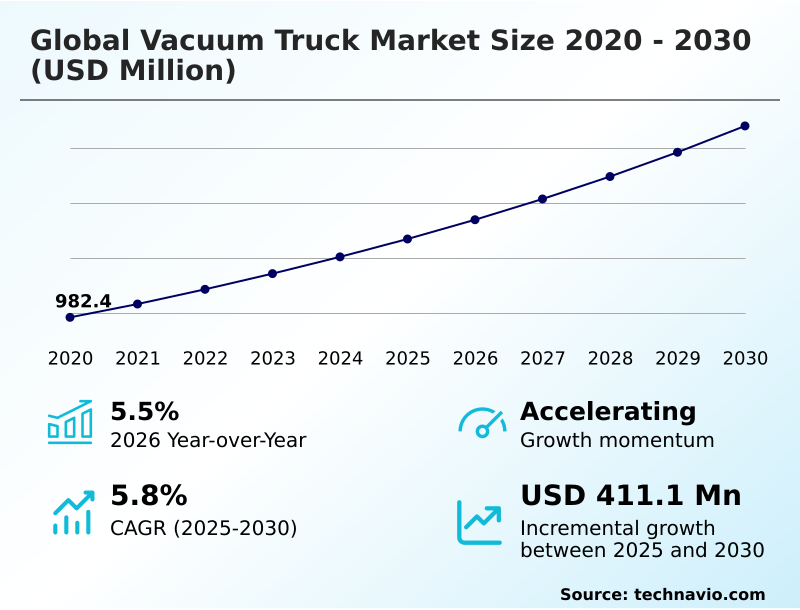

Vacuum Truck Market Size 2026-2030

The vacuum truck market size is valued to increase by USD 411.1 million, at a CAGR of 5.8% from 2025 to 2030. Rising application of vacuum trucks in industrial cleaning will drive the vacuum truck market.

Major Market Trends & Insights

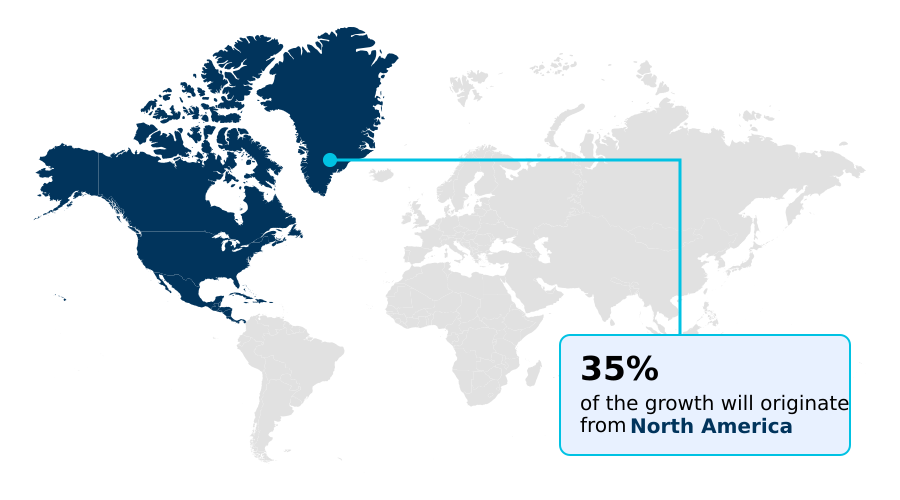

- North America dominated the market and accounted for a 35.3% growth during the forecast period.

- By Application - Industrial segment was valued at USD 459.3 million in 2024

- By Product Type - Liquid and dry suctioning segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 696 million

- Market Future Opportunities: USD 411.1 million

- CAGR from 2025 to 2030 : 5.8%

Market Summary

- The vacuum truck market is evolving beyond simple waste collection, driven by stringent environmental regulations and the critical need for safe, efficient infrastructure management. Core applications like septic system cleaning and municipal infrastructure maintenance are now complemented by advanced industrial uses.

- For instance, in the energy sector, hydro-excavation is now a standard for non-destructive digging around sensitive pipelines, a process mandated by safety protocols. This requires sophisticated equipment featuring a positive displacement blower and advanced wet dry vacuum solutions.

- Concurrently, the push for operational intelligence is driving the adoption of telematics systems for remote diagnostics and preventive maintenance scheduling, enabling fleet managers to optimize asset utilization rates and reduce costly downtime. A scenario where an industrial plant leverages these systems for plant turnaround maintenance demonstrates the market's shift toward predictive, data-driven operations.

- While challenges such as high operating costs persist, the integration of zero-emission collection vehicle technology and explosion-proof components for hazardous waste suction highlights a continuous focus on sustainability and safety, shaping the industry’s future trajectory.

What will be the Size of the Vacuum Truck Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Vacuum Truck Market Segmented?

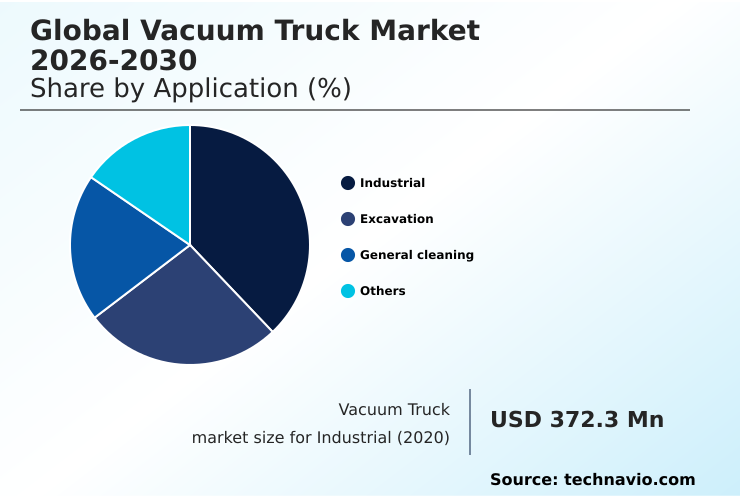

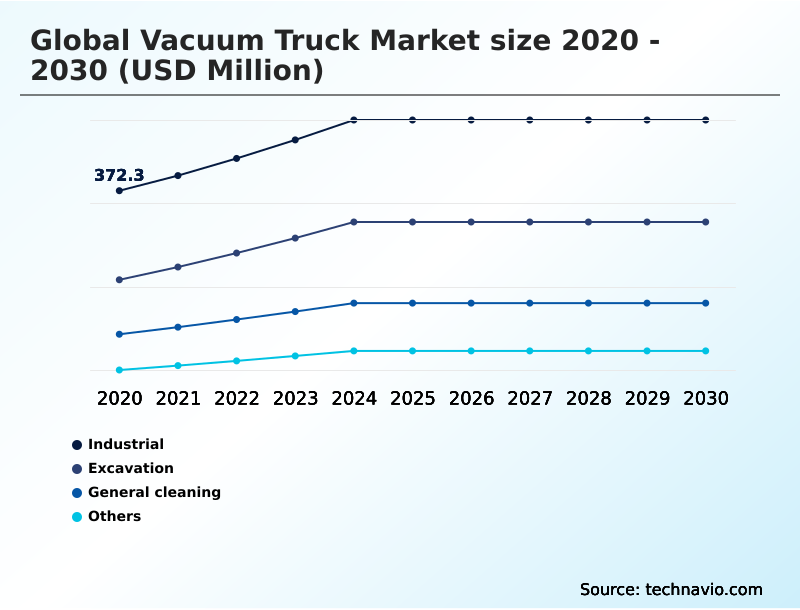

The vacuum truck industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Application

- Industrial

- Excavation

- General cleaning

- Others

- Product type

- Liquid and dry suctioning

- Liquid suctioning only

- Capacity

- Medium

- Small

- Large

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of World (ROW)

- North America

By Application Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The industrial segment is defined by its critical reliance on specialized equipment for operational continuity and environmental compliance.

Industrial facilities depend on the industrial vacuum loader for essential tasks like industrial tank cleaning and removing materials from processing equipment, with wet dry vacuum solutions handling diverse waste streams.

The use of a positive displacement blower and advanced particulate matter filtration ensures efficient and safe removal during plant turnaround maintenance. This reliance highlights the segment's importance, where a breakdown can cause significant downtime.

Ensuring fleet operational efficiency through reliable equipment improves productivity by over 15% in continuous processing environments, making environmental cleaning and industrial fluid handling central to industrial strategy and a key driver of demand.

The Industrial segment was valued at USD 459.3 million in 2024 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35.3% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Vacuum Truck Market Demand is Rising in North America Request Free Sample

The market's geographic landscape is led by North America, which accounts for over 35% of demand, driven by stringent environmental regulations and extensive municipal infrastructure maintenance projects. In this region, hydro-excavation services are standard for utility work.

Europe follows, with a strong focus on municipal waste handling and industrial applications. The APAC region, contributing nearly 23% of the market, is experiencing rapid growth due to industrialization and infrastructure development.

Here, demand for the sanitation vehicle and equipment for septic system cleaning is increasing.

The adoption of advanced pneumatic loading system technology is rising globally, with mature markets achieving up to a 15% greater operational uptime compared to regions relying on older equipment for sludge dewatering process.

hazardous waste suction is a globally recognized application.

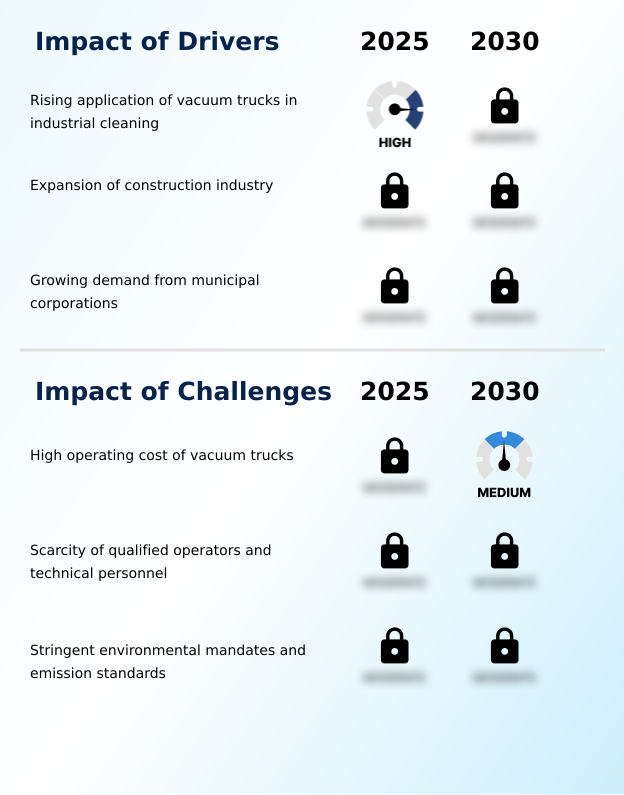

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Strategic decision-making in the global vacuum truck market 2026-2030 requires a nuanced understanding of operational trade-offs and technological advancements. When evaluating a vacuum truck for oil and gas industry use, for instance, industrial vacuum loader safety standards compliance is non-negotiable, often mandating specialized equipment.

- The debate over hydro-excavation vs traditional mechanical digging is largely settled in sensitive environments, where the key benefits of non-destructive digging methods far outweigh the higher initial cost. As the industry evolves, the electric vacuum truck operating cost comparison becomes increasingly relevant, especially for municipal fleets focused on total cost of ownership and emission reduction.

- The selection between a positive displacement blower versus vacuum pump depends entirely on the application, whether it involves effective slurry and solids transport solutions or liquid-only tasks. Many operators are now analyzing whether renting vs buying industrial vacuum trucks offers better financial flexibility.

- The choice of a compact vacuum truck for dense urban areas versus a larger model for industrial sites highlights the need for application-specific solutions. Furthermore, technological advancements in modern vacuum trucks, such as telematics integration for vacuum truck fleets and advanced filtration systems for vacuum trucks, are critical for optimizing performance.

- For any operator, understanding municipal sewer cleaning truck performance specifications, septic tank pumping truck capacity requirements, and the impact of emission standards on vacuum trucks is fundamental to fleet management.

- Ultimately, vacuum truck scheduled maintenance and repair protocols and robust vacuum truck operator training and certification are what differentiate top-performing fleets, with some achieving a 10% higher uptime than those with less rigorous programs.

What are the key market drivers leading to the rise in the adoption of Vacuum Truck Industry?

- The increasing application of vacuum trucks for industrial cleaning, maintenance, and safety compliance is a primary driver for market growth.

- Stringent regulations and the growing complexity of industrial cleaning applications are major drivers. Governments globally are tightening rules for environmental compliance, mandating the use of specialized vehicles for hazardous material collection and disposal.

- This necessitates the use of explosion-proof components and advanced waste management technology. Consequently, demand for the sewer cleaner unit for sewer maintenance and hydro-excavators for subsurface utility engineering is rising.

- For instance, companies adopting modern equipment report a 20% improvement in compliance documentation accuracy. The need for precise underground utility exposure without damage has made non-destructive digging a standard practice, further fueling market expansion.

What are the market trends shaping the Vacuum Truck Industry?

- The emergence of electric vacuum trucks represents a significant upcoming trend, driven by global initiatives toward decarbonization and the demand for zero-emission vehicles in urban and industrial settings.

- A key trend is the integration of advanced technologies to enhance performance and sustainability. The shift towards the zero-emission collection vehicle is gaining momentum, driven by corporate environmental goals and stricter urban regulations. Concurrently, onboard telematics systems are becoming standard, offering real-time remote diagnostics that improve preventive maintenance scheduling and reduce unplanned downtime by up to 25%.

- These innovations support more efficient road cleaning operations and urban infrastructure rehabilitation. The development of superior vacuum pump technology also contributes, enabling quieter operation and lower energy consumption, which can decrease fuel costs by 10% in certain applications, thereby boosting overall asset utilization rates.

What challenges does the Vacuum Truck Industry face during its growth?

- The high operating costs associated with fuel, maintenance, and specialized labor for vacuum trucks present a key challenge to market expansion and profitability.

- High operational costs and a shortage of skilled labor present significant challenges. The expense of maintaining a heavy-duty chassis and specialized components like the baghouse filter is substantial. Furthermore, finding qualified personnel with expertise in pipeline inspection support and safe operation remains difficult, with some fleet managers reporting a 30% longer recruitment cycle for specialized roles.

- These factors constrain profitability and limit expansion, especially for smaller operators. Even with tools for route planning optimization, high fuel consumption and repair costs can erode margins. The need for specialized training on operator safety features adds another layer of expense, affecting disaster cleanup and emergency spill response readiness.

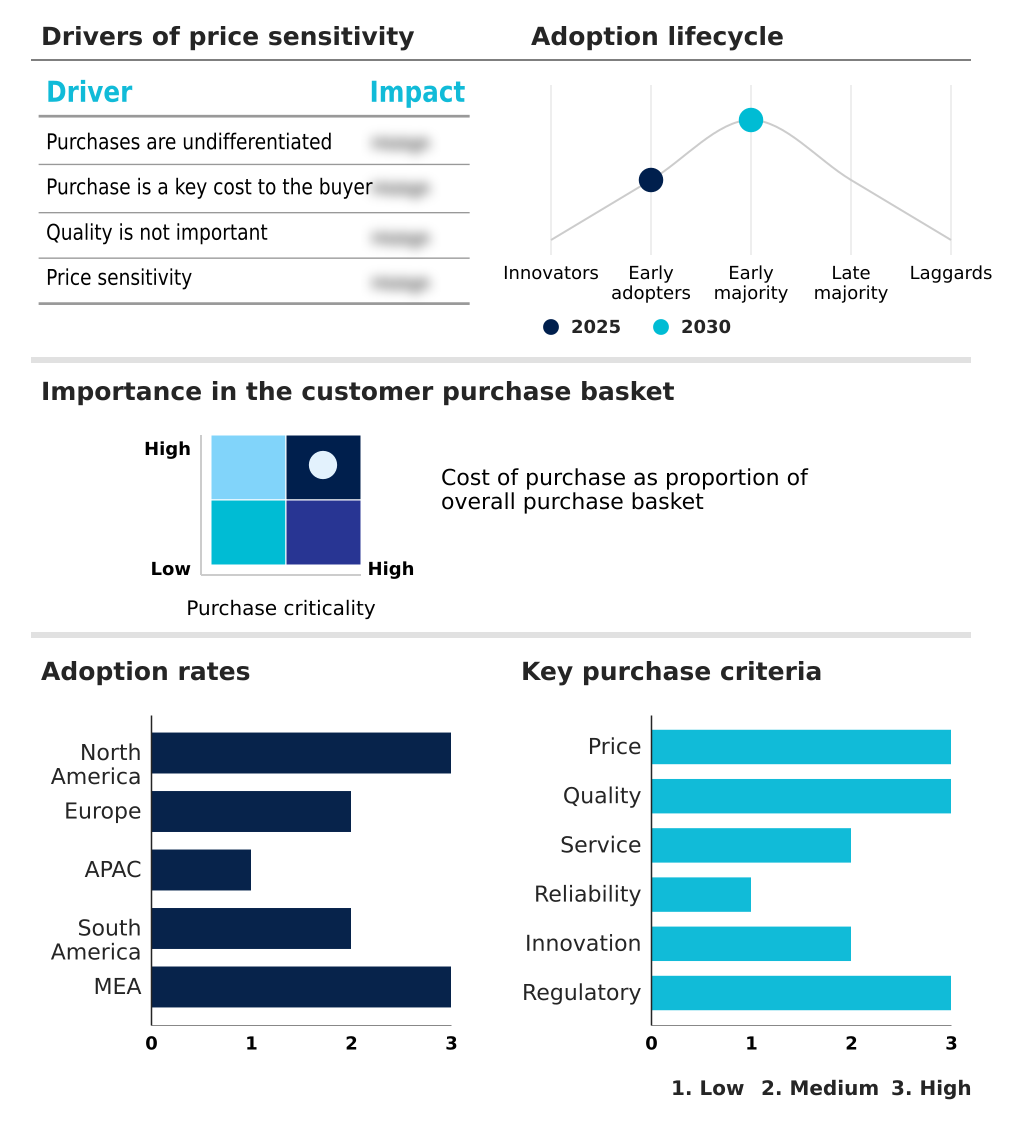

Exclusive Technavio Analysis on Customer Landscape

The vacuum truck market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vacuum truck market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Vacuum Truck Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, vacuum truck market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AFI Group - Provides specialized environmental solutions, including industrial vacuum loaders and sewer cleaners, essential for municipal and industrial maintenance operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AFI Group

- Alamo Group Inc.

- Amphitec B.V.

- Cappellotto S.p.A.

- Chengli Special Automobile Co. Ltd.

- DISAB Vacuum Technology AB

- Federal Signal Corp.

- Fulungma Group Co. Ltd.

- GapVax Inc.

- Hi Vac Corp.

- Kanematsu Engineering Co. Ltd.

- KOKS Group BV

- Ledwell

- RIVARD S.A.S

- Sewer Equipment Co.

- The Toro Co.

- Tornado Global Hydrovacs Ltd.

- Transway Systems Inc.

- Vac Con Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vacuum truck market

- In May 2025, Tornado Infrastructure Equipment Ltd. completed its acquisition of Custom Vacuum Services Ltd. for $28 million, expanding its manufacturing and service capabilities for truck-mounted and semi-trailer vacuum equipment across Canada's key industrial sectors.

- In February 2025, Custom Truck One Source announced its showcase of the new Tornado F4 vacuum truck model at WWETT 2025, targeting sewer, hydro-excavation, and water infrastructure maintenance applications.

- In October 2024, The Toro Co. announced an agreement to acquire Tornado Infrastructure Equipment Ltd., a strategic move to broaden its portfolio in the underground construction market with advanced vacuum truck technologies.

- In September 2024, Supervac announced it would exhibit its latest custom-built mining vacuum trucks and wet/dry vacuum solutions at the CEN-CAN Expo 2025, targeting demanding mining and industrial cleanup environments.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vacuum Truck Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 282 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 5.8% |

| Market growth 2026-2030 | USD 411.1 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 5.5% |

| Key countries | US, Canada, Mexico, Germany, France, UK, Italy, Spain, The Netherlands, China, India, Japan, South Korea, Australia, Indonesia, Brazil, Argentina, Chile, Saudi Arabia, UAE, South Africa, Egypt and Nigeria |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The vacuum truck market is defined by its indispensable role in environmental services and infrastructure upkeep, where technological sophistication directly translates to operational value. The integration of a high-efficiency positive displacement blower, advanced particulate matter filtration, and robust wet dry vacuum solutions has become standard for modern fleets.

- Core activities, from municipal infrastructure maintenance and septic system cleaning to complex industrial fluid handling, rely on this equipment. The push toward non-destructive digging through hydro-excavation has made subsurface utility engineering safer and more efficient, reducing utility strikes by over 40% in some projects.

- At the boardroom level, investment decisions are increasingly influenced by the need for regulatory compliance and sustainability. This is driving adoption of the zero-emission collection vehicle and equipment with explosion-proof components for hazardous waste suction.

- Furthermore, the deployment of telematics systems for remote diagnostics is no longer a luxury but a strategic necessity for managing the heavy-duty chassis and optimizing the entire lifecycle of a sanitation vehicle, sewer cleaner unit, or industrial vacuum loader. This strategic shift underscores the market's evolution from providing machinery to delivering integrated waste management technology and environmental cleaning solutions.

What are the Key Data Covered in this Vacuum Truck Market Research and Growth Report?

-

What is the expected growth of the Vacuum Truck Market between 2026 and 2030?

-

USD 411.1 million, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Industrial, Excavation, General cleaning, and Others), Product Type (Liquid and dry suctioning, and Liquid suctioning only), Capacity (Medium, Small, and Large) and Geography (North America, Europe, APAC, South America, Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising application of vacuum trucks in industrial cleaning, High operating cost of vacuum trucks

-

-

Who are the major players in the Vacuum Truck Market?

-

AFI Group, Alamo Group Inc., Amphitec B.V., Cappellotto S.p.A., Chengli Special Automobile Co. Ltd., DISAB Vacuum Technology AB, Federal Signal Corp., Fulungma Group Co. Ltd., GapVax Inc., Hi Vac Corp., Kanematsu Engineering Co. Ltd., KOKS Group BV, Ledwell, RIVARD S.A.S, Sewer Equipment Co., The Toro Co., Tornado Global Hydrovacs Ltd., Transway Systems Inc. and Vac Con Inc.

-

Market Research Insights

- Market dynamics are shaped by a push for greater fleet operational efficiency and stricter environmental compliance. The adoption of advanced systems improves asset utilization rates by over 20% in some fleets, while integrated route planning optimization tools can reduce fuel consumption by up to 15%.

- Demand is strong for specialized hydro-excavation services and industrial cleaning applications, driven by the need for safe underground utility exposure and plant turnaround maintenance. Consequently, operator safety features and reliable preventive maintenance scheduling have become key differentiators for equipment providers.

- The focus on urban infrastructure rehabilitation and municipal waste handling ensures steady demand, while the industry's ability to support emergency spill response underscores its critical role in risk management.

We can help! Our analysts can customize this vacuum truck market research report to meet your requirements.