Seafreight Forwarding Market Size 2024-2028

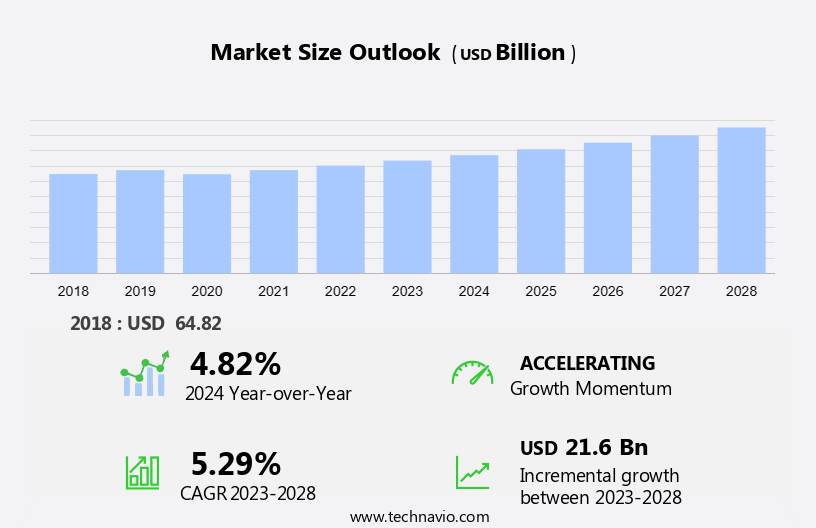

The seafreight forwarding market size is forecast to increase by USD 21.6 billion at a CAGR of 5.29% between 2023 and 2028.

The market is experiencing significant changes due to several key drivers and trends. The increasing size of retail e-commerce sales and revenues is leading to a growth in seaborne trade, resulting in higher demand for shipping services. New vessels with larger capacities are being introduced to meet this demand, but consolidation in the shipping industry is driving up freight costs and operational challenges. The integration of blockchain technology in the shipping industry aims to address these issues by enhancing transparency and efficiency. As customers continue to rely on international trade for raw materials and finished goods, shipping costs remain a critical factor in supply chain management. Staying informed of these market trends and challenges is essential for businesses looking to optimize their logistics operations and remain competitive.

What will be the Seafreight Forwarding Market Size During the Forecast Period?

- The market is a critical component of the global logistics and transportation industry, facilitating the movement of goods from their point of origin to their destination via carrier ships and containers on cargo ships. This market plays a significant role in the worldwide operations of businesses, particularly those dealing with heavy loads and long distances. Internet penetration has revolutionized the seafreight forwarding industry, enabling real-time tracking and monitoring of shipments. This transparency and efficiency have led to increased reliance on ocean freight forwarders for their services. Purchasing power parity and infrastructure development in various regions have further fueled the growth of this market. The seafreight forwarding industry is characterized by the transportation of various types of cargo, including hazardous materials, using different modes of transportation, such as waterways and marines. Carbon emissions and fuel consumption are essential considerations in seafreight forwarding, with the industry continually seeking ways to minimize these impacts. The infrastructure development in the shipping industry has been a key driver for the growth of the market. New ports, advanced container terminals, and improved shipping routes have increased the capacity and efficiency of the industry.

- Additionally, the ability to handle heavy loads and the flexibility to cater to various cargo types have made seafreight forwarding an attractive option for businesses. The market caters to a diverse range of industries, including manufacturing, retail, and agriculture, among others. The market's global reach allows businesses to source raw materials and sell finished products to customers across the world, contributing to economic growth and trade. In conclusion, the market is an essential part of the global logistics and transportation landscape. Its ability to handle heavy loads and long distances, combined with the increasing efficiency and transparency brought about by technology, makes it a valuable asset for businesses seeking to expand their reach and grow their operations. The market's continued growth is expected to be driven by infrastructure development, purchasing power parity, and the increasing reliance on real-time tracking and monitoring.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Manufacturing

- Retail and consumer goods

- Healthcare

- Others

- Type

- Full container load

- Less-than container load

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- France

- Middle East and Africa

- South America

- North America

By End-user Insights

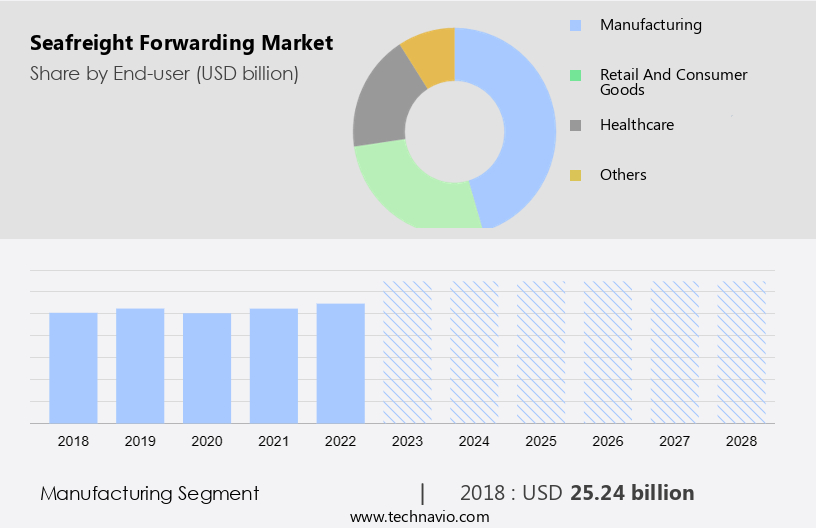

- The manufacturing segment is estimated to witness significant growth during the forecast period.

Seafreight forwarding plays a crucial role in transporting equipment, machinery, and precision instruments for various manufacturing industries such as automotive, chemical, oil and gas, electronics, and wood and paper. The increasing consumer demand for automobiles and goods in developing economies will fuel the growth of these industries and subsequently increase the demand for seafreight forwarding services. Commercial ships, including merchant vessels, are the primary mode of transportation for bulk cargo, making seafreight forwarding a cost-effective option for long-distance shipping. Moreover, the adoption of advanced technology and the rise in international trade are expected to boost the manufacturing segment of The market. Manufacturing industries, including automotive, chemical, oil and gas, electronics, and wood and paper, are significant contributors to the global economy.

Similarly, seafreight forwarding enables the efficient and reliable transportation of goods produced by these industries, enabling businesses to meet the increasing demand for their products. The merchant fleet plays a vital role in seaborne trade volumes, transporting a wide range of goods from raw materials to finished products. Ocean freight forwarders facilitate the smooth transportation of these goods, ensuring timely delivery and reducing logistical complexities. In conclusion, the manufacturing sector's growth, driven by the increasing consumer demand for goods and the adoption of technology, will continue to fuel the demand for seafreight forwarding services. Seafreight forwarding offers a cost-effective and reliable solution for transporting large volumes of cargo over long distances, making it an essential component of the global supply chain.

Get a glance at the market report of share of various segments Request Free Sample

The manufacturing segment was valued at USD 25.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

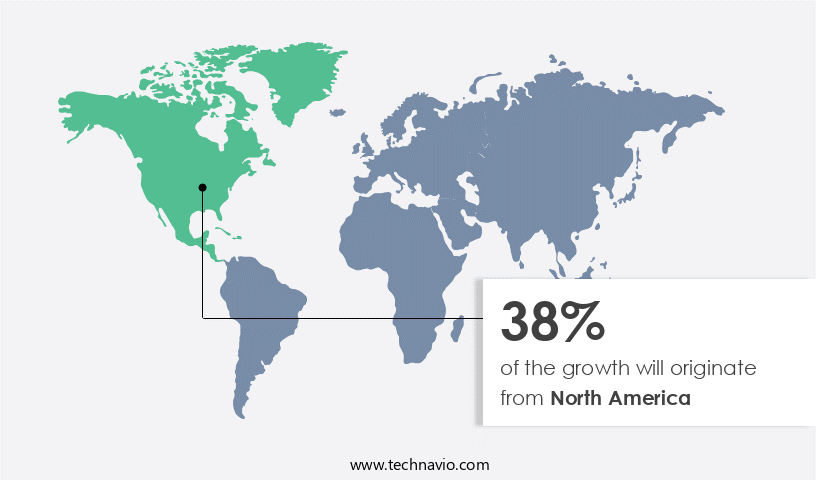

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Panama Canal expansion has significantly impacted the market in North America. With the canal now accommodating larger, wider, and heavier vessels, the transit time and cost of transportation have been reduced. This development allows seafreight forwarders to achieve economies of scale, as the higher the volume of shipments in containers, the lower the operating costs. Consequently, the growth of the market in North America is expected to be driven by the increase in freight volumes at US ports of entry during the forecast period. As freight forwarders leverage this opportunity, they can efficiently transport cargo using carrier ships and containers aboard cargo ships, ensuring timely and cost-effective logistics solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Seafreight Forwarding Market?

The growing global cross-border e-commerce market driving LCL volume is the key driver of the market.

- The expansion of the global cross-border e-commerce sector, driven by increased Internet access and rising purchasing power parity, is leading to a significant increase in the volume of seafreight cargo worldwide. The United States and China are major players in this industry, with the US being the largest importer of cross-border e-commerce goods. The growth in e-commerce sales, particularly in online shopping, is leading to a rise in the number of small package shipments, which are primarily transported via Less than Container Load (LCL) seafreight.

- To cater to this growing demand, logistics providers are expanding their LCL networks and services in seafreight. For instance, in April 2022, DACHSER announced the extension of its LCL network in seafreight, connecting Scandinavia and China. This trend is expected to continue, as more companies enter the cross-border e-commerce market and seek to offer comprehensive logistics solutions.

What are the market trends shaping the Seafreight Forwarding Market?

The introduction of blockchain in the shipping industry is the upcoming trend in the market.

- Blockchain technology, a distributed and secure digital ledger system, is revolutionizing various industries, including maritime transportation. This technology uses a chain of cryptographically secured data to record and verify transactions, eliminating the need for a central authority to maintain records. In seafreight forwarding, blockchain can streamline processes and reduce costs. However, its implementation on a large scale in the industry faces challenges, such as interoperability, device management, and cost burden. New vessels and fleet sizes continue to expand in the seaborne trade sector, driven by retail e-commerce sales and increasing e-retail revenues. Customers demand faster and more efficient shipping services to meet their needs.

- Similarly, shipping costs remain a significant factor in international trade. Blockchain technology can address these challenges by providing a secure and transparent system for tracking and verifying transactions. Despite these benefits, the adoption of blockchain technology in seafreight forwarding is uncertain. Shipping lines must invest in the necessary infrastructure and address interoperability issues to ensure effective implementation. Additionally, the cost burden of implementing blockchain technology may deter some companies from adopting it.

- However, the potential for increased efficiency and cost savings make it an attractive option for those willing to invest in the technology. In conclusion, blockchain technology offers significant benefits to the seafreight forwarding industry, including increased efficiency, transparency, and cost savings. However, challenges such as interoperability, device management, and cost burden must be addressed for widespread adoption. As the industry continues to evolve, blockchain technology may become a game-changer for seafreight forwarding operations.

What challenges does Seafreight Forwarding Market face during the growth?

Consolidation in the shipping industry leading to high freight costs and operational difficulties is a key challenge affecting the market growth.

- The market is experiencing a trend towards consolidation, leading to an oligopolistic industry structure. This consolidation is in response to the financial challenges faced by the shipping industry following the 2008 recession and the COVID-19 pandemic. The pandemic caused a significant decrease in demand, resulting in underutilized vessels and low shipping rates. In response, major shipping companies have formed alliances to reduce excess vessel capacity and lower the cost of disposing of idle ships. For example, on January 19, 2024, Mullen Group announced its intent to acquire Richmond, a container world forwarding company. Internet penetration has played a crucial role in the growth of the market, enabling businesses to connect and transact globally.

- Moreover, the purchasing power parity in various regions has influenced the demand for seafreight forwarding services, particularly in emerging markets. The infrastructure development in these regions, coupled with the availability of workforces, has further boosted the market's growth. The shipping industry's primary commodities include coal, oil, and gas. The shipping rates for these commodities have been volatile due to various economic factors, including supply and demand imbalances and geopolitical tensions. However, the market has remained resilient, providing essential logistics services to various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agility Public Warehousing Co. K.S.C.P

- AP Moller Maersk AS

- Bollore SE

- C H Robinson Worldwide Inc.

- CEVA Logistics S A

- DACHSER SE

- DB Schenker

- Deutsche Post AG

- DSV AS

- Expeditors International of Washington Inc.

- GEODIS

- Glaube Logistics

- Hellmann Worldwide Logistics SE and Co KG

- Hitachi Ltd.

- Inchcape Shipping Services

- Kuehne Nagel Management AG

- LX Pantos India Pvt Ltd.

- Mullen Group

- Nippon Express Holdings Inc.

- Nippon Yusen Kabushiki Kaisha

- SF Express Co. Ltd.

- Total Group

- United Parcel Service Inc.

- Sinotrans Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a crucial component of the global logistics and transportation industry, facilitating the movement of goods from their point of origin to their destination via cargo ships and containers. Freight forwarders play a vital role in managing the complexities of international trade activities, including the coordination of shipping, security, and documentation. The shipping industry's growth is driven by several factors, including the increasing volumes of seaborne trade, the rise of cross-border e-commerce and online shopping, and the infrastructure development of waterways and marines. Retail e-commerce sales and e-retail revenues continue to grow, leading to an increase in demand for ocean freight forwarding services.

Similarly, the shipping industry's workforces are continually adapting to technology advancements, with new vessels and fleet sizes expanding to meet the demands of various industries, such as coal, oil and gas, raw materials, and consumer goods. The shipping rates remain competitive, with the merchant fleet and commercial ships catering to a diverse range of cargo, from hazardous materials to consumer appliances, healthcare products, textiles, and industrial goods. The shipping industry's carbon footprint is a significant concern, with efforts underway to reduce carbon emissions through the use of fuel-efficient ships and alternative energy sources. Industry investors are also exploring the potential of artificial intelligence (AI) to optimize shipping routes, improve operational efficiency, and enhance customer experience. In conclusion, the market is a dynamic and evolving industry, with a vast network of worldwide operations and a diverse customer base. The market's growth is underpinned by the increasing volumes of international trade activities, the rise of e-commerce, and the continuous advancements in technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.29% |

|

Market growth 2024-2028 |

USD 21.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.82 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch