China Warehouse And Storage Market Size 2024-2028

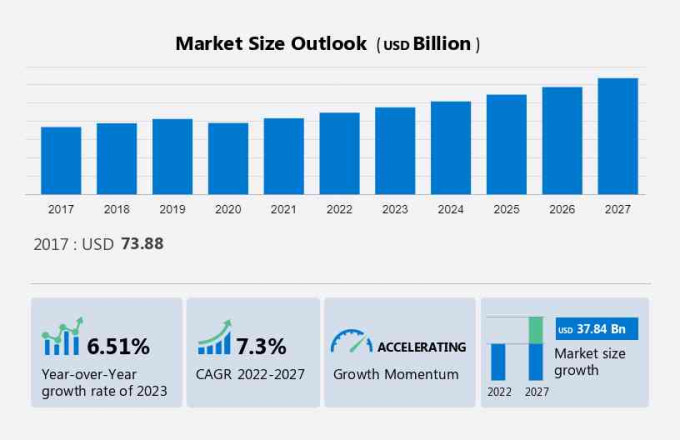

The China warehouse and storage market is estimated to grow by USD 37.84 billion at a CAGR of 7.3% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends and challenges. The rising demand in the e-commerce sector is a major growth factor, as online retailers require large amounts of warehouse and storage space to fulfill orders efficiently. Another trend is the rise of multistoried warehouses, which maximize space utilization and reduce land requirements. Additionally, increasing rentals for warehouse and storage space reflects the market's strong demand and competition for prime locations. These trends present both opportunities and challenges for market participants, requiring strategic planning and innovation to stay competitive.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The market is a significant sector that caters to the growing demand for efficient and effective storage solutions. Warehouses play a crucial role in managing inventory, streamlining supply chain operations, and ensuring timely delivery of goods. The market is driven by various factors, including the increasing e-commerce industry, growing logistics and transportation sectors, and the need for automated and technology-driven storage solutions. The market is segmented based on the type of storage solutions, such as automated storage systems, pallet racking systems, and bulk storage systems. The automated storage systems segment is expected to grow at a significant rate due to the rising demand for high-density storage solutions and the integration of advanced technologies like robotics and IoT. The warehouse and storage market also caters to various industries, including manufacturing, retail, food and beverage, and healthcare. A doctor may recommend a procedure if a mole or wart with a scaly surface shows signs of recurrence or high-risk occurrences. While many injuries and tissue changes are considered low-risk, high-risk occurrences warrant careful evaluation to prevent further injury or complications. The healthcare sector, in particular, requires specialized storage solutions for pharmaceuticals and medical equipment, which is driving the growth of the market in this segment. The market is expected to witness steady growth in the coming years, driven by the increasing demand for efficient and cost-effective storage solutions, the adoption of advanced technologies, and the growing focus on automation and digitization in the logistics and supply chain sectors.

Key Market Driver

The growing consumption of frozen and perishable foods is notably driving market growth. Factors such as increasing disposable incomes, changing consumption patterns, and rapid urbanization is driving the demand for frozen and perishable food products in China. As the shelf life of these products is much shorter, they need to be stored under controlled temperatures. Therefore, the cold chain market in China is growing due to the rise in the consumption of frozen and perishable foods.

Moreover, the consumption of products such as meat, which usually requires a cold chain to prevent its degradation, has been on the rise. The growing consumption of products that require special storage facilities will increase the demand for warehouses and storage from the cold chain market. Therefore, it is expected that the growing consumption of frozen and perishable foods will drive the China warehouse and storage market during the forecast period.

Significant Market Trend

The rise of multistoried warehouses is an emerging trend in market growth. The growth of the e-commerce market in China has led to increased demand for warehouse and storage facilities. Delivery in e-commerce services is majorly dependent on last-mile services. One of the solutions for better last-mile service is to place the warehouses as close as possible to the consumer to reduce the delivery time.

Further, as land in major cities has become scarce and expensive, particularly in key commercial centers such as Shanghai and Beijing, the rental prices for warehouse spaces are expected to increase during the forecast period. To overcome this issue, developers are adding more floors to warehouse units. In 2021, GLP Pte Ltd., one of the major builders in the logistics industry, leased an 18.7-million-meter square facility to various e-commerce players for the distribution of goods in China, increasing its revenue from warehouse and storage leasing by 53%. Hence, such developments will have a positive impact on market growth during the forecast period.

Major Market Challenge

The increase in rentals for warehouse and storage space is a major challenge impeding market growth. The rush for warehouse and storage space due to the growing demand for e-commerce is pushing up the rentals for storage units in China. As the growth of the e-commerce industry will further increase demand for short-term leasing, the rentals for warehouse and storage spaces will gradually increase. Moreover, the availability of land for industrial warehouses has been declining in China.

In addition, policies are also not favorable to those looking to acquire industrial land for warehouse and storage units in China. For instance, in China, land acquisition is a major issue for foreign players as the local government only allows temporary land use rights. Also, tax revenue generated from leasing warehouses is limited. Beijing has tightened its land quota system amid concerns that farmland was being converted into commercial zones. The resultant rise in rental prices will have a considerably negative impact on the returns generated from operating warehouse and storage units for companies. This will hamper the market during the forecast period.

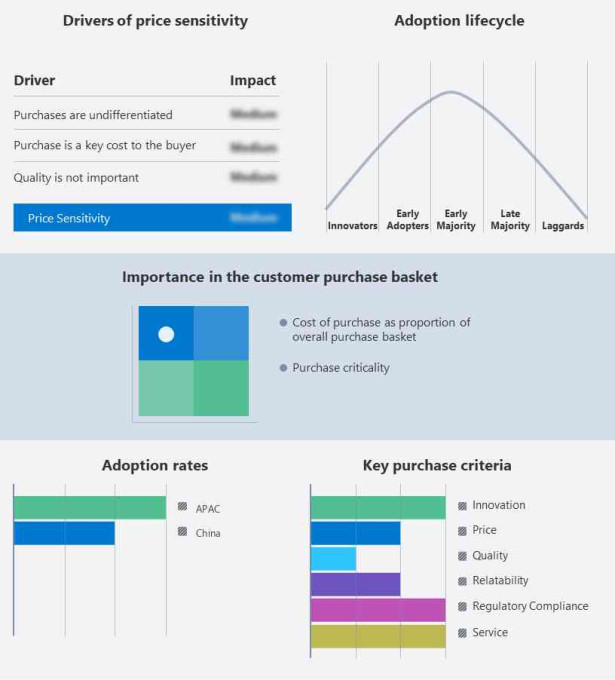

Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Agility Public Warehousing Co. K.S.C.P: The company offers warehouse and storage solutions such as sustainable warehouse, freight storage.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- AP Moller Maersk AS

- CMST Development Co. Ltd.

- Americold Realty Operating Partnership LP

- CMA CGM SA

- DACHSER SE

- DB Schenker

- Deutsche Post AG

- Expeditors International of Washington Inc.

- GLP Pte Ltd.

- John Swire and Sons Ltd.

- Kerry Logistics Network Ltd.

- Kintetsu World Express Inc.

- Lineage Logistics Holdings LLC

- Logwin AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By End-User

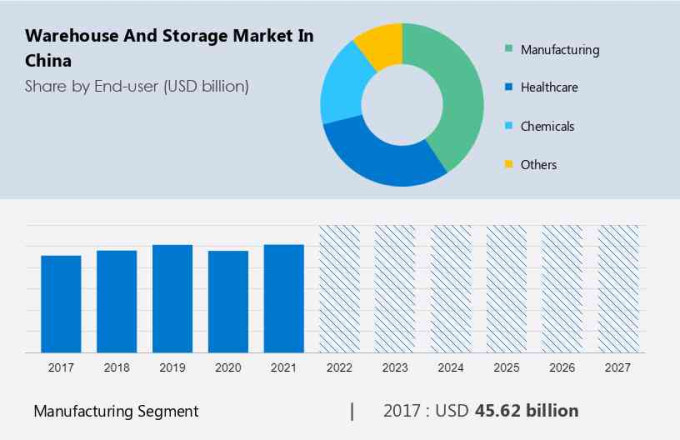

The market share growth by the manufacturing segment will be significant during the forecast period. The manufacturing and warehousing industries are closely dependent on each other. The manufacturing industry requires the support of the warehousing and storage industry to stay competitive and effective.

