Vegan Ice Cream Market Size 2024-2028

The vegan ice cream market size is forecast to increase by USD 1.31 billion, at a CAGR of 10% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expanding global population base adhering to vegan diets. This trend is leading companies to innovate and introduce new product offerings to cater to this consumer demographic. Coconut milk, almond milk, cashew milk, and soy milk are some of the common plant-based bases used in vegan ice cream production. However, product recalls pose a significant challenge to market players. In 2020, several vegan ice cream brands faced recalls due to contamination issues, damaging their reputation and sales. To mitigate this risk, companies are investing in robust quality control measures and supply chain transparency. Additionally, collaborations with influencers and partnerships with foodservice outlets are strategic moves to expand market reach and boost brand visibility.

- The market's dynamics are shaped by these key drivers and challenges, offering opportunities for companies to capitalize on the growing demand for vegan ice cream while navigating potential risks effectively.

What will be the Size of the Vegan Ice Cream Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer preferences for plant-based options and innovative product development. High-protein ice cream variants are gaining traction, utilizing natural food colorings and vegan protein sources to cater to health-conscious consumers. Production efficiency metrics, cold chain management, and texture modification techniques are essential for maintaining product quality and consistency. Emulsifier selection and ingredient sourcing are critical factors in ensuring vegan certification standards are met. Frozen dessert manufacturing involves intricate processes such as homogenization and churning, which require careful optimization for low-fat and low-sugar ice cream formulations. Prevention of freezer burn and maintaining optimal shelf life is a continuous challenge, necessitating the exploration of new packaging materials and shelf-life extension methods.

Natural flavorings and plant-based fat sources are increasingly popular, as are fat reduction strategies. Sensory evaluation methods and food safety regulations play a crucial role in ensuring product quality and consumer safety. Cost optimization strategies are essential for manufacturers to remain competitive in this dynamic market. Dairy-free alternatives continue to expand, with a focus on natural and sustainable ingredients. The ongoing evolution of this market underscores the importance of staying abreast of emerging trends and consumer preferences.

How is this Vegan Ice Cream Industry segmented?

The vegan ice cream industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Take home

- Impulse

- Artisanal

- Base Ingredient

- Almond Milk

- Coconut Milk

- Soy Milk

- Cashew Milk

- Oat Milk

- Rice Milk

- Avocado

- Other Plant-Based Milks

- Form

- Bars

- Pints/Tubs

- Sticks

- Novelties

- Cones

- Flavor

- Vanilla

- Chocolate

- Strawberry

- Coffee

- Fruit Flavors

- Nut Flavors

- Specialty Flavors

- Packaging Type

- Cups

- Cones

- Tubs

- Boxes

- Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice

- Specialty Stores

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

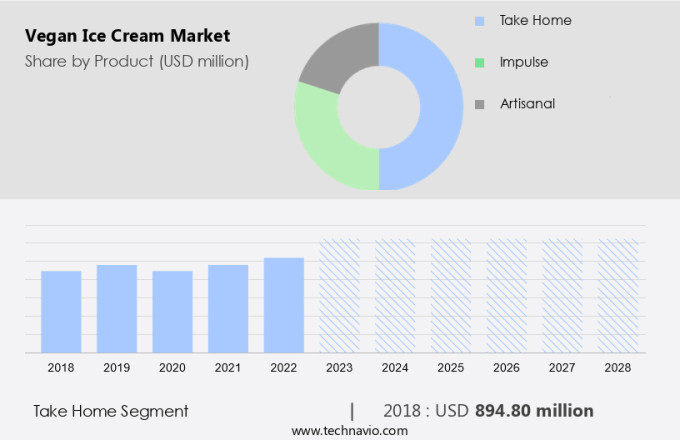

The take home segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing preference for plant-based diets and the surge in demand for dairy-free alternatives. In response, manufacturers are innovating with high-protein ice creams, natural food colorings, and texture modification techniques to cater to consumer needs. Production efficiency metrics and cold chain management are crucial considerations to maintain product quality and ensure shelf stability. Emulsifier selection and stabilizer choice are essential for creating the desired texture and preventing ice crystal formation. Ingredient sourcing from reputable suppliers and adherence to vegan certification standards are key to maintaining consumer trust. Freezer burn prevention techniques and proper packaging materials are essential to extend shelf life and maintain product integrity.

Vegan protein sources and fat reduction strategies are also being explored to cater to various dietary preferences. Sensory evaluation methods and food safety regulations are paramount for ensuring product quality and consumer safety. Low-fat and low-sugar ice cream options are gaining popularity, necessitating homogenization techniques and churning process optimization. Shelf-life extension methods and natural flavorings are also being employed to cater to evolving consumer preferences. Cost optimization strategies and plant-based ingredient sourcing are essential for maintaining competitiveness in the market. The frozen dessert manufacturing process is being streamlined through automation and advanced technologies to improve efficiency and reduce costs.

The Take home segment was valued at USD 894.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the evolving world of frozen desserts, the market is witnessing significant advancements. Plant-based ingredients, such as natural food colorings, are increasingly being adopted to cater to consumer preferences. Production efficiency metrics and cold chain management are crucial in maintaining product quality and ensuring consumer satisfaction. Texture modification techniques and emulsifier selection play vital roles in creating the desired consistency and stability. Ingredient sourcing, adhering to vegan certification standards, is essential to meet consumer expectations. Freezer burn prevention strategies are necessary to maintain product freshness and extend shelf life. Vegan fat sources, such as coconut oil and almond milk, are used in place of dairy.

Fat reduction strategies, including the use of low-fat ice cream and sugar reduction techniques, are employed to cater to health-conscious consumers. Homogenization techniques and churning process optimization ensure uniformity and smoothness. Natural flavorings and stabilizer selection contribute to the overall taste and texture of the product. Sensory evaluation methods are employed to assess product quality and consumer appeal. Food safety regulations and quality control procedures are rigorously followed to ensure product safety and consistency. The market is witnessing growth, with North America leading the charge. The US, Canada, and Mexico are major contributors to the market, driven by the expanding vegan population base and increasing awareness of the benefits of plant-based diets.

Cost optimization strategies, including the use of packaging materials and vegan protein sources, are essential for market success. The frozen dessert manufacturing industry continues to innovate, offering consumers a wide range of dairy-free alternatives.

Market Dynamics

The global vegan ice cream market is experiencing unprecedented growth, driven by dynamic vegan ice cream market trends and a rising consumer shift towards plant-based diets. The proliferation of plant-based ice cream and non-dairy ice cream options has broadened consumer choices, with innovative vegan ice cream brands offering diverse flavors. Popular bases like coconut milk ice cream and oat milk ice cream are gaining significant traction, highlighting the versatility of vegan ice cream ingredients. The perceived vegan ice cream benefits, including being lactose-free and often lower in saturated fat, contribute to its appeal. This expanding sector boasts a wide array of vegan ice cream flavors, driving the overall vegan frozen dessert industry. The increasing focus on healthy vegan ice cream and organic vegan ice cream aligns with evolving vegan ice cream consumer preferences, further propelling market expansion.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Vegan Ice Cream Industry?

- The expanding global vegan population represents a significant market driver, as an increasing number of consumers adopt vegan diets.

- The market is experiencing significant growth due to the increasing number of individuals adopting a vegan lifestyle. This trend is driven by both health benefits and ethical reasons. According to recent research, the global vegan population has grown by approximately 300% over the last decade. To cater to this market, manufacturers are employing various strategies such as sugar reduction, homogenization techniques, churning process optimization, and shelf-life extension methods.

- Natural flavorings and stabilizer selection are also crucial factors in producing high-quality vegan ice cream. These strategies enable the creation of low-sugar, delicious, and long-lasting vegan ice cream products. The market is expected to continue its growth trajectory due to the increasing demand for plant-based food options.

What are the market trends shaping the Vegan Ice Cream Industry?

- The adoption of strategic business approaches by companies is currently a significant market trend. This includes implementing innovative pricing models, enhancing customer engagement, and leveraging technology to gain a competitive edge.

- The market is experiencing significant growth due to increasing consumer preferences for plant-based alternatives. companies are focusing on producing high-protein ice creams using natural food colorings to cater to health-conscious consumers. To enhance production efficiency, they are implementing advanced cold chain management systems and texture modification techniques. The selection of appropriate emulsifiers is crucial to maintain the desired texture and mouthfeel of vegan ice creams.

- companies are also prioritizing ingredient sourcing from ethical and sustainable suppliers to meet the growing demand for vegan products. These strategies are expected to drive market growth during the forecast period. Additionally, the introduction of innovative flavors and packaging styles is attracting a wider consumer base, further fueling market expansion.

What challenges does the Vegan Ice Cream Industry face during its growth?

- Product recalls pose a significant challenge to industry growth, as companies must address safety concerns and restore consumer trust following the withdrawal of faulty products from the market.

- The market experiences significant challenges due to increasing product recalls, which can result from contamination or mislabeling. These incidents negatively impact consumer trust and damage manufacturers' reputations, leading to potential financial liabilities from legal claims. For instance, in July 2024, Van Leeuwen recalled its Vegan Cinnamon flavor due to undeclared peanuts, and in August 2022, General Mills recalled Haagen-Dazs Vanilla ice cream due to the presence of toxic ethylene oxide (ETO) exceeding regulatory thresholds. To mitigate such risks, manufacturers must adhere to stringent vegan certification standards and food safety regulations. Moreover, implementing effective fat reduction strategies using plant-based ingredients and vegan fat sources, as well as employing sensory evaluation methods, can help maintain product quality and consumer satisfaction.

- Preventing freezer burn is also crucial for maintaining the freshness and texture of vegan ice cream. By prioritizing these measures, manufacturers can build consumer trust and ensure the long-term success of their businesses.

Exclusive Customer Landscape

The vegan ice cream market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vegan ice cream market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vegan ice cream market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aurora Foods - This company specializes in producing vegan ice cream, utilizing coconut milk, coconut syrup, peanut butter, cocoa, and vanilla extract as key ingredients. Their offerings cater to consumers seeking plant-based dessert options. The use of natural, recognizable components adds to the product's appeal.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurora Foods

- Bliss Unlimited LLC

- Compassionate Choices Pvt. Ltd.

- Coolhaus

- Danone SA

- General Mills Inc.

- JENIS SPLENDID ICE CREAMS LLC

- Nestle SA

- Over The Moo

- The Booja Booja Co. Ltd.

- The Brooklyn Creamery

- Tofutti Brands Inc

- Unilever PLC

- Valsoia SpA

- Wells Enterprises Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vegan Ice Cream Market

- In January 2024, Ben & Jerry's, a leading ice cream brand, announced the launch of its new line of vegan ice cream flavors, including "Pint Sized Peace," in collaboration with the Peace Corps. This strategic partnership aimed to promote sustainability and social responsibility (Ben & Jerry's Press Release).

- In March 2024, Tesco, the UK's largest retailer, revealed its plans to triple its vegan ice cream range, making it the largest vegan ice cream selection among UK supermarkets. This expansion was driven by the growing demand for plant-based alternatives (Tesco Press Release).

- In April 2025, Unilever, the Anglo-Dutch multinational consumer goods corporation, acquired The Non-Dairy Co., a UK-based vegan ice cream manufacturer. This acquisition was part of Unilever's strategy to expand its plant-based offerings and cater to the increasing consumer preference for vegan products (Unilever Press Release).

- In May 2025, Nestlé, the world's largest food and beverage company, received regulatory approval for its new vegan ice cream production facility in the Netherlands. This facility, with an annual capacity of 25,000 tons, is expected to strengthen Nestlé's position in the European the market (Nestlé Press Release).

Research Analyst Overview

- In the dynamic market, competitive landscape assessment plays a crucial role in identifying key players and their strategies. Manufacturers focus on improving freeze-thaw stability through the exploration of cocoa butter alternatives and thickening agents. Melt rate measurement is essential for maintaining creaminess, while pricing strategies and product differentiation are vital for market penetration. Flavor stability testing and retail display strategies are crucial for appealing to the expanding target audience. Customer feedback analysis and sales forecasting inform innovation strategies, such as vegan chocolate production and fruit puree processing.

- Sweetener selection and nut paste production are critical aspects of supply chain optimization. The product development lifecycle incorporates creaminess assessment and microbial contamination control, while allergen management is essential for maintaining consumer trust. Distribution logistics and market share analysis are key factors in ensuring profitability and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vegan Ice Cream Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2024-2028 |

USD 1310.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vegan Ice Cream Market Research and Growth Report?

- CAGR of the Vegan Ice Cream industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vegan ice cream market growth of industry companies

We can help! Our analysts can customize this vegan ice cream market research report to meet your requirements.