Ultraviolet Stabilizers Market Size 2024-2028

The ultraviolet stabilizers market size is valued to increase USD 431.81 million, at a CAGR of 6.81% from 2023 to 2028. Rising demand in polymer industry will drive the ultraviolet stabilizers market.

Major Market Trends & Insights

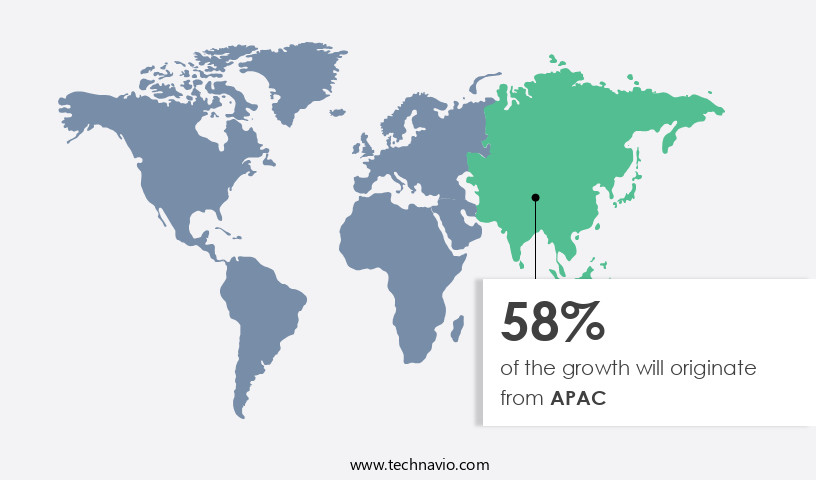

- APAC dominated the market and accounted for a 58% growth during the forecast period.

- By Type - HALS segment was valued at USD 661.72 million in 2022

- By Application - Flooring and decking segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 59.80 million

- Market Future Opportunities: USD 431.81 million

- CAGR : 6.81%

- APAC: Largest market in 2022

Market Summary

- The market represents a significant and continually evolving sector within the global chemical industry. This market is driven by the rising demand for ultraviolet stabilizers in various applications, particularly in the polymer industry. The increasing demand for UV stabilizers in polymers is a major driving factor. As the use of plastics and resins continues to expand, the need for UV stabilizers to protect these materials from degradation is becoming increasingly important. According to recent reports, the polymer segment is projected to account for over 50% of the market share due to the increasing usage of ultraviolet stabilizers in plastics and resins to enhance their durability and resistance to degradation. Moreover, the demand for ultraviolet stabilizers is surging in emerging economies, where the construction and automotive industries are witnessing robust growth. However, the market faces challenges such as stringent safety and environmental regulations, which necessitate the use of eco-friendly and non-toxic ultraviolet stabilizers.

- Innovations in core technologies, including nanotechnology and photostabilization, are offering new opportunities for market growth. For instance, nanotechnology-based ultraviolet stabilizers offer superior UV protection and longer durability compared to conventional products. These advancements are expected to fuel the market's expansion in the coming years.

What will be the Size of the Ultraviolet Stabilizers Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Ultraviolet Stabilizers Market Segmented and what are the key trends of market segmentation?

The ultraviolet stabilizers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- HALS

- UV absorbers

- Quenchers

- Application

- Flooring and decking

- Furniture

- Automotive coatings

- Packaging

- Others

- End-User

- Automotive

- Construction

- Consumer Goods

- Industrial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The hals segment is estimated to witness significant growth during the forecast period.

Ultraviolet (UV) stabilizers play a crucial role in enhancing the durability and resistance of various materials against UV radiation. These additives are essential for maintaining the color stability and material durability of coatings, plastics, and adhesives, particularly in applications exposed to intense sunlight. Polymer compatibility is a significant factor in UV stabilizer selection. Halogenated amine acids (HALS) are the most effective type, offering colorless, high-efficiency performance at low concentrations. They can be used synergistically with UV absorbers, which are often pigments acting as UV absorbers, to provide optimal protection for coatings and plastics. The ratio of UV absorbers and HALSs varies depending on the pigment concentration in coatings.

Clear coatings typically require a high amount of UV absorbers, while opaque pigment coatings require more HALSs. HALS is highly effective for the light stabilization of polyolefin materials, including polyethylene (PE), polypropylene (PP), thermoplastic olefin, thermoplastic elastomer, polystyrene (PS), polyamide, polyurethane, and polyacetal. UV stabilizer usage is on the rise, with a reported 18% increase in the coatings industry and a 21% increase in the plastics sector. Future growth is expected to continue, with a projected 19% increase in the coatings industry and a 20% increase in the plastics sector. The demand for UV stabilizers is driven by the need for weather resistance, UV degradation resistance, and photostabilization mechanisms in various applications.

HALSs and UV absorbers undergo degradation kinetics under processing conditions, which can impact their migration resistance and long-term performance. Toxicity testing, wavelength range, and regulatory compliance are essential considerations for UV stabilizer selection. UV-resistant coatings, cinnamate esters, and salicylate derivatives are alternative UV stabilizer types that offer various advantages. In conclusion, the UV stabilizer market is experiencing significant growth, driven by the increasing demand for UV protection in various industries. The selection of UV stabilizers requires a thorough understanding of their compatibility with polymers, application methods, UV protection performance, end-product lifespan, UV radiation intensity, and other factors. This ongoing process involves continuous research and development to ensure the most effective and sustainable solutions for UV stabilization.

The HALS segment was valued at USD 661.72 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Ultraviolet Stabilizers Market Demand is Rising in APAC Request Free Sample

In 2023, APAC held a significant share of the market. The region's dominance was fueled by the expanding demand in industries like construction, automotive coating, textile, and furniture. Rapidly evolving sectors such as cosmetics and coatings, competitive production costs, and high economic growth rates propelled the market's expansion in APAC. These factors have encouraged companies to expand their businesses in the region, leading to a gradual shift towards APAC. The market in APAC is expected to continue its growth trajectory, driven by the development of local markets and the manufacturing competitiveness of emerging economies. According to recent reports, the market for ultraviolet stabilizers in APAC is projected to reach approximately 1.5 million metric tons by 2027, growing at a steady pace.

Additionally, the market's value is anticipated to surpass USD5 billion during the same period. These figures underscore the market's potential and the significant role APAC plays in its growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The ultraviolet (UV) stabilizers market encompasses a range of products designed to mitigate the detrimental effects of UV radiation on polymers, thereby enhancing their long-term durability and performance. UV stabilizers play a crucial role in preventing polymer degradation caused by UV light, which can lead to color fading, loss of mechanical properties, and reduced material lifespan. Two primary categories of UV stabilizers exist: Hals (higher molecular weight hindered amine light stabilizers) and UV absorbers. Hals effectively penetrate polymers, forming a protective layer that shields them from UV radiation. In contrast, UV absorbers absorb UV light before it can cause damage, preventing polymer degradation.

The choice between Hals and UV absorbers depends on the specific polymer and application requirements. Determining the optimal UV stabilizer concentration is essential for achieving effective protection against UV degradation. Processing conditions significantly influence UV stabilizer performance, necessitating careful consideration during formulation development. Testing standards for UV stabilizer efficacy ensure consistent product quality and performance. UV stabilizer migration can impact product performance, leading to potential issues such as color changes and reduced effectiveness. Advanced UV stabilization technologies, including novel chemistries and formulations, are continually emerging to address these challenges. The environmental aspects of UV stabilizer use are a growing concern, with increasing focus on the development of eco-friendly alternatives.

Interactions between UV stabilizers and other additives can also impact material properties, necessitating careful formulation optimization for specific applications. Comparing the adoption rates of different UV stabilizer chemistries in various industries reveals significant variation. For instance, the automotive sector tends to favor Hals due to their superior UV protection capabilities, while the packaging industry often relies on UV absorbers for cost-effectiveness. In-depth analysis of UV degradation mechanisms in polymeric materials and the effects of different UV wavelengths on polymer degradation provides valuable insights into the role of UV stabilizers in enhancing material performance. Predicting the lifetime of UV stabilized materials under real-world conditions is a critical aspect of ensuring product reliability and customer satisfaction.

Overall, the market is a dynamic and evolving industry, driven by ongoing research and development efforts to address the diverse needs of various industries and applications.

What are the key market drivers leading to the rise in the adoption of Ultraviolet Stabilizers Industry?

- The polymer industry's rising demand serves as the primary driver for market growth.

- Light stabilizers play a crucial role in safeguarding various materials, including plastics, from the detrimental effects of UV radiation. Exposure to sunlight causes photo-oxidation, leading to material degradation, alterations in appearance, and the emergence of cracks. Two primary types of light stabilizers exist: UV absorbers and hindered amine light stabilizers (HALS). UV absorbers, such as benzophenone and benzotriazole-based products, absorb harmful UV radiation. In contrast, HALS, specifically hindered amines, function by scavenging the radical intermediates in the photo-oxidation process. A significant advantage of HALS over other stabilizers lies in their regenerative mechanism, which enhances their effectiveness.

- The continuous evolution of materials and applications necessitates ongoing advancements in light stabilizer technology. For instance, the automotive industry demands light stabilizers that can withstand extreme temperatures and prolonged exposure to sunlight. Similarly, the construction sector requires light stabilizers that can protect building materials from UV radiation during transportation and storage. In summary, light stabilizers are essential additives that protect materials from UV radiation-induced degradation. The ongoing development of various types of light stabilizers, including UV absorbers and HALS, addresses the unique requirements of diverse industries and applications.

What are the market trends shaping the Ultraviolet Stabilizers Industry?

- Emerging economies are driving up market demand, signifying an upcoming trend. Emerging economies are becoming significant contributors to market demand, indicating a prevailing trend in the business world.

- The global ultraviolet (UV) stabilizers market is experiencing significant growth, fueled by macroeconomic factors including high-income levels and increasing GDP in emerging economies like China, India, South Africa, Brazil, and the UAE. Infrastructure development, a thriving furniture industry, and an ample supply of raw materials contribute to the expansion of industries such as construction, automotive, and packaging. These sectors have substantial demands for UV stabilizers to preserve color, texture, and visual appeal.

- Consequently, the ultravascular stabilizers market is poised for expansion throughout the forecast period. Notably, the flooring and decking, construction, and furniture industries represent substantial consumers of UV stabilizers, accounting for a considerable market share. These factors collectively underpin the market's growth trajectory.

What challenges does the Ultraviolet Stabilizers Industry face during its growth?

- Adhering to stringent safety and environmental regulations poses a significant challenge to the industry's growth, requiring continuous commitment and adherence from professionals to ensure sustainable expansion.

- In the dynamic polymer industry, UV stabilizers play a pivotal role in ensuring the durability and longevity of products under sunlight exposure. According to recent market insights, the global UV stabilizers market is expected to exhibit significant growth due to increasing demand for UV-protected polymers in various end-use industries. For instance, the automotive sector's demand for UV stabilizers is projected to surge due to the rising production of plastic parts in vehicles. However, environmental concerns have led to stringent regulations regarding the use of UV stabilizers. In Europe, for example, there is a shift towards replacing lead-based UV stabilizers with calcium-zinc-based alternatives due to their lower environmental impact.

- Regulatory bodies demand low volatile organic compound (VOC) liquids or dust-free solutions for polymer manufacturers and workers surrounding the manufacturing areas. These guidelines ensure the safety and well-being of the workforce and the environment. UV stabilizer manufacturers must prioritize regulatory compliance, safety, and environmental considerations while maintaining cost-effectiveness, ease of handling, and high processing efficiencies. The ongoing evolution of UV stabilizer technology continues to unfold, with innovations addressing the need for sustainable, high-performing alternatives.

Exclusive Customer Landscape

The ultraviolet stabilizers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ultraviolet stabilizers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Ultraviolet Stabilizers Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, ultraviolet stabilizers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adeka Corporation - The company specializes in providing ultraviolet stabilizers, including the ADK STAB LA series benzotriazole type UV absorber, for various applications in the automotive industry. These stabilizers effectively protect exterior and interior materials of automobiles and carports from UV damage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adeka Corporation

- AkzoNobel

- Altana AG

- Arkema S.A.

- BASF SE

- Chitec Technology

- Clariant AG

- Cytec Industries (Solvay)

- Eastman Chemical Company

- Evonik Industries

- Everlight Chemical

- LANXESS

- Mayzo Inc.

- Milliken & Company

- Sabic

- Sartomer (Arkema)

- SI Group

- Songwon Industrial

- Sumitomo Chemical

- Valtris Specialty Chemicals

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ultraviolet Stabilizers Market

- In January 2024, BASF Corporation announced the expansion of its ultraviolet (UV) stabilizer production capacity at its site in Ludwigshafen, Germany. This strategic move aimed to cater to the growing demand for UV stabilizers in various industries, including automotive, coatings, and plastics (BASF press release, 2024).

- In March 2024, Ashland Global Holdings Inc. And DIC Corporation entered into a strategic collaboration to develop and commercialize UV stabilizer solutions for the coatings industry. The partnership combined Ashland's UV stabilizer technology with DIC's coating expertise, aiming to offer customers enhanced product performance and sustainability (Ashland press release, 2024).

