Industrial Filtration Market Size 2024-2028

The industrial filtration market size is forecast to increase by USD 11.4 billion at a CAGR of 5.71% between 2023 and 2028.

- The increasing number of oil refineries is a key driver of the industrial filtration market. As refineries expand, the need for efficient filtration systems to maintain product quality and meet environmental regulations grows. In response, innovations in industrial filtration equipment and industrial gas phase filtration systems by vendors are emerging as a key trend. These advancements focus on improving filtration efficiency, durability, and energy consumption, offering solutions that help industries reduce operational costs while meeting stricter standards for air, water, and waste management.

- However, the lack of regular maintenance remains a challenge, leading to equipment failures and increased operational costs. To mitigate this issue, there is a growing emphasis on implementing preventive maintenance strategies and utilizing predictive maintenance technologies. Overall, the market is poised for continued growth as industries seek to improve their production processes and reduce waste.

What will be the Size of the Industrial Filtration Market During the Forecast Period?

- The market encompasses a range of filtration solutions designed to address emissions reduction and particle separation needs in various industries, including petroleum refineries and petrochemical plants. Crude oil and its derivatives, such as gasoline, diesel, and jet fuel, generate substantial volumes of airborne and liquid particles that necessitate effective filtration systems. Filter media technologies, including ultrafiltration, centrifugal filtration, surface filtration, horizontal filtration, cross-flow filtration, and cake filtration, are employed to capture dust particles and airborne particles. Electrical equipment and industrial processes also require air filtration to ensure optimal performance and prevent damage from particulate matter. Water filtration systems are essential for treating process water and ensuring compliance with environmental regulations.

- With increasing awareness of airborne diseases, there is growing demand for advanced filtration equipment and separation systems. The industrial revolution has led to the development of advanced filtration technologies, such as activated carbon filters, air purifiers, and water filters, to address diverse filtration requirements.

How is this Industrial Filtration Industry segmented and which is the largest segment?

The industrial filtration industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Industrial liquid filtration

- Industrial air filtration

- Application

- Food and beverage

- Chemicals and petrochemicals

- Power generation

- Others

- Filter Media

- Activated carbon/Charcoal

- Fiberglass

- Filter paper

- Metal

- Non-woven fabric

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

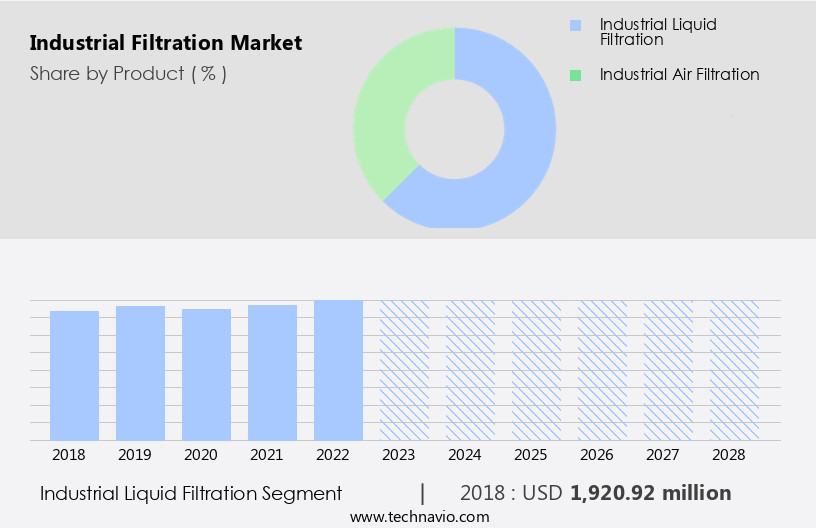

The industrial liquid filtration segment is estimated to witness significant growth during the forecast period. Industrial liquid filtration involves the separation of solids from liquids using filtering media, allowing only the purified liquid to pass. This process is crucial in various industries, including oil and gas, petrochemicals, pharmaceuticals, and power generation. Compliance with regulations and stringent requirements, particularly In the food and beverage sector, drives the growth of this market. Techniques such as ultrafiltration, centrifugal filtration, and surface filtration are employed to remove contaminants like dust particles and airborne particles. Filter media like Activated Carbon/Charcoal, Fiberglass, Filter Paper, Metal, and Nonwoven Fabric are commonly used. Applications include fuel filtration, cooling water filtration, and wastewater treatment.

The market expansion is influenced by the need for filtration in industries such as petroleum refineries, petrochemical plants, and power generation, as well as the increasing demand for water filtration systems due to environmental concerns and pollution mitigation.

Get a glance at the share of various segments. Request Free Sample

The Industrial liquid filtration segment was valued at USD 1.92 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

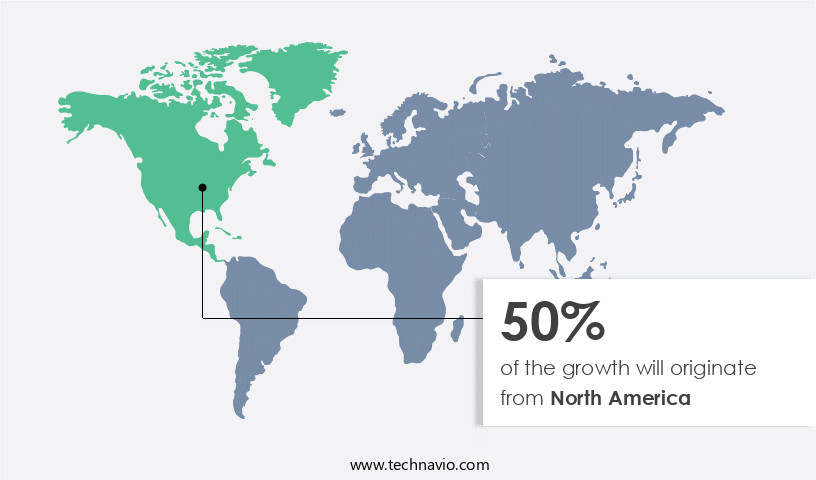

North America is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to the increasing demand for wastewater treatment In the chemical industry. Industrial filters are essential In the chemical processing sector, which produces intermediate products for various industries, including agriculture, rubber, plastics, textiles, pulp and paper, and petroleum. The US chemical industry is expanding due to the low cost of natural gas, revitalizing the petrochemical sector after years of decline. Industrial filtration solutions are integral to numerous applications, including emissions control, real-time monitoring, and the processing of crude oil, gasoline, diesel, jet fuel, petrochemicals, plastics, pharmaceuticals, and more. Filtration technologies include filter media such as Activated Carbon/Charcoal, Fiberglass, Filter Paper, Metal, and Nonwoven Fabric, as well as filtration methods like Ultrafiltration, Centrifugal filtration, Surface filtration, Horizontal filtration, Cross-flow filtration, and Cake filtration.

These filtration systems are crucial for various industries, including power generation, oil and gas, metals & mining, automotive, and water treatment. Effective filtration systems help prevent environmental damage by reducing contaminants and pollution, ensuring the production of cleaner products and reducing the risk of airborne diseases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Filtration Industry?

Increasing number of oil refineries is the key driver of the market.

- Industrial filtration plays a crucial role in petroleum refineries and petrochemical plants by capturing contaminants, such as rust and scale, that can cause equipment damage and hinder process performance. The implementation of filtration solutions leads to several benefits, including reduced downtime, lower maintenance costs, and increased operating efficiencies. These advantages are particularly significant In the context of growing investments in refinery expansions and upgrades. For instance, the Dangote Refinery in Nigeria, which officially opened on May 22, 2023, is an example of such investments. The market is poised for growth due to the expanding demand for filtration systems in various industries, including oil and gas, power generation, metals and mining, automotive, and chemicals & petrochemicals.

- Filtration systems are essential for the effective separation of matter from fluids and gases. In the context of the oil and gas industry, filtration is used to remove impurities from crude oil, resulting In the production of cleaner fuels such as gasoline, diesel, and jet fuel. In petrochemical plants, filtration is employed to produce high-purity petrochemicals, including plastics, pharmaceuticals, and other chemicals. The filtration market encompasses various filtration technologies, including air filtration, separation systems, and water filtration systems. Filter media such as Activated Carbon/Charcoal, Fiberglass, Filter Paper, Metal, and Nonwoven Fabric are used in different filtration applications. Ultrafiltration, centrifugal filtration, surface filtration, horizontal filtration, cross-flow filtration, cake filtration, and electrical equipment are some of the filtration techniques used In the industry.

- Airborne particles, dust particles, and water pollution are significant environmental concerns that filtration systems address. The nonwoven segment and activated carbon segment are expected to dominate the filtration market due to their high demand in various industries. Filtration technology is also used in renewable energy sources, power plants, and various other applications, including vehicle production, semiconductors, microelectronics, and mines and minerals. In conclusion, the market is driven by the increasing demand for cleaner fuels, high-purity chemicals, and the need to address environmental concerns. The implementation of filtration systems leads to improved process performance, reduced downtime, and lower maintenance costs, making it a valuable investment for various industries.

What are the market trends shaping the Industrial Filtration Industry?

Innovations in industrial filtration equipment by vendors is the upcoming market trend.

- Industrial filtration plays a crucial role in various industries such as petroleum refineries, petrochemical plants, and power generation, ensuring the efficient separation of contaminants and emissions. Technological advancements have led to the development of innovative filtration solutions, including ultrafiltration, centrifugal filtration, surface filtration, horizontal filtration, cross-flow filtration, and cake filtration. These filtration systems help industries address environmental concerns by reducing pollution and minimizing the disposal of chemicals and wastewater. Manufacturers invest heavily in research and development to offer a diverse range of filter media, such as Activated Carbon/Charcoal, Fiberglass, Filter Paper, Metal, and Nonwoven Fabric, catering to specific industry needs.

- For instance, the petrochemical industry requires filters for petroleum products like crude oil, gasoline, diesel, jet fuel, and petrochemicals, while the pharmaceutical industry focuses on filter media for chemicals and pharmaceuticals. The nonwoven segment and activated carbon segment are expected to dominate the market due to their high demand in various applications, including air filtration, separation systems, and water filtration systems. Industrial air filtration is essential in industries like automotive, electronics, and power plants, where airborne particles can cause airborne diseases. In May 2021, Eaton Corporation Plc introduced an optimized version of the IFPM 33 mobile, offline fluid purifier system, capable of removing particulate contamination down to 3 mm, free water, free and dissolved gases, and light to heavy lubricating oils.

- This fully automated, PLC-controlled purifier system caters to applications with high moisture content, such as marine, offshore, pulp and paper, and hydroelectric power. By investing in advanced filtration technology, industries can minimize environmental damage and ensure the production of high-quality products.

What challenges does the Industrial Filtration Industry face during its growth?

Filtration equipment failures due to less maintenance is a key challenge affecting the industry growth.

- Industrial filtration plays a crucial role in maintaining the efficiency and productivity of various industries, including petroleum refineries, petrochemical plants, power generation, and oil and gas. Filtration solutions help mitigate emissions, monitor real-time filter performance, and prevent environmental damage caused by contaminants and pollution. The market for filtration solutions In the US is vast and diverse, catering to industries that deal with crude oil, gasoline, diesel, jet fuel, petrochemicals, plastics, pharmaceuticals, and more. Filtration technology encompasses various methods, such as ultrafiltration, centrifugal filtration, surface filtration, horizontal filtration, cross-flow filtration, cake filtration, and others. Filter media, including Activated Carbon/Charcoal, Fiberglass, Filter Paper, Metal, and Nonwoven Fabric, are essential components of filtration systems.

- These media help capture dust particles, airborne particles, and other contaminants, ensuring the purity and quality of the output. Maintenance and downtime are critical factors in industrial operations. Regular filter monitoring, pressure drop assessment, and timely filter replacement help minimize downtime and ensure optimal performance. Effective filtration systems contribute to wastewater treatment, water pollution reduction, and the prevention of airborne diseases. The filtration market In the US is driven by the increasing demand for cleaner production processes, stringent regulations, and the growing focus on renewable energy sources and sustainable practices. Industries such as electronics, semiconductors, and mines and minerals also rely on filtration technology for their operations.

- In conclusion, filtration solutions are essential for various industries In the US, contributing to improved efficiency, productivity, and sustainability. Effective filtration systems help minimize downtime, reduce contaminants, and ensure the production of high-quality output.

Exclusive Customer Landscape

The industrial filtration market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial filtration market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial filtration market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3M Co. - The market encompasses a range of solutions designed to remove impurities from various industrial processes. One notable provider offers the 3M Micro Klean RT Series filter, the 3M Metal Ion Purifier SCP Series Filter cartridge, and the 3M Betapure AUL Series Filter cartridge. These filtration offerings cater to diverse industries, ensuring efficient separation of particles and contaminants for improved process performance and product quality. The 3M Micro Klean RT Series filter delivers superior filtration efficiency, while the 3M Metal Ion Purifier SCP Series Filter cartridge effectively removes metal ions. The 3M Betapure AUL Series Filter cartridge is designed for ultrafiltration applications, providing reliable separation of suspended solids and macromolecules. With a focus on innovation and quality, this company's industrial filtration solutions enhance operational efficiency and contribute to sustainable industrial processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Alfa Laval AB

- Atmus Filtration Technologies Inc.

- Boll and Kirch Filterbau GmbH

- Camfil AB

- Danaher Corp.

- Donaldson Co. Inc.

- DuPont de Nemours Inc.

- Eaton Corp. Plc

- Ecolab Inc.

- Entegris Inc.

- Filtration Group Corp.

- Freudenberg and Co. KG

- GEA Group AG

- Graver Technologies LLC

- Hengst SE

- Lenntech BV

- MANN HUMMEL International GmbH and Co. KG

- Parker Hannifin Corp.

- Pentair Plc

- Russell Finex Ltd.

- Siemens AG

- Synder Filtration Inc.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial filtration plays a crucial role in various industries, ensuring the separation and purification of fluids and gases. This process is essential for mitigating emissions, preventing environmental damage, and maintaining the quality of final products. Real-time monitoring and effective filtration systems are vital in industries such as petroleum refineries and petrochemical plants. The demand for filtration solutions is driven by the need to remove contaminants, including dust particles and airborne particles, from industrial processes. These contaminants can lead to environmental damage, pollution, and potential health hazards. Filtration systems are employed in various industries, including power generation, oil and gas, metals and mining, automotive, and water treatment.

Filter media, such as activated carbon/charcoal, fiberglass, filter paper, metal, and nonwoven fabric, are used extensively in filtration processes. Different filtration techniques, including ultrafiltration, centrifugal filtration, surface filtration, horizontal filtration, cross-flow filtration, and cake filtration, are utilized based on the specific requirements of the application. Filtration technology has evolved significantly over the years, with advancements in materials and filtration methods. For instance, nanofiber filters have gained popularity due to their high filtration efficiency and low pressure drop. Electrical equipment, such as air filtration systems, separation systems, and water filtration systems, are integral components of various industries, ensuring the cleanliness and quality of the air and water used In their processes.

The industrial revolution brought about a significant increase In the demand for filtration solutions, with the need to address the environmental challenges arising from industrialization. Today, filtration technology continues to play a crucial role in addressing the challenges of various industries, including the removal of contaminants from wastewater treatment systems and the prevention of airborne diseases in power plants and vehicle production facilities. The integration of renewable energy sources, such as wind and solar power, into the power generation sector has also increased the demand for filtration solutions. Filtration technology is employed In the production of raw materials, such as cement, steel, textiles, fertilizers, paints and inks, chemicals, electronics, and mines and minerals, ensuring the quality and purity of the final products.

In conclusion, industrial filtration is a critical process that ensures the separation and purification of fluids and gases in various industries. The demand for filtration solutions is driven by the need to mitigate emissions, prevent environmental damage, and maintaIn the quality of final products. Filtration technology continues to evolve, with advancements in materials and filtration methods addressing the specific requirements of various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.71% |

|

Market growth 2024-2028 |

USD 11400.65 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.82 |

|

Key countries |

US, Canada, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Filtration Market Research and Growth Report?

- CAGR of the Industrial Filtration industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial filtration market growth of industry companies

We can help! Our analysts can customize this industrial filtration market research report to meet your requirements.