Get a glance at the market contribution of various segments Request a PDF Sample

The manufacturing segment was valued at USD 45.62 billion in 2018. As per the Standard Industrial Classification (SIC), the manufacturing industry includes several industries, such as wood, commercial machinery, paper, rubber, tobacco, and transportation equipment. Most manufacturers either hire third-party logistics providers for warehousing or implement in-house logistics for the storage of their products. However, the establishment and operation of in-house warehouse and storage facilities may lead to high operational costs and a liquidity crunch for small and medium-sized manufacturers. Such factors will further enhance the demand for warehouses and storage from manufacturing industries during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Manufacturing

- Healthcare

- Chemicals

- Others

- Type Outlook

- General

- Refrigerated

- Farm products

You may also interested in the below market reports

-

Warehouse and Storage Market: Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, India, Japan, Germany - Size and Forecast

-

Storage and Warehouse Leasing Market: Analysis North America, APAC, Europe, South America, Middle East and Africa - US, China, India, Japan, UK - Size and Forecast

-

Warehouse and Storage Conveyor Belt Market: Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, Japan, India, UK - Size and Forecast

Market Analyst Overview

The warehouse and storage market plays a crucial role in the healthcare industry, particularly in the storage and distribution of cancer treatment solutions. As the global population continues to age and the incidence of cancer increases, so does the demand for effective and efficient storage and transportation of these vital treatments. Cancer treatments such as Surgery, Radiation therapy, Photodynamic therapy, Topical therapies, Cryosurgery, Electrodesiccation, Mohs surgery, Vismodegib, Chemotherapy, and others require specialized storage conditions to maintain their efficacy and safety. These treatments target various types of cancer cells, including those found in the skin, eyes, lungs, and other organs. Risk factors for skin cancer, such as radiation exposure, sun exposure, sunburns, and the presence of moles, bumps, or sore moles, can lead to the development of Squamous cell carcinoma and other forms of cancer.

Furthermore, early detection and timely treatment are essential for successful outcomes. Medical teams rely on reliable and secure warehouse and storage solutions to ensure the availability and accessibility of these treatments. The warehouse and storage market must keep up with the growing demand for cancer treatments and the evolving needs of the medical community. The symptoms of cancer, such as red patches, scaly surfaces, and inflammation, can vary depending on the type and location of the cancer. Warehouse and storage solutions must be flexible enough to accommodate the diverse range of cancer treatments and their unique requirements. In conclusion, the market plays a vital role in the healthcare industry's fight against cancer. By providing secure, efficient, and flexible storage solutions, warehouse and storage providers can help ensure the timely and effective delivery of life-saving treatments to medical teams and their patients. A medical team may address skin growths or bump with varying colors such as light pink, white, dark flesh tone, or lighter flesh tone—to assess the potential for metastasis and determine the occurrence of skin cancers. Advanced treatment options are considered based on the waxy appearance or pearly appearance of the skin growth. Ensuring healthy skin and monitoring for skin cancers is crucial, particularly if the skin growth presents an unusual appearance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2022 |

|

Historic period |

2018-2022 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2023-2027 |

USD 37.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

6.51 |

|

Competitive landscape |

Leading companies, Market Positioning of companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AP Moller Maersk AS, Agility Public Warehousing Co. K.S.C.P, Americold Realty Operating Partnership LP, CMA CGM SA, CMST Development Co. Ltd., DACHSER SE, DB Schenker, Deutsche Post AG, Expeditors International of Washington Inc., GLP Pte Ltd., John Swire and Sons Ltd., Kerry Logistics Network Ltd., Kintetsu World Express Inc., Lineage Logistics Holdings LLC, Logwin AG, Nippon Yusen Kabushiki Kaisha, Toll Holdings Ltd., United Parcel Service Inc., VHK LOGISTIC HK Ltd., and Yue Shing Logistic Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across China

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch