Software Market Size 2025-2029

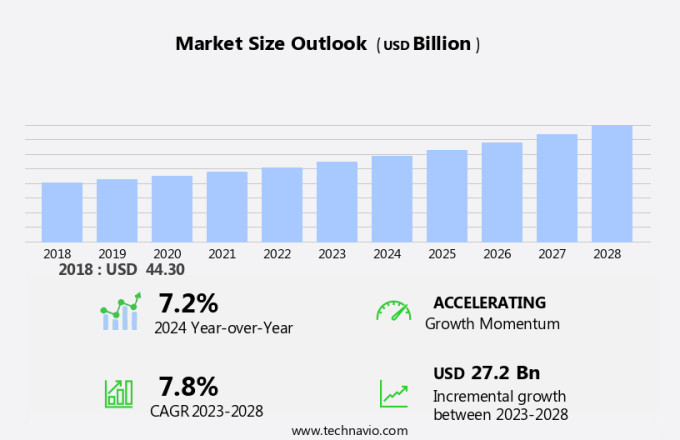

The software market size is forecast to increase by USD 30.7 billion, at a CAGR of 8.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing volume of enterprise data and the shift towards cloud computing. Businesses are recognizing the value of leveraging data to gain insights and make informed decisions, leading to a surge in demand for software solutions that can manage and analyze large data sets. Additionally, cloud computing is becoming the preferred deployment model for software, as it offers cost savings, flexibility, and scalability. However, the market also faces challenges that require careful navigation. High costs of licensing and support continue to be a significant obstacle for many organizations, particularly smaller businesses and startups.

- These costs can limit their ability to implement and maintain the software solutions they need to remain competitive. Furthermore, ensuring data security and privacy in a cloud environment is a major concern, as sensitive information is increasingly being stored and processed digitally. Companies must address these challenges effectively to capitalize on the opportunities presented by the market's growth and remain competitive in the evolving software landscape.

What will be the Size of the Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Entities such as version control systems, software quality assurance, software licensing, API integration, software maintenance, data warehousing, unit testing, project management, database management, cost optimization, and others, are seamlessly integrated into the software development lifecycle. Cloud computing is transforming the way software is deployed and accessed, while user experience remains a key focus for developers. Agile methodologies and the waterfall methodology coexist, with the former gaining popularity for its flexibility and the latter for its structured approach. Data mining and data analytics are increasingly being used to gain insights from vast amounts of data, while software security and bug tracking are essential components of any development process.

Machine learning and artificial intelligence are also making their mark, enhancing software functionality and improving user experience. Proprietary software and open source software each have their unique advantages, with CI/CD and DevOps streamlining the development process. Requirements gathering and user acceptance testing are crucial steps in ensuring software meets user needs, while code review and integration testing help maintain software quality. Technical support and software updates are ongoing requirements, with risk management and cost optimization essential for businesses to effectively manage their software investments. Business intelligence and software architecture are critical for making informed decisions and building scalable systems.

How is this Software Industry segmented?

The software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Subscriptions

- Identity and access management

- Endpoint/network/messaging/web security

- Risk management

- Deployment

- Cloud-based

- On-premises

- Sector

- Large enterprises

- Small and medium enterprises

- Application

- CRM

- ERP

- Cybersecurity

- Collaboration Tools

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

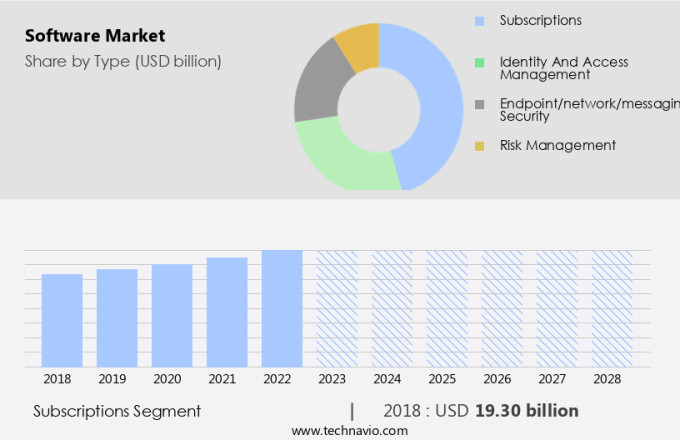

The subscriptions segment is estimated to witness significant growth during the forecast period.

In the ever-evolving the market, subscription-based models are gaining significant traction as a key growth driver. This shift is driven by the increasing recognition of the benefits offered by these models, enabling businesses to adapt to their evolving needs. Subscription models provide flexibility, allowing companies to scale their software usage efficiently, adapting to expanding operations or streamlined processes. Additionally, these models promote cost optimization, enabling businesses to spread their software expenses over time, making it a more viable option for organizations of all sizes. The software development lifecycle is undergoing a transformation, with both waterfall and agile methodologies being adopted.

Waterfall methodology, with its linear approach, is ideal for projects with well-defined requirements. In contrast, agile methodologies, with their iterative and collaborative nature, are more suitable for projects with evolving requirements. Cloud computing is revolutionizing the software landscape, offering on-demand access to software and infrastructure, reducing the need for costly hardware and maintenance. User experience is becoming a critical differentiator, with companies investing in user-centered design and user interface development to enhance customer engagement and satisfaction. Data analytics, business intelligence, machine learning, and artificial intelligence are transforming the way organizations make informed decisions. Data mining and data warehousing are essential components of this transformation, enabling companies to extract valuable insights from their data.

Software security is a top priority, with companies investing in bug tracking, defect management, and software testing to ensure the security and reliability of their software. Software documentation, version control systems, and software updates are crucial for maintaining the quality and effectiveness of software solutions. Proprietary software and open source software each have their merits, with the former offering greater control and customization, while the latter provides cost savings and a larger community of developers. Software licensing, api integration, and software maintenance are essential components of software management, ensuring that organizations can effectively utilize their software assets. Project management, database management, and cost optimization are crucial for successful software implementation and ongoing maintenance.

Risk management is also a critical consideration, with companies investing in software quality assurance and software estimation to mitigate potential risks and ensure the successful deployment of software solutions.

The Subscriptions segment was valued at USD 20.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

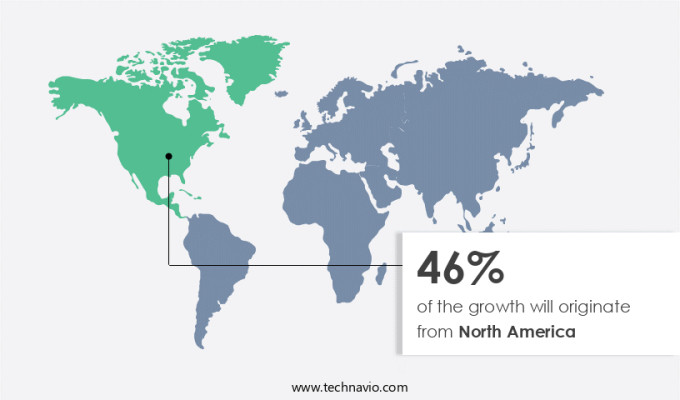

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is an ever-evolving industry, fueled by a strong culture of technological innovation and digital transformation. Major tech hubs, such as Silicon Valley, Seattle, and Boston, attract top talent and foster research and development, driving the market's growth. In this dynamic landscape, various entities play crucial roles. The software development lifecycle encompasses stages like requirements gathering, design, development, testing, deployment, and maintenance. Agile methodologies, such as Scrum and Lean, and the waterfall methodology are widely used for project management. System testing, integration testing, unit testing, and code review ensure software quality. Cloud computing and open-source software have transformed the market, enabling cost optimization, flexibility, and scalability.

Data analytics, business intelligence, machine learning, and artificial intelligence are increasingly important, with data mining and data warehousing used for insights. Proprietary software and open-source software coexist, with licensing models varying. Software security is paramount, with bug tracking, defect management, and risk management ensuring vulnerabilities are addressed. Software updates and version control systems facilitate continuous improvement. User experience is a key differentiator, with user acceptance testing, user interface design, and user interface testing ensuring a harmonious and immersive experience. Technical support and project management are essential for successful implementation and maintenance. Software estimation and cost optimization are critical for business success.

The market in North America is harmonious and striking, with stakeholders emphasizing innovation, quality, and collaboration. The market's future is promising, with emerging trends like API integration, software licensing, and software architecture shaping its evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and ever-evolving industry that caters to businesses and individuals seeking innovative solutions to streamline operations, enhance productivity, and drive growth. This vibrant marketplace is characterized by cutting-edge technologies, including artificial intelligence, machine learning, and cloud computing. Software developers and companies offer a diverse range of products, such as enterprise software, mobile applications, and productivity tools. Business software solutions address various sectors, like finance, healthcare, education, and manufacturing. Consumers also benefit from software in their daily lives, with applications for communication, entertainment, and organization. Software as a Service (SaaS) and open-source software models dominate the market, providing flexible and cost-effective options. The market continues to evolve, fueled by advancements in technology and the increasing demand for digital transformation.

What are the key market drivers leading to the rise in the adoption of Software Industry?

- The escalating volume of enterprise data serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing volume of enterprise data. Businesses are generating and collecting vast amounts of data from various sources, including customer interactions, transactions, and IoT devices. This data influx necessitates software solutions capable of managing, analyzing, and deriving insights effectively. Data-driven decision-making is becoming increasingly important for businesses, leading to a heightened demand for software tools that can handle large datasets and provide actionable insights. These tools enable organizations to identify patterns, trends, and correlations within their data, facilitating better strategic planning, operational efficiency, and enhanced customer experiences.

- Proprietary software and open source software each have their merits, with the former offering customizability and control, while the latter provides cost savings and flexibility. Continuous integration and continuous delivery (CI/CD) processes ensure software updates are released frequently and efficiently. Defect management and bug tracking systems help maintain software quality, while software security measures protect against potential vulnerabilities. Requirements gathering and user acceptance testing are crucial stages in the software development lifecycle, ensuring software meets business needs and user expectations. Software documentation is essential for maintaining and understanding complex systems, making it easier for developers and stakeholders to collaborate effectively.

What are the market trends shaping the Software Industry?

- Cloud computing is an emerging market trend that continues to gain momentum. This technological advancement is mandatory for businesses seeking to enhance efficiency and productivity.

- Cloud software solutions have gained significant traction in the business world, replacing traditional on-premises models. This transition offers numerous advantages, including flexibility in deployment, cost savings on IT infrastructure, and increased accessibility. With cloud software, users can access applications and data remotely from any device with an internet connection, facilitating seamless collaboration and remote work capabilities. Scalability is a key benefit of cloud computing, making it suitable for businesses of all sizes. Cloud-based software can easily accommodate changes in demand or user base expansion without requiring substantial hardware investments or intricate software updates. Furthermore, cloud software solutions typically offer faster implementation and deployment times compared to traditional software installations.

- Quality assurance processes, such as code review, user interface testing, integration testing, and technical support, remain crucial in the adoption of cloud software. Software estimation and testing are essential to ensure the reliability and functionality of cloud applications. Advanced features like business intelligence, machine learning, and risk management are increasingly integrated into cloud software solutions to provide businesses with valuable insights and improved decision-making capabilities.

What challenges does the Software Industry face during its growth?

- The high costs of licensing and support represent a significant challenge to the expansion and growth of the industry.

- The market has undergone significant transformations, shifting from a service-oriented sector to a product-oriented industry and now transitioning into a hybrid model. This evolution has brought about changes in software licensing and maintenance. While single-user and concurrent-user licensing models were once common in corporate applications, concurrent-use licensing is gradually being replaced. Usage-based licensing is gaining popularity, but perpetual licensing continues to dominate. This shift has resulted in substantial license and maintenance support costs, which may hinder the growth of the market. Version control systems and software quality assurance are essential components of the software development process. API integration and database management are crucial for ensuring seamless data exchange and storage.

- Project management tools facilitate efficient development and collaboration. Unit testing and software maintenance are vital for ensuring software reliability and longevity. Data warehousing solutions enable businesses to store, manage, and analyze large volumes of data. Cost optimization is a critical consideration for businesses in the software industry, as the high costs of licensing and maintenance can impact profitability. Software development is an intricate process that requires a combination of technical expertise, project management skills, and business acumen. The use of professional tools and best practices can help streamline the development process and ensure high-quality software. Software maintenance is an ongoing process that involves fixing bugs, enhancing functionality, and ensuring compatibility with new technologies.

- Effective project management is crucial for delivering software projects on time and within budget. Database management and data warehousing solutions are essential for storing, managing, and analyzing large volumes of data, enabling businesses to gain valuable insights and make informed decisions.

Exclusive Customer Landscape

The software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - This company specializes in providing cutting-edge software solutions, including Adobe Photoshop, Acrobat, Premiere Pro, and InDesign, enhancing productivity and creativity for users worldwide. Our offerings empower professionals to streamline workflows and produce high-quality results.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- ANSYS Inc.

- Autodesk Inc.

- Cisco Systems Inc.

- Dassault Systemes SE

- Focus Softnet Pvt. Ltd.

- Gen Digital Inc.

- Hewlett Packard Enterprise Co.

- IFS World Operations AB

- International Business Machines Corp.

- McAfee LLC

- Microsoft Corp.

- Oracle Corp.

- OTSUKA CORP.

- Salesforce Inc.

- SAP SE

- SYNERGIX TECHNOLOGIES PTE LTD.

- Synopsys Inc.

- VMware Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Software Market

- In January 2024, Microsoft announced the launch of its new low-code Power Apps platform, Power Apps Studio, aimed at enabling businesses to develop custom applications without extensive coding knowledge (Microsoft Press Release). In March 2024, Google Cloud and Salesforce signed a strategic partnership, integrating Salesforce Customer 360 with Google Workspace, allowing seamless data sharing and collaboration between the two platforms (Google Cloud Blog).

- In April 2024, IBM secured a USD2 billion investment from South Korea's National Pension Service to expand its cloud business in the region, marking a significant geographic expansion for IBM (IBM Press Release). In May 2025, Oracle Corporation received approval from the European Commission for its acquisition of Cerner Corporation, a major player in the health care IT sector, further strengthening Oracle's presence in the health care industry (European Commission Press Release).

Research Analyst Overview

- In the dynamic the market, serverless computing and edge computing are gaining traction, enabling businesses to build and run applications without managing infrastructure. Big data continues to drive innovation, with intellectual property protection becoming increasingly crucial for companies to safeguard their competitive edge. Design thinking and usability testing are prioritized to enhance user experience, while software patents ensure innovation and differentiation. Data loss prevention and encryption are essential for securing sensitive information, with cloud security becoming a top concern as businesses adopt agile scaling and cloud-based solutions. Lean software development, test-driven development, and behavior-driven development are streamlining development processes, while extreme programming and automated testing ensure software quality.

- Moreover, software metrics, blockchain technology, and software design patterns are shaping the future of software development. Virtual reality and augmented reality are revolutionizing industries, offering new opportunities for innovation and growth. Overall, the market is witnessing a convergence of technologies, requiring businesses to stay informed and adapt to evolving trends.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 30.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, Mexico, Italy, France, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Software Market Research and Growth Report?

- CAGR of the Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the software market growth of industry companies

We can help! Our analysts can customize this software market research report to meet your requirements.