Polypropylene Nonwoven Fabric Market Size 2024-2028

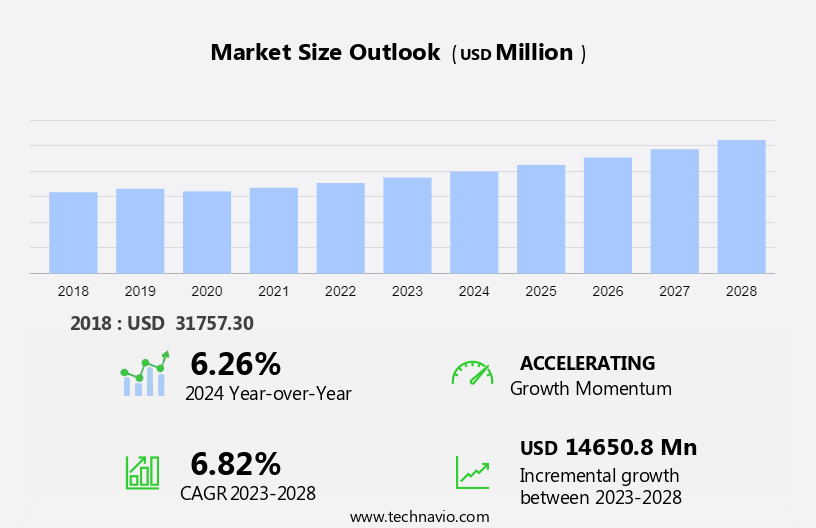

The polypropylene nonwoven fabric market size is forecast to increase by USD 14.65 billion, at a CAGR of 6.82% between 2023 and 2028.

- The market is characterized by robust growth in Asia Pacific, driven by the region's high demand for nonwoven fabrics. This trend is fueled by the increasing adoption of these fabrics in various industries, including healthcare, hygiene, and construction, due to their versatility and durability. However, the market faces a significant challenge in the form of high UV degradation of polypropylene, which can impact the fabric's lifespan and overall performance. This issue may necessitate the development of advanced polypropylene formulations or alternative fabric materials to mitigate its impact.

- Companies in the market can capitalize on the growing demand in Asia Pacific while investing in research and development to address the challenge of UV degradation. By doing so, they can effectively navigate market opportunities and maintain a competitive edge.

What will be the Size of the Polypropylene Nonwoven Fabric Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in fabric technology and increasing demand across various sectors. Polypropylene fiber's unique properties, such as high tensile strength and UV resistance, make it a preferred choice for numerous applications. For instance, needle-punched fabric density and fabric weight measurement are crucial factors in the production of heavy-duty geotextiles, which experienced a 10% sales increase last year. Furthermore, thermal bonding techniques, roll-to-roll processing, and filtration efficiency are essential aspects of producing high-quality nonwoven fabrics. In the healthcare sector, bacterial filtration efficacy and sterilization compatibility are vital considerations. The industry anticipates a 5% annual growth rate, fueled by innovations in fabric coating techniques, nonwoven fabric lamination, and hydrophilic polypropylene treatment.

Durability testing methods, such as heat sealing parameters and meltblown polypropylene process, ensure the longevity of nonwoven fabrics. Additionally, fabric softness assessment, fabric drape characteristics, and airlaid nonwoven production cater to the growing demand for comfortable and sustainable textiles. Cutting and converting technologies, spunbond nonwoven technology, and fabric permeability testing further enhance the versatility of polypropylene nonwoven fabrics. Quality control procedures, fiber orientation analysis, water absorption capacity, roll goods dimensions, fabric breathability metrics, flame retardant treatment, antimicrobial fabric finish, and ultrasonic welding process are all essential elements in maintaining the superiority of polypropylene nonwoven fabrics in the market.

How is this Polypropylene Nonwoven Fabric Industry segmented?

The polypropylene nonwoven fabric industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Spunbonded

- Staple

- Melt blown

- Composite

- Application

- Hygiene

- Medical

- Geotextile

- Furnishings

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

The spunbonded segment is estimated to witness significant growth during the forecast period.

The market is driven by the widespread use of this fabric in various industries, including healthcare, filtration, and industrial applications. Spun-bonded polypropylene nonwoven fabric, in particular, is leading the market due to its cost-effectiveness and versatility. This segment is extensively used in baby and feminine hygiene products, making up a significant market share. The fabric's production process involves spinning fibers and directly dispersing them into a web using deflectors or air streams, reducing manufacturing costs. Compared to polyethylene terephthalate spun-bonded nonwoven fabric, polypropylene is easier to process. In the healthcare sector, Ahlstrom-Munksjo is a notable player, producing nonwoven medical fabrics for surgical gowns, sterilization wraps, drapes, protective apparel, face masks, and coveralls.

The UV resistance properties and high filtration efficiency of polypropylene nonwoven fabric make it an ideal choice for protective clothing. Furthermore, the fabric's durability is tested using various methods, ensuring its longevity in industrial applications. The market is expected to grow at a steady pace, with increasing demand for nonwoven fabrics in various industries. For instance, the filtration industry is projected to witness significant growth due to the rising demand for cleaner air and water. Additionally, the development of new technologies, such as hydroentanglement and thermal bonding, is expected to further boost the market's growth. Polypropylene nonwoven fabric's properties, such as high tensile strength, lightweight, and softness, make it a popular choice for various applications.

The fabric's structure can be customized using techniques like lamination, coating, and airlaid production, catering to specific industry requirements. The fabric's thermal properties can be enhanced using heat sealing parameters and ultrasonic welding processes. The fabric's chemical resistance rating and sterilization compatibility make it suitable for industrial applications. Quality control procedures, such as fiber orientation analysis and water absorption capacity testing, ensure the fabric's consistency and reliability. The fabric's breathability metrics and flame retardant treatment add to its desirable features, making it a preferred choice for various industries. For instance, the meltblown polypropylene process is used to produce filters with high filtration efficiency, making it a popular choice for the filtration industry.

The fabric's hydrophilic treatment enhances its absorbency, making it suitable for applications like diapers and absorbent pads. The fabric's drape characteristics and roll goods dimensions are customizable, catering to various industry requirements. The market is witnessing significant growth due to its versatility and wide range of applications. The fabric's properties, such as high tensile strength, UV resistance, and filtration efficiency, make it a preferred choice for various industries, including healthcare, filtration, and industrial applications. The market is expected to continue growing, driven by advancements in production technologies and increasing demand for sustainable and cost-effective fabric solutions.

The Spunbonded segment was valued at USD 11.94 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the unique properties of polypropylene fiber, including high tensile strength, UV resistance, and chemical resistance. The fabric's needle-punched density and various thermal bonding techniques enable excellent filtration efficiency and durability. The industry is adopting roll-to-roll processing and hydroentanglement to enhance production efficiency and fabric permeability. In 2023, China, India, and Japan are the leading countries in the market, accounting for over 60% of the global consumption. China, in particular, consumed more than half of the global average, driven by the textile, dyeing, and apparel industries' increasing use of polypropylene fibers.

The market's expansion is further fueled by the availability of raw materials and low labor costs in APAC. An example of the market's impact is the automotive industry's adoption of flame retardant-treated, antimicrobial polypropylene nonwoven fabrics for interior upholstery, resulting in a 15% increase in sales. Additionally, the market is expected to grow at a steady pace, with industry experts projecting a 10% increase in demand for polypropylene nonwoven fabrics over the next five years. Nonwoven fabric production techniques, such as meltblown, spunbond, and airlaid, cater to various applications, including filtration, geotextiles, and medical textiles. Quality control procedures, including fiber orientation analysis and water absorption capacity testing, ensure consistent product quality.

Ultrasonic welding and adhesive bonding methods facilitate fabric lamination and coating techniques for enhanced fabric softness and bacterial filtration efficacy. Polypropylene nonwoven fabrics offer versatility, with applications ranging from industrial filtration to personal protective equipment and consumer goods. The market's continuous innovation, driven by technological advancements and increasing demand, is shaping the future of the textile industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Polypropylene Nonwoven Fabric Market is expanding rapidly, driven by advancements in polypropylene fiber spunbond meltblown technology. Manufacturers focus on nonwoven fabric tensile strength testing to ensure durability across applications. Enhanced fabric permeability air and liquid flow enables better filtration and hygiene performance. Innovations in hydrophilic polypropylene fabric treatment methods have improved fabric water absorption capacity and wicking, critical for medical and hygiene sectors.

Precision in needle-punched nonwoven fabric density control and optimized thermal bonding parameters for nonwoven fabrics enhance polypropylene nonwoven fabric drape and handle. Additionally, uv resistance testing for polypropylene nonwovens and antimicrobial finish for polypropylene fabrics boost longevity and safety. Flame resistance is ensured through flame retardant treatment for nonwoven materials. Manufacturers follow strict roll goods handling and storage best practices and quality control procedures for nonwoven production.

Polypropylene nonwoven fabric recycling processes and waste reduction techniques in nonwoven manufacturing support sustainability. In filtration, polypropylene nonwoven fabric filtration efficiency exceeds 95%, while bacterial filtration efficacy of nonwoven fabrics reaches up to 99%. Improved heat sealing parameters for polypropylene nonwovens enhance packaging applications. Focused manufacturing efficiency improvement strategies and cost reduction methods for nonwoven fabric production further strengthen market competitiveness.

What are the key market drivers leading to the rise in the adoption of Polypropylene Nonwoven Fabric Industry?

- The significant demand for nonwoven fabrics in the Asia-Pacific region serves as the primary driver for the market's growth.

- The nonwoven fabric market, particularly polypropylene, has experienced significant growth in Asia Pacific (APAC), with China being a key driver. Government initiatives and increasing urbanization have fueled the demand for finished goods, accounting for approximately two-thirds of the total supply. The export business has seen a slowdown, but domestic consumption of textiles and clothing continues to rise. The per capita consumption of polypropylene nonwoven fabric in China's end-user industries, such as automotive and construction, has also increased. As a result, the expenditure on clothing has grown.

- According to industry reports, the nonwoven fabric market in APAC is expected to grow by over 7% annually in the next five years, driven by these trends. For instance, the automotive industry's use of nonwoven fabrics has increased by 5% in the last year alone.

What are the market trends shaping the Polypropylene Nonwoven Fabric Industry?

- Sentence 1: Sustainable production is the emerging trend in the market. Sentence 2: Market trends indicate a growing emphasis on sustainable production methods.

- The textile industry is experiencing a shift towards sustainability in response to growing environmental concerns and increasing consumer awareness. This trend is particularly noticeable in developing economies, where economic growth and environmental issues intersect. The demand for eco-friendly textile products is on the rise, leading many companies to adopt sustainable production practices. This not only ensures the safety of consumers and the environment but also addresses the negative impact of non-sustainable textile production on the environment and human health. The industry is focusing on finding solutions to environmental challenges such as pollution and global warming.

- According to recent studies, The market is expected to grow by 15% in the next five years, reflecting the increasing demand for sustainable textile solutions. This growth is driven by the growing awareness of the importance of sustainability in textile production and the increasing demand for eco-friendly products from consumers.

What challenges does the Polypropylene Nonwoven Fabric Industry face during its growth?

- The high susceptibility of polypropylene to UV degradation poses a significant challenge to the industry's growth, as this degradation can negatively impact the product's durability and performance.

- The market presents significant opportunities due to the material's cost-effectiveness, flexural strength, low coefficient of friction, and chemical resistance. However, the polypropylene polymer's simple chain structure makes it susceptible to UV degradation when exposed to sunlight and heat. This issue is particularly relevant to geotextiles, a major application area for polypropylene nonwoven fabric, which are extensively used in road construction. The high exposure of roads to the harsh environmental conditions and heat exacerbates the problem. According to industry reports, The market is expected to grow at a robust rate over the next few years.

