Wind Turbine Market Size and Trends

The wind turbine market size is forecast to increase by USD 47.9 million at a CAGR of 9.3% between 2023 and 2028. The market is experiencing significant growth due to the increasing emphasis on clean energy and reducing carbon footprint in response to climate change. Wind turbines have emerged as an efficient and economical renewable energy resource, providing electricity generation that reduces reliance on fossil fuels and associated carbon dioxide emissions. Government initiatives to promote the use of renewable energy and improve air quality are driving market growth. Additionally, wind energy production offers agricultural income through land lease agreements and the potential for co-location with farming operations. This trend is expected to continue as the world transitions to a more sustainable energy future. Keywords: wind turbines, climate change, electricity generation, fossil fuels, carbon dioxide emissions, clean energy, air quality, public health, agricultural income.

Market Overview

Wind turbines have emerged as a crucial component in the global shift towards clean energy and reducing carbon footprint. With the increasing awareness of the negative impacts of fossil fuels on climate change, air quality, and public health, the demand for renewable energy sources, including wind power, has been on the rise. Wind turbines play a significant role in electricity generation, contributing to the reduction of carbon dioxide emissions. The use of wind turbines not only benefits the environment but also offers economic advantages. For instance, landowners can earn income by leasing their land for wind farm installations. Moreover, wind energy is an excellent option for off-grid power, providing electricity to remote areas where traditional power sources are not readily available. The wind power market in the US is expected to grow significantly in the coming years.

Furthermore, the transition to wind power and other renewable energy sources is essential for reducing our reliance on fossil fuels and mitigating the negative impacts on the environment and public health. Wind turbines offer a viable solution for electricity generation, with the added benefits of energy efficiency, economic opportunities, and a reduced carbon footprint. In conclusion, wind turbines are a crucial component in the transition to a cleaner and more sustainable energy future. With the growing demand for renewable energy sources and the increasing awareness of the negative impacts of fossil fuels, the wind turbine market is poised for significant growth in the US and beyond.

Market Segmentation

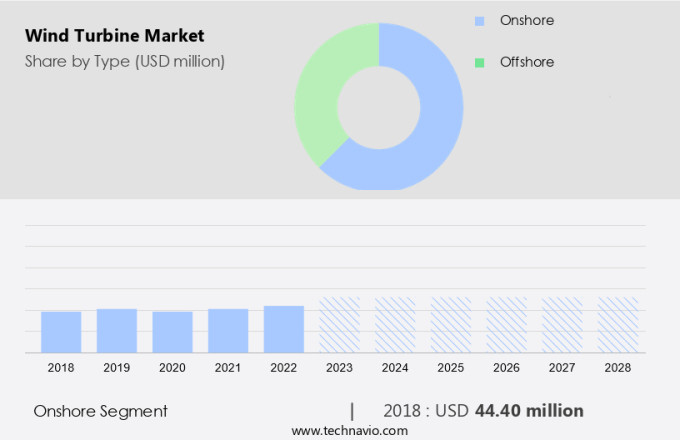

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Onshore

- Offshore

- Geography

- APAC

- China

- India

- Europe

- Germany

- Spain

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

The onshore segment is estimated to witness significant growth during the forecast period. The wind turbine market is experiencing significant growth due to the global push towards clean energy and reducing carbon footprint in electricity generation. Onshore wind turbines accounted for the largest share of the global market in 2023, with steady growth anticipated compared to offshore wind farms.

Get a glance at the market share of various segments Download the PDF Sample

The metallurgical segment was the largest and valued at USD 44.40 million in 2018. Real-time wind turbine monitoring systems, which optimize performance and efficiency, are gaining popularity in onshore applications due to their ease of implementation. APAC is expected to dominate the onshore wind power generation sector due to favorable regulations. By adopting wind turbines, countries can reduce their reliance on fossil fuels, decrease carbon dioxide emissions, improve air quality, and enhance public health. Investing in wind turbines is an excellent agricultural income source, making it an attractive option for farmers and rural communities.

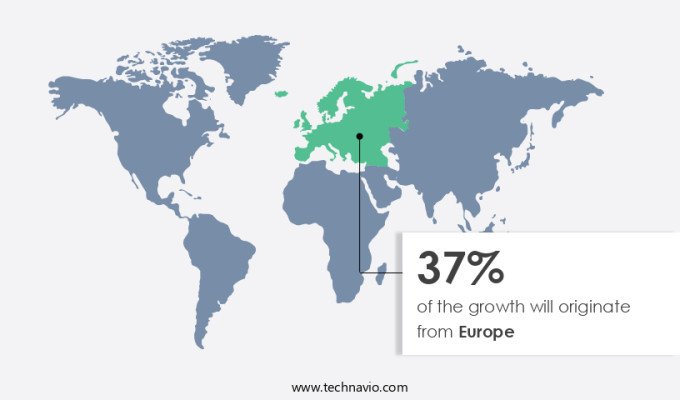

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia Pacific (APAC) region is experiencing a surge in energy demand due to population growth and improving living standards. In response, there is a heightened focus on renewable energy sources, particularly wind energy, for power generation. China and India are anticipated to dominate the installation of wind turbines in this region. China, the global leader in wind power generation, holds immense potential in this market.

