Spinal Implants Market Size 2025-2029

The spinal implants market size is forecast to increase by USD 3.55 billion at a CAGR of 5.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising prevalence of spinal disorders and the increasing adoption of minimally invasive procedures. According to estimates, the number of spinal disorders is projected to increase due to aging populations and sedentary lifestyles. This trend is particularly prominent in developed regions, such as North America and Europe, where the elderly population is growing rapidly. Moreover, the shift towards minimally invasive procedures is gaining momentum, as these procedures offer several advantages, including reduced hospital stays, lower infection rates, and faster recovery times. However, the high costs of spinal implants and procedures remain a major challenge for market growth.

- Despite these challenges, there are significant opportunities for companies to capitalize on the growing demand for spinal implants. Strategic partnerships, product innovation, and cost reduction initiatives are some of the key strategies that companies can adopt to stay competitive in this market. Overall, the market presents an attractive investment opportunity for global investors seeking to capitalize on the growing demand for advanced medical solutions to address spinal disorders.

What will be the Size of the Spinal Implants Market during the forecast period?

- The market encompasses a range of technologies and devices used in the surgical treatment of various spinal disorders. Key product categories include open ry implants, such as plates, cages, and spinal fusion devices, as well as minimally invasive options, like dynamic stabilization devices, artificial discs, and spinal decompression devices. Driven by an aging population and the prevalence of degenerative spinal conditions, market growth is fueled by increasing demand for advanced spinal solutions. Minimally invasive procedures, including minimally invasive spine ry and minimally invasive procedures for spinal deformities, are gaining popularity due to their reduced recovery time and minimal invasiveness.

- Technological advancements in spinal technologies, such as thoracic and lumbar fusion devices made of stainless steel, titanium, and cobalt chrome, as well as expandable fusion cages, are further driving market expansion. Additionally, the market is witnessing a rise in the adoption of non-fusion devices, including cervical fusion devices, to address spinal disorders without the need for fusion procedures. The market also includes road traffic crashes and spine biologics as contributing factors. Physicians and ons continue to play a crucial role in the market's growth by adopting the latest spinal implant technologies to improve patient outcomes.

How is this Spinal Implants Industry segmented?

The spinal implants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Spinal fusion implants

- Non-fusion spinal implants

- End-user

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- Rest of World (ROW)

- North America

By Product Insights

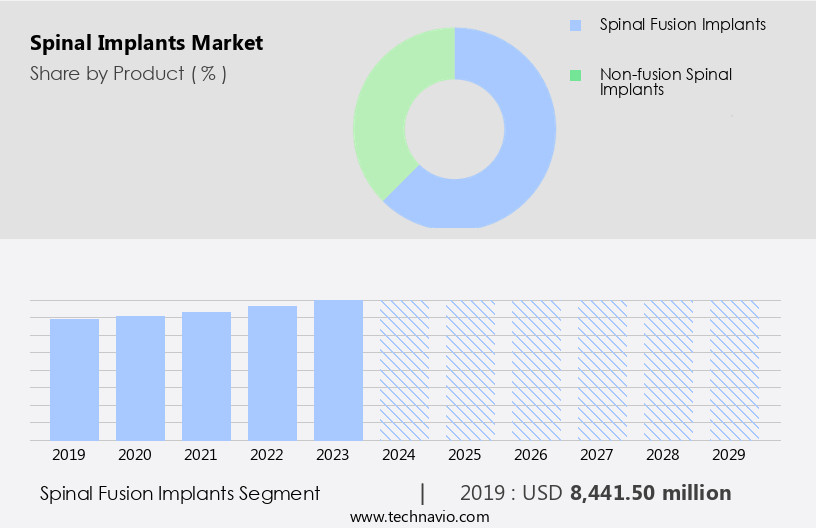

The spinal fusion implants segment is estimated to witness significant growth during the forecast period.

Spinal fusion implants are medical devices utilized in surgical procedures to address various spinal conditions causing instability, pain, or neurological symptoms. Spinal fusion is a surgical technique intended to join two or more adjacent vertebrae, forming a solid, immobile bridge between them. This fusion ensures stability, alleviates pain, and enhances spine alignment. Implants facilitate the fusion process, enabling correct healing. They are employed to correct deformities or misalignments such as scoliosis or spondylolisthesis. Fusion implants can alleviate chronic back or neck pain by immobilizing the affected spine segment. Spinal fusion implants are available in various materials, including stainless steel, cobalt chrome, polyetheretherketone, and others.

These implants come in various forms, such as spinal fusion devices, non-fusion devices, vertebral compression fracture solutions, spinal bone stimulators, and spine biologics. They are used in open ries and minimally invasive procedures, catering to diverse spinal disorders, including age-related conditions, thoracic and lumbar fusion, spinal decompression, cervical fusion, and spinal trauma.

Get a glance at the market report of share of various segments Request Free Sample

The Spinal fusion implants segment was valued at USD 8.44 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market dominates the global spinal implants industry due to its advanced healthcare infrastructure and high prevalence of spinal disorders. With well-equipped spine centers and specialized ons, the region offers access to advanced surgical techniques and diagnostic capabilities. This results in a significant demand for spinal implants, including Open ry and Minimally Invasive ry devices like Spinal Fusion Implants (Stainless Steel, Cobalt Chrome, Polyetheretherketone), Dynamic Stabilization Devices, and Spinal Trauma devices. Furthermore, the aging population and increasing incidence of degenerative spinal conditions and age-related spinal disorders drive market growth. Innovations in spinal technologies, such as Spinal Cord Injury treatments, Thoracolumbar devices (Anterior lumbar plates, Lumbar plates, Pedicle screw, Cervical fixation devices, Anterior Cervical Plates, Hook Fixation Systems), Spine Bone Stimulators, Spine Biologics, and Interbody Fusion Devices (Configuration, Non-Fusion Devices, Interspinous Process Spacers, Pedicle Screw-based Systems, Facet Replacement Products, Artificial Cervical Discs, Artificial Lumbar Discs, Annulus Repair Devices, Nuclear Disc Prostheses), and fusion procedures using Capacitive Coupling, Combined Magnetic field, Spinal allografts (Machined Bones Allograft, Demineralized Bone Matrix, Bone graft substitutes, Bone Morphogenetic Proteins, Synthetic Bone Grafts, Cell-based Matrix), and Spinal disorders (Thoracic Fusion devices, Lumbar Fusion Devices, Spinal Decompression Devices, Cervical Fusion Devices) contribute to the markets expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Spinal Implants Industry?

Rising prevalence of spinal disorders is the key driver of the market.

- The escalating prevalence of spinal disorders, including conditions such as spondylitis, spinal stenosis, spinal tumors, osteoporosis, degenerative diseases, scoliosis, and herniated discs, is fueling the demand for spinal implants. According to the National Institute of Health (NIH), approximately 299 million people in the US were diagnosed with degenerative disease of the lumbar spine in 2018. Furthermore, around 39 million people were diagnosed with spondylolisthesis, 403 million with symptomatic disc degeneration, and 103 million with spinal stenosis globally in the same year.

- The increasing incidence of these disorders will continue to drive the demand for spinal implants, thereby propelling market growth throughout the forecast period.

What are the market trends shaping the Spinal Implants Industry?

Rising minimally invasive procedures is the upcoming market trend.

- Minimally invasive spine ry (MISS) is gaining popularity due to its numerous benefits, including reduced tissue damage, less blood loss, and a lower risk of infection. These advantages lead to quicker patient recovery and shorter hospital stays. To facilitate minimally invasive procedures, implants specifically designed for these techniques are required. These implants are smaller and engineered to fit through the smaller incisions used in MISS. The utilization of such implants can improve patient satisfaction by minimizing postoperative pain and discomfort compared to traditional open ries.

- The faster recovery associated with MISS enables patients to resume their daily activities sooner, which is appealing to both patients and healthcare providers. The adoption of these minimally invasive procedures and implants is expected to continue due to their significant clinical and economic benefits.

What challenges does the Spinal Implants Industry face during its growth?

High costs of spinal implants and procedures is a key challenge affecting the industry growth.

- The market faces a notable hurdle due to the elevated cost of these implants and associated procedures. Spinal implants serve a crucial role in addressing various spinal conditions, such as deformities, scoliosis, fractures, and stenosis. The pricing of spinal implants is influenced by factors like brand and type, with pedicle screws priced between USD800 and USD900, and interbody cages costing up to USD7,000.