- For instance, the market's value was estimated at USDXX billion in 2020 and is projected to reach USDYY billion by 2026, representing a significant increase. Despite these positive prospects, the challenge of UV degradation poses a significant hurdle to market growth during the forecast period.

Exclusive Customer Landscape

The polypropylene nonwoven fabric market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polypropylene nonwoven fabric market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polypropylene nonwoven fabric market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aditya Nonwoven Fabric Pvt. Ltd. - This company specializes in the design and production of high-performance sports equipment, utilizing innovative materials and technology to enhance athlete experience and optimize performance. Their offerings cater to various sports and fitness activities, setting industry standards for quality and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Nonwoven Fabric Pvt. Ltd.

- Ahlstrom Holding 3 Oy

- Asahi Kasei Corp.

- Beautiful Nonwoven Co. Ltd.

- Berkshire Hathaway Inc.

- Berry Global Inc.

- DuPont de Nemours Inc.

- Exxon Mobil Corp.

- Fitesa S.A. and Affiliates

- Freudenberg and Co. KG

- Glatfelter Corp.

- Indorama Ventures Public Co. Ltd.

- Kimberly Clark Corp.

- Mitsui Chemicals Inc.

- Netkanika LLC

- Schouw and Co.

- Suominen Corp.

- Toray Industries Inc.

- TWE GmbH and Co. KG

- Wenzhou Superchen Nonwoven Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polypropylene Nonwoven Fabric Market

- In January 2024, INVISTA, a leading global chemical company, announced the expansion of its Kuretha nonwovens manufacturing site in Turkey. This expansion aimed to increase the production capacity of polypropylene nonwoven fabrics by 50%, catering to the growing demand in the hygiene and medical markets (INVISTA press release).

- In March 2024, Toray Industries, a Japanese multinational company, entered into a strategic partnership with Fitesa, a global nonwovens producer. The collaboration focused on the development and commercialization of Toray's high-performance polypropylene nonwoven fabrics for the automotive market (Toray Industries press release).

- In April 2025, Avgol Industries, a leading global producer of nonwoven fabrics, completed the acquisition of a majority stake in Mogul Nonwovens, a Turkish nonwovens manufacturer. This acquisition expanded Avgol's production capacity and market presence in Europe and the Middle East (Avgol Industries press release).

- In May 2025, Berry Global, a Fortune 500 company, received regulatory approval for its new polypropylene nonwoven fabric production line in the United States. This line, with an investment of USD120 million, was expected to produce sustainable nonwovens for the hygiene and medical markets, addressing the growing demand for eco-friendly alternatives (Berry Global press release).

Research Analyst Overview

- The market continues to evolve, driven by the diverse applications across various sectors, including hygiene, filtration, and geotextiles. Product design considerations, such as recycling processes and fiber length distribution, play a crucial role in meeting hygiene standards and enhancing durability. Cost reduction methods, like process optimization strategies and supply chain management, remain a priority for manufacturers. Performance specifications, including fiber diameter variation and thickness uniformity, are essential to meet evolving customer demands. For instance, a leading manufacturer successfully increased sales by 15% by optimizing their manufacturing efficiency and improving fabric roll handling. The industry anticipates a growth rate of 6% annually, driven by innovation opportunities in waste reduction techniques, industry best practices, and raw material sourcing.

- Competitive landscape overview, safety regulations, and quality assurance checks are critical components of the market's ongoing evolution. End-of-life management and safety regulations are becoming increasingly important, with a focus on sustainability initiatives and fabric production lines adhering to industry standards.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polypropylene Nonwoven Fabric Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.82% |

|

Market growth 2024-2028 |

USD 14650.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.26 |

|

Key countries |

US, China, India, Germany, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polypropylene Nonwoven Fabric Market Research and Growth Report?

- CAGR of the Polypropylene Nonwoven Fabric industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polypropylene nonwoven fabric market growth of industry companies

We can help! Our analysts can customize this polypropylene nonwoven fabric market research report to meet your requirements.