Spacesuit Market Size 2024-2028

The spacesuit market size is forecast to increase by USD 231.1 million at a CAGR of 9.45% between 2023 and 2028.

- The market is experiencing significant growth driven by the implementation of advanced 3D printing technologies and the emerging space travel concept. These developments offer opportunities for innovation and cost reduction in the production of spacesuits, making them more accessible to a broader range of customers and applications. However, high development costs remain a challenge for market players, necessitating strategic partnerships, government funding, or significant private investment. Companies seeking to capitalize on market opportunities must stay abreast of technological advancements and collaborate with industry partners to share resources and expertise.

- Additionally, focusing on research and development of reusable spacesuits and modular designs could help reduce costs and expand the addressable market. Overall, the market presents a compelling investment opportunity for those willing to navigate the complexities of the space industry and capitalize on the growing demand for advanced spacesuit technology.

What will be the Size of the Spacesuit Market during the forecast period?

- The market encompasses the design and production of various types of spacesuits, including extravehicular activity (EVA) suits and intravehicular activity (IVA) suits, for use in spaceflight missions. Key market drivers include the increasing demand for space exploration and the need for advanced technologies to support extended space missions. Spacesuit designs continue to evolve, integrating features such as smart glasses for enhanced communication and augmented reality technology for improved situational awareness. Lightweight materials and advanced technologies, such as GPS and Wi-Fi, are also being incorporated to enhance mobility and functionality. The market is expected to grow significantly due to the increasing number of space agencies and private companies investing in crewed commercial spaceflight.

- Additionally, the International Space Station and space shuttle programs have boosted the demand for high-performance spacesuits. Overall, the market is characterized by continuous innovation and a focus on improving the safety, functionality, and comfort of spacesuits for astronauts.

How is this Spacesuit Industry segmented?

The spacesuit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Hybrid suits

- Hard-shell suits

- Soft-shell suits

- Type

- EVA suits

- IVA suits

- Geography

- North America

- US

- Canada

- Europe

- Russia

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Product Insights

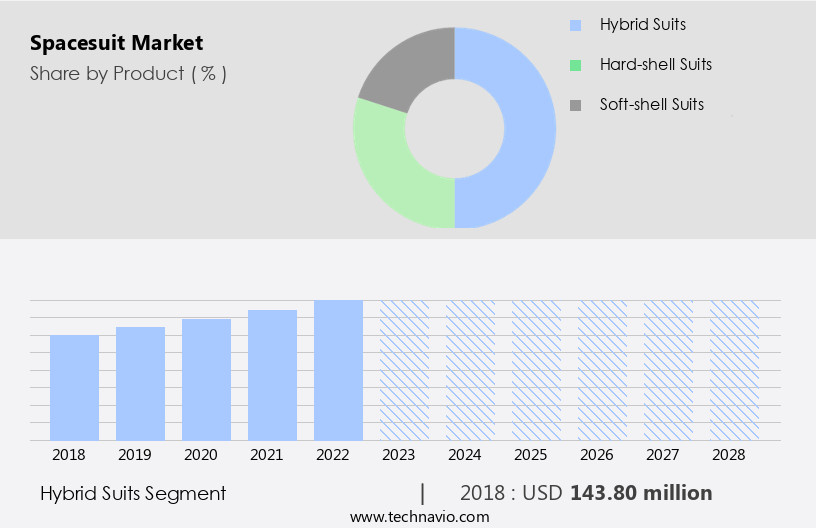

The hybrid suits segment is estimated to witness significant growth during the forecast period.

Hybrid spacesuits, which combine the benefits of hard and soft shells, have emerged as a popular choice for Extravehicular Activity (EVA) and Intravehicular Activity (IVA) suits in the space industry. NASA's Extravehicular Mobility Unit (EMU) on the International Space Station is a prime example, featuring a soft lower torso, arms, and legs for enhanced maneuverability, and a hard upper torso made of fiberglass. The joints and seals on soft-shell suits typically consist of hard materials. Advancements in technology have led to the development of suggested hybrid and intelligent spacesuits, designed to improve dexterity and motion, reparability, and sensor integration for effective communication with the environment and spacesuit degradation identification.

These suits will enable scientific and exploration operations on planetary missions, such as those planned for Mars, by integrating full-body soft-robotic components into the gas-pressurized spacesuit. The proposed hybrid technology will offer increased dexterity, comfort, and a sense of normalcy, crucial for extended space missions. Additionally, the integration of smart glasses, GPS, Wi-Fi, and connectivity systems in spacesuits will further enhance communication capabilities and overall mission efficiency. Soft shell suits, 3D printing, and body scanning technologies are also contributing to the development of lightweight and custom-fit spacesuits for crewed commercial spaceflight.

Get a glance at the market report of share of various segments Request Free Sample

The Hybrid suits segment was valued at USD 143.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

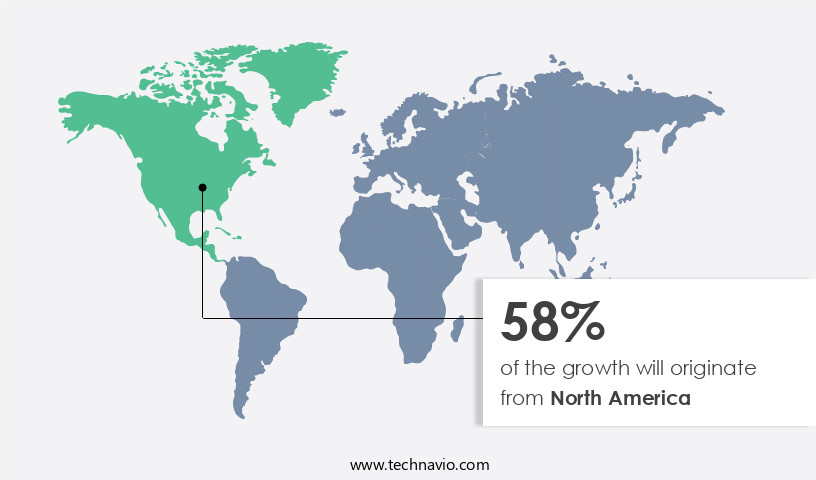

North America is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market for Extravehicular Activity (EVA) and Intravehicular Activity (IVA) suits is experiencing significant growth, driven by advancements in technology and increasing space exploration initiatives by space agencies. New innovations include lightweight space suits with digital analytics, smart glasses, and augmented reality technology, enabling enhanced communication and mobility for astronauts during space missions. Hybrid space suits, combining hard shell and skin-tight designs, cater to both EVA and IVA requirements. Companies are investing in body scanning and 3D printing to create customized suits for improved fit and functionality. The development of reusable space launch systems, such as Space Launch System, is expected to further reduce costs and expand opportunities for crewed commercial spaceflight.

Connectivity systems, including Wi-Fi and GPS, are integrated into these suits to ensure optimal performance and safety during spaceflight missions. Additionally, the integration of soft shell suits and 3D printing technology is enabling the creation of more affordable refurbished space suits, making space exploration more accessible. The future of space exploration lies in the integration of advanced technology, such as hybrid suits, IVA suits, and digital analytics, to optimize astronaut performance and safety during space missions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Spacesuit Industry?

- Implementation of 3D printing technologies is the key driver of the market.

- Three-dimensional (3D) printing manufacturing is a cutting-edge process that involves creating objects or components by adding successive layers of materials under computerized control. This innovative method enables manufacturers to produce small and micro-components of intricate shapes and sizes, significantly reducing the weight of spacesuits. The cost-efficiency of 3D printing also facilitates just-in-time (JIT) manufacturing of materials, saving time and resources. Additionally, the quick designing and adaptability of internal features of parts and components are advantages that traditional manufacturing methods cannot offer.

- The integration of 3D printing in the aerospace industry brings about substantial benefits, including reduced manufacturing time, minimized material wastage, and overall cost savings. This technology's ability to create complex geometries and structures makes it an indispensable tool in the production of advanced spacesuit components.

What are the market trends shaping the Spacesuit Industry?

- Emergence of space travel concept is the upcoming market trend.

- Space tourism refers to the commercial provision of recreational and leisure experiences beyond Earth's atmosphere. Space Adventures, a US-based company in partnership with ROSCOSMOS, is currently the sole company offering orbital space tourism to private citizens, with ticket prices ranging from USD20 million to USD40 million per passenger. The space tourism industry is gaining traction as major aerospace corporations are expressing significant interest in this sector and are expected to commence services by the end of the forecast period.

- This emerging trend in space tourism will simultaneously fuel the development of business-grade spacesuits suitable for personal use.

What challenges does the Spacesuit Industry face during its growth?

- High development costs is a key challenge affecting the industry growth.

- The demand for spacesuits is on the rise due to an increase in human-crewed space missions. However, the high development costs associated with producing these advanced suits pose a challenge for companies. Since 2011, there have been significant advancements in spacesuit materials and performance, yet the design has remained relatively unchanged. This focus on future design elements comes with increased risk, as any suspension or delay in human-crewed missions can significantly impact production and profitability.

- The market is highly concentrated, with only a few key players dominating the landscape. The market's success hinges on both production capabilities and profitability, making it a critical area of focus for companies.

Exclusive Customer Landscape

The spacesuit market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spacesuit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spacesuit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Axiom Space Inc. - The company specializes in providing astronauts with advanced exploration extravehicular activity (EVA) service spacesuits, engineered for enhanced capabilities in space exploration missions. These suits offer superior functionality and reliability, enabling astronauts to effectively execute space programs with confidence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axiom Space Inc.

- David Clark Co.

- Global Effects Inc.

- ILC Dover LP

- Oceaneering International Inc.

- Osterreichisches Weltraum Forum

- PACIFIC SPACEFLIGHT

- RTX Corp.

- Rostec

- Sure Safety (India) Ltd.

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The extravehicular activity (EVA) suit market encompasses a vital segment of the space industry, catering to the demand for protective gear used during spacewalks and other extravehicular activities. This market witnesses continuous evolution, driven by advancements in technology and the increasing number of space missions. EVA suits are essential for astronauts engaging in tasks outside a spacecraft or space station. Intravehicular activity (IVA) suits, on the other hand, are designed for use within space vehicles. Both types of suits play a crucial role in ensuring the safety and productivity of space missions. Innovations in the realm of EVA suits include the integration of smart glasses, which provide astronauts with real-time information and enhance their situational awareness.

Additionally, hybrid suits that combine features of hard and soft suits have emerged, offering advantages such as improved mobility and flexibility. The space industry's push towards commercial crewed spaceflight has led to the development of new space suits tailored for this sector. Training regimens for astronauts using these suits are meticulously designed to ensure their readiness for space missions. Refurbished space suits have gained traction in recent years due to their cost-effectiveness and sustainability. These suits undergo rigorous testing and refurbishment processes to maintain their functionality and safety standards. Digital analytics plays a significant role in the design and development of EVA suits.

By analyzing data from previous missions and simulations, designers can optimize suit features and improve overall performance. The lack of standardization in the market poses challenges for manufacturers and space agencies. Each space agency may have unique requirements, necessitating custom-designed suits. This diversity in demand results in a fragmented market landscape. Advancements in technology, such as body scanning, 3D printing, and augmented reality technology, are revolutionizing the design and manufacturing process for EVA suits. Lightweight space suits made of soft shell materials have gained popularity due to their improved mobility and comfort. Connectivity systems, such as GPS and wi-fi, are increasingly integrated into EVA suits to enhance communication and mission coordination.

As space missions expand to the Moon, Mars, and beyond, the demand for advanced spacesuits will continue to grow. The market is a dynamic and evolving landscape, driven by technological advancements, increasing space missions, and the push for commercial crewed spaceflight. The future holds exciting possibilities for innovations in suit design, materials, and functionality.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 231.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, Russia, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spacesuit Market Research and Growth Report?

- CAGR of the Spacesuit industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spacesuit market growth of industry companies

We can help! Our analysts can customize this spacesuit market research report to meet your requirements.