Virtualized Evolved Packet Core (Vepc) Market Size 2024-2028

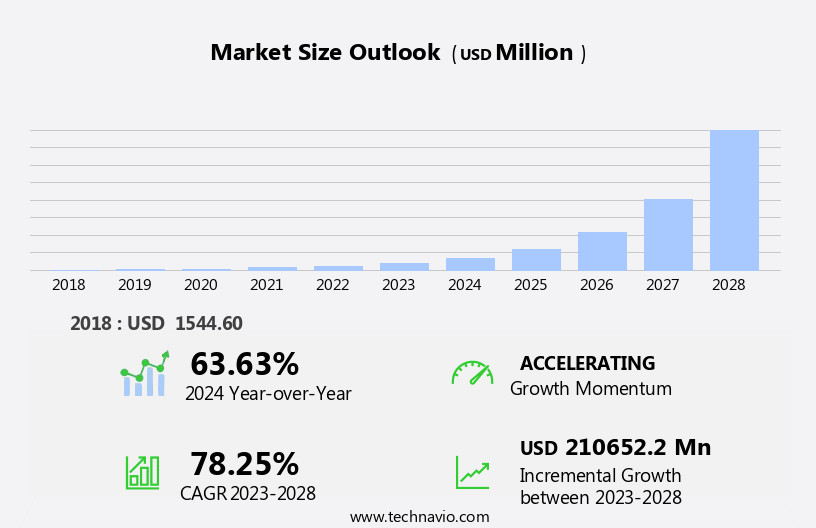

The virtualized evolved packet core (vepc) market size is forecast to increase by USD 210.65 billion at a CAGR of 78.25% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of multimedia services and the deployment of 5G infrastructure. The proliferation of multimedia content, such as high-definition videos and real-time applications, is driving the need for more efficient and flexible network solutions. Vepc offers these benefits by enabling network virtualization, allowing for the creation of agile and scalable networks that can effectively manage the increasing data traffic. However, the deployment of vEpc solutions is not without complications. The complexity of integrating vEpc with existing networks and ensuring interoperability with various companies and technologies poses a challenge.

- Additionally, the high cost of implementation and the need for specialized skills and expertise can hinder market growth. Despite these challenges, the potential benefits of vEpc, including improved network performance, increased flexibility, and reduced operational costs, make it an attractive option for communication service providers and enterprises seeking to capitalize on the growing demand for advanced network solutions. Companies looking to enter or expand their presence in the vEpc market must focus on addressing these challenges and providing innovative solutions to meet the evolving needs of their customers.

What will be the Size of the Virtualized Evolved Packet Core (Vepc) Market during the forecast period?

- The Virtualized Evolved Packet Core (VPEC) market is experiencing significant growth as the Internet of Things (IoT) and 5G technologies continue to proliferate. Connected devices, such as those from Lemko, are driving data traffic in various sectors, including telecommunications and enterprise applications. Polaris Networks and other companies are addressing security concerns in the VPEC market by implementing Software-Defined Networking (SDN) and Long-Term Evolution (LTE) frameworks. Xingtera and Telrad Networks are key players in the 5G infrastructure market, providing solutions for data-intensive applications like video streaming and online gaming. Enterprises are increasingly relying on voice and data services, cloud computing, and mobile networks for real-time data transmission.

- Parallel Wireless and Tecore are addressing bandwidth-intensive activities by offering innovative VPEC solutions. The IoT sector's growth is expected to continue, fueled by the increasing demand for seamless and reliable connectivity. 5G's ability to support massive data transmission and low latency makes it an essential component of the VPEC market's evolution.

How is this Virtualized Evolved Packet Core (Vepc) Industry segmented?

The virtualized evolved packet core (vepc) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Solutions

- Services

- Application

- LTE/VoLTE/VoWiFi

- MPN and MVNO

- IoT and M2M

- BWA

- Geography

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- Japan

- South America

- Rest of World (ROW)

- North America

By Component Insights

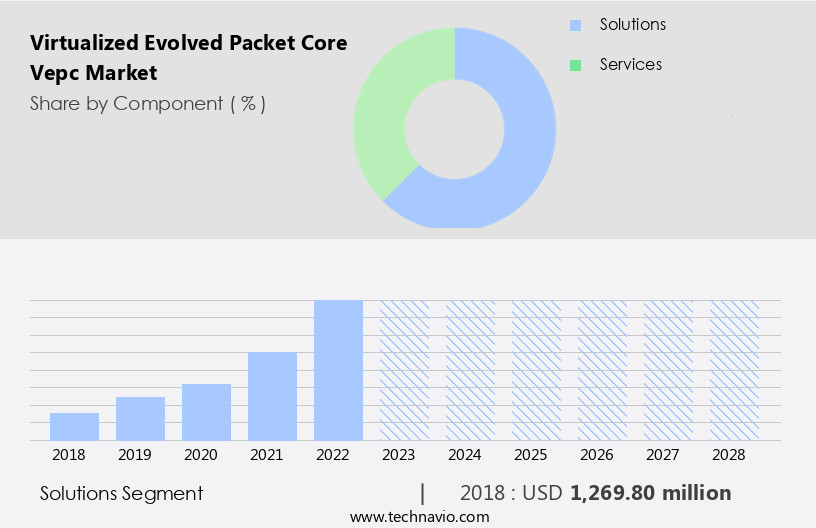

The solutions segment is estimated to witness significant growth during the forecast period.

The market encompasses a variety of software and hardware solutions offered by companies for deploying and managing vEPC networks. These solutions incorporate functionalities such as Mobility Management Entity (MME), Serving Gateway (SGW), Packet Data Network Gateway (PGW), and other network functions. The software components include virtualized instances of these elements, enabling control, management, and processing capabilities for handling subscriber traffic and services. In the telecommunications sector, network virtualization through vEPC is gaining traction due to the increasing demand for flexibility and network capacity. This is particularly relevant for 5G infrastructure and data-intensive applications like cloud computing, multimedia services, and Machine-to-Machine (M2M) devices.

Prominent companies like Xingtera, Polaris Networks, Druid Software, Cumucore, and Tech Mahindra are actively contributing to the vEPC market with their innovative solutions. These solutions cater to various industries, including telecommunications operators, service providers, ISPs, enterprises, and IoT sector players. The vEPC market is witnessing significant growth due to the integration of Virtualization Infrastructure (NFVI), SDN, and cloud packet core technologies. These advancements provide the necessary flexibility and network performance for handling bandwidth-intensive activities and real-time data transmission. Security concerns and the need for seamless integration with legacy infrastructure are key challenges in the vEPC market. companies like Parallel Wireless, Athonet, and Affirmed Networks are addressing these challenges by offering solutions that ensure secure network operations and seamless integration with existing infrastructure.

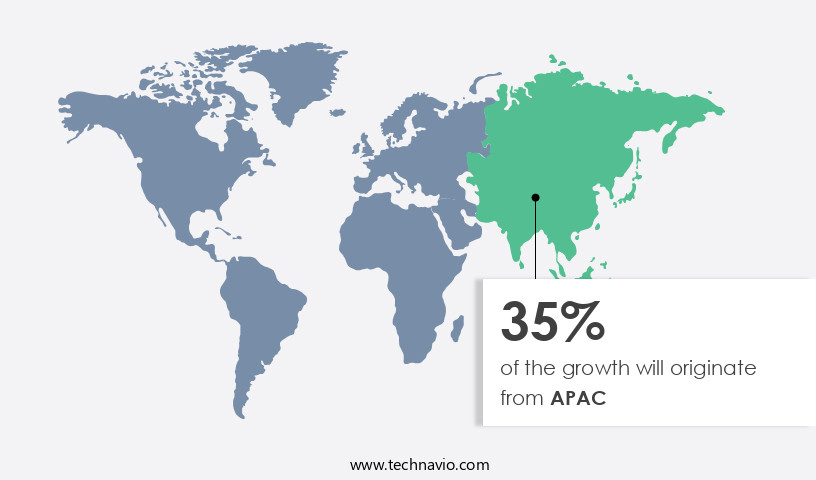

In the APAC region, the vEPC market is expected to grow significantly due to the increasing adoption of 5G technology and wireless broadband services. This growth is driven by the increasing number of connected devices and the demand for cloud-based services.

Get a glance at the market report of share of various segments Request Free Sample

The Solutions segment was valued at USD 1.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The vEPC market in North America is experiencing notable growth, driven by advanced telecommunications infrastructure and high mobile network penetration. Factors fueling this expansion include the increasing adoption of 4G and 5G networks, the growing demand for efficient mobile data management, and the necessity for network virtualization and flexibility. Major technology companies and telecommunication service providers, such as Xingtera, Polaris Networks, Druid Software, Cumucore, and Tech Mahindra, are key players in this market. They offer vEPC solutions to network operators, enabling them to enhance network performance, scalability, and agility. The vEPC market's growth is further propelled by the integration of IoT, cloud computing, and multimedia services, which generate significant data traffic.

Additionally, security concerns and the need for increased network capacity are driving the adoption of virtualization technologies like SDN and NFV infrastructure (NFVi). Companies like Parallel Wireless, Mavenir, and Affirmed Networks are also contributing to the market's growth by offering innovative solutions for cellular networks, VoLTE, and real-time data transmission. Overall, the vEPC market in North America is evolving to accommodate the demands of bandwidth-intensive activities, data-intensive applications, and the increasing number of connected devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Virtualized Evolved Packet Core (Vepc) Industry?

- Rising use of multimedia services is the key driver of the market.

- The increasing usage of multimedia services, including watching, reading, streaming, and posting content, has led to a significant rise in mobile data traffic. In 2022, the average daily time spent on social media was approximately 147 minutes, representing a 63% increase compared to 2012. This trend is driven by the availability of multimedia services on mobile devices and the increasing volume of on-demand content due to digital media. As of March 2024, there were over 5.35 billion internet users worldwide. To accommodate this growing demand, network operators must expand their bandwidth. Virtualized Evolved Packet Core (Vepc) technology plays a crucial role in addressing this challenge by providing a more efficient and scalable network infrastructure.

- Vepc enables network operators to virtualize their core network functions, reducing costs, improving performance, and enhancing network flexibility. This technology is expected to witness substantial growth due to the increasing demand for high-speed and reliable network services.

What are the market trends shaping the Virtualized Evolved Packet Core (Vepc) Industry?

- Deployment of 5G infrastructure is the upcoming market trend.

- The telecommunications industry has witnessed significant technological advancements, most notably the rollout of 5G infrastructure. The increasing adoption of Internet of Things (IoT) technology has led to a substantial rise in data traffic, compelling Mobile Network Operators (MNOs) to enhance their networks. By December 2023, India had deployed over 400,000 5G base stations, representing a 7.7-fold increase from the beginning of the year. Software-defined air interfaces are integrated into 5G network architectures, and vEPC (Virtualized Evolved Packet Core) is a crucial component in this evolution.

- VEPC enables MNOs to efficiently utilize radio resources and increase network capacity, making it an essential element for 5G networks. Faster data transfer and on-demand network services are key benefits of 5G, and the implementation of vEPC is expected to drive market growth during the forecast period.

What challenges does the Virtualized Evolved Packet Core (Vepc) Industry face during its growth?

- Complications associated with deployment of vEPC solution is a key challenge affecting the industry growth.

- The implementation of Virtualized Evolved Packet Core (vEPC) solutions poses intricate challenges for telecommunications and IT networks. One of the primary considerations is meeting the stringent demands for mobile broadband service availability, including coverage and capacity. Real-time performance monitoring is essential for managing a mix of traditional and cloud-based communication infrastructure. However, IT networks and cloud-based enterprises are not designed to accommodate the stringent regulations related to mobile core network requirements. Government regulations in telecommunication networks, such as maintaining network functionality during nodal failure, add complexity to vEPC deployment.

- These regulations present a challenge for integrating vEPC into existing IT and telecommunications infrastructure. Despite these complications, vEPC offers numerous benefits, including improved network efficiency, reduced costs, and enhanced service agility. As the market for vEPC continues to evolve, addressing these challenges will be crucial for successful implementation.

Exclusive Customer Landscape

The virtualized evolved packet core (vepc) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the virtualized evolved packet core (vepc) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, virtualized evolved packet core (vepc) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Athonet Srl - The company specializes in the development and distribution of innovative sports products, catering to diverse consumer needs and preferences. Our offerings span various categories, including equipment, apparel, and nutrition, all designed to enhance athletic performance and promote an active lifestyle. Through rigorous research and development, we continually push the boundaries of sports technology to deliver cutting-edge solutions that meet the evolving demands of modern athletes. Our commitment to quality and customer satisfaction sets us apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Athonet Srl

- Cassava Technologies

- Cisco Systems Inc.

- Cumucore Oy

- Druid Software

- Huawei Technologies Co., Ltd.

- International Business Machines Corp.

- IPLOOK Technologies

- Mavenir Systems Inc.

- Microsoft Corp.

- Mitel Networks Corp.

- Motorola Solutions Inc.

- NEC Corp.

- Nokia Corp.

- Parallel Wireless Inc.

- Samsung Electronics Co. Ltd.

- Tech Mahindra Ltd.

- Telefonaktiebolaget LM Ericsson

- Twilio Inc.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as network virtualization technologies continue to gain traction in the telecommunications sector. VEPC, a key component of Network Functions Virtualization (NFV) infrastructure (NFVI), enables the separation of control and user planes, allowing for increased flexibility and efficiency in managing voice and data traffic. The adoption of VEPC is driven by several factors, including the increasing demand for SDN solutions and the integration of IoT devices in various industries. The proliferation of 5G infrastructure and the shift towards cloud computing are also major catalysts for the market's expansion. Prominent companies in the telecommunications sector are investing heavily in VEPC technology to enhance network capacity and improve network performance.

Xingtera, Polaris Networks, Tecore, Druid Software, and Cumucore are some of the key players in the VEPC market. These companies offer innovative solutions to address the bandwidth-intensive activities and real-time data transmission requirements of various applications, including multimedia services, online gaming, and M2M devices. The VEPC market is particularly relevant to mobile networks, as it enables the virtualization of CSPS and VoLTE functions, thereby reducing the reliance on legacy infrastructure. Telecommunication operators and service providers are increasingly turning to VEPC to address the growing demand for cloud-based services and wireless broadband. The APAC region is expected to be a major contributor to the growth of the VEPC market, driven by the increasing adoption of 5G technology and the rising number of connected devices.

The flexibility offered by VEPC solutions is particularly attractive to ISPs and enterprises, as it enables them to optimize their network resources and improve network security. However, the adoption of VEPC is not without challenges. Security concerns related to data privacy and network security are major concerns for telecom operators and service providers. Ensuring the seamless integration of VEPC with existing network infrastructure and ensuring network performance during bandwidth-intensive activities are also key challenges. Despite these challenges, the VEPC market is expected to continue its growth trajectory, driven by the increasing demand for 5G networks, the proliferation of IoT devices, and the shift towards cloud-based services.

The market is expected to witness significant innovation in the coming years, with companies focusing on developing advanced VEPC solutions to address the evolving needs of the telecommunications sector. In summary, the market is experiencing significant growth, driven by the increasing adoption of network virtualization technologies and the integration of IoT devices in various industries. The market is expected to continue its growth trajectory, driven by the increasing demand for 5G networks, the proliferation of IoT devices, and the shift towards cloud-based services. The flexibility offered by VEPC solutions is particularly attractive to telecom operators and service providers, enabling them to optimize their network resources and improve network performance.

However, security concerns and the challenges of integrating VEPC with existing network infrastructure are major challenges that need to be addressed.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 78.25% |

|

Market growth 2024-2028 |

USD 210652.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

63.63 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Virtualized Evolved Packet Core (Vepc) Market Research and Growth Report?

- CAGR of the Virtualized Evolved Packet Core (Vepc) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the virtualized evolved packet core (vepc) market growth of industry companies

We can help! Our analysts can customize this virtualized evolved packet core (vepc) market research report to meet your requirements.