Inc.'s plan to deploy over 4,500 additional satellites signifies the potential growth in high-capacity satellite constellations. Satellite technology advancements enable seamless global connectivity, crucial for disaster management and emergency response scenarios. Satellite capacity expansion supports digital services in healthcare organizations, educational opportunities, and economic development, contributing to community well-being and social inclusion.

With improvements in satellite infrastructure, satellite operators offer up-to-date information, high-speed network connectivity, and bandwidth capacity, enhancing user experience. Despite bandwidth limitations, satellite infrastructure provides weather resilience, connection stability, and data speed, making it a cost-effective and energy-efficient alternative for remote places.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Satellite Internet Industry?

- Growing number of IoT devices is the key driver of the market.

- Satellite internet is witnessing significant growth with the integration of Internet of Things (IoT) devices into mobile edge computing. This evolution includes routers, integrated access devices, routing switches, multiplexers, cloud services, and various other wide-area network access devices. On June 20, 2024, the first five Kineis nanosatellites, part of the European IoT-dedicated constellation, were successfully launched into orbit via a Rocket Lab Electron vehicle from New Zealand's North Island.

- This development enables user proximity to leverage available resources on satellite internet, empowering billions of connected IoT devices to execute real-time, compute-intensive applications in diverse industries directly from the network edge. Satellite internet plays a crucial role in enabling IoT devices to perform complex tasks, enhancing overall efficiency and productivity.

What are the market trends shaping the Satellite Internet Industry?

- Increasing deployment of 5G network is the upcoming market trend.

- Telecommunication service providers and network device manufacturers are increasingly focusing on 5G deployment, with the new standard offering larger bandwidth and ultra-fast Internet connectivity compared to previous generations. This advancement will significantly improve enterprise performance. However, satellite internet can complement 5G by providing backhaul services in areas where physical infrastructure installation is challenging. Furthermore, satellite internet is effective in managing the increasing traffic and number of connections outside of densely populated cities, particularly in remote areas where the Internet of Things (IoT) devices are prevalent.

- Satellite internet's role becomes even more crucial as businesses expand their digital footprint beyond urban areas.

What challenges does the Satellite Internet Industry face during its growth?

- Influence of bad weather on satellite internet is a key challenge affecting the industry growth.

- The market faces a significant challenge due to temperature limitations. Some satellite systems, such as SpaceX's Starlink, cease to function when temperatures exceed 122 degrees Fahrenheit and resume operation once temperatures drop to 104 degrees Fahrenheit. This issue poses a significant problem for individuals residing in warmer climates, potentially rendering satellite internet systems ineffective during hot weather periods. To address this concern, companies must prioritize the development of satellite internet systems capable of adapting to various climatic conditions.

- This requirement is crucial for ensuring uninterrupted connectivity and maintaining customer satisfaction.

Exclusive Customer Landscape

The satellite internet market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the satellite internet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, satellite internet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASELSAN AS - The company delivers satellite internet solutions, including KU Band technology, ensuring consistent connectivity for businesses and individuals in diverse locations. Our advanced technology provides high-speed internet access, enabling seamless communication and productivity. By leveraging the latest satellite technology, we bridge the gap for those in areas underserved by traditional broadband providers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASELSAN AS

- AT and T Inc.

- AXESS Network Solutions S.L.

- Cobham Ltd.

- EchoStar Corp.

- General Dynamics Corp.

- Honeywell International Inc.

- Hytera Communications Corp. Ltd.

- Indra Sistemas SA

- Inmarsat Global Ltd.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo Spa

- Marlink SAS

- RTX Corp.

- SES SA

- Singapore Telecommunications Ltd.

- SITA

- Space Exploration Technologies Corp.

- Thaicom Public Co. Ltd.

- Thales Group

- Viasat Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Satellite communication plays a crucial role in providing global connectivity, bridging the digital divide in remote and rural areas. This form of connection networks enables seamless real-time communication, essential for various applications, including disaster management and emergency response scenarios. Satellite technology advancements have led to high-capacity satellite constellations, enhancing bandwidth capabilities and improving user experience. These advancements have made satellite internet an attractive alternative to terrestrial networks, especially in areas where land-based broadband services are not readily available. Despite the progress, satellite infrastructure still faces infrastructure challenges. Bandwidth limitations and data transfer rates remain concerns for satellite operators and service providers.

However, ongoing technological improvements aim to address these challenges, ensuring up-to-date information and high-speed network connectivity for users. Satellite telecommunications providers are investing in network management systems to optimize international coordination and ensure cost efficiency. These efforts contribute to the expansion of satellite capacity and the provision of reliable and eco-friendly tech for remote places. The importance of satellite communication is evident in various sectors, such as healthcare services, educational opportunities, and economic development. In mountainous areas and rural communities, satellite technology offers a vital lifeline for critical infrastructure, community well-being, and social inclusion. Satellite infrastructure's resilience to natural disasters and its ability to provide wireless network connectivity in remote locations make it an indispensable tool for disaster management and emergency response scenarios.

Additionally, satellite technology plays a significant role in ensuring the digitized economy's continuity and growth. Satellite capacity continues to expand, with satellite operators investing in geostationary (geo) and non-geostationary satellite constellations. These advancements aim to provide better signal strength, latency reduction, and bandwidth capacity, enhancing the user experience and addressing the challenges of remote reliability and energy usage. In , satellite communication plays a vital role in providing global connectivity, especially in remote and rural areas. The ongoing advancements in satellite technology aim to address bandwidth limitations, improve user experience, and ensure cost efficiency. The importance of satellite communication is evident in various sectors, including healthcare services, education, economic development, and disaster management.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.7% |

|

Market growth 2025-2029 |

USD 7613.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.3 |

|

Key countries |

US, China, Russia, France, Japan, UK, India, Canada, Germany, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Satellite Internet Market Research and Growth Report?

- CAGR of the Satellite Internet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the satellite internet market growth of industry companies

We can help! Our analysts can customize this satellite internet market research report to meet your requirements.