What is the Size of Demineralized Bone Matrix Market?

The demineralized bone matrix market size is forecast to increase by USD 521 million and market size is estimated to grow at a CAGR of 7.3% between 2024 and 2029. The market is experiencing significant growth due to the rising prevalence of orthopedic disorders, such as arthritis and traumatic injuries, in the elderly population. DBM is increasingly being used as a bone graft substitute in orthopedic surgeries due to its ability to promote bone regeneration. However, the high cost of DBM products is a major challenge limiting market growth. Product innovation and competition from alternative bone graft substitutes, such as autografts and allograft materials, also pose threats to market expansion. Disease transmission risks associated with allograft materials are a significant concern, necessitating stringent regulatory compliance. The increasing number of orthopedic surgeries and the growing prevalence of musculoskeletal disorders are expected to drive market growth. In conclusion, the market is poised for steady expansion, driven by the increasing demand for bone graft substitutes and the growing burden of orthopedic disorders in the elderly population. However, the high cost of DBM products and competition from alternative bone graft substitutes pose significant challenges to market growth.

Market Segment

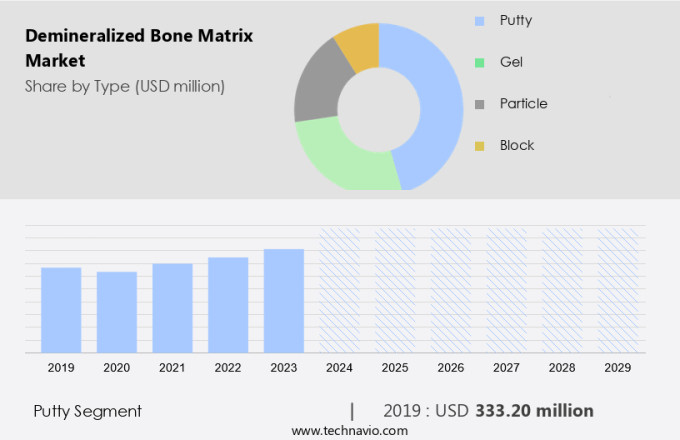

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Type

- Putty

- Gel

- Particle

- Block

- Application

- Spinal fusion surgery

- Trauma surgery

- Dental applications

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

Which is the Largest Segment Driving Market Growth?

The putty segment is estimated to witness significant growth during the forecast period. The putty segment in the demineralized bone matrix (DBM) market is experiencing notable growth due to the introduction of innovative products and regulatory approvals. DBM putty formulations are preferred for their convenience and adaptability in various orthopedic and dental procedures, aiding in bone growth and restoration.

Get a glance at the market share of various regions Download the PDF Sample

The putty segment was the largest segment and was valued at USD 333.20 million in 2019. This product features recombinant human bone morphogenetic protein 2 (rhBMP-2), which significantly contributes to bone regeneration. This approval signifies a pivotal development in the global DBM market, introducing a cutting-edge solution for improving bone healing and integration in intricate surgical procedures. In the realm of healthcare, the use of DBM allografts in addressing bone defects, such as spinal fusion, has gained considerable attention. The clinical outcomes of DBM allografts have been shown to be advantageous, leading to reduced surgical risks and increased patient satisfaction. Hence, such factors are fuelling the growth of this segment during the forecast period.

Which Region is Leading the Market?

For more insights on the market share of various regions Request Free Sample

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American market for Demineralized Bone Matrix (DBM) is experiencing significant growth due to the high prevalence of bone-related disorders, particularly in the context of orthopedic procedures, minimally invasive surgeries, and trauma care. In the United States, the incidence of bone disorders is driven by various factors, including the high number of road accidents, sports-related injuries, and traumatic injuries requiring surgical intervention. According to the National Highway Traffic Safety Administration (NHTSA), there were approximately 40,990 reported road accidents in the US in 2023, representing a 3.6% decrease from the previous year. Despite this decline, the ongoing need for effective bone graft materials in orthopedic and trauma surgeries, such as spinal fusion and joint reconstruction, continues to fuel demand for DBM products. Furthermore, advancements in cellular allografts and tissue engineering are expected to further expand the application scope of DBM in the market.

How do Technavio's company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AlloSource: The company offers Demineralized bone matrix for use in general bone grafting, orthopaedic, and spinal fusion surgeries.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Hans Biomed Co. Ltd.

- Institut Straumann AG

- Johnson and Johnson Inc.

- Medtronic Plc

- Nobel Biocare Services AG

- NovaBone Products LLC

- RTI Surgical Inc.

- SeaSpine Orthopedics Corp

- Stryker Corp.

- Xtant Medical Holdings Inc.

- Zimmer Biomet Holdings Inc.

