Big Data Market Size 2025-2029

The big data market size is valued to increase USD 193.2 billion, at a CAGR of 13.3% from 2024 to 2029. Surge in data generation will drive the big data market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 36% growth during the forecast period.

- By Deployment - On-premises segment was valued at USD 55.30 billion in 2023

- By Type - Services segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 193.04 billion

- Market Future Opportunities: USD 193.20 billion

- CAGR from 2024 to 2029 : 13.3%

Market Summary

- In the dynamic realm of business intelligence, the market continues to expand at an unprecedented pace. According to recent estimates, this market is projected to reach a value of USD 274.3 billion by 2022, underscoring its significant impact on modern industries. This growth is driven by several factors, including the increasing volume, variety, and velocity of data generation. Moreover, the adoption of advanced technologies, such as machine learning and artificial intelligence, is enabling businesses to derive valuable insights from their data. Another key trend is the integration of blockchain solutions into big data implementation, enhancing data security and trust.

- However, this rapid expansion also presents challenges, such as ensuring data privacy and security, managing data complexity, and addressing the skills gap. Despite these challenges, the future of the market looks promising, with continued innovation and investment in data analytics and management solutions. As businesses increasingly rely on data to drive decision-making and gain a competitive edge, the importance of effective big data strategies will only grow.

What will be the Size of the Big Data Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Big Data Market Segmented?

The big data industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Hybrid

- Type

- Services

- Software

- End-user

- BFSI

- Healthcare

- Retail and e-commerce

- IT and telecom

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

In the ever-evolving landscape of data management, the market continues to expand with innovative technologies and solutions. On-premises big data software deployment, a popular choice for many organizations, offers control over hardware and software functions. Despite the high upfront costs for hardware purchases, it eliminates recurring monthly payments, making it a cost-effective alternative for some. However, cloud-based deployment, with its ease of access and flexibility, is increasingly popular, particularly for businesses dealing with high-velocity data ingestion. Cloud deployment, while convenient, comes with its own challenges, such as potential security breaches and the need for companies to manage their servers.

On-premises solutions, on the other hand, provide enhanced security and control, but require significant capital expenditure. Advanced analytics platforms, such as those employing deep learning models, parallel processing, and machine learning algorithms, are transforming data processing and analysis. Metadata management, data lineage tracking, and data versioning control are crucial components of these solutions, ensuring data accuracy and reliability. Data integration platforms, including IoT data integration and ETL process optimization, are essential for seamless data flow between systems. Real-time analytics, data visualization tools, and business intelligence dashboards enable organizations to make data-driven decisions. Data encryption methods, distributed computing, and data lake architectures further enhance data security and scalability.

The On-premises segment was valued at USD 55.30 billion in 2019 and showed a gradual increase during the forecast period.

With the integration of AI-powered insights, natural language processing, and predictive modeling, businesses can unlock valuable insights from their data, improving operational efficiency and driving growth. A recent study reveals that the market is projected to reach USD 274.3 billion by 2022, underscoring its growing importance in today's data-driven economy. This continuous evolution of big data technologies and solutions underscores the need for robust data governance frameworks and data quality metrics to ensure data integrity and compliance.

Regional Analysis

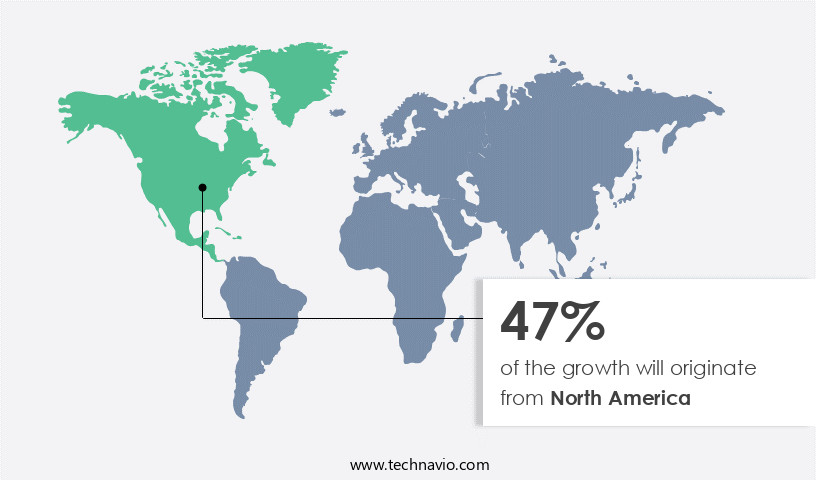

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Big Data Market Demand is Rising in APAC Request Free Sample

The North American market is experiencing significant growth, driven by digital transformation initiatives in various sectors, including healthcare, retail, BFSI, manufacturing, and consumer goods. Enterprises in this region, such as Chevron, ExxonMobil, and Shell, are adopting digital transformation strategies to enhance operational efficiency and reduce costs across their business verticals. Moreover, the e-commerce sector's expansion in North America is fueling the adoption of big data software solutions, further contributing to the market's growth.

The regional market's expansion is not limited to cost reduction and efficiency gains; it also aims to provide actionable insights from vast amounts of data to enhance decision-making processes and improve overall business performance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing unprecedented growth as businesses increasingly recognize the value of implementing data governance frameworks to optimize their operations. This shift is driving the need for more efficient ETL processes, scalable data lake architectures, and advanced analytics tools. Machine learning algorithms are being leveraged to make accurate predictions, while real-time analytics dashboards provide actionable insights in near real-time. Data security remains a top priority, with encryption methods ensuring confidentiality and metadata management improving data quality. Artificial intelligence is being used to derive advanced business insights, while IoT data streams are integrated efficiently to expand the data universe.

Sentiment analysis on social media and statistical modeling for forecasting are essential components of this data-driven approach. Deep learning models are utilized for anomaly detection, and robust data pipelines are developed for seamless data integration. Time series data analysis helps identify patterns, while data cleansing and transformation improve data quality. Designing efficient data warehousing solutions and implementing version control systems are crucial for managing the increasing volume, variety, and velocity of data. Cloud computing and NoSQL databases are popular choices for scalable data storage, offering flexibility and cost savings. Data lineage tracking is essential for accountability and transparency, ensuring that businesses can trace the origin and evolution of their data.

Compared to traditional data management methods, the adoption of big data technologies is transforming industries by enabling faster decision-making and more accurate forecasting. More than 70% of new product developments are now data-driven, underscoring the significance of this trend.

What are the key market drivers leading to the rise in the adoption of Big Data Industry?

- The surge in data generation serves as the primary catalyst for market growth.

- In today's data-driven business landscape, managing and analyzing vast quantities of structured and unstructured data is a critical challenge. This data, which originates from various sources like transactions, social media activities, and machine-to-machine data, is stored in data center infrastructure, both on-premises and in the cloud. Big data analytical software plays a pivotal role in identifying trends and patterns within this voluminous and diverse data. The data universe is characterized by the 3V concept: Volume, Variety, and Velocity. Volume signifies the massive amount of information collected, while Variety refers to its diverse nature, which can be structured, unstructured, or a combination of both.

- Velocity denotes the speed at which new data is generated and must be processed. Big data analytics enables businesses to derive valuable insights from this data, leading to informed decision-making. By harnessing the power of big data, organizations can optimize their operations, improve customer engagement, and gain a competitive edge. The continuous evolution of data generation and analytical tools underscores the importance of staying informed and adaptive in this ever-changing landscape.

What are the market trends shaping the Big Data Industry?

- The implementation of big data in the increasing adoption of blockchain solutions is an emerging market trend. This professional approach combines the power of big data analysis with the security and transparency of blockchain technology.

- Blockchain technology, a decentralized digital ledger, is gaining traction among enterprises for its potential in enhancing cybersecurity. This technology transports data in blocks, each linked to the previous one through cryptographic algorithms. Every data block comprises timestamps, cryptographic information about the preceding block, and transaction data. The integration of blockchain with big data empowers enterprises to manage and store vast amounts of data generated from various sensors.

- By employing blockchain and big data solutions, businesses can pinpoint production failures without disrupting operations. Start-ups and major industries, including oil and gas, food and beverage, and others, are actively adopting blockchain technologies. This trend underscores the continuous evolution of the market and its expanding applications across various sectors.

What challenges does the Big Data Industry face during its growth?

- The escalating concern over data security represents a significant challenge to the expansion of the industry.

- Advanced technologies, including big data analytics, are revolutionizing enterprise operations by enhancing productivity and simplifying complexities. For instance, Shell International B.V. (Shell) has implemented digital sensors at their global production and manufacturing sites. By analyzing the data generated from these sensors, Shell is streamlining its operational processes and making informed decisions. The Internet of Things (IoT) has led to the creation of vast data sets, yet data privacy concerns persist due to the massive volumes and dynamic nature of these data streams. Traditional security applications struggle to safeguard such extensive data sets and manage continuous data streams essential for big data analysis.

- The imperative for robust big data security solutions continues to grow as companies navigate the evolving digital landscape.

Exclusive Technavio Analysis on Customer Landscape

The big data market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the big data market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Big Data Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, big data market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company provides big data services through solutions like Accenture Data on Cloud and Accenture Data Self Service.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Alphabet Inc.

- Alteryx Inc.

- Amazon.com Inc.

- Cloudera Inc.

- Datameer Inc.

- Dell Technologies Inc.

- Deloitte Touche Tohmatsu Ltd.

- Enthought Inc.

- Hewlett Packard Enterprise Co.

- Hitachi Ltd.

- International Business Machines Corp.

- IRI

- Microsoft Corp.

- Oracle Corp.

- PricewaterhouseCoopers LLP

- Qubole Inc.

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Teradata Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Big Data Market

- In January 2024, IBM announced the acquisition of DataMirror, a data integration software company, to strengthen its Big Data and analytics capabilities. The deal, valued at USD 142 million, was aimed at enhancing IBM's hybrid cloud offerings and data integration services (IBM Press Release).

- In March 2024, Microsoft and Adobe entered into a strategic partnership to integrate Microsoft's Azure Synapse Analytics with Adobe Experience Platform. This collaboration enabled businesses to gain real-time insights from their customer data, enhancing personalization and marketing efforts (Microsoft News Center).

- In May 2024, Amazon Web Services (AWS) launched Amazon SageMaker Ground Truth, a human-in-the-loop machine learning service. This innovation allowed developers to build, label, and refine machine learning datasets, significantly reducing the time and cost of model training (AWS Blog).

- In April 2025, Google Cloud Platform secured a major contract with the European Union Agency for Cybersecurity (ENISA) to manage its Big Data analytics workloads. The deal marked a significant geographic expansion for Google Cloud Platform in the European market (Google Cloud Blog).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Big Data Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.3% |

|

Market growth 2025-2029 |

USD 193.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.1 |

|

Key countries |

US, China, India, Canada, Germany, UK, Japan, France, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the digital transformation era, the market continues to evolve, fueled by the insatiable demand for insights derived from vast amounts of information. IoT data integration plays a pivotal role, streaming real-time information for deep learning models to uncover hidden patterns and trends. Parallel processing and distributed computing facilitate the handling of massive datasets, enabling advanced analytics platforms to deliver AI-powered insights. Deep learning models, with their ability to learn from data, are revolutionizing industries, from healthcare to finance. Data anonymization techniques ensure data privacy while maintaining data utility, addressing ethical concerns. Stream processing engines analyze data in real-time, providing instant insights, crucial in today's fast-paced business environment.

- Data mining techniques unearth valuable patterns, while metadata management maintains order amidst the chaos of information overload. Cloud computing infrastructure offers scalable data solutions, enabling businesses to store and process data efficiently. Machine learning algorithms, with their adaptive nature, continuously improve predictive modeling capabilities. Data lineage tracking ensures data accuracy and trustworthiness, while data storytelling techniques make complex data understandable. Business intelligence dashboards provide actionable insights, and ETL process optimization streamlines data integration. Data governance frameworks ensure compliance and security, safeguarding valuable information. In-memory computing delivers lightning-fast data access, and advanced analytics platforms offer data visualization tools for data exploration.

- Data quality metrics maintain data accuracy, and data versioning control ensures data consistency. Data integration platforms facilitate seamless data flow between systems, and data encryption methods protect sensitive data. Data lake architectures offer flexible storage, and NoSQL database systems handle unstructured data effectively. Hadoop distributed storage provides scalable data processing, and data warehousing offers historical data analysis. Natural language processing enables human-like interaction with data, and real-time analytics caters to high-velocity data ingestion. Data integration, processing, and analytics are no longer standalone tasks; they are interconnected components of a data ecosystem. The market's continuous evolution reflects the ever-increasing importance of data in driving business growth.

- According to recent research, the market is projected to grow by 23% annually, surpassing USD274 billion by 2022.

What are the Key Data Covered in this Big Data Market Research and Growth Report?

-

What is the expected growth of the Big Data Market between 2025 and 2029?

-

USD 193.2 billion, at a CAGR of 13.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Deployment (On-premises, Cloud-based, and Hybrid), Type (Services and Software), End-user (BFSI, Healthcare, Retail and e-commerce, IT and telecom, and Others), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Surge in data generation, Rise in data security issues

-

-

Who are the major players in the Big Data Market?

-

Accenture PLC, Alphabet Inc., Alteryx Inc., Amazon.com Inc., Cloudera Inc., Datameer Inc., Dell Technologies Inc., Deloitte Touche Tohmatsu Ltd., Enthought Inc., Hewlett Packard Enterprise Co., Hitachi Ltd., International Business Machines Corp., IRI, Microsoft Corp., Oracle Corp., PricewaterhouseCoopers LLP, Qubole Inc., Salesforce Inc., SAP SE, SAS Institute Inc., and Teradata Corp.

-

Market Research Insights

- The market encompasses a range of analytical tools and techniques, including predictive analytics, supply chain analytics, statistical modeling, cluster analysis, marketing analytics, data architecture, data mining, regression analysis, risk analytics, anomaly detection, time series analysis, data security, web analytics, data validation, data transformation, data cleansing, financial analytics, data modeling, social media analytics, sentiment analysis, text mining, customer analytics, data governance, data privacy, data pipelines, prescriptive analytics, and more. According to recent estimates, the market is projected to reach USD 274.3 billion by 2022. In contrast, the data security segment is expected to dominate the market, accounting for over 30% of the total revenue, underscoring the critical importance of safeguarding data in the digital age.

- These trends underscore the dynamic and evolving nature of the market, with continued innovation and growth expected in the years ahead.

We can help! Our analysts can customize this big data market research report to meet your requirements.