Triazine Market Size 2024-2028

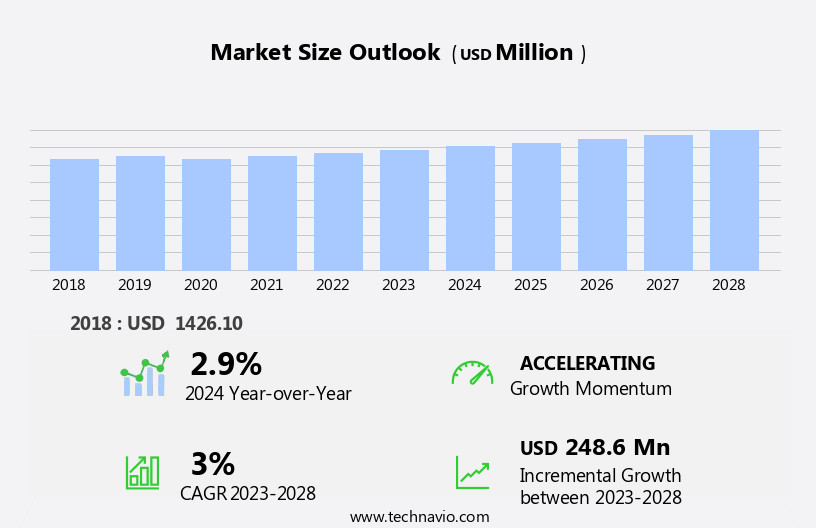

The triazine market size is forecast to increase by USD 248.6 million at a CAGR of 3% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by increasing investments in oil and gas exploration and production activities. This sector relies heavily on triazine-based corrosion inhibitors to protect pipelines and equipment from the corrosive effects of production processes and harsh environmental conditions. Another key trend influencing market expansion is the introduction of eco-friendly corrosion inhibitors derived from triazines. These green alternatives address environmental concerns and regulatory issues, making them an attractive choice for companies seeking to reduce their carbon footprint and comply with stringent regulations. However, the market is not without challenges. Regulatory issues, particularly regarding the use and disposal of triazine-based chemicals, continue to pose a significant hurdle for market participants.

- Companies must navigate these complex regulatory landscapes to ensure continued growth and profitability in the market. To capitalize on opportunities and navigate challenges effectively, businesses should stay informed of regulatory developments, invest in research and development of eco-friendly alternatives, and collaborate with industry partners to share best practices and resources.

What will be the Size of the Triazine Market during the forecast period?

- The market encompasses the production and application of triazines and their derivatives, primarily used as upstream chemicals in various industries. Triazines are essential intermediates in the manufacture of melamine resins, monoethanolamine (MEA), and hydrogen sulfide (H2S) scavengers. In the oil and gas sector, triazines serve as hydrogen sulfide (H2S) scavengers, preventing corrosion and reducing formaldehyde emissions in refineries and petrochemical plants. Triazines also find extensive applications in construction, particularly in laminate manufacturing for water resistance and improved strength. MEA, a triazine derivative, is a crucial ingredient in water treatment and as a feedstock in the production of monoethanolamine and melamine.

- Additionally, triazines are used in herbicides and agrochemical applications due to their effectiveness in controlling various pests. The market is expected to grow significantly due to the increasing demand for melamine resins, MEA, and hydrogen sulfide scavengers in various industries. The market's expansion is driven by the growing construction sector, the rising demand for corrosion protection, and the increasing usage of triazines in agrochemicals. Overall, the market is a dynamic and expanding industry, offering significant opportunities for growth in diverse sectors.

How is this Triazine Industry segmented?

The triazine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Oil and gas

- Chemical processing

- Medical

- Others

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Spain

- UK

- Middle East and Africa

- South America

- North America

By Application Insights

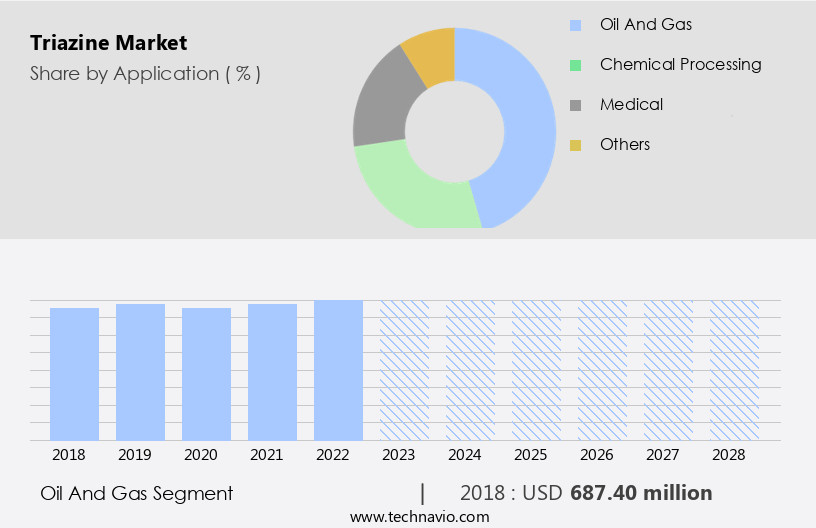

The oil and gas segment is estimated to witness significant growth during the forecast period.

Triazine, a crucial class of organic compounds with the chemical structure of 1,3,5-triazine, plays a significant role in various industries due to its unique properties. In the oil and gas sector, triazine derivatives, such as Mono Ethanolamine (MEA), serve as hydrogen sulfide (H2S) scavengers. H2S is a hazardous gas that occurs in petrochemical plants and shale production as an impurity. It can be corrosive and negatively impact the quality of natural gas, olefins, and cracker products. Moreover, H2S is harmful to human health, causing symptoms like nausea, headaches, and eye irritation. To mitigate these risks, MEA-triazine solutions are employed to effectively remove H2S gas in multiple concentrations.

Triazine also finds applications in sustainable agriculture, where it is used in the production of agrochemicals such as herbicides and fungicides. In the construction industry, triazine is utilized in the form of melamine resins for laminate applications, offering water resistance and corrosion protection. Additionally, it is used in wood adhesives for residential construction. In the petrochemical industry, triazine is a feedstock market for the production of melamine and dyes. Furthermore, it is used as a desulfurizer in the upstream chemicals sector to remove hydrogen sulfide and mercaptan from natural gas streams.

Get a glance at the market report of share of various segments Request Free Sample

The Oil and gas segment was valued at USD 687.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

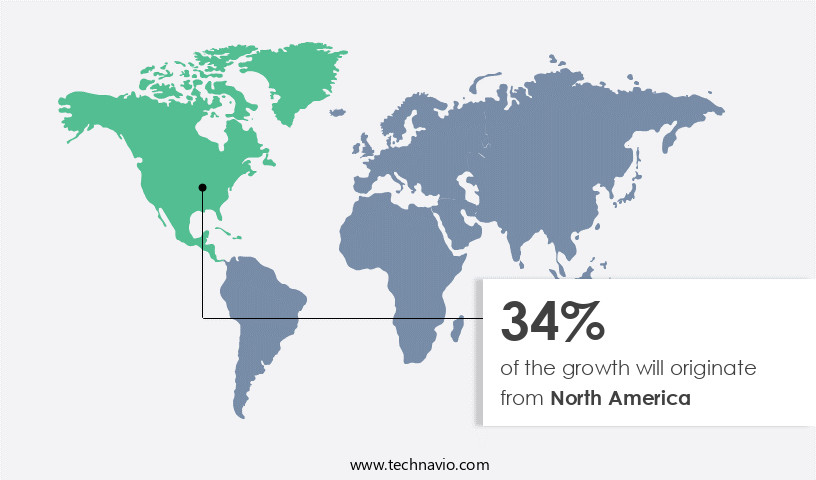

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by the increasing demand for hydrogen sulfide (H2S) scavengers. In 2023, there were approximately 132 operable oil refineries in the US, making it the largest oil and natural gas producer in the region. With oil consumption in power generation accounting for over two-thirds of the total consumption in the US in 2021, the need to remove H2S gas from oil and natural gas during refining processes is significant. Triazine derivatives, such as monoethanolamine, are commonly used as H2S scavengers in petrochemical plants. Additionally, triazine is used in laminate applications for water resistance and as a feedstock in melamine resins, dyes, and biosurfactants.

The market for triazine is expected to grow due to its applications in agrochemicals, including herbicides and fungicides, as well as its antimicrobial properties in wood adhesives and corrosion protection in construction applications. Triazine also plays a role in desulfurization processes in the oil and gas industry, making it a crucial upstream chemical.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Triazine Industry?

- Rising investments in oil and gas E and P activities is the key driver of the market.

- Liquid fuel consumption is experiencing steady growth, driven primarily by urbanization and industrialization in developing countries. According to the US Energy Information Administration (EIA), global liquid fuel consumption reached 105.5 mbpd in 2023, up from 101.45 mbpd in 2019. China and India are among the largest consumers of fuel globally, and their demand is projected to continue increasing. Major oil and gas companies are responding to this trend by initiating new Energy and Power (E&P) projects to meet the growing demand.

- These projects aim to ensure a steady supply of fuel to meet the increasing energy needs of these developing economies.

What are the market trends shaping the Triazine Industry?

- Introduction of green corrosion inhibitors is the upcoming market trend.

- Triazine is a biodegradable corrosion inhibitor, making it an eco-friendly alternative to traditional, toxic organic inhibitors. This environmental advantage, coupled with its renewability and availability, positions triazine as an attractive choice for various industrial and municipal applications. The increasing preference for green inhibitors is driven by stringent regulations and the need for sustainable solutions. For instance, the European Union has funded a project to develop an innovative, eco-friendly technology for inhibiting microbial-induced corrosion using biomimetic methods.

- Triazine's inexpensiveness, availability, and compatibility with the environment make it a cost-effective and ecologically acceptable option for corrosion control.

What challenges does the Triazine Industry face during its growth?

- Regulatory issue is a key challenge affecting the industry growth.

- The market faces challenges due to increasing regulations. companies in this market must adhere to various permit regulations, including expiration dates and residual management issues. In major countries, such as the US, legally enforced standards like the National Primary Drinking Water Regulations set guidelines for companies and users of water systems and treatment chemicals, including triazine. Additionally, regulations such as the Clean Water Act (CWA) and Resource Conservation and Recovery Act (RCRA) in the US impose strict guidelines on wastewater and hazardous waste management to prevent water and soil contamination.

- These regulations are crucial in ensuring the safety and sustainability of the market.

Exclusive Customer Landscape

The triazine market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the triazine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, triazine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashland Inc. - The company provides triazine compounds, such as Hexahydro-1,3,5-tris-(2-hydroxyethyl)-s-triazine, as antimicrobial agents in metal working fluids. This formaldehyde condensate product effectively inhibits microbial growth, enhancing fluid performance and longevity. Triazines, a class of organic compounds, offer superior antimicrobial properties for industrial applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashland Inc.

- BASF SE

- Carbone Scientific Co. Ltd.

- CHEMOS GmbH and Co. KG

- Clariant International Ltd

- Dow Inc.

- Ecolab Inc.

- Foremark Performance Chemicals

- Glentham Life Sciences Ltd.

- Haihang Industry Co. Ltd.

- Hexion Inc.

- JieJie Group Co. Ltd.

- Lonza Group Ltd.

- Merck KGaA

- RAG Stiftung

- Sagechem Ltd.

- Sintez OKA LLC

- Stepan Co.

- Tetrahedron Scientific Inc.

- Wuhan Silworld Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of compounds and derivatives, with 1,3,5-triazine being a significant component. These organic compounds, characterized by their unique ring structure, exhibit various properties that make them valuable in diverse applications. Triazines find extensive use as hydrogen sulfide scavengers, particularly in industries such as petrochemicals and oil and gas. Their ability to effectively neutralize hydrogen sulfide makes them indispensable in the prevention of corrosion and the enhancement of process efficiency. Triazine derivatives also play a crucial role in the agrochemical sector, where they are employed as herbicides, fungicides, and desulfurizers. Their antimicrobial properties contribute to their use in wood adhesives and water resistance applications.

In the realm of sustainable agriculture, biosurfactants derived from triazines have gained attention due to their potential as eco-friendly alternatives to traditional agrochemicals. These biosurfactants can enhance the bioavailability of nutrients and improve crop yields, making them an attractive option for farmers. Triazines are also integral to the production of melamine resins, which are widely used in laminate applications. Their resistance to heat and moisture makes them suitable for use in various construction applications, including residential and commercial buildings. Mercaptan derivatives, another class of triazine compounds, are employed as desulfurizers in the petrochemical industry. They facilitate the removal of hydrogen sulfide from natural gas streams, ensuring the production of cleaner fuels and reducing the environmental impact of petrochemical processes.

Triazines also find applications in the upstream chemicals sector, where they serve as feedstocks for the production of various industrial chemicals. Their versatility and wide range of applications make them a valuable commodity in the global chemical industry. The market is influenced by several factors, including raw material prices, technological advancements, and regulatory requirements. The demand for sustainable and eco-friendly alternatives is driving research and development efforts in the sector, with a focus on reducing the environmental impact of triazine production and applications. In , the market is a dynamic and diverse sector that plays a crucial role in various industries, from petrochemicals and agriculture to construction and consumer goods.

The versatility and unique properties of triazines make them indispensable in numerous applications, ensuring their continued relevance in the global chemical industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2024-2028 |

USD 248.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.9 |

|

Key countries |

US, China, Japan, Germany, UK, India, Spain, Canada, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Triazine Market Research and Growth Report?

- CAGR of the Triazine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the triazine market growth of industry companies

We can help! Our analysts can customize this triazine market research report to meet your requirements.