Deep Learning Market Size 2024-2028

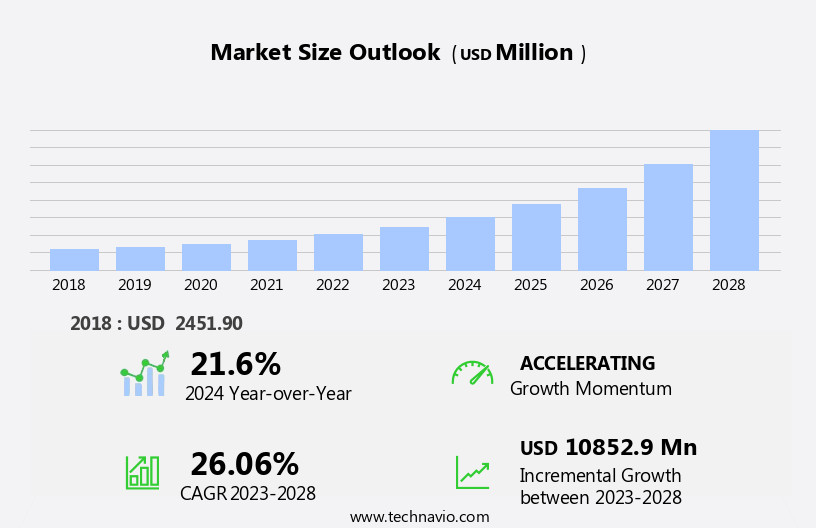

The deep learning market size is forecast to increase by USD 10.85 billion at a CAGR of 26.06% between 2023 and 2028.

- Deep learning technology is revolutionizing various industries, including healthcare. In the healthcare sector, deep learning is being extensively used for the diagnosis and treatment of musculoskeletal and inflammatory disorders. The market for deep learning services is experiencing significant growth due to the increasing availability of high-resolution medical images, electronic health records, and big data. Medical professionals are leveraging deep learning technologies for disease indications such as failure-to-success ratio, image interpretation, and biomarker identification solutions. Moreover, with the proliferation of data from various sources such as social networks, smartphones, and IoT devices, there is a growing need for advanced analytics techniques to make sense of this data. Companies In the market are collaborating to offer comprehensive information services and digital analytical solutions. However, the lack of technical expertise among medical professionals poses a challenge to the widespread adoption of deep learning technologies. The market is witnessing an influx of startups, which is intensifying the competition. Deep learning services are being integrated with compatible devices for image processing and prognosis. Molecular data analysis is another area where deep learning technologies are making a significant impact.

What will be the Size of the Deep Learning Market During the Forecast Period?

- A subset of machine learning and artificial intelligence (AI), is a computational method inspired by the structure and function of the human brain. This technology utilizes neural networks, a type of machine learning model, to recognize patterns and learn from data. In the US market, deep learning is gaining significant traction due to its ability to process large amounts of data and extract meaningful insights. The market In the US is driven by several factors. One of the primary factors is the increasing availability of big data.

- Moreover, with the proliferation of data from various sources such as social networks, smartphones, and IoT devices, there is a growing need for advanced analytics techniques to make sense of this data. Deep learning algorithms, with their ability to learn from vast amounts of data, are well-positioned to address this need. Another factor fueling the growth of the market In the US is the increasing adoption of cloud-based technology. Cloud-based solutions offer several advantages, including scalability, flexibility, and cost savings. These solutions enable organizations to process large datasets and train complex models without the need for expensive hardware.

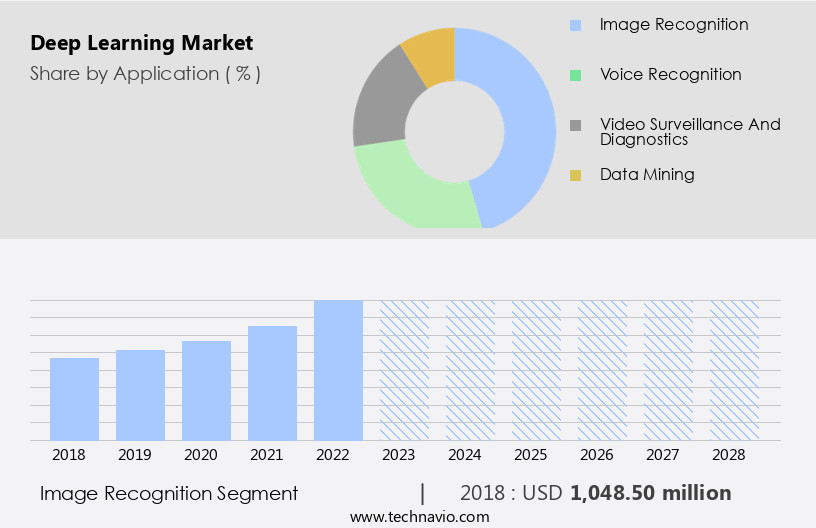

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Image recognition

- Voice recognition

- Video surveillance and diagnostics

- Data mining

- Type

- Software

- Services

- Hardware

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Application Insights

- The image recognition segment is estimated to witness significant growth during the forecast period.

In the realm of artificial intelligence (AI), image recognition holds significant value, particularly in sectors such as banking and finance (BFSI). This technology's ability to accurately identify and categorize images is invaluable, as extensive image repositories In these industries cannot be easily forged. BFSI firms utilize AI image recognition for various applications, including personalizing customer communication, maintaining a competitive edge, and automating repetitive tasks to boost productivity. For instance, social media platforms like Facebook employ this technology to correctly identify and assign images to the right user account with an impressive accuracy rate of approximately 98%. Moreover, AI image recognition plays a crucial role in eliminating fraudulent social media accounts.

Get a glance at the report of share of various segments Request Free Sample

The image recognition segment was valued at USD 1.05 billion in 2018 and showed a gradual increase during the forecast period.

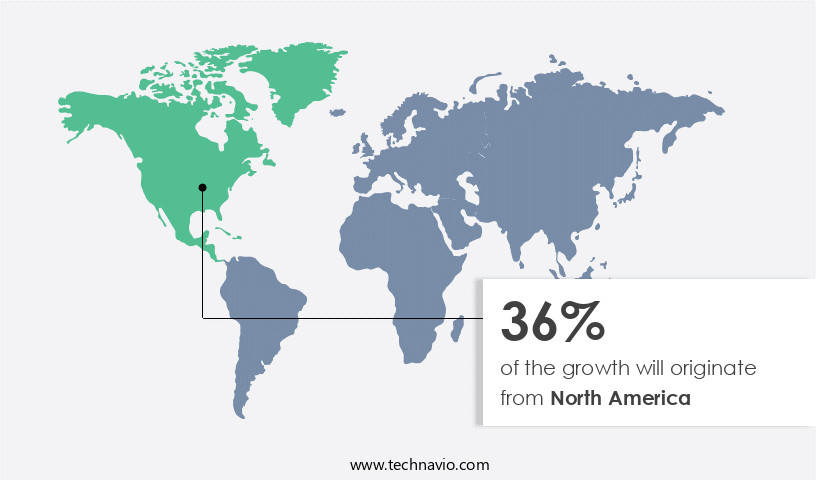

Regional Analysis

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Deep learning, a subset of artificial intelligence, is experiencing significant growth in North America, with the US, Canada, and Mexico being key contributors to this market expansion. The primary catalyst fueling this growth is the increasing implementation in various industries, including voice recognition, image recognition, and smartphone assistants. This trend is driven by the recognition of benefits, such as reduced labor costs and improved product quality. Deep learning algorithms enable organizations to detect subjective defects, like labeling errors, thereby preventing costly product recalls. Additionally, it is making strides in sectors such as cybersecurity, robots, and industrial automation, including machine vision technology, chatbots, and service bots.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption?

Increasing entry of startups is the key driver of the market.

- It is a subset of machine learning and artificial intelligence, has experienced significant growth in recent years due to increased investment in computing devices and neural network technology. This advanced form of computing utilizes a multi-layered structure of interconnected nodes, modeled after the human brain's neurons, to analyze large datasets. The applications span various industries, including healthcare.

- Moreover, in this sector, companies such as Atomwise and IBM-backed Pathway Genomics are harnessing it for drug discovery In therapeutic areas like oncological disorders, infectious diseases, neurological disorders, immunological disorders, endocrine disorders, cardiovascular disorders, and respiratory disorders. Eye disorders are also a potential application for technologies. The influx of startups in this field, fueled by substantial funding, is expected to drive the growth of the market during the forecast period.

What are the market trends shaping the Industry?

Increasing collaboration among vendors is the upcoming market trend.

- The market growth is being fueled by an uptick in strategic collaborations and partnerships among market players. For instance, in September 2023, Anthropic and Amazon.Com Inc. Joined forces to leverage each other's expertise in safe generative artificial intelligence (AI). This alliance aims to accelerate the development of Anthropic's upcoming foundation models and make them widely accessible to AWS users.

- Furthermore, such collaborations expand market participants' offerings, geographic reach, and distribution channels. Furthermore, they provide access to new technologies, resources, and products, ultimately boosting companies' market shares and driving business expansion.

What challenges does the Deep Learning Industry face during its growth?

Lack of technical expertise is a key challenge affecting the industry growth.

- Deep learning, an advanced form of artificial intelligence, holds significant potential in addressing various medical conditions such as musculoskeletal disorders and inflammatory disorders. However, the failure-to-success ratio in implementing deep learning solutions remains high due to the intricacy involved. Medical professionals require specialized knowledge of deep learning technologies, molecular data analysis, and high-resolution medical images to effectively utilize these services. Deep learning technologies are integrated with information services, digital analytical solutions, and electronic health records to process big data. The services offer image interpretation, biomarker identification solutions, and compatible devices for seamless integration. Prognosis is enhanced by analyzing vast amounts of data to identify patterns and trends.

- Moreover, despite the benefits, the market faces challenges. The scarcity of experts with expertise and the high cost of hiring them pose significant barriers. Organizations need to invest in upskilling their workforce or partner with external experts to overcome these challenges. In summary, the market holds immense potential In the healthcare sector, particularly in disease indications such as musculoskeletal disorders and inflammatory disorders. However, the high implementation complexity and the scarcity of deep learning experts pose significant challenges. Organizations need to invest in upskilling their workforce or partner with external experts to effectively leverage deep learning technologies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Amazon.com Inc.

- Atomwise Inc.

- Comma.ai Inc.

- Deep Instinct

- DeepMind Technologies Ltd.

- Graphcore Ltd.

- H2O.ai Inc.

- Hewlett Packard Enterprise Co.

- Intel Corp.

- International Business Machines Corp.

- Micron Technology Inc.

- Microsoft Corp.

- Mphasis Ltd.

- NVIDIA Corp.

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Sensory Inc.

- Teledyne FLIR LLC

- Viz.ai Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Deep learning, a subset of machine learning and artificial intelligence, is revolutionizing various industries by enabling advanced computing power and intelligent automation. The algorithms, inspired by the human brain's neural network architecture, use multi-layered structures with nodes and neurons to learn and improve from experience. These technologies are increasingly being adopted in big data analysis, image recognition, speech recognition, and natural language processing. Cloud-based technology plays a crucial role, providing the necessary computing power and storage for large datasets. Applications include facial recognition in social networks, object recognition in ATMs and self-driving cars, and sentiment analysis in media and advertising.

In addition, it is also making strides in healthcare, with applications in medical image analysis, drug discovery, and precision medicine. Deep learning is also being used in cybersecurity to detect and prevent cyberattacks, protect critical assets, and enhance encryption and data loss prevention. In addition, it is being used in industrial automation, robotics, and manufacturing for machinery inspection, production planning, and quality control. Deep learning services and technologies are transforming various industries, from agriculture and finance to healthcare and cybersecurity, offering significant benefits and opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.06% |

|

Market growth 2024-2028 |

USD 10.85 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

21.6 |

|

Key countries |

US, China, UK, Canada, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.