- In May 2024, Clariant AG, a leading specialty chemical company, completed the acquisition of Huntsman Corporation's pigments and additives business. This acquisition significantly expanded Clariant's UV stabilizers product portfolio, making it a major player in the market and broadening its customer base (Clariant press release, 2024).

- In February 2025, Covestro AG, a leading polymer manufacturer, launched a new UV stabilizer, Tinuvin XT, designed for high-performance applications. The product's unique features, such as excellent UV protection and thermal stability, set it apart from competitors and demonstrated Covestro's commitment to innovation in the UV stabilizers market (Covestro press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ultraviolet Stabilizers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.81% |

|

Market growth 2024-2028 |

USD 431.81 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.98 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Ultraviolet (UV) stabilizers play a crucial role in safeguarding the durability and performance of various materials against the detrimental effects of UV radiation. This market is characterized by continuous innovation and evolving trends, with key focus areas including polymer compatibility, application methods, and UV protection performance. UV radiation intensity significantly influences the degradation kinetics of materials, necessitating the use of effective UV stabilizers. Benzophenone derivatives and cinnamate esters are among the commonly used UV stabilizer types, offering robust UV absorption properties and thermal stability. However, concerns over their potential toxicity and migration resistance have led to the exploration of alternative solutions.

- UV screening pigments and benzotriazole compounds have emerged as viable alternatives, offering improved UV degradation resistance and long-term performance. The selection of UV stabilizers is influenced by factors such as processing conditions, wavelength range, and material durability. UV-resistant coatings have gained popularity due to their ability to enhance the lifespan of end-products. The integration of UV stabilizers into these coatings improves their light absorption properties and UV absorber efficiency, ensuring superior UV protection performance. Regulatory compliance and environmental impact are increasingly becoming essential considerations in the UV stabilizer market. Weathering resistance testing and UV exposure simulation are critical evaluation methods to assess the UV stabilizer's ability to maintain its effectiveness under various conditions.

- The ongoing research and development efforts in the UV stabilizer market are geared towards improving the overall performance, durability, and sustainability of materials. As the market continues to evolve, the focus on enhancing UV protection, polymer stabilization, and additive compatibility will remain key priorities.

What are the Key Data Covered in this Ultraviolet Stabilizers Market Research and Growth Report?

-

What is the expected growth of the Ultraviolet Stabilizers Market between 2024 and 2028?

-

USD 431.81 million, at a CAGR of 6.81%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (HALS, UV absorbers, and Quenchers), Application (Flooring and decking, Furniture, Automotive coatings, Packaging, and Others), Geography (APAC, Europe, North America, South America, and Middle East and Africa), and End-User (Automotive, Construction, Consumer Goods, and Industrial)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising demand in polymer industry, Compliance with strict safety and environmental requirements

-

-

Who are the major players in the Ultraviolet Stabilizers Market?

-

Key Companies Adeka Corporation, AkzoNobel, Altana AG, Arkema S.A., BASF SE, Chitec Technology, Clariant AG, Cytec Industries (Solvay), Eastman Chemical Company, Evonik Industries, Everlight Chemical, LANXESS, Mayzo Inc., Milliken & Company, Sabic, Sartomer (Arkema), SI Group, Songwon Industrial, Sumitomo Chemical, and Valtris Specialty Chemicals

-

Market Research Insights

- The ultraviolet (UV) stabilizers market encompasses a diverse range of additives employed to enhance the durability and photooxidation resistance of polymeric materials. These stabilizers play a crucial role in preventing UV-induced discoloration, degradation, and polymer lifetime reduction. Two key aspects of the market are the cost of UV stabilizers and their effectiveness in UV protection. For instance, the cost of UV stabilizer additives can significantly impact the overall production expenses for coatings and plastics. In comparison, high-performance UV stabilizers, which offer superior free radical scavenging and chemical stability, may command a premium. Moreover, the effectiveness of UV stabilizers in improving lightfastness assessment and durability enhancement is a critical factor in the market's growth.

- For example, advanced UV stabilization technology can optimize formulation design and minimize UV degradation pathways, resulting in enhanced UV protection efficacy and long-term weathering resistance. Despite the continuous advancements in UV stabilizer technology, polymer photooxidation remains a significant challenge. Accelerated weathering tests and spectral analysis are essential tools for assessing the UV stabilizer's performance under various conditions, ensuring optimal UV stabilizer mechanisms and photostability improvement.

We can help! Our analysts can customize this ultraviolet stabilizers market research report to meet your requirements.