Titanium Market Size 2025-2029

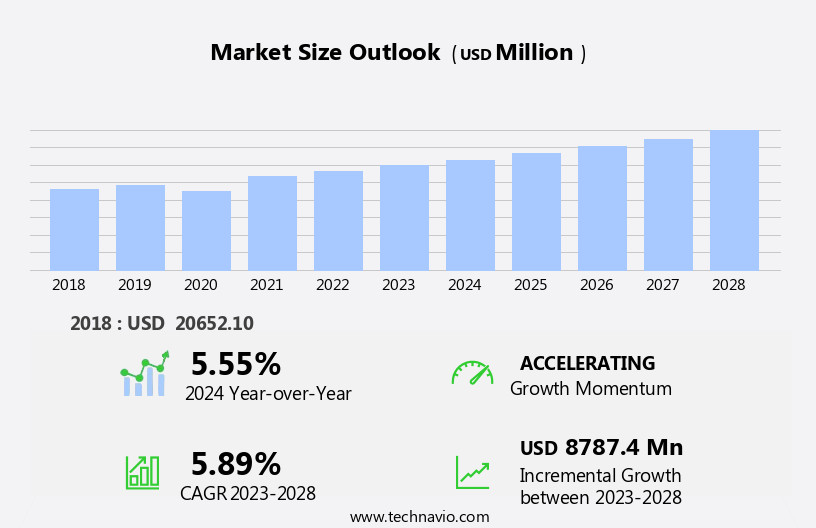

The titanium market size is forecast to increase by USD 9.58 billion at a CAGR of 6.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing adoption of titanium in various industries, particularly in the automotive sector, to reduce vehicle weight and improve fuel efficiency. This trend is driven by stringent emission norms and the growing demand for lightweight and durable materials. Additionally, the emergence of new applications for titanium alloys, such as in aerospace and medical industries, is further expanding the market's potential. However, the market faces challenges related to the carcinogenic effect of titanium dioxide (TiO2), a commonly used pigment in various industries.

- Companies seeking to capitalize on the opportunities presented by the market must navigate these challenges effectively by investing in research and development of safer alternatives and complying with regulatory requirements. Additionally, the emergence of new applications for titanium alloys in industries such as aerospace and construction is driving market expansion. The market's dynamic landscape requires strategic planning and a deep understanding of the latest trends and challenges to remain competitive. This concern has led to regulatory scrutiny and potential restrictions on its use, which may impact the market's growth trajectory.

What will be the Size of the Titanium Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Titanium, a lightweight and strong metal, plays a significant role in various industries, including civil aviation and travel and tourism. In the aerospace sector, titanium's use is prevalent in the manufacturing of aircraft engines and spacecraft components due to its high strength-to-weight ratio and corrosion resistance. The Kroll process, a common method for extracting titanium from titanium ore, contributes to the production of titanium sponge, which is further processed into alloys for engineering applications. The microstructure of titanium alloys, such as beta alloy and near alpha alloy, makes them suitable for high-performance products, including jet engines, shipbuilding, and military equipment.

The biocompatibility of titanium alloys extends their use in prosthetics and medical implants. The automotive industry also leverages titanium for its lightweight properties, enhancing fuel efficiency and reducing emissions. Defense expenditure and the demand for durable and lightweight materials continue to fuel the growth of the market. The market's dissemination extends to high-temperature applications, sports equipment, jewelry, and bearings, making titanium an indispensable element in today's industrial landscape. With applications spanning various industries, including aerospace, automotive manufacturing, and jewelry, the market's growth is driven by increasing demand for high-performance products.

How is this Titanium Industry segmented?

The titanium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Titanium dioxide

- Titanium metal

- Application

- Aerospace and marine

- Industrial

- Medical

- Others

- Form Factor

- Sheets and plates

- Bars and billets

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

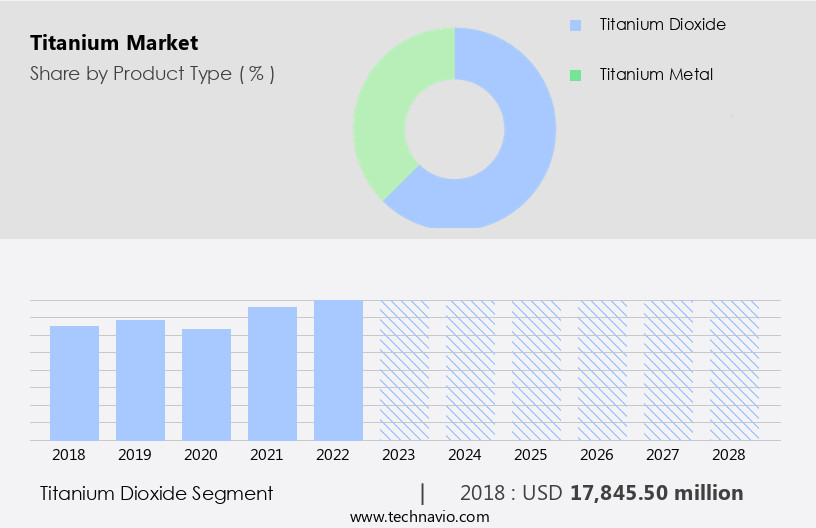

By Product Type Insights

The Titanium dioxide segment is estimated to witness significant growth during the forecast period. Titanium dioxide (TiO2), a naturally occurring oxide of titanium also known as titania, is primarily sourced from titanium-bearing minerals such as ilmenite and rutile. The exceptional whiteness, opacity, and UV resistance of TiO2 make it a sought-after component in various industries. In the realm of manufacturing, the paints and coatings industry is the largest consumer, driven by construction and automotive demands. Plastics follow closely as another significant consumer due to TiO2's use as a colorant and its ability to enhance durability and UV resistance. The cosmetics industry also leverages TiO2 for its non-reactive and UV-blocking properties, making it a popular ingredient in sunscreens and skincare products.

Furthermore, TiO2 finds applications in printing inks, rubber, textiles, food, and even in the aerospace industry as a pigment. In addition to these industries, TiO2 is used in solar power for its photocatalytic properties, in medical implants for its biocompatibility, and in military applications for its corrosion resistance and high-temperature stability. TiO2's versatility extends to engineering applications, including bearings, armor plating, and jet engines, as well as in the production of alloys for use in sports equipment, jewelry, and high-performance products. The mineral's use is not limited to these industries alone, as it also plays a role in infrastructure development, desalination, and chemical processing.

The Titanium dioxide segment was valued at USD 18.71 billion in 2019 and showed a gradual increase during the forecast period.

The Titanium Market is gaining momentum, driven by robust demand across industries such as the Spain aerospace industry, where the strength-to-weight ratio of titanium ores is vital for advanced aircraft manufacturing. Additionally, naval vessels increasingly adopt corrosion resistant metal alloys, extending operational life in harsh marine environments. The rise in environmental technologies has also sparked interest in titanium’s durability and sustainability benefits. Its application in body armor is expanding due to its exceptional strength and lightweight nature, essential for modern defense solutions. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on optimizing production processes, exploring alternative sources of TiO2, and expanding their product offerings to cater to the growing demand for eco-friendly solutions and advanced applications in industries such as cosmetics, food, and construction.

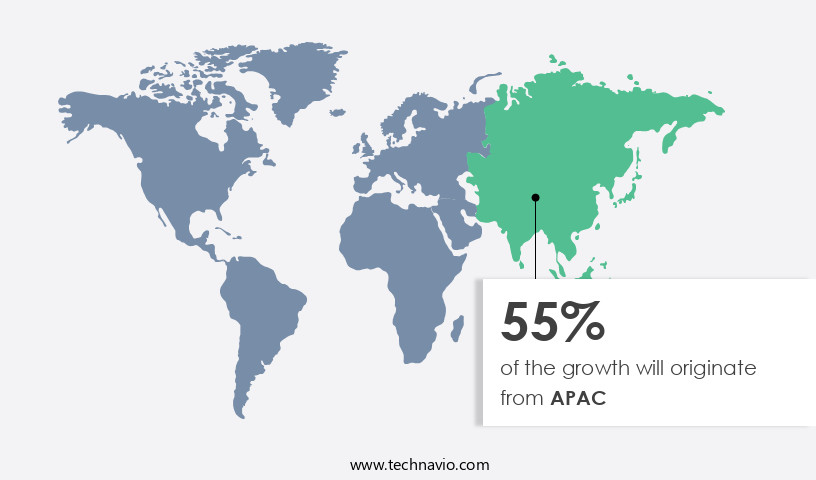

Regional Analysis

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Titanium, a transition metal known for its exceptional strength, corrosion resistance, and biocompatibility, is experiencing significant demand across various industries. In the medical field, titanium alloys are widely used in medical implants due to their biocompatibility and durability. The aerospace industry utilizes titanium extensively in aircraft production, including commercial aviation and defense applications, for its lightweight properties and high performance. Renewable energy, particularly wind turbines, also relies on titanium for its strength and durability in harsh environmental conditions. Spacecraft and defense industries value titanium for its lightweight and high-strength properties, making it an essential component in armor plating and military vehicles.

Rutile, a titanium ore, is processed through the Kroll Process to produce titanium sponge, which is then used to manufacture various alloys. Alpha and beta alloys, including near alpha alloys, are commonly used in high-performance products, such as bearings, jet engines, and automotive manufacturing. The construction industry is increasingly adopting titanium for its strength-to-weight ratio and corrosion resistance, leading to its use in infrastructure development and civil aviation projects. Consumer goods, such as sports equipment and jewelry, also incorporate titanium due to its lightweight and durable properties. Environmental sustainability is another growing area for titanium applications, with its use in shielding applications, desalination, and paints and coatings.

APAC, particularly China, is the largest consumer of titanium due to the presence of numerous companies producing titanium and its alloys. The region's growth is driven by increasing demand from countries like Japan, India, and Australia. Titanium's versatility and superior properties continue to fuel its adoption across various industries, making it a valuable resource for the future. In addition, TiO2 is used in photovoltaic cells, textile coatings, and protective coatings for its light fastness and particle size reduction properties.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Titanium market drivers leading to the rise in the adoption of Industry?

- The increasing use of titanium in automotive manufacturing to reduce vehicle weight is the primary market driver. Titanium, a lightweight and strong metal, has gained significant traction in various industries due to its superior properties. Engineering applications, particularly in the aerospace and defense sectors, have long utilized titanium alloys for their high strength-to-weight ratio and resistance to corrosion at high temperatures. More recently, titanium has found applications in travel and tourism, with its use in armor plating for luxury vehicles and sports equipment. The demand for high performance products has fueled the growth of the market. Titanium sponge, a key intermediate in the production of titanium alloys, is in high demand due to its versatility in various industries.

- The microstructure of titanium alloys can be manipulated to enhance their properties, making them suitable for use in commercial aviation services, solar power, and white pigment production. Ilmenite, a mineral rich in titanium dioxide, is the primary source of titanium. The processing of ilmenite involves the use of high temperatures to extract titanium dioxide, which is then converted into titanium sponge. This dissemination of titanium from its raw form to its final application contributes to the growth of the market. Titanium's use in armor plating for military vehicles and defense budgets is a significant driver for the market. In the realm of coatings, TiO2's role is pivotal, with its usage extending from organic to inorganic coatings, paint formulations, textiles, and plastics.

What are the Titanium market trends shaping the Industry?

-

Titanium alloys are witnessing rising demand across industries for their exceptional strength-to-weight ratio, corrosion resistance, and biocompatibility, driving new applications in aerospace, medical, and automotive sectors. These alloys offer high strength, lightweight, and excellent corrosion resistance, making them ideal for applications in aerospace, automotive, medical, and industrial sectors. The increasing demand for fuel efficiency, durability, and safety in these industries is driving the growth of the titanium alloys market. Titanium alloys have gained significant traction in various industries due to their exceptional properties, making them a preferred choice in harsh environments and demanding applications. The industrial and marine sectors have seen a growth in the adoption of titanium alloys, particularly in flue gas desulfurization units, scrubber systems, sour gas handling, deep-well services, and marine components exposed to saltwater and biofouling.

- Titanium alloys' use in environmental sustainability initiatives, such as power generation and infrastructure development, has further boosted their demand. The automotive manufacturing sector has also embraced titanium alloys for their lightweight properties, contributing to fuel efficiency and reduced emissions. Additive manufacturing has opened new possibilities for the use of titanium alloys in complex parts production. Titanium Dioxide, a common pigment, and Titanium Ore are significant by-products of the titanium industry, adding to its economic significance. The extraction process of titanium alloys involves the use of near alpha alloys and Beta alloys, which are essential for producing high-strength and corrosion-resistant alloys. The versatility and durability of titanium alloys make them indispensable in numerous industries, ensuring their continued growth and relevance.

How does Titanium market face challenges during its growth?

- The carcinogenic concerns surrounding the use of titanium dioxide (TiO2) represent a significant challenge to the industry's growth trajectory. This issue, which revolves around the potential health risks associated with TiO2, poses a major hurdle for the industry's expansion. Companies must navigate the complex regulatory landscape and invest in research and development to mitigate these concerns and ensure the continued use of TiO2 in a safe and responsible manner. Titanium, a corrosion-resistant metal alloy, holds significant importance in various industries due to its thermally stable properties. Notably, it is extensively used in the production of military vehicles and equipment, as well as in consumer electronics and aerospace applications. In the aerospace and defense sector, the Spanish Aerospace Industry is a notable consumer, given the high demand for lightweight and durable materials in infrastructure projects and military equipment.

- The International Agency for Research on Cancer (IARC) classifies titanium dioxide (TiO2), a bright, white pigment derived from titanium, as a Group 2B carcinogen, indicating a possible link to cancer in humans. Regulatory bodies such as the European Food Safety Authority (EFSA) and the German Federal Institute for Risk Assessment (BfR) have highlighted the potential genotoxicity of TiO2 nanoparticles, which can accumulate in organs like the liver and lungs and contribute to neurological and genetic disorders. Despite these concerns, the demand for titanium continues to grow due to its unique properties and diverse applications. The market dynamics are influenced by factors such as defense expenditure, technological advancements in production technologies, and the increasing demand for lightweight and durable materials in various industries.

Exclusive Customer Landscape

The titanium market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the titanium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, titanium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allegheny Technologies Inc. - The company specializes in the production and supply of advanced titanium alloys, including ATI 45Nb Alloy, which provides enhanced strength and durability for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegheny Technologies Inc.

- Bansal Brothers

- Berkshire Hathaway Inc.

- Hangzhou King Titanium Co. Ltd.

- Huntsman Corp.

- Iluka Resources Ltd.

- INEOS Group Holdings S.A.

- JX Nippon Mining and Metals Philippines Inc.

- Kenmare Resources plc

- Kobe Steel Ltd.

- Mukesh Steel

- Rostec

- Scatec ASA

- Sumitomo Corp.

- Tayca Corp.

- The Chemours Co.

- Titanium Industries Inc.

- Tronox Holdings Plc

- VVTi Pigments

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Titanium Market

- In January 2024, Tronox Holdings Plc, a leading titanium dioxide producer, announced the acquisition of Cristal's titanium dioxide business for USD 1.7 billion, creating a global titanium dioxide powerhouse with enhanced scale and geographic reach (Tronox Holdings Plc Press Release, 2024).

- In March 2024, DuPont Titanium Technologies, a leading titanium producer, and Air Liquide, a global leader in gases, announced a strategic partnership to develop a new, large-scale, low-carbon titanium dioxide production plant in the United States. This collaboration aims to reduce carbon emissions by utilizing renewable energy and hydrogen (DuPont Titanium Technologies Press Release, 2024).

- In May 2024, the European Union approved the renewal of the titanium dioxide registration under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) for a ten-year period. This approval ensures the continued use of titanium dioxide in various industries, including paints and coatings, plastics, and paper (European Chemicals Agency Press Release, 2024).

- In April 2025, Hunan Valin Titanium Industry Co. Ltd., a leading Chinese titanium producer, announced the successful deployment of a new, advanced titanium sponge production line, increasing its annual capacity by 20,000 tons (Hunan Valin Titanium Industry Co. Ltd. Press Release, 2025).

Research Analyst Overview

Titanium, a transition metal known for its exceptional strength, corrosion resistance, and thermally stable properties, continues to unfold intriguing market dynamics across various sectors. From medical devices to renewable energy, this versatile metal's applications span far and wide. In the realm of durability and environmental sustainability, titanium's role in wind turbines and solar power generation is increasingly significant. Its lightweight yet robust nature makes it an ideal choice for these applications, contributing to the growth of the renewable energy sector. Spacecraft and defense industries have long relied on titanium alloys for their shielding applications and high-performance requirements. Its high strength and resistance to impact make it an ideal material for protective applications. Additionally, its use in high performance sports equipment, such as golf clubs and bicycle frames, has gained popularity due to its lightweight and durable properties.

Titanium's use extends beyond engineering applications. Alpha alloy, a type of titanium alloy, is used in jewelry due to its unique properties, such as its ability to maintain its shape and luster. Titanium's use in the aerospace industry, particularly in the production of high performance aircraft components, has also contributed to the market's growth. In summary, the market is driven by the demand for high performance, lightweight materials in various industries, including aerospace, defense, travel and tourism, and sports equipment. The versatility of titanium and its ability to be processed into various forms make it a valuable commodity in the manufacturing sector. The continuous research and development in the field of titanium processing and alloy production are expected to further fuel the growth of the market.

The ongoing evolution of these sectors, driven by technological advancements and defense budgets, ensures a consistent demand for this metal. Titanium's use extends to the aerospace industry, where it is integral to aircraft production, from commercial aviation to military applications. The continuous development of aircraft components, including engine parts and armor plating, underscores the metal's importance in this sector. Automotive manufacturing and additive manufacturing are other burgeoning industries that are embracing titanium. Its lightweight properties make it a valuable addition to the production of high-performance automotive parts and components. The extraction process of titanium from its primary ores, rutile and ilmenite, is a complex and evolving process.

The Kroll process, a common method for producing titanium sponge, undergoes continuous refinement to increase efficiency and reduce environmental impact. Titanium alloys, such as beta alloy and near alpha alloy, are finding new applications in consumer goods, infrastructure development, and shipbuilding. Their unique microstructures and properties make them suitable for a wide range of applications, from sports equipment to desalination plants. The market's continuous dynamism is further fueled by its use in various industries, including jewelry, plastics, and chemical processing. Its versatility and durability ensure its relevance in an ever-changing world, making it a valuable asset for businesses and industries alike.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Titanium Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 9.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, China, India, Germany, Japan, Canada, France, South Korea, Australia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Titanium Market Research and Growth Report?

- CAGR of the Titanium industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the titanium market growth of industry companies

We can help! Our analysts can customize this titanium market research report to meet your requirements.