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the Market Structure and Year-over-Year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

7.2 |

Market Dynamic

Demineralized Bone Matrix (DBM) is a vital component in the field of orthopedic medicine, particularly in the context of bone regeneration and tissue engineering. This organic material, derived from donor bones, plays a crucial role in the repair and reconstruction of various orthopedic conditions. Orthopedic procedures encompass a broad spectrum of interventions aimed at correcting or improving musculoskeletal disorders. These procedures include bone-related disorders such as osteoporosis, arthritis, and bone defects resulting from traumatic injuries, sports-related accidents, or spinal fusion surgeries. In such cases, DBM serves as an effective bone graft substitute, facilitating the natural healing process. Minimally invasive surgeries have gained significant traction in recent years due to their numerous advantages, including reduced recovery time and fewer complications. DBM, with its biocompatible and osteoconductive properties, is an ideal material for these procedures. It provides a scaffold for osteoprogenitor cells to attach, proliferate, and differentiate into new bone tissue. Spinal fusion surgeries, a common orthopedic intervention, involve the fusion of two or more vertebrae to alleviate pain and improve stability. DBM, in this context, acts as a carrier for growth factors and cells, promoting the formation of new bone tissue and aiding in the fusion process. Joint reconstruction, another area where DBM finds extensive application, is essential for restoring functionality and alleviating pain in patients with damaged or diseased joints. By providing a suitable environment for cartilage formation and bone regeneration, DBM contributes significantly to the success of these procedures. The elderly population, with an increased prevalence of orthopedic disorders, represents a significant market for DBM. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the Market Growth?

Increasing geriatric population globally drives the market. The market is witnessing notable expansion due to the rising prevalence of orthopedic procedures for bone-related disorders. Orthopedic surgeries, including minimally invasive spinal fusion surgeries, joint reconstruction, and trauma care, are major contributors to the market's growth. DBM, a bone graft substitute, offers advantages over traditional autograft bone, such as eliminating the need for harvesting bone from the patient's body, reducing surgical risks, and minimizing disease transmission.

Moreover, DBM is derived from donated human bone and undergoes a process to remove mineral content, leaving behind a porous structure that retains the bone's natural osteo-inductive potential. This biomaterial can be presented in various forms, including putty, fiber, sponge, paste, gel, and others, catering to diverse surgical requirements. The market's growth is further fueled by advancements in tissue engineering, regenerative medicine, and bioactive agents like platelet-rich plasma (PRP). The application of DBM extends beyond orthopedic surgeries to include dental surgeries and procedures for dental implants, craniomaxillofacial surgeries, and spinal procedures. Hence, such factors are driving the market during the forecast period.

What are the Significant Trends being Witnessed in the Market?

Product launches is a major trend in the market. The market is witnessing significant growth due to the increasing prevalence of orthopedic procedures for bone-related disorders, such as spinal fusion surgeries, joint reconstruction, and trauma care. Minimally invasive surgeries have gained popularity, leading to an increased demand for DBM as a bone graft substitute. DBM, derived from donated human bone, offers osteo-inductive potential, making it an ideal choice for bone regeneration.

Moreover, the elderly population, with a higher susceptibility to orthopedic disorders like osteoporosis and arthritis, is a significant market driver. However, disease transmission risks associated with allograft materials remain a concern. The market is also influenced by clinical outcomes, healthcare spending, and surgical risks. DBM finds applications in various healthcare settings, including hospitals, specialty clinics, and dental surgeries for dental implant procedures and oral diseases like tooth decay and periodontal disease.

What are the Major Market Challenges?

High cost of DBM products is a major challenge hindering the market. The market is experiencing notable growth due to its application in various orthopedic procedures for the treatment of bone-related disorders. DBM, a bone graft substitute, is widely used in minimally invasive surgeries, including spinal fusion and joint reconstruction, as well as in trauma care and sports-related injuries. DBM possesses osteo-inductive potential, making it an attractive alternative to autograft bone.

Furthermore, DBM is available in various forms such as putty, fiber, sponge, paste, gel, and synthetic bone. These biomaterials are often combined with bioactive agents like platelet-rich plasma (PRP) to enhance their regenerative properties. DBM is particularly useful in spinal fusion procedures, where it promotes cartilage formation and bone formation. Despite its benefits, the high cost of DBM products remains a significant challenge. Hence, such factors are hindering the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Demineralized bone matrix (DBM) is a valuable tool in orthopedic procedures, aiding in bone regeneration for various bone-related disorders. This biomaterial, derived from natural bone, offers osteo-inductive potential for minimally invasive surgeries, including spinal fusion and joint reconstruction. It's used in trauma care and sports-related injuries, enhancing bone graft substitutes. DBM is a crucial component in tissue engineering and regenerative medicine, working synergistically with bioactive agents, synthetic bone grafts, and cellular allografts. Elderly populations and those with orthopedic disorders, such as osteoporosis and arthritis, greatly benefit from DBM in healthcare settings. Clinical outcomes of DBM usage show improvement in bone formation and cartilage formation, reducing surgical risks and healthcare spending. DBM is applicable to diverse medical fields, including spinal procedures, dental surgeries, and craniomaxillofacial procedures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 521 million |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, UK, China, Germany, Canada, Japan, France, Brazil, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AlloSource, Hans Biomed Co. Ltd., Institut Straumann AG, Johnson and Johnson Inc., Medtronic Plc, Nobel Biocare Services AG, NovaBone Products LLC, RTI Surgical Inc., SeaSpine Orthopedics Corp, Stryker Corp., Xtant Medical Holdings Inc., and Zimmer Biomet Holdings Inc. |

|

Market dynamics |

Parent market analysis, market research and growth, market report, market forecast, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, AI impact on market trends, COVID -19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies