Veterinary Ultrasound Market Size 2024-2028

The veterinary ultrasound market size is forecast to increase by USD 88.7 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing popularity of minimally invasive diagnostic procedures. As pet owners become more conscious of their animals' health and wellbeing, there is a rising demand for advanced diagnostic tools like ultrasound. Furthermore, the awareness about disease prevention and the availability of pet insurance have fueled the market's expansion. However, the market faces challenges, including the shortage of trained professionals capable of operating and interpreting ultrasound images. This skills gap may hinder the market's growth potential, necessitating investments in education and training programs.

- Companies seeking to capitalize on this market's opportunities should focus on addressing this challenge while continuing to innovate and improve their ultrasound technology offerings. By doing so, they can effectively meet the growing demand for non-invasive diagnostic solutions and establish a strong market presence. Among the key players, BCF Ultrasound Australasia Pty Ltd. stands out with its VETUS E7 machine, an advanced ultrasound solution designed for superior image quality, efficient diagnostics, and user-friendly operation, enhancing productivity and patient care in complex veterinary procedures.

What will be the Size of the Veterinary Ultrasound Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in animal ultrasound technology and the growing companion animal population. Veterinary practitioners increasingly rely on ultrasound for disease diagnosis, with diagnostic laboratories and reference laboratories offering specialized services. C3 Convex Vet and other animal ultrasound technology providers continually innovate, introducing handheld scanners, Doppler imaging, and contrast imaging solutions. Magnetic resonance imaging and digital imaging technology also play a role in veterinary care. Pet ownership continues to rise, fueling demand for portable ultrasound and compact ultrasound scanners in veterinary hospitals and clinics. Companion animals, particularly small ones, benefit from these advancements. Veterinary specialists in various fields, including orthopedics, utilize ultrasound for diagnosis and treatment planning.

IDEXX Laboratories and other players offer cart-based ultrasound scanners and veterinary imaging equipment to meet the diverse needs of the industry. Animal health and pet insurance further boost the market, as early disease detection and accurate diagnosis become increasingly important. The ongoing integration of digital imaging technology and the development of new veterinary specializations continue to shape the market landscape. The future of veterinary ultrasound is marked by continuous innovation and expanding applications across various sectors.

How is this Veterinary Ultrasound Industry segmented?

The veterinary ultrasound industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- 2 dimension

- 3 dimension

- doppler

- Technology

- Digital

- Contrast

- Animal Type

- Small

- Large

- Application

- Obstetrics

- Cardiology

- Orthopedic

- End-User

- Clinics

- Hospitals

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

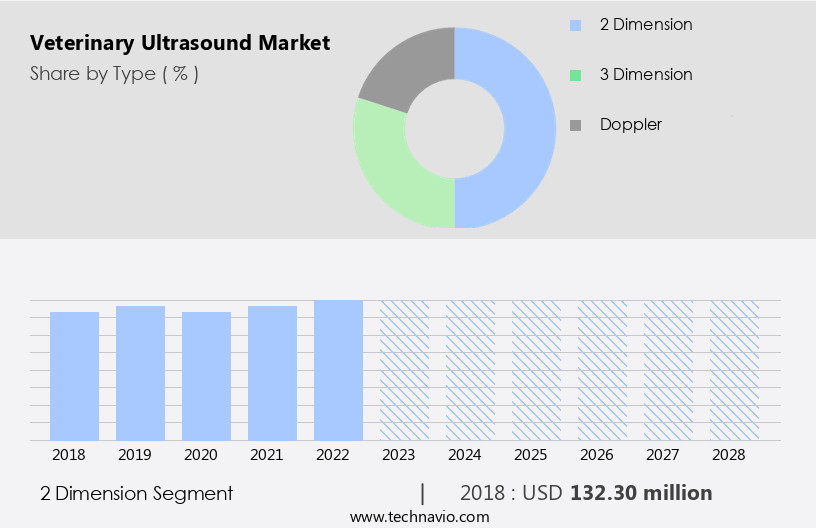

By Type Insights

The 2 dimension segment is estimated to witness significant growth during the forecast period.

In the realm of veterinary care, 2D ultrasound technology plays a pivotal role in assessing the health of companion animals' organs and tissues. This noninvasive imaging technique uses Doppler technology for real-time assessment of blood flow and contrast imaging for enhanced visualization. Handheld scanners and compact ultrasound systems, such as C3 Microconvex Vet and Celtic SMR, offer portability and ease of use for veterinary practitioners in various clinics and hospitals. Magnetic resonance imaging and analog imaging technology are also employed in veterinary medicine for disease diagnosis, particularly for large animals and veterinary specializations. The pet population continues to grow, fueled by increasing pet ownership, which in turn boosts the demand for advanced veterinary imaging equipment.

Diagnostic laboratories and reference laboratories play a crucial role in processing imaging results, while veterinary hospitals and clinics rely on these tools for accurate disease diagnosis. Digital imaging technology, including 2-D ultrasound imaging, is increasingly being adopted for its efficiency, safety, and cost-effectiveness. Animal health companies, such as IDEXX Laboratories, offer comprehensive diagnostic solutions, including veterinary imaging equipment and orthopedic products, catering to the diverse needs of the veterinary industry. Veterinary practitioners utilize these tools to provide optimal care for their patients, ensuring the best possible outcomes.

The 2 dimension segment was valued at USD 132.30 million in 2018 and showed a gradual increase during the forecast period.

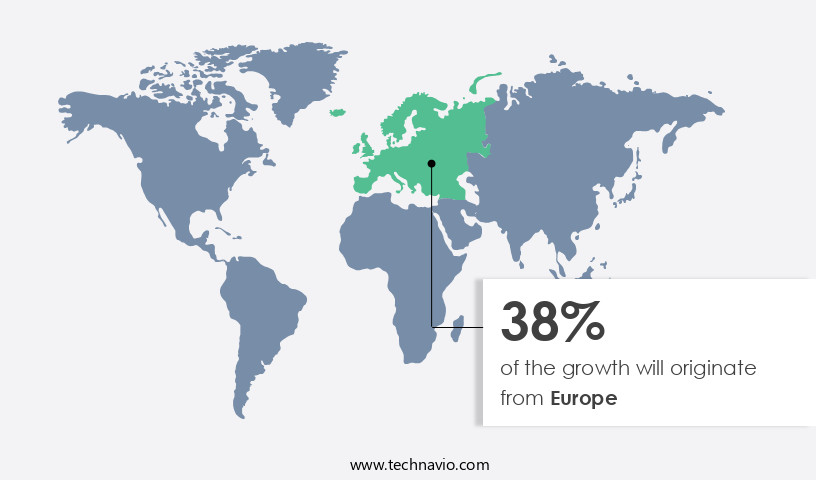

Regional Analysis

Europe is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is thriving due to the presence of major companies and their expanding product offerings. This growth is driven by the rising incidence of urological conditions in companion animals, such as urinary incontinence, urinary tract infections, bladder stones, and kidney disease. These conditions are common in dogs, particularly those with chronic kidney disease or hyperadrenocorticism. Cats, on the other hand, are less susceptible to bacterial cystitis compared to dogs. The introduction of advanced technologies, including Doppler imaging, contrast imaging, and magnetic resonance imaging, is also fueling market growth. Veterinary practitioners, diagnostic laboratories, veterinary hospitals, and veterinary clinics are increasingly adopting these technologies for disease diagnosis and pet care.

Digital imaging and portable ultrasound are becoming increasingly popular due to their convenience and cost-effectiveness. Companies like C3 Convex Vet, C3 Microconvex Vet, Celtic SMR, and IDEXX Laboratories are leading the way in animal ultrasound technology. Large animals, such as cattle and horses, also require ultrasound imaging for disease diagnosis and orthopedic evaluations. Veterinary specializations, including IMV imaging and cart-based ultrasound scanners, are also gaining traction in the market. Pet ownership continues to rise, leading to increased demand for veterinary care and diagnostic services. Pet insurance is also playing a role in driving demand for advanced diagnostic tools like ultrasound imaging.

Overall, the market is witnessing significant growth due to the increasing number of animals in need of diagnostic services and the availability of technologically advanced products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market continues to grow, driven by advancements in technology and increasing demand for non-invasive diagnostic tools. Ultrasound machines, probes, and transducers are essential components of this market, enabling vets to examine internal organs and structures in real-time. Portability and user-friendliness are key trends, with compact, battery-operated devices gaining popularity. High-frequency transducers offer superior image quality, while artificial intelligence and automation streamline workflows. The market also includes accessories such as disposable probes, imaging software, and contrast agents. Education and training are crucial for optimal usage, with ongoing research and development shaping the future of veterinary ultrasound technology.

What are the key market drivers leading to the rise in the adoption of Veterinary Ultrasound Industry?

- The significant rise in the preference for minimally invasive procedures is the primary market driver, given their increasing popularity due to reduced recovery time, minimal scarring, and comparable efficacy to traditional surgical methods.

- The market is experiencing significant growth due to the increasing number of surgical procedures, particularly in urology. Minimally invasive surgeries, such as ureteral surgery (including urethroplasty), have gained popularity among veterinary surgeons. These procedures, facilitated by ultrasound technology, enable precise organ scanning and reduce the need for large incisions. The advent of minimally invasive surgeries, such as laparoscopy, has led to shorter hospital stays, quicker recovery times, and reduced pain for animals.

- The global trend towards minimally invasive procedures for urological conditions is expected to fuel the growth of the market during the forecast period. This technological advancement in veterinary medicine enhances diagnostic accuracy and improves patient outcomes.

What are the market trends shaping the Veterinary Ultrasound Industry?

- The increasing importance of disease prevention and pet insurance is a notable trend in the market. Two significant areas of focus for pet owners and industry professionals alike.

- The preventive healthcare approach in veterinary care is gaining traction worldwide, with pet owners increasingly focusing on the regular examination of their companion animals. This trend is driven by heightened awareness of various diseases that can affect pets, leading to increased vaccinations and preventative measures such as dental care and infection prophylaxis. Early diagnosis of diseases is a significant benefit of this approach, enabling better clinical outcomes and improved animal health. Furthermore, the rise in pet insurance adoption allows for more comprehensive treatment and care for pets. This market dynamic is propelled by the growing pet population and the increasing importance placed on animal health and wellbeing.

- Doppler imaging, contrast imaging, and IMV imaging are advanced diagnostic techniques that are increasingly being utilized in veterinary care. Handheld scanners and magnetic resonance imaging are also gaining popularity due to their portability and accuracy. The use of analog imaging technology is gradually being replaced by these modern techniques, offering more precise and immersive diagnostic capabilities.

What challenges does the Veterinary Ultrasound Industry face during its growth?

- The lack of adequately trained professionals poses a significant challenge to the expansion and growth of the industry.

- Veterinary ultrasound technology plays a crucial role in the diagnosis and treatment of diseases in companion animals. Skilled veterinary practitioners and diagnostic laboratories rely on this advanced imaging technique to gain insights into an animal's internal structures and organs. The need for professionals with expertise in veterinary ultrasound is increasing due to the growing companion animal population and rising pet ownership. These professionals must possess a deep understanding of animal diseases and their underlying mechanisms to accurately diagnose and treat animals. In veterinary hospitals and reference laboratories, these professionals perform routine and advanced tests using standard operating procedures (SOPs) to ensure safety and competence.

- However, the lack of adequate training on the usage of ultrasound for disease detection and staging is a significant challenge limiting the number of qualified veterinary laboratory technicians. This shortage can hinder the growth of the market. In conclusion, the market is driven by the increasing demand for accurate disease diagnosis in companion animals. The need for skilled professionals to operate this technology and the challenges in training new technicians are essential considerations for market growth.

Exclusive Customer Landscape

The veterinary ultrasound market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the veterinary ultrasound market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, veterinary ultrasound market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BCF Ultrasound Australasia Pty Ltd. - The VETUS E7 veterinary ultrasound machine delivers superior image quality, enabling veterinarians to make accurate diagnoses during complex examinations. Its user-friendly interface ensures an intuitive experience, streamlining the diagnostic process and facilitating efficient treatment plans. This advanced technology empowers veterinary professionals to provide optimal care for their patients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BCF Ultrasound Australasia Pty Ltd.

- Canon Inc.

- Carestream Health Inc.

- Chison Medical Technologies Co. Ltd.

- DRAMINSKI SA

- E I Medical Imaging

- EDAN Instruments Inc.

- Esaote Spa

- FUZIFILM Sonosite Inc.

- Hallmarq Veterinary Imaging Ltd.

- Heska Corp.

- IDEXX LABORATORIES INC.

- IMV Imaging

- Leltek Inc.

- Mars Inc.

- Shantou Institute of Ultrasonic Instruments Co. Ltd.

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Siemens Healthineers AG

- SonoScape Medical Corp.

- Xuzhou Kaixin Electronic Equipment Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Veterinary Ultrasound Market

- In January 2024, GE Healthcare announced the launch of its new veterinary ultrasound system, the Logiq E10, featuring advanced imaging capabilities and user-friendly design, aimed at enhancing diagnostic accuracy in veterinary practices (GE Healthcare Press Release).

- In March 2024, Sonosite, an iFlex Group company, entered into a strategic partnership with PetCure, a provider of veterinary radiation oncology services, to integrate Sonosite's ultrasound systems with PetCure's radiation therapy systems, improving the accuracy and efficiency of cancer treatments for pets (Sonosite Press Release).

- In April 2025, Mindray Medical, a leading medical equipment manufacturer, completed the acquisition of Bio-Techne Corporation's veterinary diagnostics business, expanding its portfolio of veterinary imaging solutions and strengthening its presence in the global veterinary market (Mindray Medical Press Release).

- In May 2025, the European Medicines Agency granted marketing authorization for the use of the Philips Lumify portable ultrasound system in veterinary applications, allowing veterinarians to perform ultrasound examinations outside of traditional imaging facilities, enhancing accessibility and convenience for pet owners (Philips Press Release).

Research Analyst Overview

- The market encompasses the use of ultrasound technology in animal health, particularly in disease diagnosis for both large and companion animals. With the increasing pet population and rising demand for advanced veterinary care, the market for portable and handheld scanners has gained traction. Companies like Celtic SMR and C3 Vet offer compact ultrasound scanners, while IMV Imaging and C3 Microconvex Vet provide solutions for small companion animals. Veterinary clinics and hospitals integrate these technologies to enhance their diagnostic capabilities, with veterinary practitioners in various specializations relying on digital imaging technology for accurate diagnosis. Magnetic resonance imaging is another advanced technology gaining popularity, complementing the use of veterinary ultrasound.

- Cart-based ultrasound scanners and analog imaging technology continue to be used in some settings, but the trend is shifting towards more portable and advanced solutions. The integration of ultrasound technology into pet insurance plans further underscores its importance in pet care. Animal ultrasound technology continues to evolve, with companies like L7 Linear Vet introducing new innovations to meet the demands of the veterinary industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Veterinary Ultrasound Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 88.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.22 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Veterinary Ultrasound Market Research and Growth Report?

- CAGR of the Veterinary Ultrasound industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the veterinary ultrasound market growth of industry companies

We can help! Our analysts can customize this veterinary ultrasound market research report to meet your requirements.