Stainless Steel Market Size 2023-2027

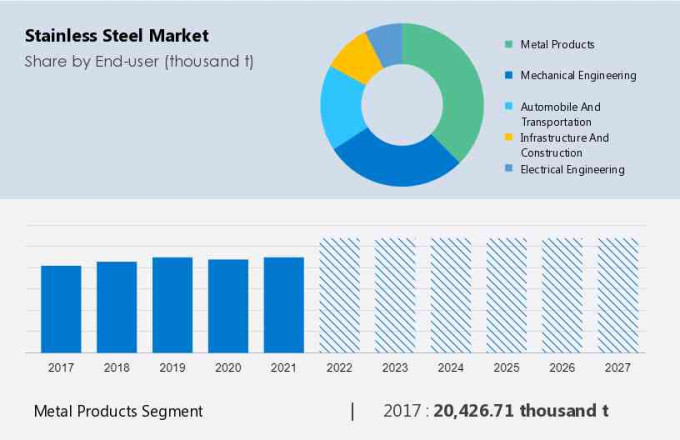

The stainless steel market size is forecasted to increase by 10,299.64 thousand tons at a CAGR of 3.38% between 2022 and 2027. Market growth relies on various factors, notably the increased consumption of high-strength stainless steel, propelled by its corrosion resistance and excellent mechanical properties. Additionally, economic expansion in China and India contributes significantly to market growth. As these nations continue to develop industrially and infrastructurally, the demand for stainless steel, particularly for construction and manufacturing applications, is expected to rise. This confluence of factors positions the market for substantial growth in the foreseeable future. Furthermore, the stainless steel market analysis report includes historic market data from 2017 to 2021. The stainless steel market forecast indicates robust expansion, driven by increasing demand for steel across various industries. The stainless steel market size growth is propelled by advancements in production technologies and the rise of sustainable manufacturing practices. Current stainless steel market trends show a surge in applications, particularly in construction and automotive sectors, underscoring its vital role in modern infrastructure.

What will be the Size of the Stainless Steel Market During the Forecast Period?

To learn more about this stainless steel market report, Download Report Sample

Stainless Steel Market Segmentation

The stainless steel market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2023 to 2027, as well as historical data from 2017 to 2021 for the following segments

- End-user Outlook

- Metal products

- Mechanical engineering

- Automobile and transportation

- Infrastructure and construction

- Electrical engineering

- Product Outlook

- Flat

- Long

- Region Outlook

- North America

- The US

- Canada

- Europe

- The UK

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East and Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East and Africa

- South America

- Argentina

- Brazil

- Chile

- North America

By End-user

The market share growth by the metal products segment will be significant during the forecast period. The use of stainless steel in metal products provides an aesthetic appeal, extensive textures, strength, functionality, corrosion resistance properties, and ease of cleaning properties such products, driving the growth of steel manufacturing. The demand for stainless steel for manufacturing metal products is high due to its ease of fabrication and mechanical properties.

Get a glance at the market contribution of various segments. Request PDF Sample

The metal products segment showed a gradual increase in the market share of 20,426.71 thousand t in 2017. Stainless steel is used in jewelry, belt buckles, clips, casings, watch straps and backs, cooker hoods, outdoor kitchen cabinets, worktops, drainers, sinks, and others. It is also used in kitchen vessels due to its hygiene properties, durability, and resilience to food discoloration and spoilage. The shift in consumer preference toward hygienic and easy-to-clean products is likely to increase the demand for stainless steel in metal products during the forecast period.

By Region

For more insights on the market share of various regions, Request PDF Sample now!

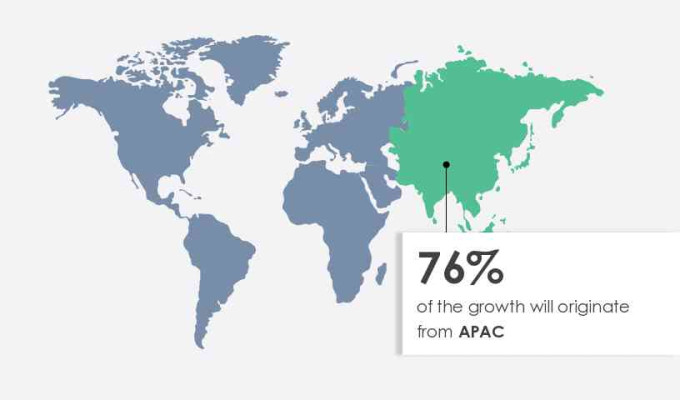

APAC is estimated to account for 76% of the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC has some of the largest stainless steel-producing countries in the world, such as China, Japan, South Korea, and India. China was the largest producer and consumer of stainless steel in 2020. Manufacturers are shifting to the consumption of scrap steel and stainless steel as raw materials to reduce pollution as well as manufacturing costs. These factors will drive the growth of the market in APAC during the forecast period.

Stainless Steel Market Dynamics

The market plays a vital role across various sectors, including residential housing, building & construction, railways, and automotive & transportation. Its resistance to corrosion surpasses that of carbon steel, making it a preferred choice. Renowned companies like Jindal Steel and Daido Steel contribute to its production capacities. Stainless steel finds applications in diverse architectural elements such as railings, roofing, and staircases, offering both pliability and appealing aesthetic properties. Moreover, it serves industrial needs like heat exchangers and tubulars, alongside providing swimming pool shades, canopies, and atriums with durability and low maintenance cost during repair and renovation. The stainless steel market forecast projects significant growth, with the stainless steel market size growth attributed to rising industrialization and urbanization. Emerging stainless steel market trends highlight the material's increased usage in green energy solutions and electric vehicles, reflecting its adaptability and environmental benefits, ensuring its continued relevance in a rapidly evolving global market.

Key Market Driver

Upsurge in consumption is notably driving market growth. The use of high-strength stainless steel is increasing in architectural, industrial, and consumer applications due to its qualities, such as affordable cost and high strength-to-weight ratio. Further, This plays vital in process industries for its durability and corrosion resistance, and is widely utilized in the production of lifts and plates, with considerations for currency fluctuations impacting its global market dynamics. Strategic positioning and branched-out product portfolios are some of the factors that will boost the sales of high-strength stainless steel during the forecast period.

Additionally, in the automotive & transportation industry, high-strength stainless steel is used for manufacturing passenger compartments as well as the crumple zone. Stainless steel, favored for its durability and corrosion resistance, is a crucial material in residential housing, building, construction, infrastructure, and process industries, where its versatile properties ensure longevity and reliability in various applications. Thus, such factors will fuel the growth of the market during the forecast period.

Significant Market Trend

The growing demand for scrap is a key trend influencing market growth. The use of scraped steel and stainless steel is increasing due to the need to reduce carbon footprint. Recycling improves the industry's economic viability and reduces the environmental impact. On average, 1.79 metric tons of CO2 is saved for each metric ton of scrap steel. Therefore, stainless steel producers prefer steel and stainless steel scrap as raw materials.

Furthermore, iron ore and steel or stainless steel scrap can be used alone or in combination with other raw materials for the preparation of stainless steel. The fluctuating prices of iron ore influence the demand for steel and stainless steel scrap. Manufacturers use steel and stainless steel scrap as major raw materials to decrease their overall cost of production. Consequently, concerns regarding global warming are propelling the use of steel and stainless steel scrap to produce stainless steel products, which will increase their demand during the forecast period.

Key Market Challenge

Volatility in raw material prices may impede market growth. The manufacturing of stainless steel depends on various commodities, metals, and industrial raw materials, including iron ore, ferrochrome, scraped steel, chromium, nickel, and others. However, the volatility in the prices of raw materials influences the profit margins of stakeholders. In January 2021, the average price of iron ore was about USD 158 per ton, which rose to USD 168 per ton in mid-2021 and declined to USD 85 per ton in November 2021. The pricing differs from one region to another based on import and export tariffs.

Additionally, the prices of stainless steel are unstable due to the volatility in raw material prices and the excess production of steel. The decline in oil prices also influences steel prices. This makes it difficult for stainless steel makers to predict raw material prices due to constant price fluctuations. Therefore, high volatility in the cost of raw materials is one of the major challenges for the market.

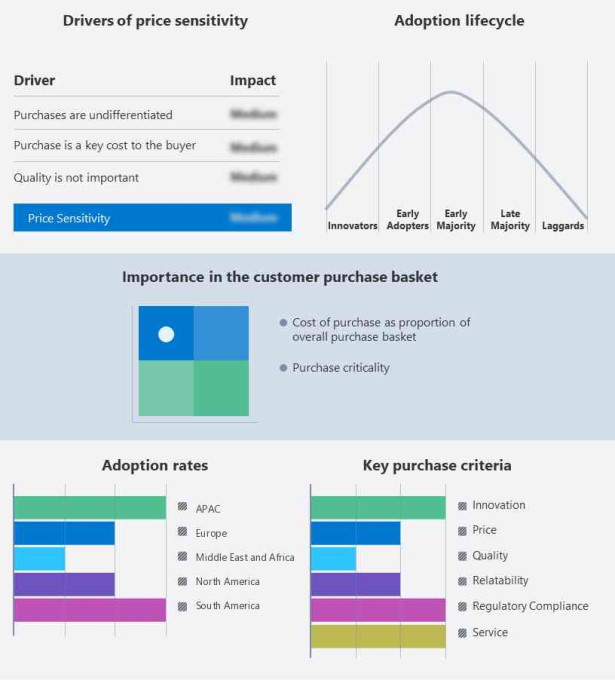

Customer Landscape

The stainless steel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the stainless steel market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Stainless Steel Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Aperam - The company offers stainless steel that is available in the form of coils and sheets, tubes, discs, flat bars, and precision strips.

The stainless steel market forecast report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Acerinox SA

- Cleveland Cliffs Inc.

- Foshan Maysky Stainless Steel Co. Ltd.

- HONG YUE STAINLESS STEEL Ltd.

- JFE Holdings Inc.

- Jindal Stainless Ltd.

- JSW STEEL Ltd.

- Mirach Metallurgy Co. Ltd.

- Nippon Steel Corp.

- Outokumpu

- Penn Stainless

- POSCO holdings Inc.

- Reliance Metalcenter

- Sandmeyer Steel Co.

- Tata Steel Ltd.

- Tsingshan Holding Group Co. Ltd.

- Ulbrich Stainless Steels and Special Metals Inc.

- WJH Stainless Steel

- Yieh Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The steel manufacturing industry serves various sectors, providing essential components for heat vessels, boilers, and power plants. Its products are integral to furnace plants, structural purposes, and infrastructure like bridges and highways. With the rise of clean energy, steel is crucial for EV charging facilities, airports, and water infrastructure. It supports communication networks and high-speed internets, contributing to carbon reduction efforts. Despite challenges like shipping costs and geopolitical conflicts, steel's low weight and high corrosion resistance make it ideal for applications ranging from aircraft parts to dairy equipment.

Further, the market is driven by diverse applications across various sectors. Processing machineries, beams, and columns rely on stainless steel for structural integrity. Despite challenges such as freight costs and trade-related tariffs, its use in pipes & fittings and HVAC systems remains essential. With a focus on clean energy & environment, stainless steel offers superior forming properties and low magnetic permeability. From cookware to architectural purposes, its non-galling and non-seizing properties ensure longevity. It finds use in containers, sterilizers, and milking machines, thanks to its resistance to stress corrosion cracking and other superior product properties.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.38% |

|

Market growth 2023-2027 |

10,299.64 thousand t |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

2.81 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 76% |

|

Key countries |

US, China, India, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acerinox SA, Aperam, Cleveland Cliffs Inc., Foshan Maysky Stainless Steel Co. Ltd., HONG YUE STAINLESS STEEL Ltd., JFE Holdings Inc., Jindal Stainless Ltd., JSW STEEL Ltd., Mirach Metallurgy Co. Ltd., Nippon Steel Corp., Outokumpu, Penn Stainless, POSCO holdings Inc., Reliance Metalcenter, Sandmeyer Steel Co., Tata Steel Ltd., Tsingshan Holding Group Co. Ltd., Ulbrich Stainless Steels and Special Metals Inc., WJH Stainless Steel, and Yieh Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our stainless steel market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Stainless Steel Industry Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this stainless steel industry report to meet your requirements. Get in touch