Automotive Paints and Coatings Market Size 2024-2028

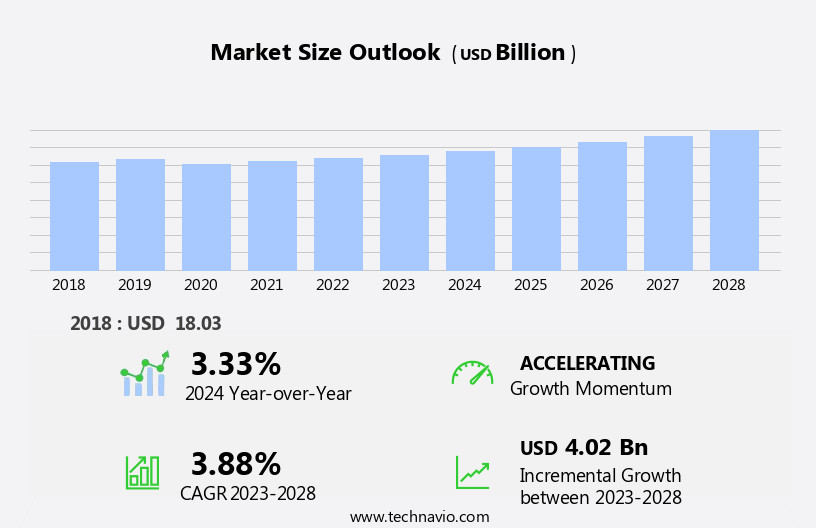

The automotive paints and coatings market size is forecast to increase by USD 4.02 billion at a CAGR of 3.88% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for innovative and specialty coatings. Coating additives offer superior protection and unique features such as self-healing and self-cleaning capabilities.

- Additionally, stringent environmental regulations are driving the market towards the development of eco-friendly coatings. These regulations aim to reduce the amount of volatile organic compounds (VOCs) in paints and coatings, making them more sustainable and environmentally friendly.

- The market is expected to continue growing as automakers and consumers prioritize the use of advanced coatings to enhance the aesthetic appeal and durability of vehicles.

What will be the Automotive Paints and Coatings Market Size During the Forecast Period?

- The market encompasses a diverse range of products used in the production and refinishing of passenger cars, light commercial vehicles, and electric vehicles. Key market drivers include advancements in technology, such as the adoption of powder coating and UV protection for enhanced color retention and durability. However, increasing focus on reducing VOC emissions and air pollution has led to the proliferation of waterborne paints and water-soluble paints.

- Furthermore, the integration of autonomous technologies in vehicle production necessitates coatings that can withstand varying temperatures, acid rains, and dust. The OEM segment dominates the market, with auto manufacturers continually seeking high-performance coatings for improved vehicle quality and consumer appeal.

- Automotive clearcoats, a critical component of the coating type, ensure superior UV protection and resistance to scratches and chips. VOC regulations continue to shape the market, with stringent norms driving innovation in low-emission coatings. The refinish industries also contribute significantly to market growth, as the need for high-quality, long-lasting coatings remains paramount in maintaining the appearance and value of vehicles.

How is this Automotive Paints and Coatings Industry segmented and which is the largest segment?

The automotive paints and coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Heavy commercial vehicles

- Product

- Solvent-based products

- Water-based products

- Other technology-based products

- Geography

- APAC

- China

- India

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

Automotive paints and coatings play a crucial role in enhancing the appearance and protecting the exterior surfaces of passenger cars. Manufacturers provide various color options and finishes, catering to consumers' preferences and enabling personalization. Brands use unique paint colors as a marketing strategy to distinguish their vehicles. Specialty coatings, such as clearcoats and protective films, ensure scratch and chip resistance, preserving the vehicle's appearance and resale value. Clearcoats offer an extra layer of defense against minor damages caused by road debris. Additionally, environmental concerns have led to the increasing popularity of waterborne paints, which emit fewer volatile organic compounds (VOCs) compared to solvent-borne paints, contributing to reduced air pollution.

Epoxy resin and polyurethane-based coatings provide improved performance and longer durability. Key players In the market include AkzoNobel, Axalta, Berger Paints, and Sherwin-Williams. The automotive industry's growing production, particularly in light commercial vehicles, and the rising demand for sustainable refinish services further fuel the market's growth.

Get a glance at the Automotive Paints and Coatings Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 12.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to the expanding automotive industry in countries like China, India, Japan, and South Korea. Increased urbanization, rising disposable incomes, and infrastructure development are driving the demand for passenger cars, commercial vehicles, and two-wheelers, leading to increased consumption of paints and coatings for vehicle assembly and finishing. Moreover, the region is witnessing a shift towards electric vehicles (EVs) as governments and consumers prioritize sustainability. In the automotive OEM segment, there is a growing trend towards waterborne paints, epoxy resins, and polyurethane-based coatings for their improved appearance, high gloss, longer period, and environmental benefits.

The automotive production sector, including auto manufacturers and refinish industries, is also adopting sustainable practices such as digital color-matching solutions, training programs, and VOC regulations to minimize environmental impact. Additionally, the market is witnessing a rising demand for advanced and luxury vehicles, requiring automotive clearcoats for UV protection, color retention, and a gloss finish to ensure an excellent exterior appearance. The automotive production sector's growth is expected to continue due to increasing vehicle production and the need for lighter, more durable coatings that can withstand environmental factors such as acid rains, dust, and water.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Paints and Coatings Industry?

Increasing demand for innovative and specialty automotive paints and coatings is the key driver of the market.

- The market is experiencing significant growth due to the increasing production of passenger cars and light commercial vehicles. Automakers are focusing on enhancing the aesthetics and performance of vehicles by introducing advanced technologies in coatings, such as waterborne paints, powder coating, and epoxy resin systems. These coatings offer improved appearance, longer period durability, and better UV protection and color retention. Environmental concerns have led to stricter regulations on VOC emissions and air pollution, driving the demand for waterborne coatings. Lead-free and low VOC epoxy-based coatings, such as those offered by PPG Industries Inc, are gaining popularity. High-tech polymer-based coatings, applied using air guns and high-volume, low-pressure guns, are used in modern vehicles to ensure a glossy finish and longer-lasting exterior appearance.

- Moreover, the rise in automotive production, particularly In the premium segment, is fueling the demand for coatings. Auto manufacturers are partnering with coating companies to develop sustainable refinish services and digital color-matching solutions. These collaborations also include training programs to ensure the highest quality standards are maintained. The market for automotive clearcoats is expected to grow significantly due to the increasing demand for luxurious vehicles. Polyurethane-based coatings and polyester-based coatings are popular choices for their high gloss finish and improved resistance to environmental factors. Acrylic-based coatings are also gaining popularity due to their cost-effectiveness and ease of application.

- In summary, the market is witnessing a rising demand due to the increasing production of passenger cars and light commercial vehicles, the need for sustainable and environmentally-friendly coatings, and the growing popularity of advanced technologies in coatings. The market is expected to continue growing as automakers focus on enhancing the appearance and performance of their vehicles while reducing their environmental impact.

What are the market trends shaping the Automotive Paints and Coatings Industry?

Emergence of self-healing and self-cleaning coatings is the upcoming market trend.

- The market encompasses various types of coatings used In the production and refinishing of passenger cars, including electric vehicles (EVs). Two prominent coating types are powder coating and electrocoats, which cater to the unique requirements of EVs and advanced vehicles. Environmental concerns, such as VOC emissions and air pollution, have led to the increasing popularity of waterborne paints, which contain fewer solvents than solvent-borne paints. Self-healing and self-cleaning coatings are gaining traction due to their ability to maintaIn the aesthetics and performance of vehicles. Axalta, AkzoNobel, Sherwin-Williams, Berger Paints, and other market players offer a range of coatings, including epoxy resin, polyurethane-based, acrylic-based, and polyester-based coatings.

- Vehicle production is on the rise, driven by increasing demand for automobiles and light commercial vehicles. Self-healing coatings help restore scratched areas, while self-cleaning coatings repel dirt and other contaminants, ensuring a longer lifespan for the paintwork. Waterborne coatings, such as those based on epoxy resin systems and acrylic-based coatings, are increasingly being adopted due to their environmental benefits and improved appearance with high gloss finishes. The market is expected to continue growing, driven by the rising demand for automotive production, sustainable refinish services, and digital color-matching solutions. Eastman Chemical and other key players are investing in research and development to create advanced coatings with enhanced UV protection, color retention, and longer periods of protection.

- The market dynamics are influenced by factors such as VOC regulations, auto manufacturers' preferences, and consumer trends. Self-healing and self-cleaning coatings offer significant benefits for both OEM and refinish industries, ensuring a glossy finish and longer-lasting exterior appearance for vehicles.

What challenges does the Automotive Paints and Coatings Industry face during its growth?

Stringent environmental regulations for automotive paints and coatings is a key challenge affecting the industry growth.

- In the automotive industry, coatings manufacturers face the challenge of meeting stringent environmental regulations while maintaining the performance, durability, and aesthetic properties of their products. Compliance with regulations, such as those related to VOC emissions and air pollution, can result in significant costs for manufacturers. These costs may include investments in research and development, process improvements, and emissions control technologies. To comply with regulatory limits, coatings manufacturers are reformulating their products using alternative solvents and raw materials. For instance, waterborne paints are increasingly popular due to their lower VOC emissions compared to solvent-borne paints. Epoxy resin systems and polyurethane-based coatings are also gaining popularity due to their improved performance and longer period of protection.

- Moreover, the rise in automotive production, particularly In the OEM segment for passenger cars and light commercial vehicles, is driving the demand for automotive paints and coatings. Advanced vehicles, including electric vehicles (EVs), require specialized coatings for UV protection, color retention, and gloss finish. Coating types, such as electrocoats and automotive clearcoats, are essential for vehicle production. Manufacturers must also consider the environmental impact of coatings beyond VOC emissions. Coatings can contribute to air pollution during application and curing, and waterborne paints may contain heavy metals that can harm aquatic life if not disposed of properly. Sustainable refinish services and digital color-matching solutions can help mitigate these issues.

- Training and education are crucial for coatings manufacturers and refinish industries to stay informed of the latest regulatory requirements and technological advancements. Companies like Axalta, AkzoNobel, Berger Paints, Sherwin-Williams, and Chemetell are investing in research and development to create innovative, eco-friendly coatings that meet the evolving needs of the automotive industry. In summary, the market is undergoing significant changes due to environmental regulations and the rising demand for sustainable coatings. Manufacturers must invest in research and development, process improvements, and emissions control technologies to meet regulatory requirements while maintaining performance and aesthetics. The use of alternative solvents, raw materials, and coating technologies is essential to create eco-friendly coatings that meet the evolving needs of the automotive industry.

Exclusive Customer Landscape

The automotive paints and coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive paints and coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive paints and coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3M Co. - The automotive paint and coatings market encompasses a range of products designed to enhance and protect vehicle surfaces. Among these offerings are solutions from leading industry innovators, such as 3M's polyester thinner, rust preventer spray, and dry guide coat. These advanced coatings optimize paint application and adhesion, ensuring a flawless finish. Additionally, 3M's Scotchcast electrical resin provides superior electrical insulation for automotive wiring systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Arkema Group

- Axalta Coating Systems Ltd.

- Clariant International Ltd.

- Colors Co. for Paints

- Covestro AG

- Diamond Vogel

- Durr AG

- Jotun AS

- Kansai Paint Co. Ltd.

- KCC Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin Williams Co.

- WEG Equipamentos Eletricos S.A.

- YATU ADVANCED MATERIALS CO., LTD.

- Henkel AG and Co. KGaA

- BASF SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of products utilized In the manufacturing and refinishing of vehicles. These coatings serve multiple purposes, including enhancing the aesthetic appeal, providing protection against environmental elements, and ensuring durability. Coatings play a crucial role in automotive production, with various types catering to distinct requirements. For instance, solvent-borne paints have traditionally been popular due to their high gloss finish and excellent color retention. However, the shift towards more sustainable production methods has led to the increasing adoption of waterborne paints, which offer several advantages. Environmental concerns have been a significant driving force In the evolution of the market.

VOC (Volatile Organic Compound) emissions from solvent-borne paints contribute to air pollution and are detrimental to human health. In response, regulatory bodies have imposed stringent VOC regulations, compelling manufacturers to explore alternatives. Waterborne paints, on the other hand, offer a more eco-friendly solution. They emit fewer VOCs, making them a preferred choice for automotive OEMs (Original Equipment Manufacturers) and refinish industries. Furthermore, they are less susceptible to dust and water, ensuring better UV protection and longer periods of color retention. The market is diverse, with various types catering to different segments. For instance, epoxy resin systems are commonly used for primers due to their excellent adhesion properties.

Polyurethane-based coatings are popular for their improved appearance and longer durability. Acrylic- and polyester-based coatings offer cost-effective solutions with good color retention and UV protection. The market dynamics are influenced by several factors, including the rising demand for advanced and luxurious vehicles, the increasing automotive production, and the need for sustainable refinish services. Digital color-matching solutions and training programs have become essential tools for ensuring consistent and high-quality finishes. Moreover, the market is witnessing the emergence of innovative technologies, such as electrocoats and powder coatings. Electrocoats offer superior corrosion protection, while powder coatings provide a durable, uniform finish with minimal environmental impact.

The market is a dynamic and evolving landscape, driven by technological advancements, regulatory requirements, and consumer preferences. Manufacturers must continually innovate to meet the changing demands and expectations of the industry. In conclusion, the market plays a vital role In the production and refinishing of vehicles. With a focus on sustainability, performance, and aesthetics, the market is poised for continued growth and innovation.

|

Automotive Paints and Coatings Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.88% |

|

Market growth 2024-2028 |

USD 4.02 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.33 |

|

Key countries |

US, China, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Paints and Coatings Market Research and Growth Report?

- CAGR of the Automotive Paints and Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive paints and coatings market growth of industry companies

We can help! Our analysts can customize this automotive paints and coatings market research report to meet your requirements.