Furthermore, digital technology and smart grid technology are crucial for optimizing the variability of wind and ensuring grid stability. Blade design innovations, such as aerodynamics and bend-twist-coupled blades, play a significant role in energy capture. These advancements are essential for the efficient operation of wind turbines and the overall growth of the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Wind Turbine Market Driver

Economical and efficient renewable energy resource is notably driving market growth. The global energy landscape is undergoing a significant transformation as nations prioritize renewable energy sources, such as wind power, over traditional fossil fuels. This transition is driven by the depletion of conventional energy resources and the increasing demand for energy efficiency and clean energy. These projects represent the growing importance of wind power in the global power generation mix.

Furthermore, the wind energy sector is poised for continued growth, as countries seek to reduce energy costs and minimize their carbon footprint. Offshore wind energy is also gaining traction, offering even greater potential for energy production. The wind power market is expected to expand significantly in the coming years, making it an attractive investment opportunity for businesses and governments alike. This shift towards renewable energy sources is a key trend in the power sector, with wind power leading the charge towards a cleaner, more sustainable future. Thus, such factors are driving the market's growth during the forecast period.

Wind Turbine Market Trends

Increasing government initiatives to shift toward the use of renewable energy is the key trend in the market. The wind power generation market is experiencing significant growth due to the increasing demand for utility-scale renewable energy sources in the US and globally. For instance, the Indian Ministry of New and Renewable Energy (MNRE) has set ambitious targets for offshore wind power generation, aiming for 5 GW by 2022 and 30 GW by 2030.

Similarly, in the US, Maryland state has passed legislation to double its wind energy target, adding 1.2 GW capacity by 2030. In 2017, the Maryland regulators approved financial incentives for two major offshore wind projects, Orsteds Skipjack, and US Winds MarWin, which are planned for sites off the coast of Ocean City. These initiatives underscore the commitment to reducing carbon emissions and expanding the use of renewable energy sources, including vertical-axis wind turbines, in the power generation mix. Thus, such trends will shape the market's growth during the forecast period.

Wind Turbine Market Challenge

Increasing adoption of alternate energy sources is the major challenge that affects the growth of the market. The market has witnessed significant growth in recent years due to the increasing focus on decarbonization and energy security. According to industry reports, the global installed capacity of wind energy is projected to expand at a steady pace, with both onshore and offshore wind projects contributing to this growth. Turbine technology continues to evolve, with advancements in floating wind technology enabling wind energy production in deeper waters. Carbon emissions are a major concern for many countries, and wind power is seen as a viable alternative to fossil fuels. However, the high cost of establishing wind energy farms and the inconsistency of power output compared to fossil fuels are challenges that must be addressed. Technology hubs are investing heavily in research and development to improve the efficiency and affordability of wind turbines. Offshore wind projects are becoming increasingly popular due to their potential to generate larger amounts of electricity than onshore projects.

Furthermore, decarbonization efforts and energy security concerns are driving the growth of this sector. The US, in particular, has significant potential for offshore wind development, with several major projects in the pipeline. Energy security is a top priority for many nations, and wind power offers a domestic and renewable energy source. Wind turbines are a key component of this transition, providing a clean and sustainable source of energy. The rotor blades of wind turbines are a critical part of their design, and advancements in blade technology are leading to increased efficiency and reduced costs. In conclusion, the wind turbine market is poised for continued growth as countries seek to reduce carbon emissions and improve energy security. Despite the challenges, advancements in technology and increasing investment in research and development are driving innovation and improving the affordability and efficiency of wind power. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acciona SA - The company offers wind turbines for both onshore and offshore wind farms.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acciona SA

- Bergey Wind Power Co.

- E.ON UK Plc

- Eaton Corp plc

- ENERCON GmbH

- Envision Group

- General Electric Co.

- Hitachi Ltd.

- Ming Yang Smart Energy Group Ltd.

- Nordex SE

- Senvion SA

- Siemens Gamesa Renewable Energy SA

- Sinovel Wind Group Co. Ltd.

- Suzlon Energy Ltd.

- Vestas Wind Systems AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

Wind turbines have emerged as a prominent solution in the global electricity generation landscape, contributing significantly to the reduction of carbon dioxide emissions and the mitigation of climate change. With the increasing awareness of the adverse effects of fossil fuels on air quality, public health, and agricultural income, the demand for clean energy sources has surged. Wind turbines, as renewable energy sources, offer an attractive alternative to diesel generators for energy security and sustainability. The wind turbine market is driven by the need to decrease carbon footprint and greenhouse gas emissions. Wind turbines convert wind energy into electricity, thereby reducing the reliance on fossil fuels and contributing to energy efficiency.

Furthermore, the variability of wind and grid stability are key challenges in wind power generation, which are being addressed through blade design innovations, digital technology, and smart grid integration. The market for wind turbines comprises onshore and offshore installation. Offshore wind energy is gaining popularity due to its high energy potential and potential for large-scale projects. Turbine technology advancements, such as floating wind and vertical axis designs, are expanding the market's scope. The installed capacity of wind turbines is expected to reach gigawatt levels, making it a significant contributor to decarbonization efforts and energy security.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market Growth 2024-2028 |

USD 47.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.3 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 37% |

|

Key countries |

China, US, Germany, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acciona SA, Bergey Wind Power Co., E.ON UK Plc, Eaton Corp plc, ENERCON GmbH, Envision Group, General Electric Co., Hitachi Ltd., Ming Yang Smart Energy Group Ltd., Nordex SE, Senvion SA, Siemens Gamesa Renewable Energy SA, Sinovel Wind Group Co. Ltd., Suzlon Energy Ltd., and Vestas Wind Systems AS |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch