Smart Refrigerator Market Size 2025-2029

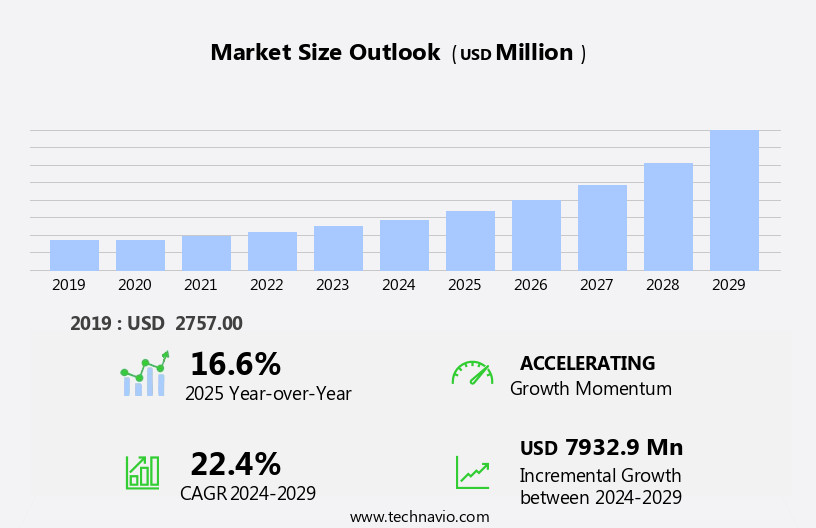

The smart refrigerator market size is forecast to increase by USD 7.93 billion at a CAGR of 22.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of Internet of Things (IoT) technology and the proliferation of connected devices in households. New product launches, featuring advanced features such as touchscreens, voice control, and remote monitoring, are further fueling market expansion. However, the market is not without challenges. Cyber-attacks pose a significant threat due to the Internet connectivity of these devices, raising concerns around data security and privacy. As global investors, it is crucial to closely monitor these trends and challenges to capitalize on the market's opportunities and navigate potential risks effectively. Companies seeking to enter or expand in this market should focus on developing security measures and innovative features to differentiate themselves from competitors.

- The integration of artificial intelligence and machine learning technologies could also provide a competitive edge, enabling personalized user experiences and optimizing energy consumption. Overall, the market presents a compelling investment opportunity, with strong growth potential and a strategic landscape that rewards innovation and security.

What will be the Size of the Smart Refrigerator Market during the forecast period?

- The market is experiencing significant growth as consumers increasingly embrace tech-enabled living and seek to optimize their kitchens for convenience, energy savings, and food management. Connected home devices, including smart refrigerators, are transforming the way we store and manage food, with features such as remote access, voice assistant integration, and AI-powered appliances. These innovations offer benefits beyond traditional refrigeration, including food waste management, recipe databases, and energy savings through automation and optimization. Smart refrigerators are part of a larger ecosystem of smart home solutions, integrating with smart home hubs and other connected devices to create a seamless and efficient living experience.

- Consumer behavior trends indicate a preference for devices that offer convenience, connectivity, and enhanced functionality, driving demand for advanced features such as food storage optimization, refrigerator maintenance alerts, and cybersecurity protections. As the market continues to evolve, we can expect to see further innovation in areas such as smart kitchen design, recipe databases, and voice assistant integration, as well as new applications and use cases for smart refrigerators in both residential and commercial settings. The overall size of the market is projected to grow steadily, driven by increasing consumer adoption and advancements in technology.

How is this Smart Refrigerator Industry segmented?

The smart refrigerator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- UAE

- North America

By Distribution Channel Insights

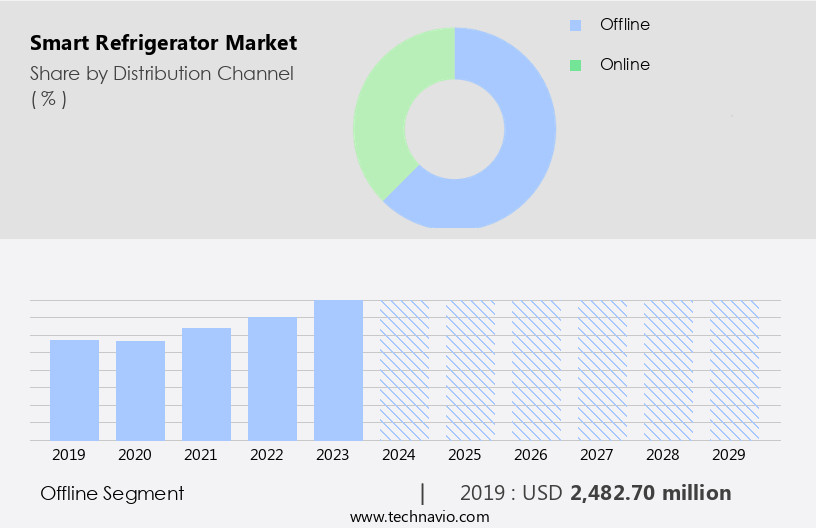

The offline segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, driven by the integration of advanced technologies such as Cloud Service Providers, Machine Learning, Artificial Intelligence (AI), and Data Analytics. Premium Appliance Manufacturers are focusing on Ecosystem Development, collaborating with Software Developers to create innovative features like Smart Displays, Freshness Preservation, and Food Expiration Tracking. High-Income Households are increasingly adopting these technologies for their Smart Kitchens, which offer Family Sharing, App Control, and Smart Home Integration. Moreover, Smart Refrigerators come with Camera Integration, Humidity Control, and Remote Monitoring, enabling Food Waste Reduction and Inventory Management. Cloud Storage and Automatic Ordering are additional features that add convenience for Tech-Savvy Consumers, especially Gen Z.

Energy Consumption Monitoring and Temperature Control contribute to Energy Efficiency, making these appliances an attractive investment. However, concerns around Data Security and Privacy are emerging as significant challenges in the market. As the market evolves, we can expect the integration of Emerging Technologies like Voice Control, Smart Lighting, and Home Automation to further enhance the user experience. The integration of these features will create a seamless, connected ecosystem of Smart Devices, offering significant benefits to consumers.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 2.48 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing adoption of Premium Appliances in High-Income Households. Cloud Service Providers and Software Developers are collaborating to develop ecosystems that integrate Smart Displays, Camera Integration, and App Control. These innovations offer Freshness Preservation, Food Waste Reduction, and Inventory Management features. Data Analytics and Machine Learning enable Recipe Recommendations and Automatic Ordering. Smart Refrigerators are becoming essential components of the Smart Kitchen and Smart Home Integration. They offer Remote Monitoring, Humidity Control, Family Sharing, and Food Expiration Tracking. Data Security is a priority, ensuring consumer privacy concerns are addressed. Appliance Manufacturers are investing in advanced technologies like AI and Cloud Storage to create Luxury Appliances that cater to Tech-Savvy Consumers.

Emerging Technologies like Smart Dispensers, Voice Control, Smart Lighting, Home Automation, Energy Consumption Monitoring, and Temperature Control are enhancing the user experience. Energy Efficiency and Gen Z's preference for Connected Devices are driving market demand. Despite these advancements, privacy concerns and energy consumption remain critical factors. Smart Refrigerators are transforming the way we manage our kitchens and homes, offering convenience, energy savings, and advanced features. They are more than just appliances; they are essential components of a modern, connected lifestyle.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Refrigerator Industry?

- New product launches is the key driver of the market.

- The market is experiencing significant growth due to the continuous introduction of innovative new products. These refrigerators offer advanced features, such as Wi-Fi connectivity and app control, transforming the way consumers manage their food storage. For instance, LG Electronics recently launched Wi-Fi-enabled refrigerators that can be controlled via the LG thinQ app, enabling users to convert the freezer into a fridge. Similarly, Panasonic unveiled its new prime convertible series refrigerators in September 2023. These developments underscore the competitive landscape and are expected to fuel the expansion of the market.

- The market's growth is driven by the increasing demand for convenience, energy efficiency, and advanced technology in home appliances. This trend is anticipated to continue, as manufacturers continue to innovate and introduce new features to meet evolving consumer needs.

What are the market trends shaping the Smart Refrigerator Industry?

- Growing adoption of IoT-enabled devices is the upcoming market trend.

- The market is experiencing significant growth due to the integration of Internet of Things (IoT) technology. This development allows home appliances to be fully connected and controlled through an Intelligent Digital Network (IDN). One of the most notable trends in this market is the IoT-enabled family hub refrigerator. These advanced refrigerators offer various features, including the ability to monitor the contents of the refrigerator remotely, leave messages on a digital whiteboard, identify visitors at the front door via a connected doorbell, adjust the thermostat, and even watch CCTV videos.

- Furthermore, they provide suggestions for recipes and shopping recommendations. This technology enhances convenience and efficiency in household management. The integration of smart technology in refrigerators is transforming the way we manage our homes and daily lives.

What challenges does the Smart Refrigerator Industry face during its growth?

- Cyber-attacks due to security issues related to Internet connectivity is a key challenge affecting the industry growth.

- The market for smart refrigerators is witnessing significant growth as more household appliances integrate Internet connectivity. However, this trend comes with its challenges, particularly in terms of security. Hacking and cyber-attacks pose a threat to these devices due to their weak security parameters and interconnectivity with other home devices. To mitigate these risks, companies are investing in developing software and IoT features to enhance security. As the Internet of Things (IoT) expands its reach, an increasing number of devices, including refrigerators, are becoming smarter and offering Internet-related services.

- This not only enhances the user experience but also provides manufacturers with valuable data. It is essential for consumers to be aware of the full extent of their devices' Internet capabilities and take necessary precautions to secure them. companies must prioritize security measures to build consumer trust and ensure the success of the market.

Exclusive Customer Landscape

The smart refrigerator market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart refrigerator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart refrigerator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Electrolux group - The company showcases innovative smart refrigeration solutions, including the 600L UltimateTaste 700 and 680L UltimateTaste 900 French door models. These advanced appliances offer enhanced food preservation and personalized temperature settings, providing consumers with optimal freshness and taste. With sleek designs and intuitive interfaces, these refrigerators elevate the kitchen experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Electrolux group

- General Electric Co.

- Haier Smart Home Co. Ltd.

- Hisense International Co. Ltd.

- Hitachi Ltd.

- LG Corp.

- MIDEA Group Co. Ltd.

- Motorola Mobility LLC

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Siemens AG

- Smeg S.p.a.

- THOR Kitchen Inc.

- Toshiba Corp.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth as premium appliance manufacturers continue to invest in ecosystem development and software integration. These advanced kitchen appliances are transforming the way consumers manage their food and household tasks. Cloud service providers play a crucial role in enabling these smart features, offering cloud storage and data analytics capabilities. Software developers are also essential partners, creating apps that allow users to control their refrigerators remotely and integrate them into their smart homes. Smart displays are becoming increasingly popular in smart refrigerators, offering users easy access to information, entertainment, and communication. Freshness preservation is a key feature, with humidity control and temperature regulation ensuring that food stays fresh for longer.

High-income households are the primary target market for these premium appliances, as they offer added convenience and efficiency. Data security is a significant concern, with manufacturers implementing measures to protect users' data and privacy. Food waste reduction is another significant benefit of smart refrigerators. Camera integration allows users to monitor their inventory and receive alerts when items are nearing their expiration dates. Machine learning algorithms can even suggest recipes based on the available ingredients. Emerging technologies, such as artificial intelligence (AI) and voice control, are also being integrated into smart refrigerators. Automatic ordering and inventory management are becoming increasingly common features, allowing users to order groceries and manage their supplies with ease.

Smart lighting and energy consumption monitoring are additional benefits, helping users save energy and reduce their carbon footprint. Energy efficiency is a critical consideration for manufacturers, as consumers become more conscious of their environmental impact. The market for smart refrigerators is also attracting tech-savvy consumers, particularly those from the Gen Z demographic. These consumers are looking for luxury appliances that offer advanced features and seamless integration with their smart homes. Refrigerator connectivity is a key trend, with smart kitchen appliances becoming an essential part of the broader home automation ecosystem. Connected devices are transforming the way we live, offering increased convenience, efficiency, and control over our homes.

However, privacy concerns remain a significant challenge for manufacturers. Balancing the benefits of data collection and analysis with consumer privacy is a delicate issue that requires careful consideration and transparency. In , the market is experiencing significant growth, driven by advances in technology and changing consumer preferences. Premium appliance manufacturers, cloud service providers, software developers, and other partners are collaborating to create innovative solutions that offer added convenience, efficiency, and sustainability. The future of the market is bright, with many exciting developments on the horizon.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.4% |

|

Market growth 2025-2029 |

USD 7932.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, Brazil, Italy, India, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Refrigerator Market Research and Growth Report?

- CAGR of the Smart Refrigerator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart refrigerator market growth of industry companies

We can help! Our analysts can customize this smart refrigerator market research report to meet your requirements.