Ti-6Al-4V Titanium Alloy Market Size 2024-2028

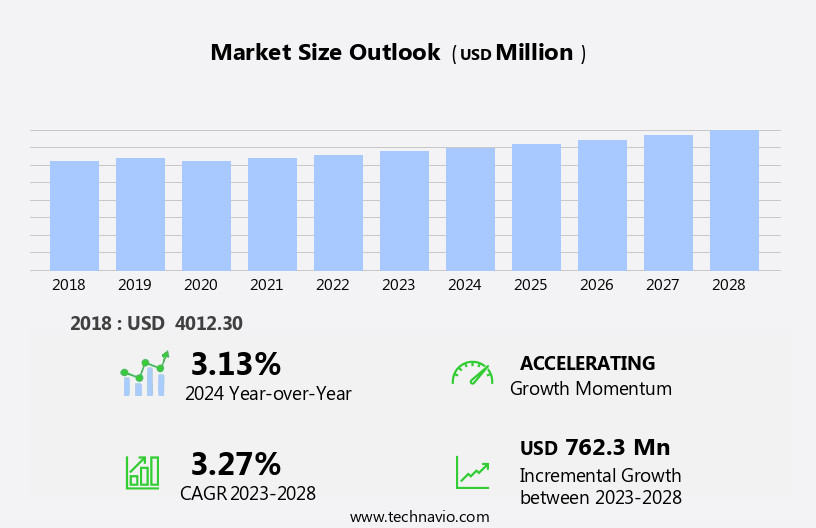

The ti-6al-4v titanium alloy market size is forecast to increase by USD 762.3 million at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth due to its high demand in the healthcare sector, particularly for orthopedic implants. This trend is driven by the biocompatibility and lightweight properties of Ti-6Al-4V, making it an ideal choice for producing durable and effective implants. Additionally, the emergence of new applications in industries such as aerospace and automotive is expanding the market's reach. However, the market's growth is not without challenges.

- The stringent certification process required for new technologies can hinder adoption and increase costs. Companies seeking to capitalize on market opportunities must navigate these regulatory hurdles while also staying abreast of emerging trends and competitors. Effective strategic planning and operational agility will be essential for success in this dynamic market.

What will be the Size of the Ti-6Al-4V Titanium Alloy Market during the forecast period?

- The market in the United States is experiencing significant growth due to its extensive applications in various industries. The automotive sector is a major contributor to the market's expansion, as the demand for lightweight and high-strength materials increases. Aerospace development activities also drive the market's growth, with the increasing production of aircraft and spacecraft. Additionally, the profitability of the medical sector, particularly in the synthesis of high-precision components for orthopedic implants, is fueling market expansion. The publishing of studies and research on the benefits of titanium alloys in the renewable energy sector, artificial intelligence, and defense industries are also creating new opportunities.

- Despite the increasing demand, pricing remains a critical factor in the market's dynamics. Overall, the market is poised for continued growth, driven by its diverse applications and the increasing demand for lightweight and high-strength materials.

How is this Ti-6Al-4V Titanium Alloy Industry segmented?

The ti-6al-4v titanium alloy industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Medical

- Aerospace

- Chemical

- Automobile

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- France

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

The medical segment is estimated to witness significant growth during the forecast period.

Titanium alloys, specifically Ti-6Al-4V, are widely used in various industries due to their exceptional properties. This chemical composition offers high-strength, excellent corrosion resistance, and biocompatibility. In the aerospace sector, titanium alloys are essential for high-precision components in aerospace development activities. The manufacturing process includes both hot and cold rolling, forging, and synthesis. In the medical field, titanium alloys are indispensable for orthopedic implants, such as knee and hip replacements, due to their biocompatibility and osintegration properties. The material's resistance to corrosion ensures the longevity and effectiveness of these implants. The automotive, marine, and emerging renewable energy sectors also benefit from the lightweight and durable nature of titanium alloys.

The aerospace and defense industries, in particular, profit significantly from titanium alloys due to their high ultimate tensile strength. The manufacturing process, including forging and cold rolling, ensures the production of high-quality components for these industries. The titanium alloys' versatility extends to emerging applications in artificial intelligence and the manufacturing process of advanced materials. In , the demand for titanium alloys, including Ti-6Al-4V, continues to grow due to their unique properties and applications in various industries. The potential for profit is significant, especially in the aerospace, medical, automotive, marine, and renewable energy sectors. Wholesalers and direct sales channels play a crucial role in distributing these valuable materials to manufacturers and end-users.

Get a glance at the market report of share of various segments Request Free Sample

The Medical segment was valued at USD 1270.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

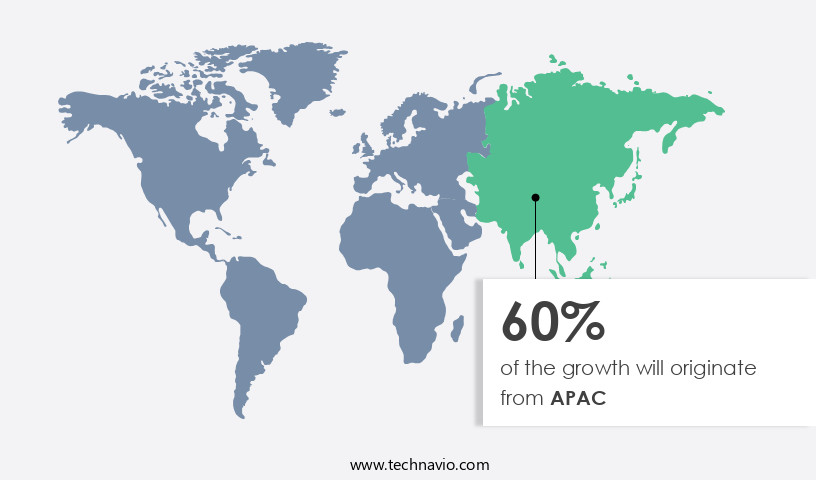

APAC is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to increasing aerospace development activities in Asia Pacific (APAC). With over 15,000 new aircraft expected to be delivered to APAC by 2035, the demand for high-precision components made from this alloy is on the rise. The manufacturing process for Ti-6Al-4V involves both hot and cold rolling, depending on the desired properties and end application. In the aerospace industry, Ti-6Al-4V is widely used for producing high-strength, lightweight components for aircraft and aeronautical applications. Its ultimate tensile strength and excellent corrosion resistance make it an ideal choice for aerospace components. Additionally, the alloy is also used in the medical industry for producing orthopedic implants, particularly in the form of Grade 5 and Grade 23.

The market dynamics for Ti-6Al-4V are driven by the increasing demand for lightweight materials in various industries, including marine, automotive, and emerging applications. The renewable energy sector is also a significant contributor to the market growth due to the increasing use of titanium alloys in wind turbines and solar panels. Furthermore, the defense industry is a major consumer of Ti-6Al-4V due to its excellent strength-to-weight ratio and high resistance to fatigue. The pricing for Ti-6Al-4V depends on various factors such as manufacturing process, form, and end-use industry. Wholesalers and direct sales are the primary distribution channels for this alloy.

The market is expected to continue growing steadily during the forecast period due to the increasing demand for lightweight materials and the expanding applications in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ti-6Al-4V Titanium Alloy Industry?

- High demand for Ti-6Al-4V titanium alloy for orthopedic implants is the key driver of the market.

- Titanium 6AL4V and 6AL4V ELI alloys, composed of 6% aluminum and 4% vanadium, are the most frequently used forms of titanium in the medical industry. These alloys are highly compatible with the human body and are commonly utilized in surgical procedures and body piercings. In mature skeletal patients, titanium alloys are strongly recommended for spinal fusion ries in conjunction with autogenous bone grafts. For instance, Zavation Medical Products introduced the Titanium/PEEK Posterior LEIF cage in 2021, a high-quality spinal implant that contributes to the increasing demand for Ti-6Al-4V titanium alloy implants in the medical sector.

- This trend is anticipated to propel the expansion of the market during the forecast period. The compatibility of these alloys with the human body, along with their superior strength and biocompatibility, makes them an ideal choice for various medical applications.

What are the market trends shaping the Ti-6Al-4V Titanium Alloy Industry?

- Emerging applications of titanium alloys is the upcoming market trend.

- Titanium alloys, specifically Ti-6Al-4V, have gained significant traction in various industries and marine applications due to their unique properties. These alloys offer high strength, low density, and excellent resistance to erosion and corrosion. The expanding market for titanium alloys can be attributed to their increasing acceptance in new application areas, such as scrubber systems, flue gas desulfurization, sour gas, and deep-well services, as well as marine applications. The corrosion resistance of titanium allows end-users to plan for longer equipment life, resulting in reduced maintenance and downtime.

- The material's resistance to attack in aggressive environments makes it a preferred choice for construction in numerous services. The growing demand for lightweight and durable materials in industries, coupled with the increasing focus on sustainability and efficiency, further bolsters the market growth for titanium alloys.

What challenges does the Ti-6Al-4V Titanium Alloy Industry face during its growth?

- Stringent certification process hindering adoption of new technologies is a key challenge affecting the industry growth.

- The acceptance of new materials in aerospace applications is subject to stringent certification processes. These procedures are mandated by both government bodies, such as the US Air Force and the Federal Aviation Administration, and aircraft manufacturers. For each aerospace program, materials and processes must undergo separate certification. The certification process, which typically lasts 18 to 24 months, involves extensive qualification procedures and the manufacturing and validation of test articles at the company's expense.

