Spunbond Nonwoven Market Size 2024-2028

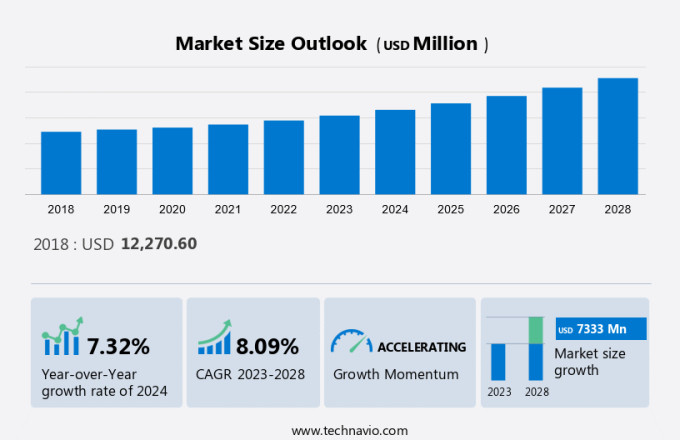

The spunbond nonwoven market size is estimated to increase by USD 7.33 billion and grow at a CAGR of 8.09% between 2023 and 2028. Market expansion hinges on various factors, notably the robust demand for nonwoven materials in APAC, the increasing utilization of geotextiles in infrastructure projects, and the expansion of the global textile sector. However, challenges persist, such as the susceptibility of PP to UV degradation, price fluctuations in raw materials, and heightened reliance on government approvals. Overcoming these hurdles necessitates strategic approaches to mitigate PP's vulnerability to UV, stabilize raw material costs, and diversify sourcing channels. Moreover, reducing dependence on government authorization through proactive engagement with regulatory bodies and fostering innovation in material development can bolster market resilience. By addressing these challenges effectively, the nonwoven materials market can capitalize on burgeoning demand drivers and sustain its growth trajectory amidst evolving market dynamics.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Segmentation

By Type

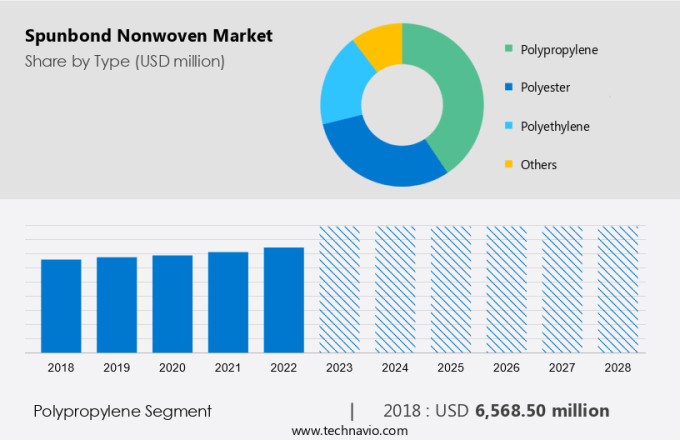

The market share growth by the polypropylene segment will be significant during the forecast period. PP-based spunbond nonwoven fabrics accounted for the highest revenue share. Some of its major applications include hygiene, medical, and geotextiles. The growing demand for surgical and medical face masks is expected to drive the segment's growth.

Get a glance at the market contribution of various segments View the PDF Sample

The polypropylene segment was valued at USD 6.57 billion in 2018. Geotextiles in the form of staple fibers are made from PP-based spunbond nonwovens. An irregularly woven mesh of polypropylene fibers gives the fabric high strength. These fibers can withstand UV rays. Plus, it won't mold or corrode when encountering inert chemicals in the soil. Additionally, the fibers are non-biodegradable and resistant to insect and rodent damage. These properties allow polypropylene fibers to filter water and drain it into the soil, strengthen the soil, and protect it from erosion. Such factors are expected to increase the demand for PP, which will have a positive impact on the market during the forecast period.

Key Regions

For more insights on the market share of various regions Download PDF Sample now!

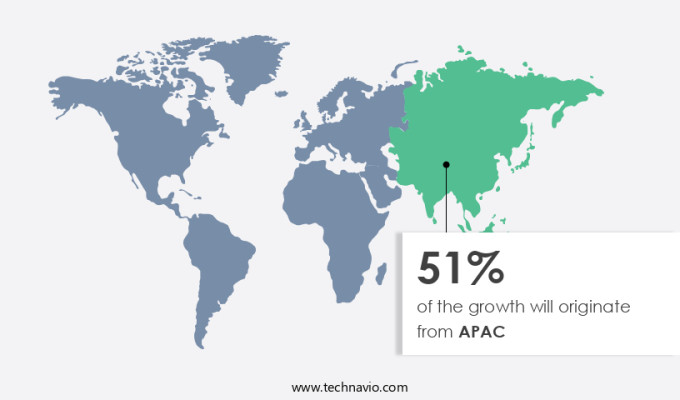

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Most of the demand comes from Northeast Asia, followed by the Indian subcontinent and Southeast Asia. This is due to the enormous contribution of the hygiene, health and geotextile industries. There are many manufacturers of sanitary napkins and hygiene products in China, such as Hengan, Vinda, C and S, Daddybaby. These end-users focus on expanding their operations in Southeast Asia and other overseas regions to increase their market share, thereby increasing the demand for various products in this region.

Market Dynamics and Customer Landscape

The market serves diverse sectors, including medical, hygiene, and beyond, driving innovation and meeting evolving needs. Spunbond nonwovens, like Polypropylene, polyester, and polyethylene, are integral to producing essential items such as face masks, isolation gowns, and wipes, ensuring hygiene and protection in the medical industry and personal care realm. With their inherent flexibility and durability, these materials also find applications in agriculture, packaging, and even automotive sectors. Moreover, their adoption contributes to addressing various challenges, from maintaining cleanliness in healthcare settings to providing comfort and protection in adult incontinence products. As the demand for hygiene and medical products continues to rise, spunbond nonwovens remain at the forefront, supporting essential industries worldwide.

Key Market Driver

One of the key factors driving growth in the market is the strong demand for nonwoven fabric in APAC. The demand for finished goods in APAC witnessed an increase, regardless of a slowdown in the export business. The domestic consumption of textiles and clothing expanded to approximately two-thirds of the total supply. The increasing urbanization in China and increasing per capita consumption of spunbond nonwoven by the end-user industries in China have driven the expenditure on clothing.

Moreover, the markets in India and Pakistan are smaller than that of China as the major markets are still untapped in these countries. The current aggressive development of downstream polymer activities by companies such as Reliance Industries and Indorama Ventures is expected to drive the consumption during the forecast period.

Significant Market Trends

Sustainable production is the primary trend in the global market. The demand for eco-friendly textile products is increasing, and numerous companies have adopted eco-friendly practices. They have started producing eco-friendly products, which would ensure the safety of consumers and the environment. The increasing awareness among companies and consumers regarding the impact of non-sustainable products on the environment and human health are factors that drive the demand for sustainable products.

Moreover, there is a shift in preference from petroleum-based non-biodegradable synthetic fibers like polyester to renewable and biodegradable synthetic fibers manufactured from natural resources like polylactic acid and lyocell. The awareness of the rising environmental issues and the availability of numerous alternatives have compelled manufacturers in the industry to practice sustainability by adopting textile fibers. This will create new growth opportunities for the vendors in the global market during the forecast period.

Major Market Challenge

The high UV degradation of PP will be a major challenge for the market during the forecast period. PP has many advantages, such as cost-effectiveness, flexural strength, low coefficient of friction, and chemical resistance, but it is prone to UV degradation. The polymer structure of PP is a single chain, and this bond tends to break when exposed to sunlight and heat. This UV degradation can occur during road construction operations.

However, though PP geotextiles are predominantly used in road construction activities owing to their good fatigue resistance, their demand is likely to hamper due to UV degradation owing to the high exposure of roads to harsh environment and heat. Such factors will pose a challenge to the market during the forecast period.

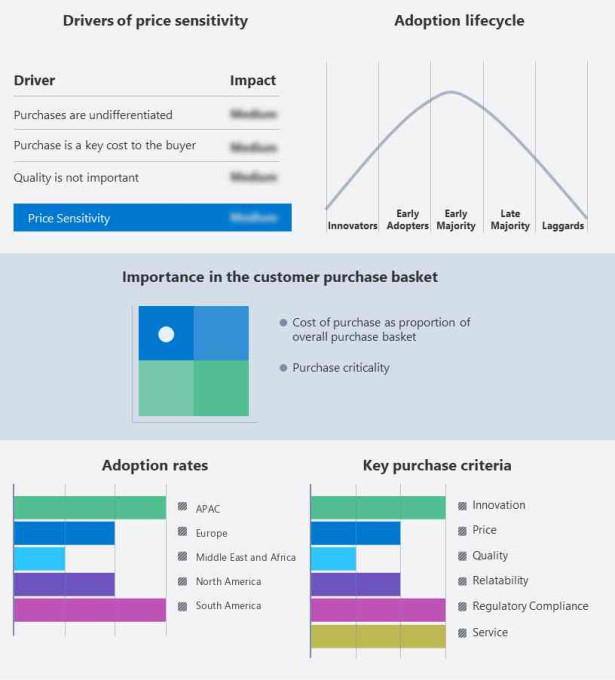

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Advance Nonwoven Vietnam Co. Ltd.: The company offers spunbond nonwoven products such as BioPBS.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Ahlstrom Munksjo Oyj

- Alpha Foam Ltd.

- Asahi Kasei Corp.

- Avgol Ltd.

- Berry Global Inc.

- CHTC Jiahua Nonwoven Co. Ltd.

- DuPont de Nemours Inc.

- FIBERWEB India LTD.

- Fitesa SA

- Kimberly Clark Corp.

- Mitsui Chemicals Inc.

- Mogul Co. Ltd.

- PFNonwovens AS

- Radici Partecipazioni Spa

- Schouw and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- Polypropylene

- Polyester

- Polyethylene

- Others

- Application Outlook

- Personal care and hygiene

- Medical

- Agriculture

- Packaging

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Market Analyst Overview

The market experiences significant growth driven by its versatile applications across various segments, notably the medical and personal care industries. Spunbond nonwovens find extensive use in isolation gowns, surgical gowns, bandages, and wipes, offering flexibility, durability, and lightweight properties. They cater to the rising demand for disposable products in the medical segment, driven by factors like the increasing birth rate and adoption of spunbond nonwovens in baby diapers and adult incontinence products. Additionally, spunbond nonwovens play a vital role in the automotive industry, enhancing the interior of automobiles with materials like polyester fabric and polyamides. With advantages including enhanced filtration and erosion control, spunbond nonwovens are increasingly favored across various sectors, driving market growth amidst evolving consumer preferences and infrastructure development. Infectious disease training is crucial for cleaning professionals, especially in industries like crude oil and personal care & hygiene products manufacturing. PF Nonwovens and First Quality Nonwovens are pioneering companies in producing spunbond nonwoven materials, revolutionizing the industry's standards.

Further, the adoption of spunbond nonwoven has enhanced the efficiency of cleaning processes, offering superior protection against infectious agents. Cleaning professionals trained in handling such materials ensure the maintenance of stringent hygiene standards, vital for public health and safety. As the demand for quality hygiene products continues to rise, proficiency in utilizing advanced materials like spunbond nonwovens becomes increasingly indispensable in the cleaning industry. The market thrives across various sectors, including medical, personal care, and beyond. With its versatile applications, it caters to the diverse needs of medical segments and the personal care & hygiene industry. Spunbond nonwovens are integral in producing essential items like disposable face masks, gloves, and personal care products, ensuring durability and hygiene. They are also pivotal in the healthcare sector, where their adoption enhances the production of medical care products. Additionally, spunbond nonwovens offer environmental benefits, contributing to the reduction of waste in landfills. With their numerous advantages, including adaptability to changing consumer preferences and extended shelf life, spunbond nonwovens remain indispensable in various applications, from transportation infrastructure to mining and oil drilling sites.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 7.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 51% |

|

Key countries |

US, China, India, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advance Nonwoven Vietnam Co. Ltd., Ahlstrom Munksjo Oyj, Alpha Foam Ltd., Asahi Kasei Corp., Avgol Ltd., Berkshire Hathaway Inc., Berry Global Inc., CHTC Jiahua Nonwoven Co. Ltd., DuPont de Nemours Inc., Fiberwebindia Ltd., Fitesa S.A. and Affiliates, Kimberly Clark Corp., Mitsui Chemicals Inc., Mogul Co. Ltd., PFNonwovens Holding s.r.o., Radici Partecipazioni Spa, Schouw and Co., Sunshine Nonwoven Fabric Co. Ltd., Ultra Nonwoven, and Unitika Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecasting Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch