5G Technology Market Size 2024-2028

The 5G technology market size is forecast to increase by USD 1,330.8 billion at a CAGR of 114.45% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of smartphones and the emergence of new applications such as the metaverse, video conferencing, telemedicine, and artificial intelligence. The rollout of 5G networks is revolutionizing industries, from smart factories and industrial automation to autonomous vehicles and smart agriculture.

- The benefits of 5G, including high-speed connectivity and low latency, are enabling advancements in edge computing and enabling new use cases. However, the high deployment cost of 5G technology remains a challenge for widespread adoption. In the US and North America, the market is expected to grow rapidly as businesses and consumers embrace the opportunities presented by 5G technology.

- The future of 5G lies in its ability to transform industries and create new value propositions, from enhancing the user experience in smartphones to enabling the next generation of industrial automation and autonomous systems.

What will be the Size of the 5G Technology Market During the Forecast Period?

- The market is experiencing significant growth as the global shift towards high-speed, real-time data collection and transmission continues. This next-generation mobile technology is poised to revolutionize various industries, including smart agriculture, XR, AI, and IoT. The market's size is projected to expand exponentially due to the growing application of 5G in mobile broadband services, enhancing user experience and enabling new use cases.

- Key drivers of the market include the rollout of 5G networks by mobile network operators and internet service providers, as well as the increasing demand for digital tools and telecommunications services from businesses and consumers. The adoption of 5G is also fueled by the need for high-speed, low-latency connectivity in sectors such as autonomous vehicles, industrial automation, and remote healthcare.

- Spectrum auctions and infrastructure contracts are shaping the competitive landscape, with major players investing heavily in 5G technology to expand their offerings. However, concerns around data espionage and mobile data consumption remain, necessitating robust security measures and innovative solutions. Overall, the market is expected to continue its upward trajectory, transforming industries and reshaping the digital landscape.

How is this 5G Technology Industry segmented and which is the largest segment?

The 5g technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2020-2022 for the following segments.

- Application

- Manufacturing

- Automotive

- Energy and utilities

- Others

- Component

- Software

- Services

- Connectivity

- Enhanced Mobile Broadband (EMBB)

- Ultra-Reliable Low Latency Communication (URLLC)

- Massive Machine Type Communication (MMTC)

- Geography

- APAC

- China

- South Korea

- North America

- Europe

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

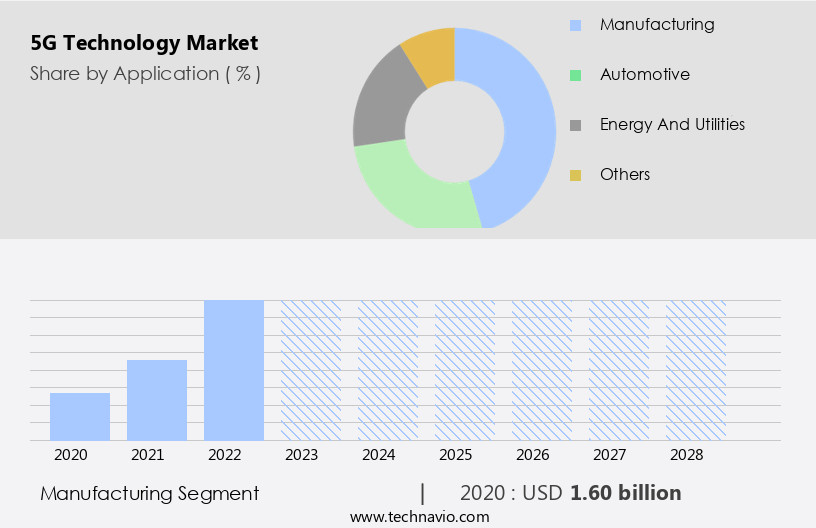

- The manufacturing segment is estimated to witness significant growth during the forecast period.

The market is projected to reach USD113 billion by 2026, according to Ericsson's 5G Business Potential study. This represents a significant 7% potential revenue growth from current service forecasts. 5G technology offers numerous advantages for manufacturers, enabling the development of smart factories through AI, automation, augmented reality, and IoT. This sector is a major revenue generator for operators, as they address industry digitalization. 5G technology's high-speed, low-latency capabilities facilitate real-time data collection and analysis in manufacturing applications, such as smart agriculture and precision farming, utilizing sensors for soil conditions, weather patterns, crop health, irrigation, and pesticide use. Additionally, 5G technology's benefits extend to smart grid systems, energy distribution, energy consumption, and environmental sensors, contributing to waste reduction and exabytes of data.

The market's growth is driven by the increasing adoption of 5G services, including mobile broadband and standalone 5G networks, by mobile service providers and internet service providers. The rollout of 5G networks is expected to face challenges related to spectrum harmonization, interoperability, network performance, and roaming capabilities. Despite these difficulties, 5G infrastructure providers, professional services, and managed services offer solutions to ensure seamless connectivity for machines, infrastructures, and things. The lucrative segment includes in-venue digital services, such as live sports streaming and mobile gaming. 5G leaders, including telecom providers and mobile internet companies, are investing in 5G networks, fiber, cable, and FWA connections, aiming for widespread adoption and economies of scale. The market's growth is influenced by emerging markets' increasing mobile bandwidth demands and the immersive experience offered by next-generation 5G networks.

Get a glance at the 5G Technology Industry report of share of various segments Request Free Sample

The Manufacturing segment was valued at USD 1.60 billion in 2020 and showed a gradual increase during the forecast period.

Regional Analysis

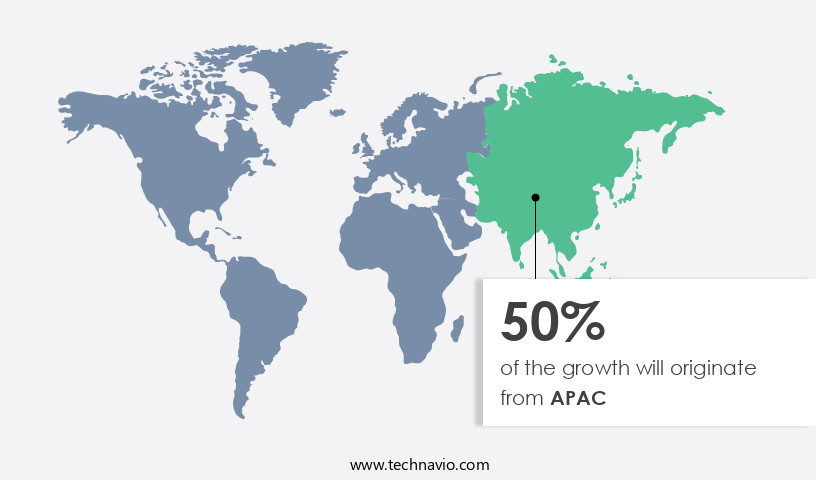

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia Pacific region is experiencing significant growth due to the increasing demand for high-speed connectivity and communication. Countries such as China, India, Malaysia, and Singapore, along with developed markets like Japan, Australia, and South Korea, are witnessing improvements In their telecom sectors, fueling the expansion of the 5G technology industry. The regional market is also driven by the increasing number of 5G subscribers, particularly in India, where the launch of 5G-enabled smartphones is expected to boost demand. The market is further propelled by the implementation of 5G technology in various sectors, including smart agriculture, smart grid systems, and smart cities, for real-time data collection and analysis of soil conditions, weather patterns, crop health, and energy consumption.

The market In the Asia Pacific region is expected to grow exponentially during the forecast period, with the integration of IoT devices, fiber, cable, and FWA connections, and the rollout of standalone 5G networks and services. The challenges of spectrum harmonization and interoperability are being addressed by standards organizations and mobile operators, ensuring seamless connectivity and enabling the delivery of in-venue digital services, live sports streaming, and mobile gaming. The lucrative segment of mission-critical services, such as emergency response systems and public services, is also expected to contribute significantly to the market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of 5G Technology Industry?

Growing research and development and deployment of 5G network is the key driver of the market.

- The market is experiencing significant growth due to the increasing research and development in 5G hardware. companies are competing to deploy 5G networks, particularly in North and South America, which will drive demand for related technologies. High-speed and low-latency capabilities of 5G services are fueling the adoption in various sectors such as smart agriculture, precision farming, and smart grid systems. Real-time data collection from sensors monitoring soil conditions, weather patterns, crop health, irrigation, pesticide use, and waste reduction is becoming increasingly important. In addition, 5G technology is expected to revolutionize energy distribution, environmental sensors, and IoT devices in industries like telecommunications services, mobile service providers, and internet service providers.

- The market is anticipated to grow exponentially, with 5G standalone services and standalone 5G networks becoming increasingly popular. Despite the challenges in spectrum harmonization and interoperability, network performance, roaming capabilities, economies of scale, and financial burden on international businesses are expected to be addressed. The widespread adoption of 5G technology will lead to the growth of financial and professional services, managed services, Enhanced Mobile Broadband, and mission-critical services. The market is expected to experience significant growth In the coming years, with mobile broadband services, FWA connections, and in-venue digital services becoming lucrative segments.

What are the market trends shaping the 5G Technology Industry?

Adoption of 5G networks for smart cities is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for high-speed and low-latency capabilities. With the widespread adoption of 5G services, various industries are leveraging this next-generation technology for real-time data collection and analysis. Smart agriculture is one such sector that is benefiting from 5G, with precision farming using sensors for monitoring soil conditions, weather patterns, crop health, irrigation, and pesticide use, leading to waste reduction. In addition, 5G is being utilized in smart grid systems for energy distribution and consumption, environmental sensors, and Internet of Things (IoT) devices. 5G networks are also revolutionizing mobile broadband services, enabling speed-based tariff plans and providing a lucrative segment for mobile service providers and internet service providers.

- Spectrum harmonization and interoperability are crucial for network performance, roaming capabilities, and economies of scale for international businesses. Small cells are being deployed to enhance coverage and capacity, especially in urban infrastructure, where real-time monitoring and city management processes are essential. Enhanced Mobile Broadband (eMBB) is a key component of 5G, offering high reliability and low latency for mission-critical services. The 5G New Radio (NR) mmWave and Standalone (SA) networks are expected to have an exponential share In the market due to their ability to provide faster download speeds and higher traffic capacity. The rollout of 5G networks is facing difficulties due to spectrum auctions and infrastructure contracts, but the benefits are significant, including seamless connectivity for machines, infrastructures, and things.

- 5G is also transforming industries such as healthcare, manufacturing, transportation, and entertainment, with applications ranging from telecommunications services to digital tools and in-venue digital services like live sports streaming and mobile gaming. The market for 5G standalone services and standalone 5G networks is growing, with infrastructure providers and professional services offering managed services and component hardware and software solutions. The challenges include addressing the financial burden of network infrastructure and ensuring standards organizations and mobile operators can deliver on the promise of 5G. Overall, the market is poised for significant growth, offering an immersive experience for businesses and consumers alike.

What challenges does the 5G Technology Industry face during its growth?

High deployment cost of 5G technology is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for high-speed and low-latency capabilities. The implementation of 5G services in various industries, such as smart agriculture and precision farming, is driving the market forward. Real-time data collection from sensors monitoring soil conditions, weather patterns, crop health, irrigation, and pesticide use is facilitated by 5G technology, leading to waste reduction and improved efficiency. In addition, the energy sector is benefiting from 5G through smart grid systems, energy distribution, and environmental sensors. However, the high acquisition cost of 5G technology and the challenges of spectrum harmonization and interoperability are hindering the market's growth.

- The installation of small cell networks and the security concerns associated with remotely placed outdoor power systems also pose challenges. Stringent regulations, such as spectrum allocation and management, and security and privacy requirements set by telecommunication standard organizations, further add to the complexities. The pressure for competitive pricing from customers has also negatively affected profit margins, with data tariffs being similar to those of 4G and LTE broadband communications. Despite these challenges, the market is expected to grow as 5G rollout continues and new applications, such as in-venue digital services, live sports streaming, and mobile gaming, become more prevalent. The lucrative segment of Internet of Things (IoT) devices, fiber, cable, and FWA connections, as well as the growing adoption of 5G infrastructure providers' professional and managed services, are also contributing to the market's expansion.

Exclusive Customer Landscape

The 5G technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 5G technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 5g technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Accenture Plc - 5G technology is a significant advancement in wireless communication, and Accenture provides network acceleration services to help businesses optimize their transition to this next-generation technology. These services ensure seamless integration and efficient implementation of 5G infrastructure, enabling enterprises to leverage its high-speed capabilities and low latency for enhanced operational efficiency and improved customer experiences. Accenture's expertise in network optimization and transformation equips organizations with the necessary tools to capitalize on the potential of 5G and stay competitive in today's digital landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- Dell Technologies Inc.

- Deutsche Telekom AG

- Fujitsu Ltd.

- HCL Technologies Ltd.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- Nokia Corp.

- Qualcomm Inc.

- Siemens AG

- Samsung Electronics Co. Ltd.

- T Mobile US Inc.

- Tech Mahindra Ltd.

- Telefonaktiebolaget LM Ericsson

- Telstra Corp. Ltd.

- Tietoevry

- TIM S.p.A.

- Viavi Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as businesses and industries worldwide embrace the high-speed and low-latency capabilities of this next-generation technology. The 5G services market is poised for expansion due to the increasing demand for real-time data collection and analysis in various sectors. One of the primary applications of 5G technology is in agriculture, where precision farming and smart agriculture are becoming increasingly prevalent. Sensors placed in soil conditions and weather patterns help farmers optimize irrigation, reduce waste, and monitor crop health. These advanced technologies enable farmers to make data-driven decisions, leading to increased productivity and profitability. The energy sector is another significant area of growth for 5G technology.

Smart grid systems and energy distribution networks are being upgraded to take advantage of 5G's high-speed capabilities. Environmental sensors monitor air quality, traffic patterns, and other critical data points, enabling more efficient energy consumption and distribution. The Internet of Things (IoT) is a lucrative segment of the 5G market, with millions of connected devices requiring seamless and reliable connectivity. From smartphone devices to industrial machines and infrastructures, 5G networks offer faster download speeds and higher traffic capacity, making them an essential component of the digital transformation. Spectrum harmonization and interoperability are critical challenges In the 5G market. Network performance and roaming capabilities are essential for international businesses seeking to expand their operations across borders.

Economies of scale and the development of professional and managed services are helping to address these challenges, making it easier for businesses to adopt 5G technology. The rollout of 5G networks is a race among mobile service providers and internet service providers. Fiber, cable, and FWA connections are all vying for market share, with speed-based tariff plans and component offerings differentiating the competition. Small cells are becoming increasingly important in densely populated urban areas, providing coverage and capacity where traditional cell towers may be insufficient. Despite the many benefits of 5G technology, there are also challenges. The financial burden of upgrading network infrastructure and the difficulties of meeting standards organizations' requirements can be significant.

Data espionage and mobile data consumption are also concerns, with mobile network operators and internet service providers working to address these issues through digital tools and telecommunications services. The 5G market is expected to see widespread adoption In the coming years, with applications ranging from smart cities and real-time monitoring to mission-critical services and immersive experiences. As the technology continues to evolve, it will undoubtedly transform the way we live and work, offering new opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2020-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 114.45% |

|

Market growth 2024-2028 |

USD 1,330.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

86.0 |

|

Key countries |

China, South Korea, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 5G Technology Market Research and Growth Report?

- CAGR of the 5G Technology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 5G technology market growth of industry companies

We can help! Our analysts can customize this 5G technology market research report to meet your requirements.