- This significant time and financial investment can act as a barrier to the adoption of new technologies in the aerospace industry.

Exclusive Customer Landscape

The ti-6al-4v titanium alloy market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ti-6al-4v titanium alloy market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ti-6al-4v titanium alloy market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allegheny Technologies Inc. - The company specializes in Ti-6Al-4V titanium alloy, featuring aluminum as the alpha stabilizer and vanadium as the beta stabilizer. This alloy's unique composition enhances its strength and corrosion resistance, making it an ideal choice for various industries. The aluminum addition stabilizes the alpha phase, while vanadium stabilizes the beta phase, ensuring optimal microstructural balance. This alloy's properties contribute to its widespread usage in aerospace, medical, and industrial applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegheny Technologies Inc.

- AMETEK Inc.

- Baoji Titanium Industry Co. Ltd

- Carpenter Technology Corporation

- Eramet

- Haynes International Inc

- Hebei Metals Industrial Ltd.

- Heraeus Holding GmbH

- Hermith GmbH

- NeoNickel

- Nippon Steel Corp.

- Nova Steel Corp.

- PTC Industries Ltd

- Rickard Metals Inc.

- Rostec

- Sandvik AB

- Smiths Metal Centres Ltd.

- Tekna Holdings ASA

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Titanium alloys, specifically Ti-6Al-4V, have gained significant attention in various industries due to their exceptional properties. This alloy is known for its high strength-to-weight ratio, excellent corrosion resistance, and ability to withstand extreme temperatures. The global market for Ti-6Al-4V titanium alloys is driven by its diverse applications in various sectors. Aerospace development activities continue to be a significant market for Ti-6Al-4V alloys. The material's high strength and lightweight properties make it an ideal choice for manufacturing high-precision components in the aeronautical industry. The demand for lightweight and fuel-efficient aircraft is expected to drive the growth of this market.

The manufacturing process for Ti-6Al-4V alloys includes both hot and cold rolling. Hot rolling is used to produce large, flat products, while cold rolling is used for producing thin, formed parts. The choice of manufacturing process depends on the specific application requirements. The market for Ti-6Al-4V alloys is influenced by various factors, including pricing dynamics. Wholesalers play a crucial role in the supply chain, and price fluctuations can significantly impact the profitability of manufacturers. Grade 5 and Grade 23 are two commonly used grades of Ti-6Al-4V alloys, and their pricing trends can influence the overall market dynamics.

The medical industry is another significant market for Ti-6Al-4V alloys, particularly in the production of orthopedic implants. The material's biocompatibility and corrosion resistance make it an ideal choice for medical applications. The aging population and increasing incidence of orthopedic disorders are expected to drive the growth of this market. The automotive industry also utilizes Ti-6Al-4V alloys in various applications, including engine components and exhaust systems. The renewable energy sector is an emerging market for Ti-6Al-4V alloys, particularly in the production of wind turbine blades. The material's high strength-to-weight ratio makes it an ideal choice for manufacturing lightweight and efficient wind turbine blades.

The defense industry is another significant market for Ti-6Al-4V alloys, particularly in the production of high-strength components for military vehicles and aircraft. The material's ability to withstand extreme temperatures and its excellent corrosion resistance make it an ideal choice for defense applications. The market for Ti-6Al-4V alloys is also influenced by emerging applications in various industries, including the marine industry and the synthetic aeronautical industry. The material's lightweight properties make it an ideal choice for manufacturing components for high-performance boats and submarines. In the synthetic aeronautical industry, Ti-6Al-4V alloys are used in the production of artificial intelligence-powered drones and other unmanned aerial vehicles.

The use of Ti-6Al-4V alloys is not limited to traditional manufacturing processes. The material is also used in additive manufacturing processes, such as 3D printing, to produce complex and lightweight components. The use of additive manufacturing processes is expected to drive the growth of the Ti-6Al-4V alloy market in emerging economies. In , the market for Ti-6Al-4V titanium alloys is driven by its diverse applications in various industries, including aerospace, medical, automotive, renewable energy, defense, and marine. The material's exceptional properties, including high strength-to-weight ratio, excellent corrosion resistance, and ability to withstand extreme temperatures, make it an ideal choice for manufacturing high-performance components.

The market dynamics are influenced by various factors, including pricing, manufacturing processes, and emerging applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 762.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ti-6Al-4V Titanium Alloy Market Research and Growth Report?

- CAGR of the Ti-6Al-4V Titanium Alloy industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ti-6al-4v titanium alloy market growth of industry companies

We can help! Our analysts can customize this ti-6al-4v titanium alloy market research report to meet your requirements.