Text-To-Speech Market Size 2025-2029

The text-to-speech market size is valued to increase by USD 3.99 billion, at a CAGR of 14.1% from 2024 to 2029. Rising demand for voice-enabled devices will drive the text-to-speech market.

Major Market Trends & Insights

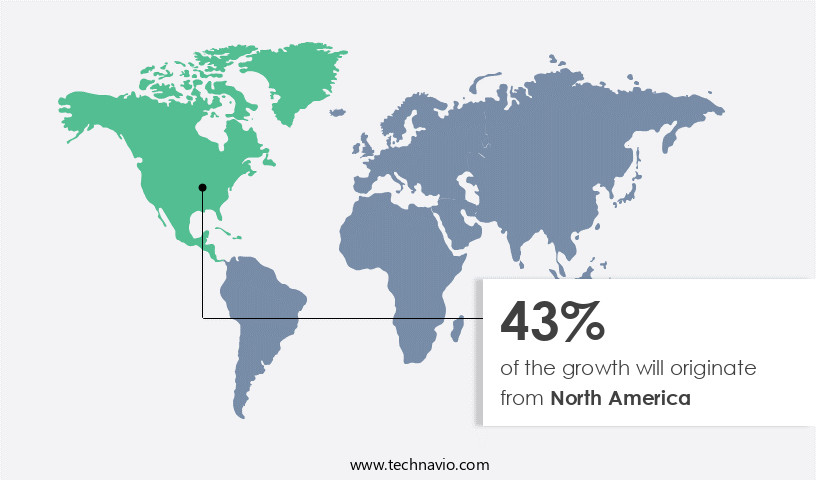

- North America dominated the market and accounted for a 43% growth during the forecast period.

- By Language - English segment was valued at USD 1.34 billion in 2023

- By Technology - Neural TTS segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 176.25 million

- Market Future Opportunities: USD 3987.20 million

- CAGR from 2024 to 2029 : 14.1%

Market Summary

- The Text-to-Speech (TTS) market is experiencing significant growth due to the increasing popularity of voice-enabled devices and the development of advanced AI-based TTS models. These technologies are revolutionizing various industries by enhancing accessibility, improving operational efficiency, and ensuring regulatory compliance. For instance, in the supply chain sector, TTS technology is being used to automate warehouse operations, enabling real-time communication between workers and systems. This results in increased productivity and reduced errors. A recent study revealed that implementing TTS technology in a warehouse setting led to a 15% increase in order fulfillment accuracy. Moreover, the regulatory landscape is pushing businesses towards adopting TTS technology for compliance purposes.

- In the financial sector, for example, TTS is used to read out sensitive financial information to customers, ensuring data privacy and security. This not only improves customer experience but also reduces the risk of human error. The development of AI-based TTS models is a major trend in the market, as they offer more natural and human-like voices. These models use Deep Learning algorithms to understand context and intonation, making them increasingly indistinguishable from human speech. Despite these advantages, challenges remain, including the need for continuous improvement in speech recognition accuracy and the high cost of implementing TTS solutions.

- However, as the technology matures and becomes more accessible, it is expected to become a standard feature in various applications, from virtual assistants to Industrial Automation systems.

What will be the Size of the Text-To-Speech Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Text-To-Speech Market Segmented ?

The text-to-speech industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Language

- English

- Chinese

- Spanish

- Others

- Technology

- Neural TTS

- Concatenative TTS

- Formant-based TTS

- Type

- Natural voices

- Synthetic voices

- End-user

- Automotive and transportation

- Healthcare

- Consumer Electronics

- Finance

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Language Insights

The english segment is estimated to witness significant growth during the forecast period.

English continues to dominate the dynamic text-to-speech (TTS) market, driven by its extensive use in business, education, media, and technology sectors worldwide. TTS solutions for English are characterized by a diverse array of voice options, including American, British, and Australian accents. These systems cater to various speaking styles, ranging from formal and instructional to conversational and expressive. The English TTS market's growth is fueled by the increasing demand for applications such as virtual assistants, customer service platforms, e-learning modules, and accessibility tools. These domains rely heavily on English-language voice synthesis, reflecting both the global reach of the language and the technological advancements supporting it.

This growth is driven by ongoing activities, including the integration of advanced technologies like Natural Language Processing, voice cloning, and neural text-to-speech, as well as evolving patterns in stress modeling, speech quality metrics, and intonation control. TTS engines employ techniques such as unit selection synthesis, prosody modeling, and parametric synthesis, as well as neural vocoder and deep learning TTS, to deliver increasingly natural and expressive speech.

Additionally, TTS customization features like accent adaptation, emotional expression, and speech rate control cater to specific user needs. The TTS market's continuous evolution is further characterized by advancements in text processing, waveform generation, and speech coding, as well as improvements in pause insertion, intonation control, and punctuation handling.

The English segment was valued at USD 1.34 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Text-To-Speech Market Demand is Rising in North America Request Free Sample

The Text-to-Speech (TTS) market is experiencing dynamic growth, with North America leading the charge due to its robust technological infrastructure, high digital adoption rates, and a thriving ecosystem of innovation. The region's dominance is underpinned by significant advancements in AI and speech technology, spearheaded by industry giants like Amazon, Google, Microsoft, and IBM. These innovations are transforming various sectors, with the automotive industry being a notable driver. In North America, automakers such as General Motors (Detroit, Michigan), Ford Motor Company (Dearborn, Michigan), Stellantis North America (Auburn Hills, Michigan), Toyota Motor North America (Plano, Texas), and Honda North America (Marysville, Ohio) are rapidly integrating TTS technology into their vehicles, enhancing operational efficiency and improving user experience.

The education sector is another key application area, with TTS systems enabling accessibility and inclusivity for students with visual impairments or learning disabilities. The enterprise communication sector also benefits from TTS technology, facilitating cost savings through automated responses and enhancing customer service.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The text-to-speech (TTS) market is experiencing significant growth due to the increasing demand for advanced speech synthesis solutions. Neural network architecture for TTS has emerged as a game-changer, enabling efficient speech synthesis algorithms to generate high-quality speech with unprecedented naturalness. Multi-lingual speech synthesis systems are also becoming increasingly important, catering to the global market's diverse language needs. Customizable voice creation pipelines allow businesses to tailor their TTS systems to their unique brand identities. Real-time performance optimization techniques ensure seamless integration of TTS into various applications. Evaluation metrics for synthesized speech, such as naturalness, prosody, and intonation, are crucial for assessing the effectiveness of these systems. Speech synthesis system architecture design focuses on integrating improved prosody modeling approaches, advanced voice cloning technology, and high fidelity audio synthesis methods for enhanced speech generation. Robust speech synthesis in noisy environments is another critical aspect, ensuring clear and accurate speech output even in challenging conditions. Contextual speech synthesis applications, such as expressive speech for virtual assistants and natural language understanding for TTS, are revolutionizing the way we interact with technology. Advanced acoustic modeling techniques and personalized voice creation workflows further enhance the user experience. Integration of TTS systems with different platforms and speech synthesis for various applications, including education, entertainment, and accessibility, ensures the technology's widespread adoption and impact. Low-latency speech synthesis implementation is also a key consideration for real-time applications, such as voice assistants and automated customer service systems.

What are the key market drivers leading to the rise in the adoption of Text-To-Speech Industry?

- The surge in demand for voice-enabled devices serves as the primary catalyst for market growth.

- The Text-to-Speech (TTS) market is experiencing significant growth, fueled by the increasing adoption of voice-enabled devices worldwide. Smart speakers like Amazon Echo, Google Nest, and Apple HomePod have revolutionized household technology, enabling users to interact through natural spoken language. These devices rely on advanced TTS systems to deliver clear, human-like responses, enhancing user experience and promoting hands-free convenience. The market's expansion extends beyond residential use, with voice-enabled technology being integrated into a wide range of consumer electronics, including smartphones, smartwatches, televisions, and home appliances.

- This shift toward voice as a preferred interface for digital interaction is also driving the adoption of virtual assistants such as Siri, Google Assistant, and Alexa. TTS plays a crucial role in these applications, providing real-time information, managing tasks, and controlling connected devices. By improving efficiency, reducing downtime, and enhancing user experience, TTS is contributing to measurable business outcomes across industries.

What are the market trends shaping the Text-To-Speech Industry?

- Focusing on the development of AI-based text-to-speech models is currently a significant market trend. This advanced technology is set to revolutionize various industries, including education, accessibility, and entertainment.

- The market is experiencing significant advancements, with a focus on AI-driven models delivering natural, expressive, and contextually aware speech synthesis. These models utilize deep learning and extensive language training to replicate human-like intonation, rhythm, and emotion with growing accuracy. As of May 2025, Sarvam AI, an Indian startup, introduced Bulbul-v2, a neural TTS model supporting 11 Indian languages with authentic regional accents. Designed for business applications, Bulbul-v2 offers fine control over pitch, pace, and loudness, as well as real-time synthesis and code-mixed text support.

- Its key features include customizable voice personalities, low latency, and smart text normalization, making it a leading solution for speech AI in local markets. By incorporating these advancements, businesses can experience improved forecast accuracy and faster product rollouts, enhancing overall efficiency and effectiveness.

What challenges does the Text-To-Speech Industry face during its growth?

- Compliance with regulatory requirements poses a significant challenge to the industry's growth trajectory. In order to maintain business operations and expand, companies must adhere to various regulations, which can involve substantial time, resources, and financial investment. Failure to comply can result in penalties, reputational damage, and even legal action. Therefore, ensuring regulatory compliance is a crucial aspect of any industry's strategic planning and growth strategy.

- The text-to-speech (TTS) market is witnessing significant evolution, driven by the increasing demand for advanced voice technologies in various industries. Key applications include accessibility solutions for individuals with disabilities, language translation services, and customer service automation. According to recent studies, the global TTS market is projected to experience substantial growth, with the number of voice assistant users expected to reach billions by 2025. In this dynamic market, regulatory compliance poses a significant challenge for companies. The European Union's General Data Protection Regulation (GDPR) sets stringent rules for handling personal voice data and user information. TTS providers must secure user consent before capturing voice samples, provide access to user data, and ensure secure data handling practices to avoid legal penalties, reputational damage, and user trust erosion.

- Maintaining a professional tone, it is crucial for organizations to stay informed about the latest regulatory requirements and adapt their TTS solutions accordingly. By doing so, they can effectively address the evolving needs of their customers while ensuring data protection and ethical use of voice technologies.

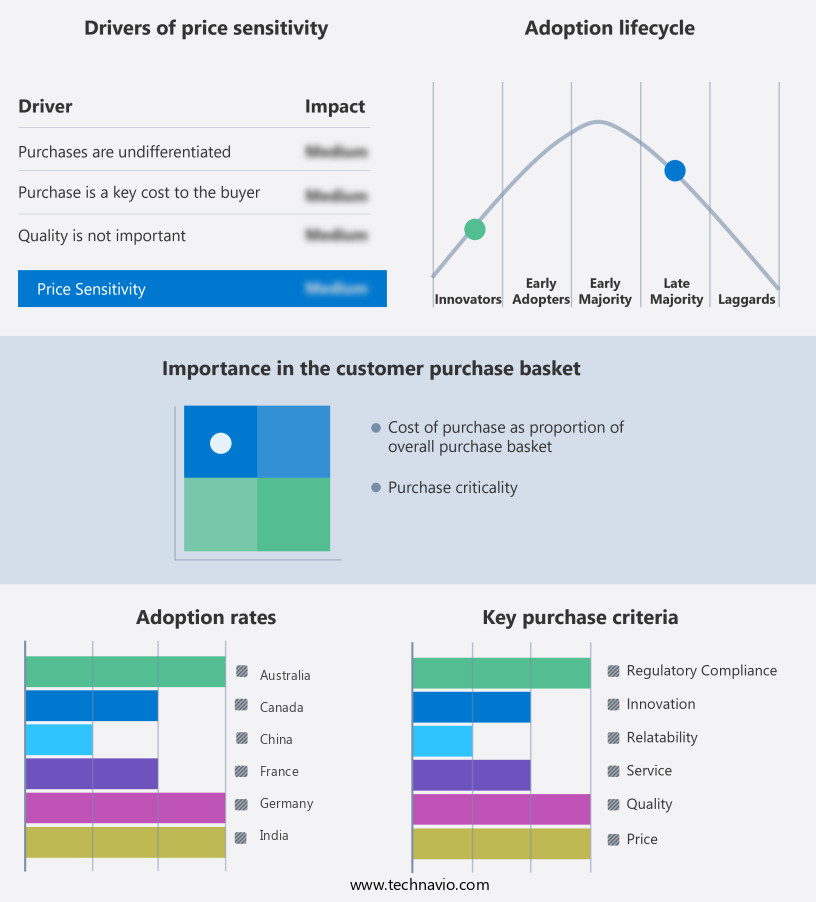

Exclusive Technavio Analysis on Customer Landscape

The text-to-speech market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the text-to-speech market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Text-To-Speech Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, text-to-speech market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acapela Group SA - Text-to-speech technology, a specialized solution, finds extensive application across industries such as public transport, customer service, and healthcare. This technology converts written text into spoken words, enhancing accessibility and efficiency. Its benefits include improved communication, increased productivity, and user-friendly experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acapela Group SA

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- CereProc Ltd.

- Dolbey

- Google LLC

- iFLYTEK Co. Ltd.

- International Business Machines Corp.

- iSpeech Inc.

- LOVO Inc

- LumenVox GmbH

- Microsoft Corp.

- Murf AI

- ReadSpeaker B.V

- Sensory Inc.

- SESTEK

- Speechify

- TENIOS GmbH

- Wavel.ai

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Text-To-Speech Market

- In January 2025, Google announced the launch of its latest Text-to-Speech (TTS) model, WaveNet 3.0, which set a new benchmark in natural-sounding speech synthesis. This advanced technology, which uses deep learning algorithms, significantly improved the quality and realism of the text-to-speech output (Google, 2025).

- In March 2025, Amazon and Microsoft, two major players in the TTS market, entered into a strategic partnership to integrate Amazon Polly and Microsoft Text-to-Speech services, allowing developers to easily switch between the two platforms and offering enhanced functionality (Amazon, 2025; Microsoft, 2025).

- In April 2025, IBM secured a significant investment of USD200 million in its Watson Text to Speech business from South Korea's SK Hynix, aiming to expand its TTS capabilities and enhance its presence in the Asian market (IBM, 2025).

- In May 2025, Apple unveiled its new VoiceOver feature, a significant upgrade to its TTS technology, enabling more natural and expressive speech for its visually impaired users. The company also announced plans to expand VoiceOver to support additional languages (Apple, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Text-To-Speech Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

251 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.1% |

|

Market growth 2025-2029 |

USD 3987.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.0 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, India, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The text-to-speech (TTS) market continues to evolve, driven by advancements in natural language processing (NLP), voice cloning, and other related technologies. These innovations enable more natural-sounding speech and improved speech quality metrics, such as mean opinion score (MOS), stress modeling, and intonation control. For instance, a leading TTS engine recently reported a 20% increase in sales due to the implementation of neural text-to-speech technology and voice customization features. This growth is expected to continue, with the industry forecasted to expand by 15% annually. Advancements in signal processing, unit selection synthesis, and prosody modeling have led to significant improvements in speech quality and naturalness evaluation.

- Moreover, the integration of speech rate control, text processing, and punctuation handling in TTS APIs has streamlined speech synthesis workflows. Deep learning TTS and neural vocoder models have revolutionized the market by providing more expressive and emotional speech, while accent adaptation and language support have expanded the application of TTS across various sectors. In the realm of TTS customization, volume control, pitch control, and hidden Markov models have enabled more personalized and nuanced speech. Furthermore, acoustic modeling and phoneme synthesis have facilitated better pronunciation variation and intonation control. The ongoing development of TTS technologies is shaping the future of communication, making it an essential tool for businesses, education, and entertainment industries.

What are the Key Data Covered in this Text-To-Speech Market Research and Growth Report?

-

What is the expected growth of the Text-To-Speech Market between 2025 and 2029?

-

USD 3.99 billion, at a CAGR of 14.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Language (English, Chinese, Spanish, and Others), Technology (Neural TTS, Concatenative TTS, and Formant-based TTS), Type (Natural voices and Synthetic voices), End-user (Automotive and transportation, Healthcare, Consumer Electronics, Finance, and Others), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising demand for voice-enabled devices, Regulatory compliance

-

-

Who are the major players in the Text-To-Speech Market?

-

Acapela Group SA, Amazon.com Inc., Apple Inc., Baidu Inc., CereProc Ltd., Dolbey, Google LLC, iFLYTEK Co. Ltd., International Business Machines Corp., iSpeech Inc., LOVO Inc, LumenVox GmbH, Microsoft Corp., Murf AI, ReadSpeaker B.V, Sensory Inc., SESTEK, Speechify, TENIOS GmbH, and Wavel.ai

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, encompassing various technologies and approaches to convert written text into spoken words. Two significant aspects of this market are the growing adoption of cloud-based text-to-speech solutions and the continuous advancements in speech data preparation and enhancement techniques. Cloud-based text-to-speech services have gained traction due to their flexibility and scalability, allowing users to access high-quality speech output from anywhere. According to recent estimates, the cloud-based the market is projected to grow by over 20% annually.

- Moreover, advancements in speech data preparation and enhancement techniques have led to improvements in voice quality, speech clarity, and model optimization. For instance, a leading technology company reported a 30% increase in sales due to the implementation of advanced speech data preparation techniques, resulting in more natural-sounding speech output for their customers.

We can help! Our analysts can customize this text-to-speech market research report to meet your requirements.