- Absorbable implants tend to be more expensive than metallic ones. This substantial cost burden not only affects healthcare providers but also patients. The overall expense of spinal procedures, which encompasses implant costs, implantation procedures, consultations, medications, and consumables, further adds to the financial strain.

Exclusive Customer Landscape

The spinal implants market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spinal implants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spinal implants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

B.Braun SE - The company specializes in providing advanced spinal implant solutions, including the S4 spinal system and lumbar fusion implants. Our offerings prioritize originality and search engine visibility, ensuring clear communication of our research-driven perspective. Examples of our product range include the S4 spinal system and lumbar fusion implants, aligning with our commitment to delivering innovative spinal healthcare solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B.Braun SE

- Globus Medical Inc.

- icotec AG

- Implanet SA

- Inion Oy

- Innovasis Inc.

- JAYON IMPLANTS Pvt. Ltd.

- Johnson and Johnson Inc.

- Medacta International SA

- Medtronic Plc

- MicroPort Scientific Corp.

- Orthofix Medical Inc.

- OrthoPediatrics Corp.

- Precision Spine Inc.

- RTI Surgical Inc.

- Stryker Corp.

- ulrich GmbH and Co. KG

- Xtant Medical Holdings Inc.

- ZAVATION

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for spinal implants continues to experience significant growth, driven by the increasing prevalence of spinal disorders and advancements in minimally invasive surgical techniques. This market encompasses a range of products, including artificial discs, dynamic stabilization devices, spinal fusion implants, and various types of plates and screws. Artificial discs and dynamic stabilization devices represent non-fusion alternatives to traditional spinal fusion procedures. These technologies aim to preserve spinal motion and flexibility, making them particularly appealing for younger patients with degenerative spinal conditions. Artificial discs, available in both cervical and lumbar varieties, mimic the natural function of the intervertebral disc.

Dynamic stabilization devices, on the other hand, provide support and stability without fusing vertebrae. Spinal fusion implants, which include stainless steel, cobalt chrome, and polyetheretherketone (PEEK) devices, remain a cornerstone of spinal ry. These implants are used to promote bone growth and stabilize the spine following fusion procedures. The materials used in these implants have evolved to prioritize biocompatibility and mechanical strength. The aging population and the resulting increase in age-related spinal disorders are major factors driving market growth. Degenerative spinal conditions, such as vertebral compression fractures, spinal bone stimulators, and spine biologics, are increasingly common among older adults.

Thoracolumbar and lumbar fusion devices, as well as cervical fusion devices, are frequently used to treat these conditions. Minimally invasive spine ries, such as balloon kyphoplasty and vertebroplasty, have gained popularity due to their reduced recovery time and lower risk of complications compared to open ries. These procedures utilize various bone substitutes, including machined bones, allograft bone, and synthetic bone grafts, to promote bone healing. Spinal trauma, including spinal cord injury, is another significant market driver. Thoracic and lumbar fusion devices, as well as cervical fixation devices, are often used to stabilize the spine following traumatic injuries.

Anterior lumbar plates, lumbar plates, pedicle screws, and hook fixation systems are commonly employed in these procedures. Advancements in spinal technologies continue to shape the market. Interbody fusion devices, interspinous process spacers, and pedicle screw-based systems have gained traction due to their ability to improve surgical outcomes and patient satisfaction. Facet replacement products, artificial cervical and lumbar discs, annulus repair devices, and nuclear disc prostheses are also gaining popularity as they offer motion preservation and reduced post-operative pain. Market dynamics are influenced by various factors, including technological advancements, regulatory approvals, and competitive landscape. The increasing prevalence of spinal disorders and the aging population continue to fuel market growth.

Additionally, the development of non-fusion technologies, such as capacitive coupling devices and combined magnetic field systems, is expected to further expand the market. In , The market is poised for continued growth due to the increasing prevalence of spinal disorders and advancements in minimally invasive surgical techniques. This market comprises a diverse range of products, including artificial discs, dynamic stabilization devices, spinal fusion implants, and various types of plates and screws. The aging population, technological advancements, and regulatory approvals are key drivers of market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 3554.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, Germany, Canada, UK, France, China, Japan, Italy, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spinal Implants Market Research and Growth Report?

- CAGR of the Spinal Implants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spinal implants market growth of industry companies

We can help! Our analysts can customize this spinal implants market research report to meet your requirements.