US Cookies Market Size 2025-2029

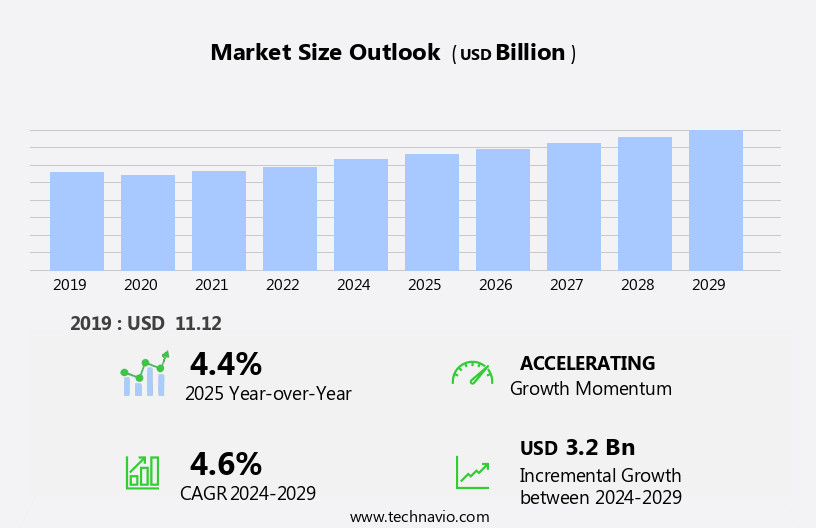

The us cookies market size is forecast to increase by USD 3.2 billion billion at a CAGR of 4.6% between 2024 and 2029.

- The US cookies market is experiencing significant growth, driven by the increasing trend towards cookie premiumization. Consumers are now seeking higher quality, artisanal cookies that offer unique flavors and textures, leading to increased demand and innovation in the market. Additionally, improvements in clean labeling and packaging have made cookies an attractive snack option for health-conscious consumers. However, this market growth is not without challenges. Competition from healthier snack alternatives, such as fruit and nut bars and popcorn, is increasing, forcing companies to differentiate their offerings and focus on product innovation.

- To capitalize on market opportunities and navigate these challenges effectively, companies must stay abreast of consumer preferences and trends, invest in research and development, and explore strategic partnerships and collaborations. By doing so, they can position themselves as leaders in the cookies market and meet the evolving demands of consumers.

What will be the size of the US Cookies Market during the forecast period?

- The cookies market in the US exhibits a growth trajectory, driven by the expanding consumer base and their increasing spending power. This market encompasses a wide range of products, including digestive, bar, molded, and rolled cookies. Functional ingredients, such as low-fat and sugar-free alternatives, cater to the health-conscious consumer segment. The market is also influenced by dietary trends, with an increasing number of consumers adhering to gluten-free diets. Manufacturers prioritize operational efficiency and energy-efficiency in their production processes, utilizing advanced technologies like rigid packaging, lighting systems, and signaling devices. The production of cookies involves various stages, from mixing and baking to cooling and packaging.

- These processes are continuously optimized to enhance overall production efficiency and meet the evolving consumer demands. The cookies market in the US is a significant contributor to the food industry, with a substantial market size and continuous growth. The market dynamics are influenced by various factors, including consumer preferences, dietary trends, and technological advancements in production processes.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Plain and butter-based cookies

- Chocolate-based cookies

- Other cookies

- Packaging

- Rigid packaging

- Flexible packaging

- Geography

- US

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The Cookies market in the US is primarily driven by the consumer base, with a significant portion of sales occurring through offline distribution channels. Brick-and-mortar retailers, including bakeries and supermarkets, dominate the market due to the convenience they offer. Consumers value the ability to physically examine and purchase cookies, making this distribution method popular. Consumer spending power, influenced by factors such as income level and urbanization, plays a crucial role in market growth. Health-conscious consumers seek out functional ingredients, low-fat, sugar-free, and gluten-free alternatives. Home bakers also contribute to the market, with a growing interest in healthy living and creating healthy alternatives.

Obesity, poor diet, and health issues continue to be concerns, driving demand for cookies with functional attributes. Companies are innovating to meet these demands, offering clean-labeled, natural flavor, and oatmeal cookies, as well as a biscuit range. Competition is fierce, with key players including Want Want Group, Wheat Thins, NutriChoice, Little Hearts, and Marie Gold. Packaging innovation is essential for standing out in the market, with rigid and flexible packaging options available. The Cookies industry continues to grow, with digestive, gluten-free, bar, molded, rolled, and rigid packaging being popular categories.

Get a glance at the market share of various segments Request Free Sample

The Offline segment was valued at USD 6.92 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Cookies Market?

- Growing emphasis on cookie premiumization is the key driver of the market.

- The global cookies market is experiencing growth due to the expanding millennial population and increasing disposable incomes. Premium cookies, with their branding, packaging, and positioning, have become a popular choice for consumers. companies such as Mondelez, Parle Products, and PepsiCo cater to this demand with a diverse range of offerings. The health-conscious consumer trend is driving the market, enabling companies to charge higher prices for premium products.

- Manufacturers are differentiating their offerings by incorporating ingredients like dry fruits, seeds, traditional grains, and nuts. For instance, Mondelez's Tates Bake Shop in the US produces thin-and-crispy premium cookies using natural and high-quality ingredients. This market dynamic is expected to continue shaping the cookies industry.

What are the market trends shaping the US Cookies Market?

- Improvements in clean labeling and packaging of cookies is the upcoming trend in the market.

- In the cookies market, consumer preferences are shifting towards cleaner and more recognizable ingredients. Manufacturers are addressing this trend by simplifying ingredient lists, eliminating artificial additives, preservatives, and high-fructose corn syrup. Natural sweeteners and flavorings are becoming more common. Clear labeling of allergens is essential for consumers with food sensitivities or allergies. Manufacturers ensure consumer safety by providing detailed allergen information on packaging. Cookies made with organic ingredients and free from genetically modified organisms (GMOs) are gaining favor. Clean labeling often includes organic and non-GMO certifications.

- Environmentally conscious consumers are driving demand for eco-friendly packaging. Manufacturers are exploring sustainable options, such as recyclable or biodegradable packaging, to minimize environmental impact. This shift towards cleaner, more sustainable cookies reflects broader consumer trends towards healthier and more environmentally-friendly food choices.

What challenges does US Cookies Market face during the growth?

- Competition from healthier snacks is a key challenge affecting the market growth.

- In the US market, the demand for healthier snack options is on the rise as consumers prioritize dietary and wellness goals. Traditional cookies, which often contain high levels of added sugars, saturated fats, and artificial additives, are being replaced by alternatives that offer nutritional benefits. Granola bars, fruit snacks, and yogurt are popular choices due to their whole grains, fiber, vitamins, and minerals.

- For individuals managing their weight or following specific dietary restrictions, such as gluten-free or dairy-free diets, these snacks cater to their unique needs. The trend towards healthier snacking reflects a broader consumer preference for more natural, wholesome food options.

Exclusive US Cookies Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Campbell Soup Co.

- Corporativo Bimbo SA de CV

- Ferrero International S.A.

- General Mills Inc.

- Girl Scouts of the USA

- Imagine Baking Inc

- InBite GF Inc

- McKee Foods

- Meiji Holdings Co. Ltd.

- Mondelez International Inc.

- PepsiCo Inc.

- Rosa Food Products Co. Inc.

- Royal G Snacks Inc.

- Silver State Baking Co

- The J.M Smucker Co.

- Wandas Barium Cookie LLC.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cookies market in the global context is a significant segment of the bakery products industry, characterized by its wide consumer base and diverse product offerings. This market caters to various consumer segments, including home bakers and commercial bakeries, with a focus on providing functional ingredients that cater to dietary preferences and health-conscious consumers. The market dynamics of the cookies industry are influenced by several factors. The rising awareness of obesity and poor diet-related health issues has led to an increased demand for low-fat and sugar-free cookies. Consumers are increasingly seeking healthy alternatives to traditional cookies, leading to the development of functional attributes such as gluten-free, lactose-free, and dairy-free options.

The consumer base for cookies is diverse and includes various demographics, with a particular focus on the younger population and those with rising income levels. The cookies industry has responded to this trend by introducing premium cookies that cater to the evolving tastes and preferences of consumers. Rapid urbanization and the convenience factor have also contributed to the high consumption of cookies. Freshly hand-made cookies, transparency of ingredients, and product innovations have become essential factors in the competitive positioning of brands in the cookies market. The cookies industry is not without its challenges, however. Input costs, such as the price of raw materials and energy, can significantly impact the profitability of cookie manufacturers.

Glutamic disorders and other chronic diseases have created a sensitive issue for the industry, with consumers increasingly seeking natural flavors and clean-labeled cookies. The cookies market is vast and diverse, with a range of product offerings, including digestive cookies, bar cookies, molded cookies, rolled cookies, and biscuit range. Some popular cookie varieties include oatmeal raisin cookies, snickerdoodles, caramel flavored minis, chocolate cookies, chocolate chip cookies, and gluten-free cookies. Packaging innovation is a crucial aspect of the cookies market, with rigid and flexible packaging options available to cater to various consumer preferences and product types. The industry is also focused on sustainability and reducing waste, with eco-friendly packaging becoming increasingly popular.

The cookies market is a dynamic and evolving industry, with constant innovation and brand creation driving growth. Advanced product innovations, such as adaptive lighting systems and energy-efficient production processes, are being adopted to improve operational efficiency and reduce costs. In , the cookies market is a significant and diverse industry that caters to various consumer segments and dietary preferences. The market is influenced by several factors, including health consciousness, consumer demographics, and packaging innovation. The industry faces challenges such as input costs and the need for transparency and sustainability, but continues to evolve and adapt to consumer demands.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 3.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch