Submarine Market Size 2024-2028

The submarine market size is forecast to increase by USD 9.56 billion at a CAGR of 5.52% between 2023 and 2028.

- Fleet replacement programs are the key driver of the submarine market, as nations look to modernize their naval forces with advanced, more capable submarines. The upcoming trend is the development of multi-mission submarines. These versatile submarines are designed to perform a range of operations, including intelligence gathering, surveillance, reconnaissance, and combat, making them more adaptable and cost-effective for various military needs.

- Furthermore, the increasing demand for submarine power cables and submarine fiber cables is influencing the industry's development, highlighting the need for advanced infrastructure. These factors are shaping the market's future, making it a compelling space for stakeholders and investors. The market analysis report provides a comprehensive overview of these trends and challenges, offering valuable insights for businesses looking to capitalize on growth opportunities.

What will be the Size of the Submarine Market During the Forecast Period?

- The market encompasses the production and sale of submarines for various applications, primarily In the defense sector. Key drivers in this market include new submarine acquisitions by defense forces worldwide and the need for advanced underwater detection systems to secure maritime boundaries and offshore resources. High-strength alloy steel and titanium are commonly used in submarine construction due to their durability and resistance to corrosion.

- Layoffs and order deliveries can impact the market, while geopolitical tensions and military systems modernization fuel demand. Technological advancements continue to shape the market, with innovations in propulsion, sonar systems, and missile attacks. Seafaring nations with significant submarine fleets, such as those involved In the nuclear triad or maritime disputes, are major players.

- Submarines serve diverse roles, from covert operations and surprise attacks to deterrents against naval forces and groundwater bodies In the ocean coast and offshore territories.

How is this Submarine Industry segmented and which is the largest segment?

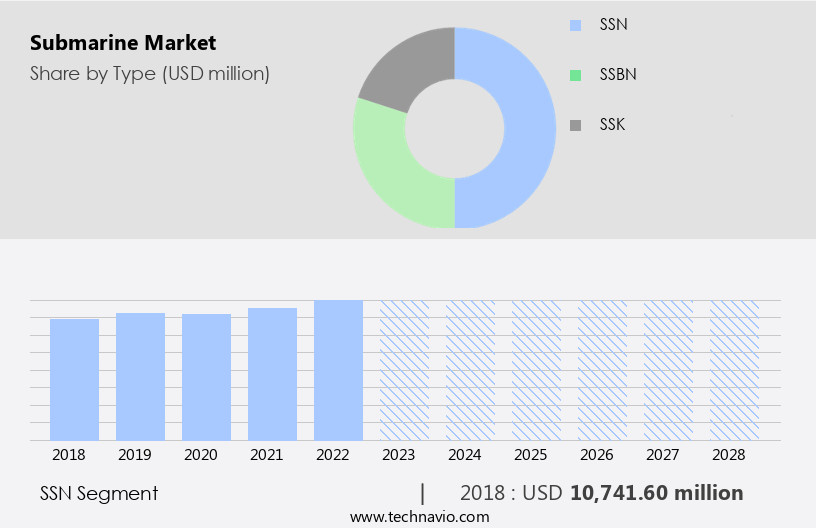

The submarine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- SSN

- SSBN

- SSK

- Application

- Military

- Commercial

- Geography

- North America

- US

- APAC

- China

- Japan

- South Korea

- Europe

- Middle East and Africa

- South America

- North America

By Type Insights

The SSN segment is estimated to witness significant growth during the forecast period. Nuclear-powered submarines (SSNs) offer military forces significant advantages with their independent power source, enabling prolonged underwater operations without the need for frequent surface visits. The nuclear propulsion system delivers increased power for high-speed travel and extended voyage times, making SSNs an essential component of naval military segments. Despite controversy surrounding their deployment due to nuclear proliferation concerns, the demand for SSNs remains strong due to their superior capabilities. These submarines can host advanced weapons and sensors, extend their operational life beyond 25 years without refueling, and operate covertly in enemy territories or offshore resources. Technological advancements, including nuclear technology, 3D printing, and complex submarine parts like missile fins and guidance systems, contribute to the cost-effectiveness and strategic importance of SSNs.

The defense sector continues to invest in submarine capabilities, with acquisition programs and military budgets prioritizing the development of attack submarines, combat SSNs, and crewless vessels. The naval industry's focus on strengthening submarine capabilities includes the integration of intelligence, surveillance, and reconnaissance roles, as well as addressing maritime disputes, geopolitical conflicts, and naval forces.

Get a glance at the Submarine Industry report of share of various segments. Request Free Sample

The SSN segment was valued at USD 10.74 billion in 2018 and showed a gradual increase during the forecast period.

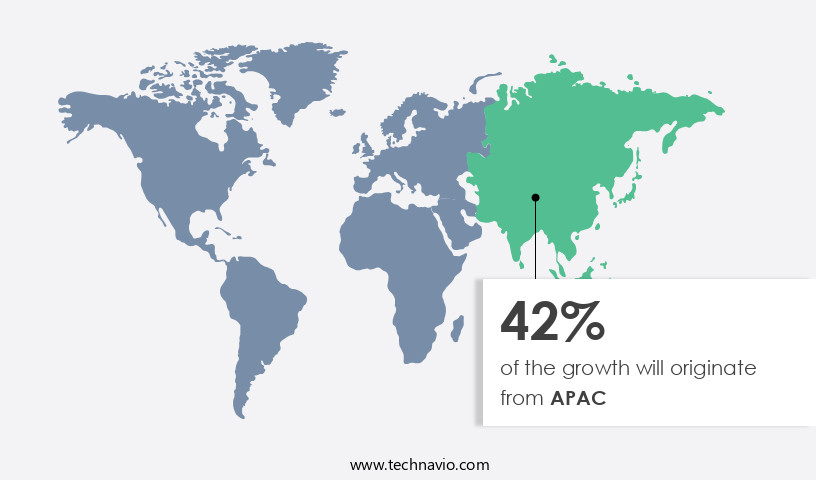

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is predominantly driven by the United States, which holds the largest market share due to its substantial defense budget and strategic focus on enhancing deterrent capabilities. The US Navy's SSBN fleet is a significant component of the country's nuclear triad, necessitating consistent expansion. With numerous submarines reaching the end of their service life, the US is investing in new projects to replace and upgrade its aging fleet. High-strength alloy steel and titanium are essential materials in submarine construction, while technological advancements in areas such as 3D printing, complex submarine parts, missile fins, and guidance systems contribute to cost-effectiveness and improved performance.

The naval military segment, including defense forces, naval intelligence, and covert operations, continues to prioritize submarines for underwater detection, surveillance activities, and surprise attacks on enemy territories. Geopolitical conflicts and maritime disputes further emphasize the importance of strengthening submarine capabilities, including the development of crewless submarines and nuclear-powered submarines (SSNs and Diesel Electric Submarines) for deep-sea exploration and cargo transports. Nuclear energy and additive manufacturing techniques are also integral to the defense industry's submarine development programs.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Submarine Industry?

Fleet replacement programs is the key driver of the market.

- The market is experiencing a significant push due to the increasing need for submarine replacement in various defense forces worldwide. With the average submarine lifespan being approximately 40 years, prolonged usage beyond this period can lead to increased maintenance costs and potential risks. To maintain strategic stabilities and ensure naval intelligence, countries are investing in new submarines to enhance their underwater detection, surveillance activities, and covert operations capabilities. High-strength alloy steel and titanium are primary raw materials used In the production of submarines. The naval military segment and commercial cargo transports are the major consumers of submarines. Nuclear-powered submarines (SSNs) and conventional diesel electric submarines (SSMs) are the two main types, with the former offering longer voyage times and the latter being more cost-effective.

- Technological advancements, such as 3D printing and complex submarine parts like missile fins and guidance systems, are contributing to the cost-effectiveness and efficiency of submarine acquisition programs. The defense sector is also exploring the potential of crewless submarines for military systems and intelligence, surveillance, and reconnaissance roles. Geopolitical conflicts and maritime disputes continue to strengthen submarine capabilities, with offshore territories and resources becoming increasingly valuable. Nuclear technology and naval intelligence are essential components of modern submarines, providing power, high speed, and the ability to remain underwater for extended periods. Military budgets and acquisition programs are crucial factors influencing the market's growth.

- Attack submarines, ballistic missile submarines, and midget submarines (SSMs) all play a vital role in defense forces' strategic plans, from deterrent and surprise attacks to naval forces and offshore resource protection. Submarine wakes and ocean topography, including groundwater bodies, are essential considerations in submarine design and operation. The defense industry continues to innovate, with nuclear power, air and surface power, and complex systems driving advancements In the market.

What are the market trends shaping the Submarine Industry?

Multi-mission submarines is the upcoming market trend.

- Submarines are essential assets for defense forces worldwide, and the market for submarines and related technologies continues to evolve. companies are focusing on developing high-performance submarines using raw materials such as high-strength alloy steel and titanium. These submarines are designed to perform various roles, including underwater detection, surveillance activities, and covert operations. The US Navy, for instance, has deployed advanced submarines like the Virginia-class (SSN-774 class) for open ocean operations, littoral warfare, and surveillance. These submarines feature superior imaging capabilities with camera masts connected to fiber optic cables and operate within a wide range of frequencies. They also offer high data rate communication capabilities and can be fitted with a special mission-configurable mast for enhanced combat capabilities.

- Military budgets and acquisition programs are driving the growth of the market. The naval military segment and commercial segment, including cargo transports and nuclear energy, are significant contributors to the market. Technological advancements, such as 3D printing, are being used to produce complex submarine parts like missile fins and guidance systems, offering cost-effectiveness and increased efficiency. Geopolitical conflicts and maritime disputes continue to strengthen submarine capabilities. Nuclear-powered submarines (SSN) and conventional submarines, such as diesel electric submarines (SSK) and ballistic missile submarines (SSBN), are essential components of the nuclear triad and naval forces' strategic stabilities. Covert operations, surprise attacks, and deterrent capabilities are crucial aspects of submarine design.

- The naval intelligence and surveillance roles of submarines are increasingly important in maintaining naval superiority and ensuring strategic stability. Midget submarines (SSM) are also gaining popularity for their ability to operate in shallow waters and conduct reconnaissance activities. The offshore territories and offshore resources are significant areas of focus for submarine capabilities. The market is witnessing significant growth due to the increasing demand for advanced submarines with high-performance capabilities and operational flexibility. The use of advanced materials, technological advancements, and cost-effective manufacturing techniques are driving the market's growth. The market dynamics, including geopolitical conflicts, military budgets, and acquisition programs, are shaping the future of the submarine industry.

What challenges does the Submarine Industry face during its growth?

Limitations in submarine building capabilities is a key challenge affecting the industry growth.

- Submarines are intricate military systems utilized by defense forces for underwater detection, surveillance activities, and covert operations. The production of submarines involves the use of raw materials such as high-strength alloy steel and titanium. Developing countries seeking to enter the market often collaborate with established defense industries for technology and design. However, these collaborations come with limitations, as exporting countries are reluctant to share their most advanced submarine technologies. Instead, they offer second-best designs and technologies. Consequently, importing countries become reliant on the selling nation for technical support and services throughout the submarine's service life. The market encompasses various segments, including Nuclear Powered Submarines (SSNs), Diesel Electric Submarines (SSMs), and Ballistic Missile Submarines.

- Technological advancements in naval military segments and commercial sectors have led to innovations such as 3D printing of complex submarine parts, missile fins, and guidance systems. Cost-effectiveness and crewless submarines are also gaining popularity. Naval intelligence and surveillance, reconnaissance roles, and deterrent capabilities are crucial aspects of submarines. Geopolitical conflicts and maritime disputes have strengthened the need for submarine fleets to protect offshore territories and resources. Naval forces worldwide invest heavily in submarine acquisition programs, with military budgets allocated towards these strategic military systems. Nuclear propulsion, high speed, long voyage times, and nuclear technology are essential features of SSNs.

- Conventional submarines, on the other hand, rely on diesel-electric power. The naval industry continues to innovate, with advancements in additive manufacturing techniques, deep-sea cables, and maritime boundaries. Covert operations, surprise attacks, and deterrent capabilities are essential for submarines in a world of increasing maritime tensions.

Exclusive Customer Landscape

The submarine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the submarine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, submarine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Anschutz - The market specializes in providing a diverse range of sports products, catering to various customer needs and preferences. Our offerings span across multiple categories, ensuring comprehensive coverage of the sports industry landscape. With a commitment to quality and innovation, we deliver products that enhance the athletic experience for consumers worldwide. Our portfolio encompasses equipment, apparel, and accessories, reflecting the dynamic nature of the sports market. By staying abreast of market trends and consumer demands, we continuously expand our product line to meet the evolving needs of our global customer base.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anschutz

- ASC Pty Ltd.

- BAE Systems Plc

- Fincantieri Spa

- General Dynamics Corp.

- Hanwha Corp.

- Hyundai Heavy Industries Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Lockheed Martin Corp.

- Mazagon Dock Shipbuilders Ltd.

- Mitsubishi Heavy Industries Ltd.

- NauticExpo

- Naval Group

- Navantia SA

- Saab AB

- Submarine Manufacturing and Products Ltd.

- The Boeing Co.

- thyssenkrupp AG

- Triton Submarines LLC

- United Shipbuilding Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of underwater vessels utilized for various applications in both military and commercial sectors. These vessels, which include nuclear-powered submarines (SSNs), conventional submarines, and cargo transports, are engineered with high-strength alloys and advanced materials such as titanium to ensure durability and functionality In the harsh underwater environment. The naval military segment is a significant contributor to the market, with these vessels playing a crucial role in defense forces' strategic stabilities. Their covert capabilities enable surprise attacks and deterrent functions, making them essential components of the nuclear triad. The defense industry invests heavily in submarine acquisition programs, driven by military budgets and the need to strengthen submarine capabilities.

Technological advancements continue to shape the market, with innovations in nuclear propulsion, high-speed capabilities, and nuclear energy. Nuclear-powered submarines offer extended voyage times and reduced refueling requirements, making them a cost-effective solution for extended underwater missions. The commercial segment of the market includes the use of submarines for cargo transports and deep-sea cable installations. These applications require submarines to operate in various topographies, including ocean coasts and groundwater bodies, necessitating versatile designs and robust engineering. The naval military segment's submarine fleets consist of various types, including attack submarines, ballistic missile submarines, and electric boats. Attack submarines are designed for combat roles, while ballistic missile submarines serve as part of the nuclear triad, providing a strategic deterrent.

Electric boats offer a quieter, more stealthy alternative to traditional diesel-electric submarines. The market also includes the development of crewless submarines, which offer cost savings and reduced risk to personnel. These vessels can be used for underwater surveillance, reconnaissance, and even 3D printing complex submarine parts, such as missile fins and guidance systems, on-site. Maritime disputes and offshore territorial claims have led to increased competition and geopolitical tensions, further emphasizing the importance of submarine capabilities. Seafaring nations continue to invest In their submarine fleets to maintain a strong naval presence and secure their offshore resources. The market is a dynamic and evolving industry, driven by technological advancements and the need for advanced underwater capabilities in both military and commercial applications.

The market is expected to continue growing as nations seek to strengthen their naval forces and secure their strategic interests.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.52% |

|

Market growth 2024-2028 |

USD 9560.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.12 |

|

Key countries |

US, China, Russia, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Submarine Market Research and Growth Report?

- CAGR of the Submarine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the submarine market growth of industry companies

We can help! Our analysts can customize this submarine market research report to meet your requirements.