Solar Purifiers Market Size 2024-2028

The solar purifiers market size is forecast to increase by USD 277.93 million at a CAGR of 8.51% between 2023 and 2028. The solar purifier market is experiencing significant growth due to the increasing water scarcity and the need for clean drinking water. Energy storage solutions have become essential for solar purifiers to ensure uninterrupted water supply. Market trends include the introduction of smart, connected solar purifiers, which offer advanced features such as real-time monitoring and remote control. However, the presence of counterfeit purifier products poses a challenge to market growth.

Consumers increasingly prefer ultra-filtration systems due to their ability to remove bacteria and viruses effectively. Data validation methodologies and data forecasting models are being employed to ensure the accuracy of market research and trends. HP Watermaker, with its energy-efficient and advanced filtration technology, is a key player in the market. Product preferences and consumer patterns continue to shape the market landscape, making it crucial for companies to stay updated on the latest trends and challenges.

What will be the size of the Solar Purifiers Market During the Forecast Period?

Market Segmentation

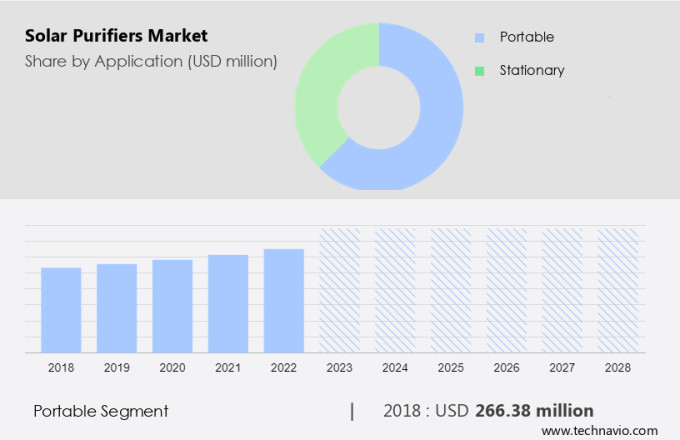

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Portable

- Stationary

- Type

- Water

- Air

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

The portable segment is estimated to witness significant growth during the forecast period. Solar water purification through portable systems is an effective method for pathogen-contaminant purification in various applications, particularly in remote areas and during emergencies. The portable segment of solar water purification systems is projected to expand significantly during the forecast period. This growth can be attributed to the increasing popularity of outdoor activities, such as camping, hiking, and trekking, the expanding tourism and leisure industry, and the rise in natural disasters leading to the disruption of potable water sources. Portable solar purifiers are an inexpensive and sustainable solution for purifying water contaminated with harmful bacteria and viruses. These systems utilize solar panel to generate power and filter water, making them an ideal choice for individuals and organizations in need of clean water in remote locations or during emergencies.

Get a glance at the market share of various segments Request Free Sample

The portable segment accounted for USD 266.38 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

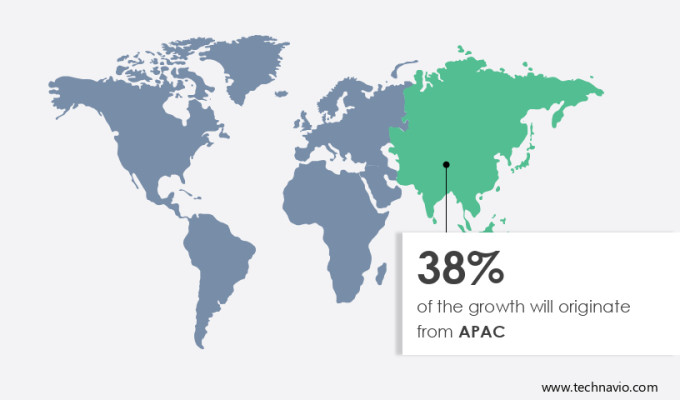

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth due to its effectiveness in pathogen-contaminant purification in remote areas. Solar panels, as the power source, make solar water purification an inexpensive way to access clean water, especially in regions with limited resources. The market, particularly in the Asia Pacific (APAC) region, is expanding rapidly. Factors contributing to this growth include rising air pollution levels in countries like India and China, plummeting solar panel prices, and a global shift towards Renewable energy sources. The positive economic climate in emerging APAC economies, such as India, China, Vietnam, and the Philippines, is driving spending in the commercial and residential sectors.

Additionally, population growth and urbanization in this region have heightened the demand for smart and sustainable water purification solutions. This is leading to a rise in requests for affordable solar water purifiers in both urban and rural areas, particularly in India and China.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Dynamics

Solar water purifiers have gained significant attention in recent years as an effective method for providing clean, drinkable water, particularly in areas with contaminated water sources. Solar water purification utilizes solar energy, often through the use of a solar panel, to power water purification systems. This process is effective in removing harmful bacteria, viruses, and even microplastics from water, making it safe for household purposes such as drinking and cooking. Solar water purifiers offer inexpensive ways to access clean water in remote areas where large electric generators may not be available. Renewable energy sources like solar power reduce the carbon impression and contribute to the environment by reducing greenhouse gas emissions.

Furthermore, solar water purification is also crucial during natural disasters such as hurricanes, droughts, and floods, which can lead to water scarcity and the spread of waterborne diseases. An is often used in solar water purifiers to ensure thorough pathogen-contaminant purification. Energy storage solutions are also integrated into these systems to ensure a consistent water supply even during periods of limiteultra-filtration systemd sunlight. Overall, solar water purifiers offer a sustainable, clean, and cost-effective solution for accessing drinkable water, especially in areas where traditional water sources may be contaminated or unreliable.

Market Driver

The increase in demand for energy-efficient purifiers is the key driver of the market. The demand for solar water purifiers is surging as consumers prioritize eco-friendly solutions for producing purified water for household purposes. Solar energy is an ideal source for powering these appliances, providing access to clean and drinkable water without relying on traditional energy sources. Contaminated water is a significant health concern, and solar water purifiers offer a sustainable and cost-effective solution.

Furthermore, these companies are focusing on developing energy-efficient solar water purifiers to cater to the increasing consumer preference for eco-friendly appliances. Government regulations mandating energy efficiency for home appliances further boost the market growth. Solar water purifiers offer a viable alternative to conventional purifiers, providing clean water while reducing energy consumption and carbon footprint.

Market Trends

The introduction of smart, connected solar purifiers is the upcoming trend in the market. The market is witnessing significant growth due to the increasing demand for purified water for household purposes. Solar water purifiers, which utilize solar energy to purify contaminated water and provide clean, drinkable water, are gaining popularity. Smart solar purifiers are emerging as innovative solutions in this market, offering user-friendly designs, advanced technologies, and improved aesthetics.

Furthermore, these smart solar purifiers come with several features to enhance user comfort, such as Energy Star certification for energy savings, hassle-free maintenance with automatic cleaning, and alerts for faults or issues. These features make solar purifiers an attractive option for consumers seeking clean water while also being environmentally conscious.

Market Challenge

The presence of counterfeit purifier products is a key challenge affecting the market growth. The market has witnessed significant growth in recent years due to the increasing demand for purified water for household purposes. Solar water purifiers, which utilize solar energy to purify contaminated water and provide clean, drinkable water, have gained popularity in both developed and developing regions. However, the market's growth is threatened by the proliferation of counterfeit solar purifier products.

Furthermore, these products, made from low-quality raw materials, have less durability and may not provide effective purification. The ease of distribution and sales through e-commerce platforms has facilitated the spread of counterfeit solar purifier components. Consumers often find it challenging to distinguish genuine products from counterfeit ones. Despite this, the relatively low price of counterfeit solar purifiers continues to fuel their demand. Government authorities worldwide seize counterfeit products, including purifiers, regularly. Consumers must ensure they purchase genuine solar purifiers to ensure their health and safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BHARAT SOLAR ENERGY: The company offers residential solar purifiers and solar water pumps, under its subsidiary called Solar Energy solutions.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- C AND B INTERNATIONAL HOLDINGS CO. LTD.

- COSMIC MICRO SYSTEMS PVT. LTD.

- Desolenator

- GRS India Corp.

- H20 Heroes

- Hi Tech Sweet Water Technologies Pvt. Ltd.

- HikePower Ltd.

- Netsol Water Solutions Pvt. Ltd.

- Nevon Projects

- NEWater China

- Nuetech Solar Systems Pvt. Ltd.

- Power4 Industries Ltd.

- Puralytics

- Solar Water Plc

- Solar Water Solutions Oy Ltd.

- Solatron Inc.

- Swajal Water Pvt. Ltd.

- Tata Power Co. Ltd.

- WattSun Energy India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Solar water purifiers have gained significant attention in recent years as an effective method for providing clean, drinkable water for household purposes in remote areas. Solar energy, a renewable and abundant resource, is used to power these water purifiers, making them an inexpensive way to purify contaminated water. Solar water purification systems use solar panels to convert sunshine into electricity, which powers the water filtration system. This process is effective in removing harmful bacteria, viruses, and even microplastics from water. Solar water purifiers are particularly useful in areas with waterborne diseases, which are often caused by contaminated water sources.

Furthermore, in regions prone to natural disasters such as hurricanes, droughts, and floods, solar water purifiers provide a reliable source of clean drinking water. The solar water purification system consists of a solar panel, water filter, and energy storage solutions. The filtration system uses an ultra-filtration system to remove impurities and salinity from the water. Consumer preferences and product availability in various markets influence the design and implementation of solar water purifiers. Data validation methodologies and data forecasting models are used to understand consumer patterns and product demand. Eco-friendly technologies, such as solar water purifiers, contribute to reducing the carbon impression and greenhouse gas emissions associated with large electric generators. As the world faces water scarcity and climate change, solar water purifiers provide a sustainable and efficient solution for providing clean drinking water to domestic and low-income groups in coastal and tribal areas.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market Growth 2024-2028 |

USD 277.93 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.1 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 38% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BHARAT SOLAR ENERGY, C AND B INTERNATIONAL HOLDINGS CO. LTD., COSMIC MICRO SYSTEMS PVT. LTD., Desolenator, GRS India Corp., H20 Heroes, Hi Tech Sweet Water Technologies Pvt. Ltd., HikePower Ltd., Netsol Water Solutions Pvt. Ltd., Nevon Projects, NEWater China, Nuetech Solar Systems Pvt. Ltd., Power4 Industries Ltd., Puralytics, Solar Water Plc, Solar Water Solutions Oy Ltd., Solatron Inc., Swajal Water Pvt. Ltd., Tata Power Co. Ltd., and WattSun Energy India Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch