Spray Gun Market Size 2025-2029

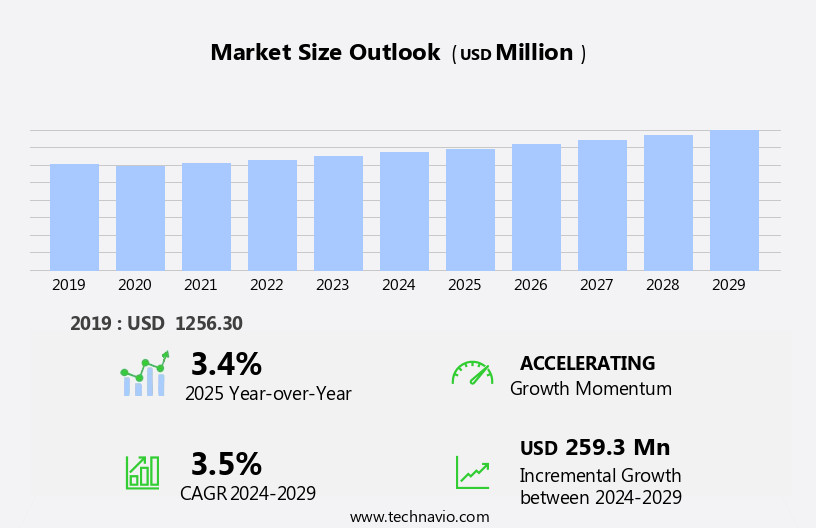

The spray gun market size is forecast to increase by USD 259.3 million, at a CAGR of 3.5% between 2024 and 2029. The market is driven by the expanding paints and coatings industry, which continues to witness significant growth due to increasing infrastructure development and urbanization. Companies in this market are capitalizing on digital transformation by leveraging e-commerce platforms to expand their market reach and penetration.

Major Market Trends & Insights

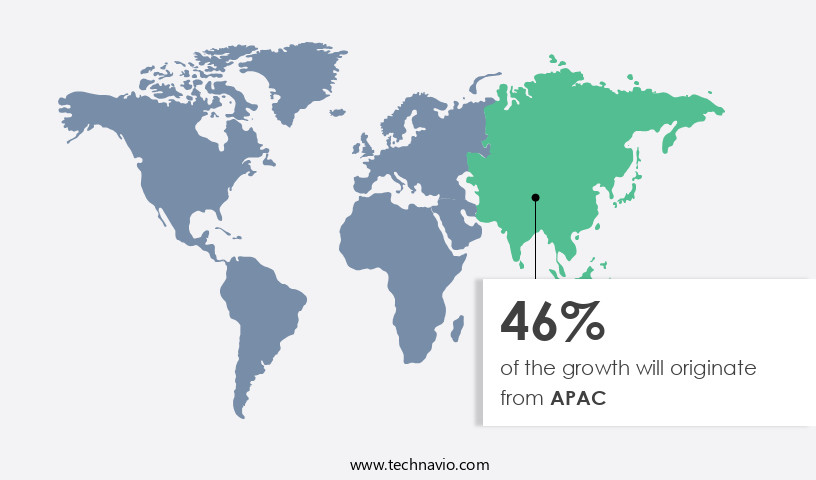

- Asia Pacific dominated the market and accounted for a 46% share in 2023.

- North America spray gun market is expected to grow significantly over the forecast period.

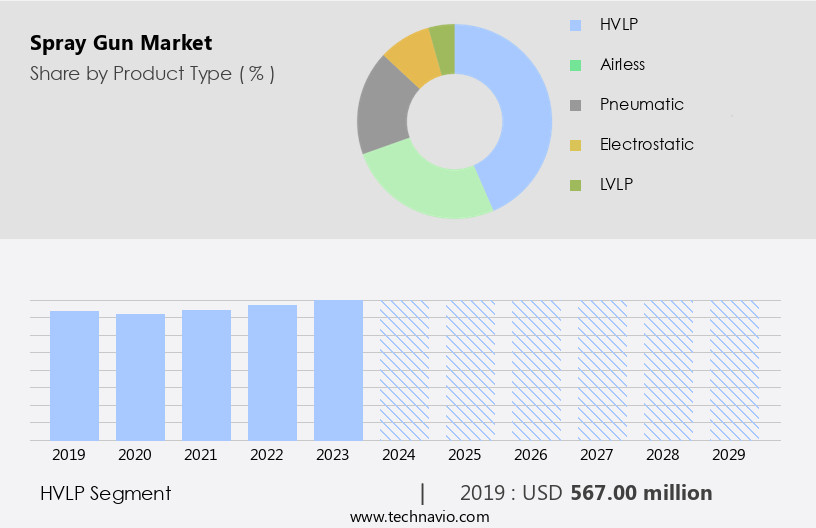

- Based on product type, the HVLP segment led the market and was valued at USD 613.2 Million of the global revenue in 2023.

- Based on type, the manual segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 1.44 Billion

- Future Opportunities: USD 259.3 Million

- CAGR (2024-2029): 3.5%

- Asia-Pacific: Largest market in 2023

The market continues to evolve, driven by advancements in atomization control and paint flow regulation. These technologies ensure efficient transfer of coatings, maintaining desired coating thickness and product finishing. Spray application methods, such as electrostatic technology and airless technology, expand the market's reach across various sectors, including automotive painting and industrial coating. Fluid dynamics and respiratory protection are crucial considerations in spray gun design. Trigger mechanisms, nozzle sizes, and power sources cater to diverse user needs. Cleaning systems and filter systems enhance the longevity and performance of spray guns. Spray pattern and application techniques are essential for surface finishing, with fan width adjustment and spray gun training enabling precision.

What will be the Size of the Spray Gun Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

High-pressure and low-pressure spray systems cater to different applications, while air compressors facilitate material delivery and material handling. Color matching and HVLP spray guns offer improved transfer efficiency and reduced overspray. Compliance regulations and material compatibility are ongoing concerns, with waste disposal and ventilation systems addressing environmental considerations. Safety features, including protective gear and spray booths, ensure safe working conditions. Spray tip cleaning and drying time are essential for maintaining optimal spray gun performance. Professional use and DIY applications require varying levels of spray gun accessories and repair services. The fluid tip's design influences spray distance, pattern control, and material delivery.

The market faces challenges from the adverse effects of paints and coatings on health and the environment. As consumers become more conscious of their impact on the planet, there is a growing demand for eco-friendly alternatives. Additionally, stringent regulations regarding the use and disposal of traditional solvent-based coatings are pushing manufacturers to innovate and develop water-based and powder coatings. To succeed in this market, companies must invest in research and development to create sustainable, high-performance coatings while complying with environmental regulations. Adopting digital strategies, such as e-commerce and automation, will also be crucial to remain competitive and meet evolving customer demands.

The airless segment is the second largest segment and was valued at USD 404.50 million in 2023. Powder coating and aerosol spray cans offer alternative coating methods. Material handling and surface preparation are crucial steps in the spraying process, ensuring optimal results. Continuous innovation in spray gun technology addresses the evolving needs of diverse industries, ensuring efficient, effective, and safe coating applications.

How is this Spray Gun Industry segmented?

The spray gun industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- HVLP

- Airless

- Pneumatic

- Electrostatic

- LVLP

- Type

- Manual

- Automatic

- Application

- Automotive

- Construction

- Woodworking

- Aerospace

- Industrial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The HVLP segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 613.20 million in 2023. It continued to the largest segment at a CAGR of 3.42%.

HVLP spray guns have gained significant traction in various industries due to their advanced features and environmental benefits. These guns employ high-volume, low-pressure technology to minimize overspray and volatile organic compound (VOC) emissions, making them compliant with stringent regulations in countries like the US and the UK. HVLP spray guns offer high transfer efficiency, ensuring more paint adheres to the surface and less is wasted. The finer atomization of paint particles results in a smoother, more even finish. HVLP technology also enables fan width adjustment and pressure regulation, catering to diverse application requirements. Training programs are available for users to master application techniques and optimize performance.

Air compressors power most HVLP spray guns, while accessories such as hoses, air caps, and filters are essential for efficient operation. HVLP spray guns are suitable for DIY use as well as industrial coating applications, including powder coating and automotive painting. Material compatibility is crucial, and manufacturers ensure their guns can handle various paint viscosities and materials. Safety features, such as respiratory protection and ventilation systems, are essential considerations. Regular maintenance, including spray gun repair and tip cleaning, is necessary to maintain optimal performance. HVLP technology also offers advantages in surface finishing, waste disposal, and low-pressure applications.

Compliance with regulations, paint mixing, and material handling are essential aspects of using HVLP spray guns effectively.

The HVLP segment was valued at USD 567.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Data suggests that the future opportunities for growth in APAC region estimates to be around USD 259.3 million.

The market in APAC is experiencing significant growth due to the increasing demand for vehicles and infrastructure projects. With over half of the world's population, the region's high population growth rate leads to a rising need for essentials like housing and transportation. Urbanization and robust economic growth further fuel this demand. For instance, in December 2024, the Ministry of Housing and Urban Affairs (MoHUA) introduced Affordable Rental Housing Complexes (ARHCs) under Pradhan Mantri Awas Yojana - Urban (PMAY-U) to provide affordable rental accommodation to migrant workers. Spray guns are essential tools for various applications, including industrial coating, powder coating, DIY use, and automotive painting.

Their functionality relies on several factors, such as atomization control, paint flow control, cleaning system, fluid dynamics, respiratory protection, spray pattern, trigger mechanism, nozzle size, power source, and hose length. Advanced technologies like electrostatic spraying, airless technology, and HVLP technology are also gaining popularity due to their efficiency and transfer efficiency. Ventilation systems, air caps, fan width adjustment, spray gun training, high-pressure spray systems, air compressors, color matching, and protective gear are other crucial aspects of the market. Compliance regulations, material compatibility, and material handling are also essential considerations for manufacturers and users. Spray guns are used extensively in various industries, including automotive, furniture finishing, and surface preparation.

Their application techniques require expertise and adherence to safety features, such as pressure regulation and fan pattern control. Proper surface preparation, spray distance, and drying time are also essential factors to ensure optimal coating thickness and product finishing. In conclusion, the market in APAC is driven by the region's population growth, urbanization, and economic development. The market's evolution is shaped by various factors, including advanced technologies, application techniques, and safety features. Proper use and maintenance of spray guns are crucial for achieving optimal results and minimizing waste disposal.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to various industries, including automotive, construction, and manufacturing, offering versatile solutions for applying coatings, paints, and sealants. These advanced tools enable efficient and precise application, ensuring high-quality finishes. Key features include adjustable pressure control, various spray patterns, and ergonomic designs. Materials used range from water-based to solvent-based, with options for high-performance coatings and eco-friendly alternatives. HVLP (High Volume, Low Pressure) and LVLP (Low Volume, Low Pressure) technologies ensure minimal overspray, reducing waste and improving cost-effectiveness. Airless spray guns offer even coverage and are ideal for thicker coatings, while air-assisted guns provide a more controlled and finer finish. Accessories like nozzles, filters, and hoses extend the functionality of spray guns, making them indispensable tools for professionals and DIY enthusiasts alike.

What are the key market drivers leading to the rise in the adoption of Spray Gun Industry?

- The paints and coatings industry, characterized by its continuous growth, serves as the primary driver for the market expansion.

- The global paints and coatings market is experiencing significant growth due to the increasing standard of living and urbanization in various regions. This trend is driving the demand for high-quality, visually appealing products, such as vehicles and furniture, leading to increased usage of spray guns for applications like powder coating and industrial coating. The APAC region, particularly China and India, is witnessing a rapid expansion in this market, fueled by a growing population, an increasing number of middle-class consumers, and urbanization. The demand for paints and coatings is particularly high in sectors like construction, automotive, and public infrastructure. Spray guns are essential tools in the application of these coatings.

- Their versatility, with adjustable fan width and paint viscosity, makes them suitable for various applications. The high-pressure spray systems used with spray guns require an air compressor for operation. To ensure the best results, users may need training and protective gear. Color matching is crucial in the application process, and advanced technologies like HVLP spray guns and airless technology facilitate this. Regular maintenance, including spray gun repair and filter system cleaning, is essential for optimal performance. Application techniques play a significant role in achieving a harmonious finish.

What are the market trends shaping the Spray Gun Industry?

- E-commerce is increasingly being used as a strategic tool to enhance market penetration, representing a significant market trend for businesses. Boosting market reach through e-commerce platforms is an essential business practice in today's digital economy.

- The market has experienced significant growth due to its increasing application in product finishing industries, particularly in automotive painting and furniture finishing. Transfer efficiency and coating thickness are crucial factors driving market demand. Pressure regulation and safety features are essential considerations for professional use. Spray gun accessories, such as spray tips and spray booths, enhance the performance and productivity of the spray gun. Surface preparation and spray distance are other essential factors influencing the market. Spray tip cleaning and drying time are crucial aspects of the spray gun's maintenance.

- With advancements in technology, spray guns offer immersive and harmonious experiences for users. Market dynamics continue to evolve, with market players focusing on improving product offerings to cater to the expanding e-commerce sector and evolving consumer preferences.

What challenges does the Spray Gun Industry face during its growth?

- The growth of the paints and coatings industry is significantly impacted by the potential adverse effects on both human health and the environment. It is essential to address these concerns through the implementation of sustainable manufacturing processes and the development of eco-friendly products to mitigate any negative impacts and ensure industry progression.

- The market faces challenges due to the health and environmental concerns arising from the use of harmful chemicals in coatings and paints. These substances, which include isocyanates, solvents, and pigments, can negatively impact human health and the environment when released. Isocyanates, used in clearcoats and primers, are particularly hazardous, even in small quantities. VOCs from paint thinners can significantly harm the environment. To mitigate these issues, advanced technologies like electrostatic spraying, HVLP (High Volume, Low Pressure) technology, and airless sprayers are being adopted. These methods improve pattern control, fan pattern, material delivery, and material handling, while reducing material waste and ensuring material compatibility.

- Compliance with regulations regarding paint mixing and waste disposal is also crucial for market participants.

Exclusive Customer Landscape

The spray gun market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spray gun market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spray gun market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing advanced spray gun systems, including the 3M Performance spray gun system with PPS 2 sales kit, 3M Accuspray HGP spray gun kit, and 3M Accuspray ONE spray gun. These innovative solutions enhance painting efficiency and deliver superior coating results. Our expertise lies in offering top-tier, research-backed spray gun technologies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- ANEST IWATA Corp.

- Asahi Sunac Corp.

- Bullows Paint Equipment Pvt. Ltd.

- Carlisle Companies Inc.

- Everest Industrial Corp.

- Fuji Industrial Spray Equipment Ltd.

- Graco Inc.

- J Wagner GMBH

- JMD International

- Ningbo Lis Industrial Co. Ltd.

- Nordson Corp.

- Prowin Tools Co.

- SATA GmbH and Co. KG

- Sindhu Enterprises

- Technochem Industries

- V. R. Coatings Pvt. Ltd.

- Willson Enterprise

- Zhejiang Auarita Pneumatic Tools LLC

- Zhejiang Rongpeng Air Tools Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Spray Gun Market

- In January 2024, Graco Inc., a leading manufacturer of spray guns and equipment, announced the launch of its new line of airless spray guns, the ProX19, designed for industrial and commercial applications (Graco Press Release). In March 2024, PPG Industries, another major player in the market, entered into a strategic partnership with 3M to co-develop and commercialize advanced coating technologies, including spray gun systems, for the automotive refinish industry (PPG Industries Press Release).

- In May 2024, Wagner Spray Tech, a subsidiary of PPG Industries, completed the acquisition of the spray gun business of Italian company, Same De Cervia, expanding its product portfolio and market presence in Europe (Wagner Spray Tech Press Release). In February 2025, Axalta Coating Systems received regulatory approval from the European Chemicals Agency for its new line of waterborne spray guns, further strengthening its commitment to sustainable coating solutions (Axalta Coating Systems Press Release). These developments underscore the market's ongoing focus on innovation, strategic partnerships, and geographic expansion to cater to evolving customer needs and regulatory requirements.

Research Analyst Overview

- In the dynamic the market, calibration plays a crucial role in ensuring optimal performance and consistent results. Spray gun stands facilitate this process, providing stability and ease of access for technicians. Paint spraying techniques continue to evolve, with overspray reduction techniques gaining traction to minimize material waste and improve transfer efficiency. Eye protection, remote control systems, and protective clothing are essential safety measures in spray gun applications. Robotic spraying systems and automated spraying systems are increasingly integrated into production lines for enhanced productivity and energy efficiency. HVLP compressors, fluid meters, and air regulators are integral components of high-volume low-pressure (HVLP) systems, which offer material savings and reduced paint waste.

- Powder coating equipment, paint cups, and airless spray tips are essential for applying thick, even coats. Internal mix and external mix systems cater to various application requirements, while pressure pots and spray pattern adjustment ensure precise application. UV coatings, digital control systems, and improved transfer efficiency are emerging trends in the market. Surface cleaning agents and air-assisted airless technology contribute to better adhesion and smoother finishes. Respirator masks and improved filtration systems ensure a safer working environment. Overall, the market is driven by advancements in technology and a focus on material savings and energy efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Spray Gun Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 259.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.4 |

|

Key countries |

US, China, Japan, India, South Korea, Germany, Canada, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spray Gun Market Research and Growth Report?

- CAGR of the Spray Gun industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spray gun market growth of industry companies

We can help! Our analysts can customize this spray gun market research report to meet your requirements.